UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20222023

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-39122

89bio, Inc.

(Exact name of Registrantregistrant as specified in its Charter)

Delaware |

| 36-4946844 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

142 Sansome Street, Second Floor San Francisco, California 94104 |

| 94104 |

(Address of principal executive offices) |

| (Zip Code) |

|

|

|

Registrant’s telephone number, including area code: (415) 432-9270

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading |

| Name of each exchange on which registered |

Common stock, par value $0.001 per share |

| ETNB |

| Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrantregistrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes☐No ☒ No ☐

Indicate by check mark if the Registrantregistrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes☐ No ☒

Indicate by check mark whether the Registrant:registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrantregistrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒No☐

Indicate by check mark whether the Registrantregistrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrantregistrant was required to submit such files). Yes ☒No☐

Indicate by check mark whether the Registrantregistrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.Act.

Large accelerated filer |

| ☒ | Accelerated filer | ☐ | |||

|

|

|

|

|

|

| |

Non-accelerated filer |

| Smaller reporting company | ☒ | ||||

|

|

|

|

|

|

| |

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the Registrantregistrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrantregistrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐☒

Indicate by check mark whether the Registrantregistrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officersofficers during the relevant recovery period pursuant to §240.10D-1(b). ☐

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, basedregistrant (based on the closing price of the shares of commonsuch stock on The Nasdaq Global Market on June 30, 2022,2023, the last business day of the Registrant’sregistrant’s most recently completed second fiscal quarter,quarter) was approximately $30.41,175.6 million. Shares of common stock held by each officer and director and by each person who is known to own 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the Registrant.registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of Registrant’sthe registrant’s common stock outstanding as of March 3, 2023February 21, 2024 was 52,230,62193,501,210.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitiveregistrant’s proxy statement relating to its 2023for the 2024 Annual Meeting of Stockholders, to be held on or about May 31, 2023,29, 2024, are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated.to the extent stated herein. Such proxy statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year to which this report relates.ended December 31, 2023.

Auditor Firm Id: | 185 | Auditor Name: | KPMG LLP | Auditor Location: | San Francisco, California, USA |

Table of Contents

Page | ||

PART I | ||

Item 1. | 5 | |

Item 1A. |

| |

Item 1B. |

| |

Item 1C. | 58 | |

Item 2. | 59 | |

Item 3. | 59 | |

Item 4. | 59 | |

|

|

|

PART II |

| |

Item 5. | 60 | |

Item 6. | 60 | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 61 |

Item 7A. |

| |

Item 8. |

| |

Item 9. | Changes in and Disagreements |

|

Item 9A. |

| |

Item 9B. |

| |

Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

| ||

PART III |

| |

Item 10. |

| |

Item 11. |

| |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

Item 13. | Certain Relationships and Related Transactions, and Director Independence |

|

Item 14. |

| |

| ||

PART IV |

| |

Item 15. |

| |

Item 16. |

| |

|

| |

| ||

2

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. All statements, other than statements of historical facts included in this Annual Report on Form 10-K, including statements concerning our plans, objectives, goals, strategies, future events, future revenues or performance, financing needs, plans or intentions relating to acquisitions, business trends and other information referred to in “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “design,” “estimate,” “predict,” “potential,” “plan,” “anticipate,” “target,” “forecast,” or the negative of these terms, and similar expressions intended to identify forward-looking statements. Forward-looking statements are not historical facts and reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from the forward-looking statements contained in this Annual Report on Form 10-K. Such risks, uncertainties and other important factors include, among others, the risks, uncertainties and factors set forth in “Risk Factors,” and the following risks, uncertainties and factors:

3

There may be other factors that may cause our actual results to differ materially from the forward-looking statements, including factors disclosed in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You should evaluate all forward-looking statements made in this Annual Report on Form 10-K in the context of these risks and uncertainties.

We caution you that the risks, uncertainties and other factors referred to above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. All forward-looking statements in this Annual Report on Form 10-K apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this Annual Report on Form 10-K. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

4

PART I

In this Annual Report on Form 10-K, unless context otherwise requires or where otherwise indicated, the terms “89bio” “we,” “us,” “our,” “our company,” “the company,” and “our business” refer to 89bio, Inc. and its consolidated subsidiaries.

Item 1. Business.

Overview

We are a clinical-stage biopharmaceutical company focused on the development and commercialization of innovative therapies for the treatment of liver and cardio-metabolic diseases. Our lead product candidate, pegozafermin, (previously BIO89-100), a specifically engineered glycoPEGylated analog of fibroblast growth factor 21 (“FGF21”), is currently being developed for the treatment of nonalcoholic steatohepatitis (“NASH”) (also known as metabolic dysfunction-associated steatohepatitis (“MASH”)) and for the treatment of severe hypertriglyceridemia (“SHTG”).

NASH is a severe form of nonalcoholic fatty liver disease (“NAFLD”), characterized by inflammation and fibrosis in the liver that can progress to cirrhosis, liver failure, hepatocellular carcinoma (“HCC”) and death. There are currently no approved products for the treatment of NASH. In 2020 and 2022, we presented positive topline results from cohorts 1 through 6 and cohort 7, respectively, in our Phase 1b/2a trial of pegozafermin in NASH patients, which hashave informed the advancement of our subsequent clinical strategy in NASH. We initiated aIn our Phase 2b ENLIVEN trial (ENLIVEN) evaluatingof pegozafermin in fibrosis stage 2 or 3 NASH patients, in June 2021. In the ENLIVEN trial, patients receivereceived weekly doses or an every two-weekevery-two-week dose of pegozafermin or placebo for 24 weeks followed by a blinded extension phase of an additional 24 weeks for a total treatment period of 48 weeks. We reported topline 24 week data from ENLIVEN completed enrollment in August 2022March 2023. The 44 mg every-two-week and the 30 mg weekly dose groups both met, with high statistical significance, both of the primary histology endpoints per the U.S. Food and Drug Administration (“FDA”) guidance definitions on endpoints for accelerated approval in non-cirrhotic NASH patients. In September 2023, the FDA granted Breakthrough Therapy designation to pegozafermin in patients with NASH. In November 2023, we are expecting to reportannounced positive topline data from thisthe blinded extension phase of our Phase 2b ENLIVEN trial in March 2023. at 48 weeks. Both the 44 mg every-two-week and 30 mg weekly dose groups demonstrated statistically significant improvements across Non-Invasive Tests (“NITs”) representing key markers of liver health. The benefits observed at week 48 represented by NITs were consistent with the histology and NITs results observed at week 24, indicating sustained benefits over time.

In 2021,the fourth quarter of 2023, we completed a pharmacokinetic studyheld successful end-of-Phase 2 meetings with the FDA, supporting the advancement of pegozafermin into a Phase 3 program. We have also obtained alignment with the FDA on proposed late-stage chemistry, manufacturing and controls (“CMC”) development plans and expectations in NASHsupport of future biologics license application (“BLA”) filing.

The Phase 3 ENLIGHTEN program will include two Phase 3 trials evaluating patients with NASH: ENLIGHTEN-Cirrhosis is expected to enroll patients with compensated cirrhosis (fibrosis stage F4) demonstrating that a 30 mg dose of pegozafermin has similar single-dose pharmacokinetics(F4) and pharmacodynamics in F4 as it does in non-cirrhotic NASH. We are currently evaluating the potential opportunity for pegozafermin in theseENLIGHTEN-Fibrosis is expected to enroll patients with fibrosis stage F2-F3 (F2-F3). The F2-F3 and the F4 patients. trials are expected to initiate in the first quarter and the second quarter of 2024, respectively. In November 2023, we received initial scientific advice from the European Medicines Agency (“EMA”), which generally aligned with the feedback from the FDA.

We are also developing pegozafermin for the treatment of SHTG. In June 2022, we announced positive topline results from the ENTRIGUE Phase 2 trial of pegozafermin in SHTG patients. SHTG is a condition identified by severely elevated levels of triglycerides (≥500 mg/dL), which is associated with an increased risk of NASH, cardiovascular events and acute pancreatitis. The trial met its primary endpoint demonstrating statistically significant and clinically meaningful reductions in triglycerides from baseline and key secondary endpoints. We have received feedback from the FDA supporting the advancement of pegozafermin intoand initiated our Phase 3 and are planning to initiateENTRUST trial, the first of two recommended Phase 3 trials, in the second quarter of 2023. In parallel, we have developed plansWe expect to optimizereport topline results from our clinical development program across both indications that would leveragePhase 3 ENTRUST trial in 2025. Safety data from the safety database from ourongoing SHTG Phase 3 program is expected to support ourthe safety database requirements for NASH program. We expect to finalize these plans after we have reviewed results from the ENLIVEN trial.and vice versa.

