UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

| FORM 10-K |

__________________

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIESEXCHANGE ACT OF 1934 |

For the Fiscal Year Ended: July 31, 2016

2018

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIESEXCHANGE ACT OF 1934 |

For the Transition Period from to

| For the Transition Period from to |

Commission file number: 1-3647

J.W. MAYS, INC.

(Exact name of registrant as specified in its charter)

| New York | 11-1059070 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 11201-5805 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:(718) 624-7400

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, par value $1 per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:None

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes☐ No ☒Yes☐ No☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒Yes☐ No☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐Yes☒ No☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Webweb site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes☒ No☐Yes☒ No☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.☒ No delinquent filers

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated | Accelerated | Emerging growth company☐ | |

| Non-accelerated | Smaller reporting |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐Yes☐ No☒

The aggregate market value of voting stock held by non-affiliates of the registrant was approximately $22,057,982$16,836,624 as of January 31, 20162018 based on the average of the bid and asked price of the stock reported for such date. For the purpose of the foregoing calculation, the shares of common stock held by each officer and director and by each person who owns 5% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the registrant’s common stock as of September 2, 20164, 2018 was 2,015,780.

DOCUMENTS INCORPORATED BY REFERENCE

| Part of Form 10-K | ||

| in which the Document | ||

| Document | is incorporated | |

| Annual Report to Shareholders for Fiscal Year Ended July 31, | Parts I and II | |

| Definitive Proxy Statement for the | Part III |

J.W. MAYS, INC.

FORM 10-K FOR THE FISCAL YEAR ENDED JULY 31, 20162018

J.W. Mays, Inc. (the “Company” or “Registrant”) with executive offices at 9Nine Bond Street, Brooklyn, New York 11201, operates a number of commercial real estate properties, which are described in Item 2 “Properties”. The Company’s business was founded in 1924 and incorporated under the laws of the State of New York on July 6, 1927.

The Company has 30 employees and has a contract, expiring November 30, 2016,2019, with a union covering rates of pay, hours of employment and other conditions of employment for approximately 23% of its employees. The Company considers that its labor relations with its employees and union are good.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K may contain forward-looking statements which include assumptions about future market conditions, operations and financial results. These statements are based on current expectations and are subject to risks and uncertainties. They are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The Company’s actual results, performance or achievements in the future could differ significantly from the results, performance or achievements discussed or implied in such forward-looking statements herein and in prior U. S. Securities and Exchange Commission (“SEC”) filings by the Company. The Company assumes no obligation to update these forward-looking statements or to advise of changes in the assumptions on which they were based.

Factors that could cause or contribute to such differences include, but are not limited to, changes in the competitive environment of the Company, general economic and business conditions, industry trends, changes in government rules and regulations and environmental rules and regulations. Statements concerning interest rates and other financial instrument fair values and their estimated contribution to the Company’s future results of operations are based upon market information as of a specific date. This market information is often a function of significant judgment and estimation. Further, market interest rates are subject to potential significant volatility.

Risks Relating to Ownership Structure

The controlling shareholder group may be able to vote its shares in favor of its interests that may not always coincide with the interests of shareholders not part of such group. This risk may be counter-balanced to a degree by the actions of the Board of Directors whose composition is made up of a majority of independent directors.

The controlling shareholder group includes a corporation that owns a significant percentage of the Company’s common stock and which does business with the Company, as further described in the Notes to the Consolidated Financial Statements. In theory, this could result in a conflict of interest; nevertheless, the Company and its largest shareholder have put in place some controls to reduce the effects of any perceived conflict of interest.

Certain conflicts of interest may be perceived by the relationship between the Company and its largest shareholder. Both entities have the same Chief Executive Officer, and certain management personnel work for both entities. Nevertheless, the Company’s Board of Directors (“Board”) is composed of a majority of independent directors. As recently as 2005, in a case involving both entities, the Delaware Supreme Court in connection with an attempt to obtain books and records of the Company through a proceeding against the Company’s significant shareholder, held that the actions of the Company’s Board were proper.

Risks Related to Our Business

We are a part of the communities in which we do business. Accordingly, like other businesses in our communities, we are subject to the following risks:

| ● | the continued threat of terrorism; |

| ● | economic downturns, both on a national and on local scales; |

| ● | loss of key personnel; |

| ● | the availability, if needed, of additional financing; |

| ● | the continued availability of insurance (in different types of policies) at reasonably acceptable rates; |

| ● | the general burdens of governmental regulation, at the Local, State and Federal levels; |

| ● | climate change; and |

| ● | cyber security. |

Risks Related to Real Estate Operations

Our investment in property development may be limited by increasing costs required to “fit up” property to be leased to tenants. Also, as the cost of fitting up properties increases, we may be required to wait and forsake opportunities that would be revenue producing until such time that we obtain the necessary financing of such ventures. This risk may be mitigated by our obtaining lines of credit and other financing vehicles, although such have significant limitations on the amounts that may be borrowed at any point in time.