FGF21 is aan anti-fibrotic metabolic hormone that regulates energy expenditure and glucose and lipid metabolism. FGF21 analogs represent a promising class of drugs to treat NASH, because they not only address the liver manifestations, but also have an effect on the multiple co-morbidities that worsen NASH. FGF21 is a clinically

5

validated mechanism that has been shown in humans to reduce steatosis, improve the histological features of NASH including through anti-fibrotic effects, and address cardio-metabolic dysregulation. It is thought to exert effects on liver fibrosis by improving metabolic regulation, which reduces ongoing liver injury thus giving the liver time to heal. FGF21 also generates an on-target effect to increase adiponectin, a hormone released from adipose tissue that, among other functions, can suppress development and progression of hepatic fibrosis. It is also thought to exert effects on liver fibrosis by improving metabolic regulation, which reduces ongoing liver injury thus giving the liver time to heal. However, FGF21 in its native form suffers from a short half-life and a tendency to aggregate in solution, both of which impact its suitability as a viable drug. To address these challenges, we have specifically engineered pegozafermin to extend the half-life of the molecule while maintaining potency and thereby the clinical benefits of FGF21.

5

Pegozafermin may be a differentiated FGF21 therapy based on its robust and durable biological effects, a favorable tolerability profile and its potential for every two-weekevery-two-week dosing. Given its ability to address the key liver pathologies in NASH, as well as the underlying metabolic dysregulation in NASH patients, pegozafermin has the potential to become a backbone of treatment in NASH. Pegozafermin is the only FGF21 analog being developed for the treatment of SHTG and its broad metabolic effects could potentially differentiate it from competitors in this market. Pegozafermin has a long half-life which allows convenient weekly or every two-weekevery-two-week dosing and is currently the only FGF21 analog being tested for every two-weekin Phase 3 trials with every-two-week dosing. The convenient dosing regimen may support adoption and compliance amongst patients living with these chronic and generally asymptomatic diseases. Pegozafermin is self-administered by patients subcutaneously in a liquid formulation. We have developedformulation using a new pre-filled syringe using our approved liquid formulation and plan to utilize this presentation in our planned SHTG Phase 3 trial in the second quarter of 2023.syringe.

StrategyOur Strategic Priorities

Our goal is to become a leading biopharmaceutical company focused on the development and commercialization of innovative therapies for the treatment of liver and cardio-metabolic diseases. The key components ofdiseases by focusing on our strategy are to:

Our Focus on Liver and Cardio-Metabolic Disease

We are focused on developing and commercializing therapeutic interventions that have a clinically meaningful impact on patients with liver and cardio-metabolic diseases. These diseases, including NASH and SHTG, represent leading global causes of morbidity and mortality. Despite a wave of public health campaigns to promote better diet and exercise habits and a range of treatment options available for many of these diseases, there is a significant unmet medical need for more effective therapies to improve patient outcomes and reduce the burden on global healthcare systems.

We are currently developing our lead product candidate, pegozafermin, a specifically engineered glycoPEGylated analog of FGF21, for the treatment of NASH and SHTG. We believe pegozafermin is an ideal candidate for the treatment of NASH based on its ability to address the key liver pathologies in NASH through anti-fibrotic effects as well as its ability to address the underlying metabolic dysregulation in NASH patients, its favorable tolerability profile, and its potential

6

for a longer dosing interval. Multiple epidemiological studies have linked NAFLD to increased cardiovascular disease, concluding that the majority of deaths among NAFLD patients are attributable to cardiovascular disease. As a result, we believe it is important that new therapeutics options for NASH address the underlying cardiovascular and metabolic dysregulations in these patients. We are also developing pegozafermin for the treatment of SHTG given the potential of pegozafermin to meaningfully reduce triglycerides. Pegozafermin may have a competitive differentiation from approved therapies and other molecules in development based on its impact on improving liver fat and other metabolic markers in addition to triglyceride reduction.

Disease Overview - NASH

NASH (also known as MASH), a severe form of NAFLD, is characterized histologically by the additional presence of inflammation and hepatocellular injury such as visible ballooning and has a significantly worse prognosis, with the potential to progress to liver fibrosis, cirrhosis or HCC.

NASH represents a large and rapidly growing problem in the United States and worldwide. Diagnoses have been on the rise and are expected to increase dramatically in the next decade. The prevalence of NAFLD, which

6

affects approximately 25% of the global population, and NASH, which develops in approximately 20% to 25% of NAFLD patients, is driven primarily by the worldwide obesity epidemic. As a result, the prevalence of NASH has increased significantly in recent decades, paralleling similar trends in the prevalence of obesity, insulin resistance and Type 2 diabetes. The prevalence of these conditions is expected to increase further in view of the unhealthy nutrition habits, such as consumption of a diet high in fructose, sucrose and saturated fats, and sedentary behavior that characterize modern lifestyle.

The critical pathophysiologic mechanisms underlying the development and progression of NASH include reduced ability to handle lipids, increased insulin resistance, injury to hepatocytes and liver fibrosis in response to hepatocyte injury. NASH patients have an excessive accumulation of fat in the liver resulting primarily from a caloric intake above and beyond energy needs. A healthy liver contains less than 5% fat, but a liver in someone with NASH can contain more than 20% fat. This abnormal liver fat contributes to the progression to NASH, a liver necro-inflammatory state, that can lead to scarring, also known as fibrosis, and, for some, can progress to cirrhosis and liver failure—cirrhosis develops in approximately 20% to 45% of patients. In some cases, cirrhosis progresses to decompensated cirrhosis which results in permanentwith attendant severe morbidity and risk of death from end stage liver damage that can lead to liver failure.disease. In addition, it is estimated that 8% of patients with advanced fibrosis will develop HCC. NASH is a complex, multifaceted disease that doesn’t just affect the liver. Patients with NASH frequently have other significant metabolic co-morbidities such as obesity, hyperglycemia, dyslipidemia and systemic hypertension (a constellation of which is commonly referred to as metabolic syndrome) and these further contribute to the risk of cardiovascular disease.

Disease Overview - SHTG

We are also developing pegozafermin for the treatment of SHTG. Hypertriglyceridemia (“HTG”) is characterized by elevated fasting plasma triglyceride levels > 200 mg/dL and SHTG is typically defined as triglyceride levels of ≥ 500 mg/dL. SHTG is associated with an increased risk of NAFLD, NASH and cardiovascular diseases, as well as acute pancreatitis, accounting for up to 10% of all acute pancreatitis episodes. A third-party study utilizing an omega-3 fatty acid (“omega-3 FA”) demonstrated the linkage between a reduction in triglycerides and favorable cardiovascular clinical outcomes.

It is estimated that there are 4 million patients in the United States with triglyceride levels of ≥ 500 mg/dL of which approximately 800,000 patients are inadequately treated with existing therapies and are thereby at increased risk for acute pancreatitis and atherosclerotic cardiovascular events. Of these patients, it is estimated that up to 100% have clinically meaningful hepatic fat using magnetic resonance imaging – proton density fat factor (“MRI-PDFF”) definition of ≥ 5%; baseline fat fraction (baseline data from the sub-study in ENTRIGUE; n=24), up to 70% have Type 2 diabetes, and up to 65% have high LDL. This patient population is expected to increase due to the triple epidemic of obesity, metabolic syndrome and Type 2 diabetes. In addition, the addressable market has the potential to expand as a result of increasing awareness of the importance of treating elevated triglyceride levels, similar to the focus today of physicians on managing LDLLDL-c levels, as well as the commercial efforts of other companies that are expected to promote triglyceride reduction.

7

The treatment regimen for SHTG includes dietary restrictions and lipid-lowering drug treatment such as fibrates, omega-3 fish oils and niacin. Some statins are indicated in HTG but do not have an indication for use in SHTG. Despite multiple agents approved for the treatment of SHTG, these agents have limitations that may not make them ideal for all patients. In third-party studies, up to 50% of treated SHTG patients were unable to reduce their triglyceride levels to < 500 mg/dL despite using approved drugs and are considered refractory patients. These refractory patients have substantial unmet medical need and represent a significant market opportunity for pegozafermin as an add-on therapy along with the opportunity for pegozafermin to be used in patients not on any background therapy. Given the continuing unmet need in SHTG and limitations of current treatments, there are other novel agents in development for the treatment of SHTG, including ANGPTL3 and APOC3 inhibitors.

Diagnosis of NASH

Most people with NASH are asymptomatic and their disease is often discovered incidentally following a liver imaging procedure, such as an ultrasound, prescribed for other reasons or as part of an investigation for elevated liver enzymes. Once suspected clinically, a liver biopsy is required to definitively diagnose NASH, which necessitates the joint presence of steatosis, ballooning and lobular inflammation. Once pathologically confirmed, the

7

severity of NAFLD and NASH is determined using the histologically validated NAS, which grades disease activity on a scale of 0 to 8. The NAS is the sum of the individual scores for steatosis (0 to 3), lobular inflammation (0 to 3), and hepatocellular ballooning (0 to 2) but does not include a score for fibrosis. Fibrosis staging (F0-F4) relies on the Kleiner classification (F0 = no fibrosis; F1 = perisinusoidal or periportal fibrosis (not both); F2 = both perisinusoidal and periportal fibrosis; F3 = bridging fibrosis; F4 = cirrhosis).

Histological diagnosis remains the gold standard for assessment of NASH and fibrosis. However, given that liver biopsy is associated with risks of pain, bleeding and other morbidity, as well as significant cost, the procedure is not practical for general patient screening. Additionally, histology diagnosis is confounded by evaluation of a small sliver of a large heterogenous organ that may not represent the full organ, and significant variability in reading of slides including inter- and intra-reader variability. Several non-invasive tools such as clinical risk scores, serum markers and imaging techniques are increasingly used to assess NASH patients. Non-invasive tests (“NITs”)NITs, such as the Fibroscan-AST (“FAST”) score, Fibrosis-4 index, the Enhanced Liver Fibrosis score and vibration-controlled transient elastography, (“VCTE”), have been validated and are increasingly used. These NITs have an excellent negative predictive value and an acceptable positive predictive value for detection of advanced (≥ F3) fibrosis and are increasingly used in clinical settings. Additionally, evidence is emerging that shows a correlation between reduction in steatosis as measured by MRI-PDFF and reduction in ALT ≥17 U/L and histologic improvement on liver biopsy. In draft guidance, the FDA encouraged sponsors to identify biochemical or noninvasive imaging biomarkers that, once characterized and agreed by the FDA, could replace liver biopsies for patient selection and efficacy assessment in clinical trials.

We expect that the validation and subsequent adoption of these NITs will result in an increase in the diagnosis and treatment rates for NASH in the future.

FGF21 Overview

Fibroblast growth factors (“FGFs”), including FGF21, and FGF19, are a large family of cell-signaling proteins involved in the regulation of many processes within the body. FGF21 is an endogenous metabolic hormone that regulates energy homeostasis, glucose-lipid-protein metabolism and insulin sensitivity, and modulates the pathways that mitigate against intracellular stress. FGF21 is secreted primarily by the liver but is also secreted by the white adipose tissue, (“WAT”), skeletal muscle and the pancreas. FGF21 exerts its biological benefits through the activation of three fibroblast growth factor receptors (“FGFRs”), FGFR1c, FGFR2c and FGFR3c, and requires co-activation of the transmembrane protein cofactor beta Klotho (“ß-Klotho”). FGF21 is not believed to activate FGFR4, which has been associated with adverse effects. FGF21 can act directly or indirectly on target organs by mediating downstream regulators, such as adiponectin, and upstream regulators that induce FGF21, such as nutritional stress or transcription factors.

8

Biological Effects of FGF21:

Reducing Liver Steatosis by Improving Lipid Handling and Insulin Sensitivity

FGF21 has been clinically shown to reduce liver steatosis. FGF21 reduces liver steatosis by (1) increasing fatty acid oxidation in the liver, (2) reducing the deposition of free fatty acids from peripheral tissue to the liver and (3) reducing DNL in the liver. FGF21 exerts its systemic effects by reducing the serum levels of lipids (e.g., triglycerides, LDL cholesterol) and increasing insulin sensitivity. Increasing insulin sensitivity reduces lipolysis and can also reduce serum levels of lipids. In particular, FGF21 has been demonstrated to reduce liver fat in patients with NASH in multiple clinical trials.

Improving Liver Inflammation and Fibrosis

FGF21 is also believed to reduce liver fibrosis, the pathological change most clearly linked to liver-related morbidity in NASH patients via two potential pathways. One pathway is through the metabolic benefits of FGF21 described above. Long-term improvements in metabolic regulation reduce the ongoing liver injury that drives fibrosis and thus allows the liver time to heal. The other pathway is a direct anti-fibrotic effect mediated via adiponectin, an adipokine that is upregulated by FGF21. Increased adiponectin downregulates the hepatic stellate cells that are activated upon hepatic injury and responsible for collagen deposition and subsequent fibrosis. FGF21 demonstrated an improvement in liver fibrosis in patients in NASH in a clinical trial.

8

FGF21 Signaling

As noted above, FGF21 exerts its biological benefits through the co-activation of FGFRs and ß-Klotho. FGFRs are expressed widely throughout the body whereas ß-Klotho is primarily expressed in metabolic tissues such as adipose tissue, liver, and pancreas, thereby providing organ specificity to FGF21. The binding of FGF21 is a two-step process. The C-terminus of FGF21 initially binds to ß-Klotho enabling the N-terminus to form an expanded complex with one of the FGFRs. Once the co-receptor complex has formed with ß-Klotho and one of the FGFRs, a series of intracellular signaling cascades is initiated. These signaling cascades enable FGF21 to exert its biological functions.

FGF21 activates three specific FGFRs (FGFR1c, FGFR2c and FGFR3c), which based on nonclinical studies and clinical trials, appear to be responsible for mediating the desired therapeutic actions of FGF21 in NASH. FGF21 is not believed to activate FGFR4. Activation of FGFR4 results in an increase in LDL cholesterol and has been implicated in the etiology or progression of HCC.

Pegozafermin

Overview

We are developing pegozafermin, a specifically engineered glycoPEGylated analog of FGF21, for the treatment of NASH and SHTG. Pegozafermin has been specifically engineered to retain the activity of native FGF21 while extending its half-life. Specifically, it has been engineered to: (1) protect against proteolysis and reduce renal clearance, (2) have an extended half-life, (3) minimize susceptibility to aggregate in solution and (4) optimize its potency, enabling the potential use of lower dosage/doses. Additionally, we believe that pegozafermin may enhance binding affinity for ß-Klotho, by altering the conformation of the C-terminus which could have a positive impact on efficacy.

9

Primary Structure and Protein Engineering of Pegozafermin

Pegozafermin has been optimally constructed with two mutations via substitutions with natural amino acids at site-specific positions (173 and 176) toward the C-terminus end of the hormone. The mutations were incorporated into the FGF21 sequence after existing proline to create a consensus sequence for glycosylation. Subsequently, the glycosyl linker and a single 20 kDa glycoPEG moiety were enzymatically introduced at the O-linked glycosylation consensus site (position 173) via the proprietary glycoPEGylation technology. Our glycoPEG moiety is an activated form of the PEG molecule with the use of Sialic Acid, CMP-SA-PEG. The proximity of the mutations ensures consistent and efficient attachment of the glycoPEG moiety.

Pegozafermin has two modified natural amino acid residues:

In addition, a Methionine residue was introduced at the N-terminus which acts as the translation initiation signal. Figure 1 below shows the structure of pegozafermin.

9

Figure 1: Structure of Pegozafermin

The increase in the size of the molecule from 19.4 kDa to 40 kDa together with the site-specific mutations adjacent to the primary cleavage site of FGF21 (by the FAP enzyme between positions 171 and 172 on the native amino acid chain, which would be represented by positions 172 and 173 in our molecule starting with Methionine in position 1) are designed to prolong the half-life of the molecule. Additionally, we believe that the use of glycoPEGylation technology produces a comparatively stronger and more flexible structure, which aids in the development of a stable formulation. PEGylation technology has been used successfully in many pharmaceutical products including products that have been marketed for more than 10 years. Similar moles of FGF21 are delivered with pegozafermin 30mg and efruxifermin 50mg.

Pegozafermin uses a proprietary glycoPEGylation technology that has been previously validated by a third party, as this technology is incorporated in another pharmaceutical product (Lonquex® by Teva) that has received regulatory approval and is currently commercialized in the European Union.

10

Figure 2: Summary of Pegozafermin Attributes and Benefits

Features | Description | Potential Benefit |

Use of PEG (via glycoPEGylation) | ▪ Increases protein size and hydrodynamic volume that reduces renal filtration ▪ Prevents degradation by endocytosis and proteolytic enzymes | ▪ Prolongs half-life |

▪ Protects antigenic sites present on the protein surface (i.e. antigenic epitopes) | ▪ Reduces immunogenicity | |

▪ Steric repulsion between the PEGylated surfaces increases water solubility and reduces aggregates | ▪ Results in more stable formulation | |

Site-Specific Mutations | ▪ Mutation at position 173 is immediately adjacent to the primary cleavage (FAP enzyme) site of FGF21 | ▪ Prolongs half-life |

GlycoPEGylation Technology | ▪ Allows site specific linkage (glycoPEG moiety to position 173) ▪ Proximity of the glycoPEG moiety to the C-terminus induces conformational changes to the molecule | ▪ Retains potency against receptor to improve efficacy |

▪ Provides a strong and flexible glycosyl bond that helps the glycoPEG moiety to remain intact, further reducing degradation | ▪ Further enhances half-life |

10

Therapeutic Potential of Pegozafermin Supported by Preclinical Animal Models of NASH, Diabetes and Obesity

Pegozafermin has been evaluated in three animal models of direct relevance to NASH. These included: (1) Stelic Animal Model, (“STAM”), (2) Diet-induced NASH (“DIN”) model and (3) spontaneous diabetic obese cynomolgus monkey model. Additional studies done in diabetes mouse model and diet induced obesity mouse model showed benefits in key markers of relevance in NASH.

A wide range of doses were tested in these studies as well as weekly and once every two-weekevery-two-week dosing regimen was tested in a cynomolgus monkey study. The key outcomes of these studies are summarized in Figure 3 below.