We also may be subject to environmental liability as an owner or operator of properties. Many of our properties are old and when we need to fit up a property for a new tenant, we may find materials and the like that could be deemed to contain hazardous elements requiring remediation or encapsulation.

We try to lease our properties to tenants with adequate finances, but as a result of the economic downturn,occasional business downturns, even formerly financially strong tenants may be at risk. The Company is trying to mitigate the lattermitigates risks of tenants with less than adequate finances by leasing our properties to multiple tenants where applicable in order to diversify the tenant base.

Risks Related to our Investments

Excess cash and cash equivalents may be invested from time to time. We seek to earn rates of return that will help us finance our business operations. These investments may be subject to significant uncertainties and may not be successful for many reasons, including, but not limited to the following:

| ● | fluctuations in interest rates; |

| ● | worsening of general economic and market conditions; and |

| ● | adverse legal, financial and regulatory developments that may affect a particular business. |

Risk Factors Summary

These are some of the “Risk Factors” that could affect the Company’s business. The Company endeavors to take actions and do business in a way that reduces these “Risk Factors” or, at least, takes them into account when conducting its business. Nevertheless, some of these “Risk Factors” cannot be avoided so that the Company must also take actions and do business that negates the adverse effects that these may have on the Company.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

There are no unresolved comments from the staff of the U. S. Securities and Exchange Commission as of the date of this Annual Report on Form 10-K.

The table below sets forth certain information as to each of the properties currently operated by the Company:

| Approximate | ||||

| Location | Square Feet | |||

| 1. | Brooklyn, New York | |||

| Fulton Street at Bond Street | 380,000 | |||

| 2. | Brooklyn, New York | |||

| Jowein building at Elm Place | 201,000 | |||

| 3. | Jamaica, New York | |||

| Jamaica Avenue at 169th Street | 297,000 | |||

| 4. | Fishkill, New York | |||

| Route 9 at Interstate Highway 84 | 203,000 | |||

| (located on | ||||

| 14.6 acres) | ||||

| 5. | Levittown, New York | |||

| Hempstead Turnpike | 10,000 | |||

| (located on | ||||

| 75,800 square | ||||

| feet of land) | ||||

| 6. | Massapequa, New York | |||

| Sunrise Highway | 133,400 | |||

| 7. | Circleville, Ohio | |||

| Tarlton Road | 193,350 | |||

| (located on | ||||

| 11.6 acres) | ||||

| 8. | Brooklyn, New York | |||

| Truck bays, passage facilities and tunnel-Schermerhorn Street | 17,000 | |||

| Building-Livingston Street | 10,500 |

Properties are leased under long-term leases for varying periods, the longest of which extends to 2073, and in most instances renewal options are included. Reference is made to Note 5 to the Consolidated Financial Statements contained in the 20162018 Annual Report to Shareholders, incorporated herein by reference. The property owned which is held subject to mortgage is the Brooklyn Fulton Street at Bond Street building.

| 1. | Brooklyn, New York—Fulton Street at Bond Street |

90% of the property is owned by the Company and the remaining 10% of the property is leased by the Company under five separate leases. Expiration dates are as follows: 12/8/2043 (1 lease) which lease currently has one thirty-year renewal option through 12/8/2073. The Company in July 2012, exercised the first renewal option for thirty years ending 12/8/2043; 4/30/2026 (1 lease), 4/30/2021 The property is currently leased to

In |

In In November, 2017, the Company extended a lease with In May 2018, an office tenant who occupies In In In August 2018, the Company entered into a lease agreement with an existing office tenant for an additional 1,849 square feet until June 30, 2022 at its Nine Bond Street Brooklyn, New York building. It is the intention of the Company to negotiate the renewals of the expiring leases as they come due, providing the tenants maintain adequate finances. |

| Occupancy | Lease Expiration | Rent | |||||||||||||||

| Year | Year | Number of | Area | Annual | Percentage to | ||||||||||||

| Ended | Rate | Ended | Leases | Sq. Ft. | Rent | Gross Annual Rent | |||||||||||