Figure 3: Summary of NASH Pharmacology Studies

Preclinical pharmacology study with pegozafermin | Improved Insulin Sensitivity | Improved Triglycerides and Cholesterol | Reduced Hepatocyte Injury | Reduced Liver Steatosis, Inflammation & Fibrosis | Body Weight Reduction |

DIN mouse model I (10 weeks) | ✓ | ✓ | ✓ | ✓ | ✓ |

DIN mouse model II (19 weeks) | ✓ | ✓ | ✓ | ✓ | ✓ |

Diabetic obese cynomolgus monkey study 1 (8 weeks; weekly dosing) | ✓ | ✓ | ✓ | Not evaluated | ✓ |

Diabetic obese cynomolgus monkey study 2 (4 weeks; QW or Q2W dosing) | ✓ | ✓ | ✓ | Not evaluated | ✓ |

11

Pegozafermin Clinical Development in NASH

Phase 1a Clinical Trial of Single-Dose of Pegozafermin in Healthy Volunteers

We conducted a Phase 1a clinical trial to evaluate the safety, tolerability and pharmacokinetics (“PK”) of pegozafermin in 58 healthy volunteers. In this randomized, double-blind, placebo-controlled, Phase 1a, first-in-human, SAD clinical trial the PK profile of pegozafermin was generally dose-proportional or slightly more than dose-proportional with a half-life of approximately 55 to 100 hours. At single doses of 9.1 mg and higher, significant improvements were observed in key lipid parameters measured at Day 8 and Day 15 after dosing on Day 1. The mean changes versus baseline include significant reductions in triglycerides (up to 51%) and LDL-C (up to 37%) and increase in HDL-C (up to 36%) despite the baseline values being in the normal range. Pegozafermin demonstrated rapid (starting from Day 2), sustained and durable improvements on lipid parameters for two weeks or more after single-dose administration. Pegozafermin was well tolerated across the dose range and there were no deaths, serious adverse events or discontinuations due to adverse events. The most commonly observed treatment-related adverse events, occurring in at least two subjects in the pooled pegozafermin group, were injection site reactions and headache, all of which were reported as mild. No clinically meaningful trends were observed in gastrointestinal events, laboratories or vital signs including blood pressure or heart rate changes.

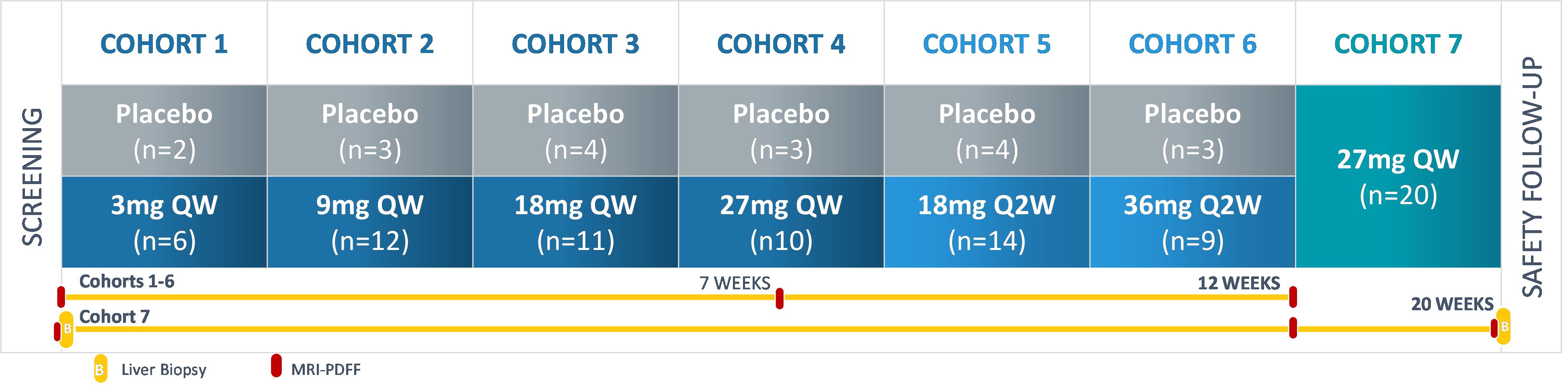

Phase 1b/2a Proof of Concept Clinical Trial in NASH Patients

In 2020 and 2022, we presented positive topline results from cohorts 1 to 6 and cohort 7, respectively, in our Phase 1b/2a trial in NASH patients which has informed the advancement of our clinical strategy in NASH. The Phase 1b/2a trial for cohorts 1 to 6 was multicenter, randomized, double-blind, placebo-controlled, multiple ascending dose-ranging and enrolled a total of 81 patients to receive weekly (3 mg/9 mg/18 mg/27 mg) or every two-weekevery-two-week (18 mg/36 mg) dosing of pegozafermin or placebo for up to 12 weeks. Key endpoints assessed were

11

safety, tolerability, and PK of pegozafermin as well as change in liver fat measured by MRI-PDFF and other metabolic markers. Cohort 7 was an open label cohort that enrolled 20 patients who received weekly dosing of pegozafermin at 27 mg for 20 weeks. Key endpoints assessed were changes in histology from baseline, liver fat changes from baseline and safety and tolerability. The trial design is shown in Figure 4 below.

Figure 4: Phase 1b/2a Trial Design

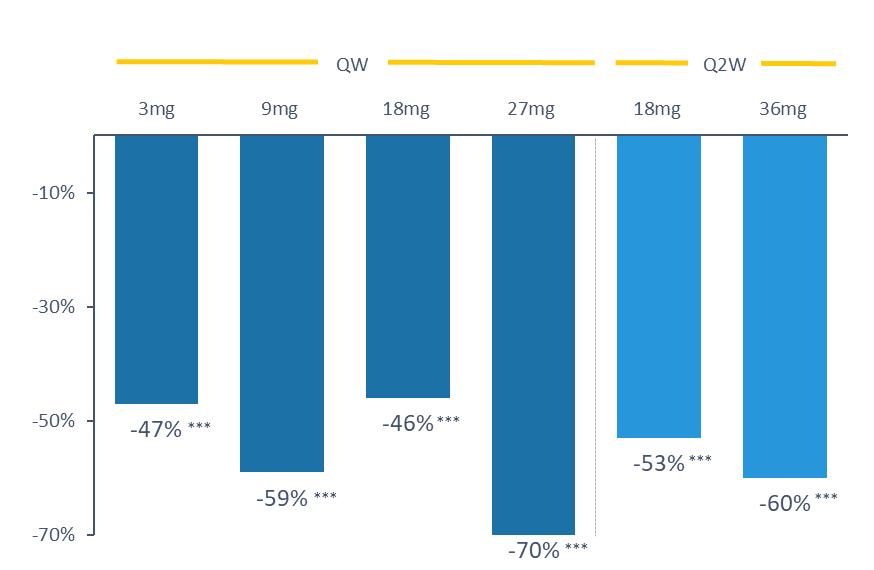

As shown in Figure 5 below, allAll dose groups in cohorts 1 to 6 demonstratedachieved statistically significant reductions in liver fat, at week 13, with relative reductions of up to 60% versus baseline and up to 70% versus placebo, as measured by MRI-PDFF. 43% ofplacebo. For the patients at27mg weekly and 36mg every-two-week dose, the highest dose achieved normal liver fat content of < 5%. A significant proportion of patients respondedwith greater than or equal to therapy with up to 88% and 71% of patients achieving a ≥ 30% or a ≥ 50%relative reduction in liver fat versus baseline,was 86% and 88%, respectively.

12

Figure 5: Relative Reduction Pegozafermin was well tolerated at all doses with low incidence of adverse events that occurred in Liver Fat vs. Placebo at Week 13

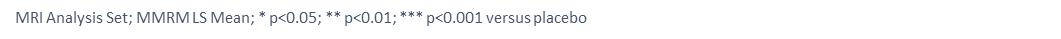

As shown in Figure 6 below for cohorts 1greater than or equal to 6, treatment with pegozafermin also resulted in significant improvements in liver transaminases, with up10% of subjects and very low frequency of gastrointestinal events relative to a 44% reduction in ALT and a 35 U/L decrease in ALT in patients with elevated baseline levels. Treatment with pegozafermin resulted in significant reductions in triglycerides (up to 28%; p<0.05), non-HDL (up to 16%; p<0.01) and LDL-C (up to 16%; p<0.05). Triglycerides were reduced to a greater extent in patients with elevated triglycerides at baseline (TG ≥ 200 mg/dL), and 53% of the pegozafermin patients in this group normalized triglyceride levels versus 0% in the placebo group. Pegozafermin also demonstrated significant increases in the insulin-sensitizing hormone adiponectin (up to 61%; p<0.001). Improvements were also noted across the spectrum of metabolic marker data vs. placebo for the 27 mg QW dose group including HOMA-IR, glucose, HbA1c, and body weight (p<0.05).

13

Figure 6: Clinically Meaningful ALT Reduction; Greater Reduction in Patients with High ALT

Additional analyses demonstrated that pegozafermin treatment resulted in significant reductions in liver volume of up to 15% and liver fat volume of up to 65% in treated patients at 13 weeks compared to baseline, as measured by MRI-PDFF. A post-hoc analysis presented at The Liver Meeting of AASLD in November 2021 assessed the effect of pegozafermin on spleen volume (SV) in NASH patients without advanced fibrosis. SV was evaluated by MRI in all eligible patients on pegozafermin 27 mg every week dose (n=8), pegozafermin 36 mg every two-week dose (n=8) and 16 patients on placebo. At baseline, it was observed that SV was correlated with liver volume, vibration-controlled transient elastography (VCTE) score and body mass index (BMI), and negatively correlated with platelet count. Findings at study Day 50 and Day 92 demonstrated that treatment with pegozafermin led to a progressive and significant decrease in SV compared to placebo (on Day 50, treated patients saw an average 7.4% decrease in SV and by Day 92 patients saw an average 11.8% decrease in SV).

Paired-biopsy, Open-label Histology Cohort (Cohort 7)

Cohort 7 in the Phase 1b/2a trial was a single-arm cohort that enrolled 20 patients with biopsy-confirmed fibrosis stage F2 and F3 NASH who were treated once weekly for 20 weeks with 27 mg of pegozafermin. 19 of 20 patentspatients received an end of treatment biopsy and one patient withdrew consent. A greater than or equal to 2-point improvement in NAS (with 1-point from either ballooning or inflammation) and no worsening of fibrosis was the nominal primary endpoint. Key secondary endpoints included response rates on NASH resolution without worsening of fibrosis, improvement in at least one stage of fibrosis without worsening NAS and safety/tolerability. Patients had a mean BMI of 37 and type 2 diabetes was prevalent in most patients. 65% had fibrosis stage F3 NASH and 35% had fibrosis stage F2 NASH. The baseline values for VCTE, ProC3, and transaminases were consistent with a more advanced population.

74% of patients achieved a greater than or equal to 2-point improvement in NAS with at least a 1-point improvement in ballooning or inflammation. Substantial reductions were observed across all 3 NAS components (≥1 point change) – ballooning (79%), inflammation (47%), and steatosis (74%). All patients had improvement or no change in ballooning and inflammation. The histology results demonstrate proof-of-concept for the translation of pegozafermin’s effects on liver fat, ALT, and other relevant non-invasive measures into histological improvement.

14

Figure 7: Histology Results

|

|

|

|

|

|

|

|

|

|

NAS = NAFLD Activity Score

1A 2-point improvement in NAS score required a 1-point improvement in either ballooning or inflammation

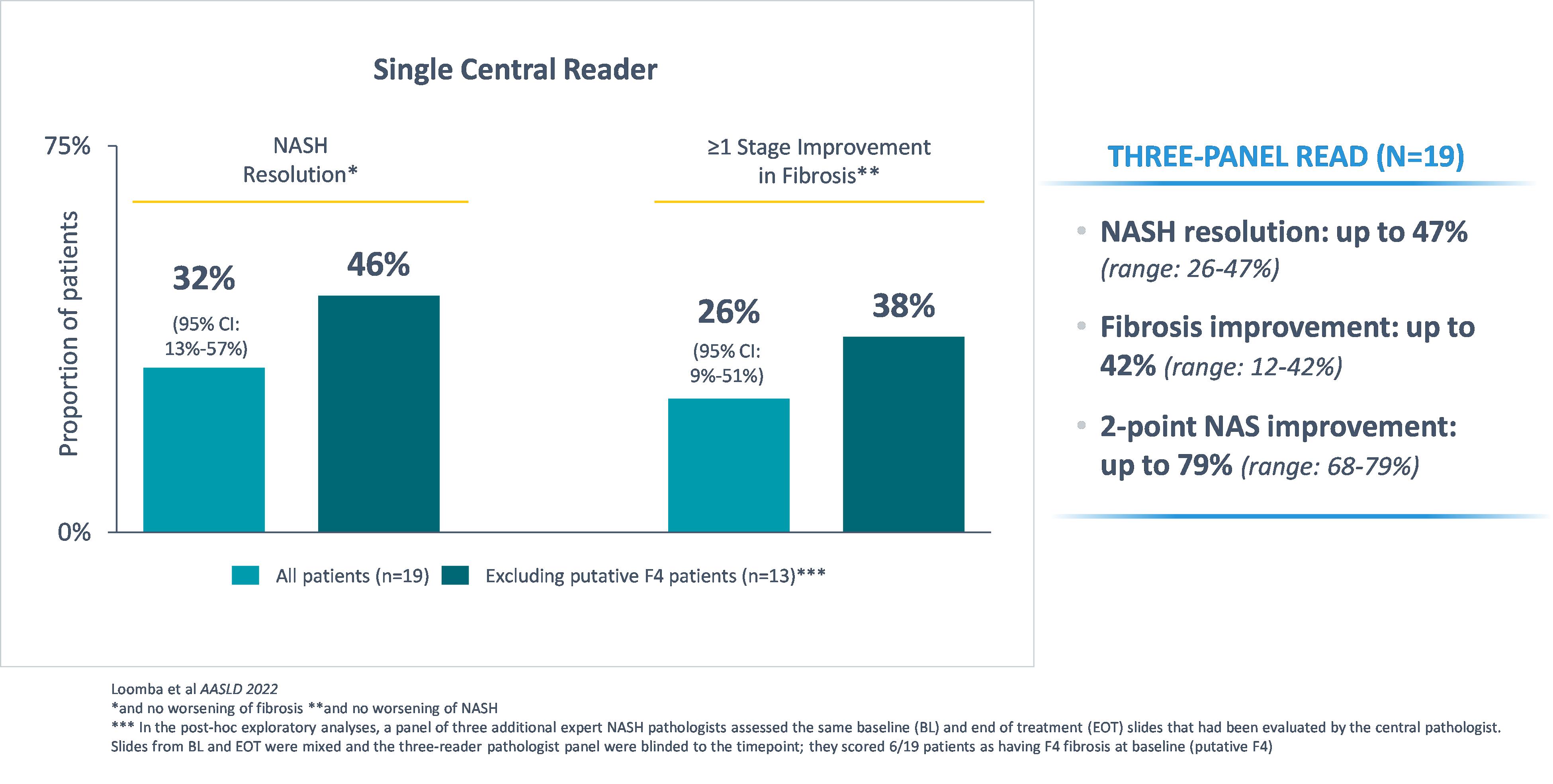

Data from a newan analysis of the same histology slides by a panel of an additional three expert liver pathologists resulted in a wide range of response rates, with rates of NASH resolution without worsening of fibrosis up to 47% (range: 26%-47%) and rates of ≥ 1-stage improvement in fibrosis without worsening of NASH up to 42% (range: 12%-42%). This three-reader panel scored six of the nineteen patients as having F4 fibrosis at baseline (putative F4), which was an exclusion criterion for the Phase 1b/2a trial. Excluding the putative F4 patients (n=6) resulted in a higher proportion of patients meeting the registration enabling histological endpoints compared to the primary analysis based on the single central reader, as shown in Figure 8 below.reader.

Figure 8: New Analysis of Cohort 7 Histology Slides By a Panel of Three Experts

15

Pegozafermin also demonstrated beneficial effects in the subset of patients with F4 stage fibrosis as shown in Figure 94 below.

Figure 9:4: Pegozafermin Effects in Fibrosis and Non-Invasive Test (NITs) in Stage F4 Patients

12

To assess pegozafermin’s effect on the whole liver, a number of NITs including imaging, serum biomarkers, and risk stratification scores were built into the study. Clinically meaningful and significant changes were observed across these key NITs associated with fibrosis, risk of fibrosis, or NASH resolution. The consistency of data across all these endpoints and the magnitude of changes observed in these NITs suggest that pegozafermin is improving total liver health.

Figure 10: Non-Invasive Tests (NITs) [marker of]

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*** p<0.001

1 Changes from baseline ≥ 30% and ≥ 50% have been correlated with NASH improvement

2 ALT changes ≥ 17 U/L have been correlated with histological improvement

3 In patients with elevated ALT as defined by ≥ 30 U/L in women and ≥ 40 U/L in men (n=14)

4 FAST score is a composite of imaging and blood markers and measured on 0-1 scale, a score ≤ 0.35 predicts Fibrosis Stage F0/F1 and NAS < 4

5 VCTE is a Fibroscan assessment, > 20% reduction has been correlated with fibrosis improvement

6 Pro-C3 is a blood-based measurement, > 15% reduction has been correlated with fibrosis improvement

In addition to significant improvement in liver health, treatment with pegozafermin also had significant positive effects on glycemic control, lipids, adiponectin, and body weight.

16

Figure 11: Cardio-Metabolic Endpoints

| |

|

|

|

|

|

|

|

|

|

|

|

|

*p<0.05; **p<0.01; ***p<0.001

1 In patients with HbA1c ≥ 6.5% at baseline (n=10); patients were all on concomitant diabetes medications

2 In patients with elevated triglycerides at baseline (n=11); reduction was -26% across total population

In 83 patients treated with pegozafermin across the full Phase 1b/2a trial in cohorts 1 to 7, pegozafermin continues to be generally well tolerated with a favorable safety profile. There have been no drug-related serious adverse events and only one treatment-related discontinuation. Pooled pegozafermin treatment related adverse events in greater than or equal to 10% of patients were increased appetite (13% vs 0% placebo), diarrhea (13% vs 11% placebo), and nausea (12% vs 11% placebo). Most of the GI adverse events were mild and of short duration. A few mild injection site reactions were reported and there were no tremors and no hypersensitivity adverse events observed. Pegozafermin had no adverse effects on blood pressure or heart rate.

Phase 2b (ENLIVEN) Trial in Fibrosis Stage 2 or 3 NASH Patients

ENLIVEN iswas a multicenter, randomized, double-blind, placebo-controlled Phase 2b trial in biopsy-confirmed NASH patients with fibrosis stage 2 or 3 and NAS ≥ 4. The trial enrolled a total of 219 patients who receive either a weekly dose (15 mg or 30 mg) or an every two-weekevery-two-week dose (44 mg) of pegozafermin in a liquid formulation or placebo for 24 weeks with a randomization schema of 4: 4: 2.5: 1 (placebo: 30 mg QW: 44 mg Q2W: 15 mg QW). All patients will continuecontinued treatment in a blinded extension phase for 24 weeks for a total treatment period of 48 weeks, with some of the placebo patients re-randomized to receive pegozafermin in the extension phase. The primary analysis will evaluateevaluated the effect of pegozafermin on the two FDA approvable histology endpoints, 1-point fibrosis improvement with no worsening of NASH and NASH resolution with no worsening of fibrosis, and will includeincluded F2/F3 patients who met histologic entry criteria F2/F3 patients and NAS ≥ 4 based on the three-panel consensus read of biopsies at baseline to ensure consistency between baseline and end of treatment biopsy reading methods. This three-panel consensus read was instituted after receipt of data from the expansion cohort of the Phase 1b/2a trial (cohort 7) to address biopsy reading variability and increase the likelihood of showing the true benefit of pegozafermin while maintaining adequate study power. Prior to this change, biopsy entry criteria for ENLIVEN was based on a single reader.

We expect to reportreported topline data from ENLIVEN in March 2023. The 44 mg every-two-week and the 30 mg weekly dose groups both met, with high statistical significance, both of the primary histology endpoints per FDA guidance on endpoints for accelerated approval in non-cirrhotic NASH patients. The 44 mg every-two-week and the 30 mg weekly dose groups both demonstrated at least one-stage fibrosis improvement without worsening of NASH (27% and 26%, respectively) at 3.5 times the placebo rate (7%), as reflected in Figure 5 below.

Figure 5: Fibrosis Improvement Without Worsening of NASH at Week 24

13

As seen in Figure 6 below, the 44 mg every-two-week and the 30 mg weekly dose groups both demonstrated NASH resolution without worsening of fibrosis of 26% and 23%, respectively, which is between 12 to 14 times the placebo rate (2%).

Figure 6: NASH Resolution Without Worsening of Fibrosis at Week 24

These dose groups also demonstrated statistically significant and clinically meaningful improvements in liver fat, non-invasive markers of liver fibrosis and inflammation as well as meaningful improvements in other metabolic and lipid markers. Pegozafermin was generally well tolerated with a favorable safety profile consistent with prior studies. Across dose groups, the most common adverse events (AEs) were Grade 1 or 2 gastrointestinal events (diarrhea, nausea and increased appetite), most of which were mild to moderate in nature. No clinically relevant or statistically significant effects on DEXA scans, bone biomarkers or vital signs were noted. No drug-induced liver injury, tremor or hypersensitivity reactions were reported.

The ENLIVEN study also included 14 biopsy-confirmed NASH patients with compensated cirrhosis (F4 patients) who were not part of the primary analysis but continued in the study. 12 of these 14 patients underwent a follow-up biopsy at week 24. In a descriptive analysis of these data, five out of 11 pegozafermin-treated patients experienced at least one-stage improvement in liver fibrosis with no worsening of NASH by week 24 compared with zero out of 1 patient on placebo. An additional two pegozafermin-treated patients experienced at least one-stage improvement in liver fibrosis with no worsening of ballooning or inflammation.

Results from the ENLIVEN trial were published in the New England Journal of Medicine and simultaneously presented in a late-breaking oral session at the European Association for the Study of the Liver Congress. Additional data included in these publications showed that treatment with pegozafermin resulted in significant benefit across several key sub populations of NASH patients, and adding pegozafermin to patients taking GLP-1 therapies improved key NASH measures.

Long-term Data from ENLIVEN Phase 2b Trial

In November 2023, we announced positive topline data from the blinded extension phase of our Phase 2b ENLIVEN trial evaluating treatment with pegozafermin in patients with NASH. At week 48, both the 44 mg every-two-week and 30 mg weekly dose groups demonstrated statistically significant improvements across key markers of liver health. The benefits observed at week 48 were consistent with the results observed at week 24, indicating sustained benefits over time.

14

ENLIVEN Extension Data

Patients in ENLIVEN continued in a blinded extension phase for an additional 24 weeks (the “Extension Phase”) past the primary endpoint at week 24 (the “Main Study”), for a total treatment period of 48 weeks. A subset of patients in the placebo arm of the Main Study (n=19) were re-randomized to receive 30 mg of pegozafermin weekly during the Extension Phase. The efficacy endpoints assessed in the Extension Phase included liver fat, non-invasive markers of fibrosis and inflammation, and metabolic markers. Per the protocol, these patients did not undergo biopsies at week 48.

Figure 7. Extension Phase Data at Week 48: Liver Non-Invasive Tests (NITs) Results [marker of]

F2-F3 Patients | Placebo | Pegozafermin | |

|

| 30mg QW | 44mg Q2W |

(n=35)1, 2 | (n=50)2 | (n=45)2 | |

MRI-PDFF [liver fat] 4 | -11% | -60%** | -47%* |

ALT [liver injury/inflammation]3 | -11% | -42%*** | -35%** |

AST [liver injury/inflammation]3 | -4% | -39%*** | -36%*** |

ELF score [liver fibrosis]3 | +0.1 | -0.3** | -0.4*** |

Pro-C3 [collagen deposition]3 | +5% | -15%*** | -14%*** |

VCTE (kPa) [liver stiffness]4 | -0.8 | -2.9* | -1.3 |

FAST [liver fibrosis]3 | -4% | -59%*** | -51%*** |

***p<0.001, **p<0.01, *p<0.05 versus placebo. 1Dataset excludes 19 placebo patients who were re-randomized to pegozafermin 30mg QW in the Extension Phase. 2 Extension data at week 48 represents patients who entered the blinded Extension Phase. 3 Least Square (LS) mean change from baseline. 4 Median change from baseline.

Patients on Background GLP-1 Therapy:

Consistent with results observed in the Main Study, patients on background GLP-1 therapy who received pegozafermin continued to derive a greater benefit on markers of liver fibrosis, liver injury/inflammation, liver fat and lipids, compared to patients who continued GLP-1 therapy in the placebo group. Patients entering ENLIVEN on background GLP-1 therapies were required to have been on a stable regimen for at least six months.

Figure 8. Extension Phase Data at Week 48: Patients on Background GLP-1, Liver NITs and Lipids Results [marker of]

Placebo | Pegozafermin3 | |

MRI-PDFF [liver fat]2 | -34% | -53% |

ALT [liver injury/inflammation]1 | -15% | -44% |

AST [liver injury/inflammation] 1 | -11% | -42% |

ELF score [liver fibrosis] 1 | 0 | -0.5 |

Pro-C3 [collagen deposition]1 | -9% | -19% |

VCTE (kPa) [liver stiffness]2 | -3.2 | -2.2 |

FAST [liver fibrosis] 1 | -43% | -52% |

Triglycerides [lipids]2 | -12% | -22% |

LDL-C [lipids]2 | -5% | -14% |

1 LS mean change from baseline. 2 Median change from baseline. 3 Patients dosed with pegozafermin 30mg QW or 44mg Q2W.

Compensated Cirrhosis (F4) Patients:

Biopsy-confirmed compensated cirrhosis F4 patients who had previously demonstrated histological response and improvement across NITs at week 24 continued to demonstrate robust and sustained improvements in non-invasive measures at week 48.

15

Figure 9. Extension Phase Data at Week 48: F4 Patients, Liver NITs Results [marker of]

Pegozafermin3 (n=12) | |

ALT [liver injury/inflammation]1 | -58% |

AST [liver injury/inflammation]1 | -38% |

ELF score [liver fibrosis]1 | -0.5 |

Pro-C3 [collagen deposition]1 | -20% |

VCTE (kPa) [liver stiffness]2 | -1.1 |

FAST [liver fibrosis]1 | -42% |

1 LS mean change from baseline. 2 Median change from baseline. 3 Patients dosed with pegozafermin 15mg QW, 30mg QW or 44mg Q2W.

Patients Re-randomized from Placebo to Pegozafermin:

The patients re-randomized to receive 30 mg weekly during the Extension Phase demonstrated robust improvements in NITs of liver fibrosis, liver injury/inflammation and liver fat following 24 weeks of treatment with pegozafermin after experiencing minimal to no change during the first 24 weeks on placebo. Patients in the re-randomized group served as their own control.

Pegozafermin continued to demonstrate a favorable safety and tolerability profile at week 48, consistent with previously reported data. The most common treatment-emergent adverse events were Grade 1 or 2 gastrointestinal events. Incidence rates of adverse events remained generally stable between week 24 and week 48 with no new patients on pegozafermin reporting diarrhea or nausea during the Extension Phase. At week 48, no clinically meaningful or statistically significant changes in bone mineral density or bone biomarkers were observed relative to placebo. No clinically meaningful or statistically significant changes in blood pressure or heart rate were observed relative to placebo.

Regulatory Update on Phase 3 Program

In December 2023, we announced a successful end-of-Phase 2 meeting with the FDA, supporting the advancement of pegozafermin into a Phase 3 program in NASH. The program will include two Phase 3 trials evaluating patients with NASH. ENLIGHTEN-Cirrhosis is expected to enroll patients with compensated cirrhosis (F4) and ENLIGHTEN-Fibrosis is expected to enroll patients with fibrosis stage F2-F3.

The planned ENLIGHTEN program will be comprised of two randomized, double-blinded, placebo-controlled Phase 3 trials, evaluating the efficacy and safety of pegozafermin in patients with NASH. ENLIGHTEN-Fibrosis and ENLIGHTEN-Cirrhosis are expected to initiate in the first quarter and the second quarter of 2024, respectively. In November 2023, we received initial scientific advice from the EMA, which generally aligned with the feedback from the FDA.

ENLIGHTEN-Cirrhosis

16

ENLIGHTEN-Fibrosis

Both ENLIGHTEN-Fibrosis and ENLIGHTEN-Cirrhosis are expected to enroll a significant proportion of patients on stable doses of GLP-1 based therapies and data from these patients in the trials will evaluate the expected incremental benefit of adding pegozafermin to these therapies. Both trials will employ the three-panel consensus biopsy reading methodology, which was successfully utilized in the ENLIVEN trial, for both baseline and primary endpoint biopsy reads. Patients will self-administer pegozafermin using the planned commercial liquid formulation delivered as a single subcutaneous injection.

Pegozafermin Clinical Development in SHTG

In June 2022, we reported positive topline results from the ENTRIGUE Phase 2 trial of pegozafermin in SHTG patients. ENTRIGUE was a randomized, double-blind, placebo-controlled trial that enrolled a total of 85 SHTG patients either on stable background therapy (55% - statin/statin combos, and/or prescription fish oil, and/or fibrates) or not on any background therapy treated weekly (9 mg, 18 mg or 27 mg) or every two weeksevery-two-weeks (36 mg) with pegozafermin or placebo over an eight-week treatment period. The trial enrolled an advanced population of patients with high risk of cardiovascular disease as evidenced by mean baseline values of treated patients with TGs of 733 mg/dL, non-HDL-C of 211 mg/dL, 43.5% with HbA1c ≥ 6.5%, and liver fat content of 20.1%. The primary endpoint was the percentage change in fasting triglyceride levels from baseline.

As shown in Figure 1210 below, results demonstrated statistically significant reductions in median triglycerides from baseline across all dose groups treated with pegozafermin compared to placebo after 8 weeks. Additionally, as shown in Figure 1311 below, results were consistent in patients not on background therapy or on background therapy (consistent results on statins or statin combos, prescription fish oils, and fibrates) and across various subgroups, including those with the greatest disease burden, such as Type 2 diabetes and baseline TG levels ≥ 750 mg/dL.

17

Figure 12:10: Median Percent Change in Triglycerides from Baseline at Week 8

Dosing group | Median TG reduction |

Placebo (n=18) | -12% |

9 mg QW (n=16) | -57%*** |

18 mg QW (n=17) | -56%*** |

27 mg QW (n=18) | -63%*** |

36 mg Q2W (n=16) | -36%* |

* p<0.05; *** p<0.001 versus placebo based on Wilcoxon Rank-Sum Test

Figure 13:11: Median Percent Change in Triglycerides from Baseline at Week 8

Dosing group | Patients on background therapy1 | Patients not on background therapy |

Placebo | -18% | 5% |

9 mg QW | -59% | -50% |

18 mg QW | -56% | -59% |

27 mg QW | -68% | -62% |

36 mg Q2W | -45% | -21% |

1. Background therapy defined as concomitant lipid modifying therapy

17

Patients on background therapy: placebo (n=11), 9 mg QW (n=8), 18 mg QW (n=9), 27 mg QW (n=10), 36 mg Q2W (n=8)

Patients not on background therapy: placebo (n=6), 9 mg QW (n=8), 18 mg QW (n=8), 27 mg QW (n=6), 36 mg Q2W (n=8)

Responder analysis on primary endpoint of TG reduction demonstrated:

Pegozafermin treatment also resulted in significant improvements compared to placebo (mean percent change from baseline) and clinically meaningful changes on an absolute basis in non-HDL-C and apo B that are key markers of cardiovascular risk (absolute change from baseline of 55 mg/dL and 22 mg/dL in non-HDL-C and apo B respectively with 27 mg QW dose). As shown in Figure 1412 below, patients treated across all doses with pegozafermin also demonstrated an improvement in HDL-C and no change in LDL-C vs. placebo.

Figure 14:12: Mean Percent Change in non-HDL-C and apo B from Baseline at Week 8

Dosing group | non-HDL-C | apo B |

Placebo | -3% | -1% |

9 mg QW | -14% | -11% |

18 mg QW | -22%** | -14%* |

27 mg QW | -29%*** | -18%** |

36 mg Q2W | -9% | -1% |

* p<0.05; ** p<0.01; *** p<0.001 versus placebo based on MMRM analysis

18

Pegozafermin treatment resulted in a mean relative reduction in liver fat from baseline at week 8 across all dose groups versus placebo in the sub-study of patients with MRI-PDFF. The results are summarized in Figure 1513 below.

Figure 15:13: Mean Relative Reduction in Liver Fat vs. Baseline at Week 8 in Sub-study

Dosing group | MRI-PDFF |

Placebo (n=6) | -5% |

9 mg QW (n=3) | -55%* |

18 mg QW (n=5) | -38% |

27 mg QW (n=7) | -44% |

36 mg Q2W (n=2) | -37% |

* p<0.05 versus placebo based on ANCOVA analysis

Pegozafermin continues to be generally well tolerated with a favorable safety profile across doses consistent with prior studies. In ENTRIGUE, the most commonly reported treatment-related adverse events were nausea, diarrhea and injection site reactions, all which were classified as mild or moderate. No tremors or transaminase elevation adverse events were observed. There were no drug-related serious adverse events and two Grade 2 treatment-related discontinuations.

WeIn 2022, we received feedback from the FDA supporting the advancement of pegozafermin into Phase 3.3 for the treatment of SHTG. The FDA agreed that the pre-clinical and clinical data package support the advancement of pegozafermin into Phase 3 with the proposed primary endpoint of reduction in triglycerides from baseline without the need for a clinical outcome study. The FDA also agreed to the proposed doses and proposed

18

secondary endpoints and were generally aligned with other trial parameters. Since SHTG is a common, chronic condition and pegozafermin is a novel investigational biologic therapy, and SHTG could be the first indication for pegozafermin, the agency recommended conducting two Phase 3 trials in SHTG, each of one year duration as part of the efficacy and safety database required to support the registration package. We have incorporatedIn December 2023, we announced a successful end-of-Phase 2 meeting with the agency’s feedbackFDA for the NASH program, supporting the advancement of pegozafermin into our protocolPhase 3 in NASH and two Phase 3 trials are planned to initiate in 2024. We plan to initiatemeet with the FDA in 2024 to revisit discussions regarding the registration package requirements for SHTG.

In May 2023, we initiated the first of two recommended Phase 3 trials in SHTG, ENTRUST. ENTRUST is a randomized, double-blind, placebo-controlled global trial that is planned to enroll up to 360 SHTG patients randomized in the second quartera 3:3:2 ratio of 2023.pegozafermin (30 mg, 20 mg or placebo) given once weekly (“QW”) by subcutaneous injection for 52 weeks. The primary endpoint is the percent change from baseline in fasting triglycerides at week 26 compared to placebo. Secondary endpoints include the plannedassessment of liver fat measured by magnetic resonance imaging proton density fat fraction (MRI-PDFF), non-high-density lipoprotein cholesterol (non-HDL-C), high-density lipoprotein cholesterol (HDL-C), apolipoprotein B (apo-B), very low-density lipoprotein cholesterol (VLDL-C), HbA1c for those with baseline ≥ 6.5%, and total cholesterol (TC) at week 26 compared to placebo. We expect to report topline results from our Phase 3 trialsENTRUST trial in 2025. The trial design is anticipated to be assessed at week 26.shown in Figure 14 below.

Figure 14: ENTRUST Trial Design

Agreements with Teva

Agreements Relating to FGF21 Program

In April 2018, we entered into an Asset Transfer and License Agreement (the “FGF21 Agreement”) with Teva Pharmaceutical Industries Ltd (“Teva”), under which we acquired certain patents, intellectual property and other assets relating to Teva’s glycoPEGylated FGF21 program. Under this agreement, Teva also granted a perpetual, non-exclusive (but exclusive as to pegozafermin), non-transferable, worldwide license to patents and know-how related to glycoPEGylation technology for use in the research, development, manufacture and commercialization of the compound pegozafermin and products containing pegozafermin. In addition, we entered into a Sublicense Agreement with ratiopharm (the “ratiopharm Sublicense”), under which we were granted a perpetual, exclusive, worldwide sublicense to patents and know-how related to glycoPEGylation technology used in the development, manufacture and commercialization of pegozafermin and products containing pegozafermin.

19

Under the FGF21 Agreement, we are obligated to use commercially reasonable efforts to develop and commercialize pegozafermin in each of the United States and five major European countries. We have the right to sublicense all rights licensed to us by Teva under the FGF21 Agreement.

Pursuant to the FGF21 Agreement and the FASN Agreement (as defined and described below), we paid Teva a nonrefundable upfront payment of $6.0 million. In addition, under the FGF21 Agreement,each agreement, we are required to make certain payments topay Teva totaling $2.5 million forupon the achievement of certaina specified clinical development milestones,milestone, and additional payments totaling up to $65.0 million upon achievement of certain commercial milestones. In the fourth quarter of 2023, we made a $2.5 million milestone payment to Teva under the FGF21 Agreement following the achievement of a clinical development milestone related to our ENTRUST clinical trial in SHTG. We are also obligated to pay Teva tiered royalties at percentages in the low-to-mid single-digits on worldwide net sales of products containing pegozafermin. Our royalty obligations will terminate, on a product-by-product and country-by-country basis, at the later of: (1) the date of expiration of the last to expire valid claim in the assigned patents that covers pegozafermin in such country, (2) the expiration of data or regulatory exclusivity for pegozafermin in such country and (3) 10 years from the first commercial sale of pegozafermin in such country. We are not required to make any payments to ratiopharm pursuant to the ratiopharm Sublicense.

The term of the FGF21 Agreement will continue, on a product-by-product and country-by-country basis, until the royalty term with respect to pegozafermin in such country expires. The ratiopharm Sublicense will continue until terminated in accordance with its terms. We may terminate the FGF21 Agreement and the ratiopharm Sublicense for any reason. Either party may terminate the FGF21 Agreement for cause for the other party’s uncured material breach. ratiopharm may terminate the ratiopharm Sublicense for certain material breaches by us. Either party may terminate the FGF21 Agreement or the ratiopharm Sublicense in the event of bankruptcy of the other party. Teva may terminate the FGF21 Agreement if we challenge the validity of any patent licensed to us under the FGF21 Agreement. Termination of the FGF21 Agreement or the ratiopharm Sublicense will impact our rights under the intellectual property licensed to us by Teva and ratiopharm, respectively, but will not affect our rights under the assets assigned to us.

In April 2018, we also entered into a Reagent Supply and Technology Transfer Agreement, under which Teva supplied us with certain reagents required for the glycoPEGylation process that are necessary for our development and commercialization of pegozafermin, and transfer to us certain know-how required for the production of such reagents. This agreement expired in accordance with its terms on December 31, 2022. We transferred the manufacturing of such reagents to new suppliers prior to the end of 2022.

FASN Agreements

In April 2018, we entered into an Asset Transfer and License Agreement with Teva under which we acquired from Teva patents, intellectual property and other assets relating to Teva’s development program of small molecule inhibitors of FASN (the “FASN Agreement”). Under the FASN Agreement we are obligated to use commercially reasonable efforts to develop and commercialize FASN in the United States and five major European countries. We have the right to sublicense all rights licensed to us by Teva under the FASN Agreement.

Pursuant to the FASN Agreement and the FGF21 Agreement (as described above), we paid Teva a nonrefundable upfront payment of $6.0 million. In addition, under the FASN Agreement,each agreement, we are required to make certain payments topay Teva totaling $2.5 million forupon the achievement of certaina specified clinical development milestones,milestone, and additional payments totaling up to $65.0 million upon achievement of certain commercial milestones. We are also obligated to pay Teva tiered royalties at percentages in the low-to-mid single-digits on worldwide net sales of products arising from the FASN program. Our royalty obligations will terminate, on a product-by-product and country-by-country basis, at the later of: (1) the date of expiration of the last to expire valid claim in the assigned patents that covers FASN in such country, (2) the expiration of data or regulatory exclusivity for such product arising from the FASN program in such country and (3) 10 years from the first commercial sale of a product arising from the FASN program in such country. To date, no milestone or royalty payments have been made under the FASN Agreement.

The term of the FASN Agreement will continue, on a product-by-product and country-by-country basis, until the royalty term with respect to the product arising from the FASN program in such country expires. We may terminate the FASN Agreement for any reason. Either party may terminate the agreement for cause for the other party’s uncured material breach, or in the event of bankruptcy of the other party.

20

Government Regulation and Product Approval

The FDA and other regulatory authorities at federal, state and local levels, as well as in foreign countries, extensively regulate, among other things, the research, development, testing, manufacture, quality control, import, export, safety, effectiveness, labeling, packaging, storage, distribution, record keeping, approval, advertising,

20

promotion, marketing, post-approval monitoring and post-approval reporting of biologics, such as those we are developing. We, along with third-party contractors, will be required to navigate the various preclinical, clinical and commercial approval requirements of the governing regulatory agencies of the countries in which we wish to conduct studies or seek approval or licensure of our product candidates.

The process required by the FDA before biologic product candidates may be marketed inIn the United States, is expensivebiological products are subject to regulation under the Federal Food, Drug, and time-consuming.Cosmetic Act, the Public Health Service Act and other federal, state, local, and foreign statutes and regulations. The process of obtaining regulatory approvals and the subsequence compliance with appropriate federal, state, and local statutes and regulations requires the expenditure of substantial time and financial resources. Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process or following approval may subject an applicant to administrative action and judicial sanctions. Generally, this process involves completing pre-clinical laboratory studies before the FDA will allow human clinical trials to commence. We are then required to complete human clinical trials to demonstrate that a product candidate is safe and effective. Following the completion of these clinical trials, we are required to prepare and submit a biologics license application (“BLA”), which presents the FDA with detailed clinical and safety data, as well as manufacturing data. As part of the review of a BLA, the FDA may inspect manufacturing facilities to assure the facilities, methods and controls are adequate to preserve the biological product’s continued safety, purity and potency, and may also inspect selected clinical investigation sites to assess compliance with current Good Clinical Practices (“cGCP”). This process takes many years from inception through filing of a BLA application and the likelihood of success is highly uncertain.

Preclinical and Clinical Development

Prior to beginning the first clinical trial with a product candidate, we must submit an investigational new drug (“IND”) application to the FDA. An IND is a request for authorization from the FDA to administer an investigational new drug product to humans. The central focus of an IND submission is the general investigational plan and the protocol(s) for clinical studies. The IND also includes results of animal and in vitro studies assessing the toxicology, pharmacokinetics, pharmacology and pharmacodynamic characteristics of the product, chemistry, manufacturing and controls information, and any available human data or literature to support the use of the investigational product. An IND must become effective before human clinical trials may begin. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA, within the 30-day period, raises safety concerns or questions about the proposed clinical trial. In such a case, the IND may be placed on a partial or full clinical hold and the IND sponsor and the FDA must resolve any outstanding concerns or questions before the clinical trial can begin. Submission of an IND therefore may or may not result in FDA authorization to begin a clinical trial. Submission of an IND may or may not result in FDA authorization to begin a clinical trial.

Clinical trials involve the administration of the investigational product to human subjects under the supervision of qualified investigators in accordance with cGCPs, which include the requirement that all research subjects provide their informed consent for their participation in any clinical study. Furthermore, an independentinstitutional review board (“IRB”) for each site proposing to conduct the clinical trial must review and approve the plan for any clinical trial and its informed consent form before the clinical trial begins at that site, and must monitor the study until completed. Regulatory authorities, the IRB or the sponsor may suspend a clinical trial at any time on various grounds, including a finding that the subjects are being exposed to an unacceptable health risk or that the trial is unlikely to meet its stated objectives.

For purposes of BLA approval, human clinical trials are typically conducted in three sequential phases that may overlap.

21

21

Concurrent with clinical trials, companies must finalize a process for manufacturing the product in commercial quantities in accordance with current good manufacturing practices (“cGMP”) requirements. The manufacturing process must be capable of consistently producing quality batches of the product candidate and, among other things, must develop methods for testing the identity, strength, quality and purity of the final product, or for biologics, the safety, purity and potency.

A sponsor may choose, but is not required, to conduct a foreign clinical study under an IND. When a foreign clinical study is conducted under an IND, all IND requirements must be met unless waived. When the foreign clinical study is not conducted under an IND, the sponsor must ensure that the study complies with certain FDA regulatory requirements in order to use the study as support for an IND or application for marketing approval or licensure, including that the study was conducted in accordance with Good Clinical Practice (“GCP”), including review and approval by an independent ethics committee and use of proper procedures for obtaining informed consent from subjects, and the FDA is able to validate the data from the study through an onsite inspection if the FDA deems such inspection necessary. The GCP requirements encompass both ethical and data integrity standards for clinical studies.

BLA Submission and Review

Assuming successful completion of all required testing in accordance with all applicable regulatory requirements, the results of product development, nonclinical studies and clinical trials are submitted to the FDA as part of a BLA requesting approval to market the product for one or more indications. The submission of a BLA requires payment of a substantial application user fee to FDA, unless a waiver or exemption applies.