| 7/31/2012 | 72.28% | 7/31/2017 | 3 | 26,578 | $939,311 | 5.393 | |||||||||||

| 7/31/2013 | 74.73% | 7/31/2018 | 2 | 3,363 | 87,442 | .502 | |||||||||||

| 7/31/2014 | 76.21% | 7/31/2019 | 2 | 57,909 | 975,341 | 5.600 | |||||||||||

| 7/31/2015 | 77.08% | 7/31/2020 | 1 | 1,000 | 41,520 | .238 | |||||||||||

| 7/31/2016 | 76.44% | 7/31/2021 | 5 | 23,797 | 1,230,916 | 7.068 | |||||||||||

| 7/31/2022 | 1 | 2,000 | 103,205 | .593 | |||||||||||||

| 7/31/2023 | 1 | 2,160 | 69,000 | .396 | |||||||||||||

| 7/31/2024 | 1 | 1,140 | 64,477 | .370 | |||||||||||||

| 7/31/2025 | 1 | 3,080 | 109,958 | .631 | |||||||||||||

| 7/31/2032 | 2 | 28,218 | 855,849 | 4.914 | |||||||||||||

| 7/31/2036 | 2 | 138,124 | 3,275,465 | 18.807 | |||||||||||||

| 21 | 287,369 | $7,752,484 | 44.512 | ||||||||||||||

| Occupancy | Lease Expiration | Rent | |||||||||||||||||

| Year | Year | Number of | Area | Annual | Percentage of | ||||||||||||||

| Ended | Rate | Ended | Leases | Sq. Ft. | Rent | Gross Annual Rent | |||||||||||||

| 7/31/2014 | 76.21 | % | 7/31/2019 | 6 | 62,229 | $ | 1,187,390 | 6.152 | |||||||||||

| 7/31/2015 | 77.08 | % | 7/31/2020 | 1 | 1,000 | 42,000 | .218 | ||||||||||||

| 7/31/2016 | 76.44 | % | 7/31/2021 | 4 | 17,205 | 801,463 | 4.152 | ||||||||||||

| 7/31/2017 | 75.59 | % | 7/31/2022 | 2 | 27,423 | 1,080,858 | 5.600 | ||||||||||||

| 7/31/2018 | 75.26 | % | 7/31/2023 | 1 | 63 | 10,250 | .053 | ||||||||||||

| 7/31/2024 | 1 | 1,140 | 64,799 | .336 | |||||||||||||||

| 7/31/2028 | 4 | 18,327 | 428,257 | 2.219 | |||||||||||||||

| 7/31/2032 | 2 | 28,218 | 891,343 | 4.618 | |||||||||||||||

| 7/31/2036 | 2 | 139,547 | 3,393,538 | 17.582 | |||||||||||||||

| 23 | 295,152 | $ | 7,899,898 | 40.930 | |||||||||||||||

The Company uses 17,810 square feet of available space. As of July 31, The real estate taxes for this property are | |

| 2. | Brooklyn, New York—Jowein building at Elm Place |

The building is owned. The property is currently leased to In November, In May

|

It is the intention of the Company to negotiate the renewals of the expiring leases as they come due, providing the tenants maintain adequate finances. |

| Occupancy | Lease Expiration | Rent | |||||||||||||||

| Year | Year | Number of | Area | Annual | Percentage to | ||||||||||||

| Ended | Rate | Ended | Leases | Sq. Ft. | Rent | Gross Annual Rent | |||||||||||

| 7/31/2012 | 76.38% | 7/31/2017 | 1 | 305 | $2,420 | .014 | |||||||||||

| 7/31/2013 | 61.45% | 7/31/2019 | 3 | 73,288 | 1,925,558 | 11.056 | |||||||||||

| 7/31/2014 | 70.49% | 7/31/2021 | 1 | 500 | 34,673 | .199 | |||||||||||

| 7/31/2015 | 68.83% | 7/31/2022 | 1 | 5,500 | 126,851 | .728 | |||||||||||

| 7/31/2016 | 70.70% | 7/31/2023 | 1 | 13,460 | 318,421 | 1.828 | |||||||||||

| 7/31/2025 | 1 | 23,004 | 423,335 | 2.431 | |||||||||||||

| 7/31/2036 | 1 | 8,500 | 29,372 | .169 | |||||||||||||

| 7/31/2037 | 1 | 17,425 | — | .000 | |||||||||||||

| 7/31/2059 | 1 | 19,437 | 114,550 | .658 | |||||||||||||

| 11 | 161,419 | $2,975,180 | 17.083 | ||||||||||||||

| Occupancy | Lease Expiration | Rent | |||||||||||||||||

| Year | Year | Number of | Area | Annual | Percentage of | ||||||||||||||

| Ended | Rate | Ended | Leases | Sq. Ft. | Rent | Gross Annual Rent | |||||||||||||

| 7/31/2014 | 70.49 | % | 7/31/2019 | 5 | 30,360 | $ | 825,173 | 4.275 | |||||||||||

| 7/31/2015 | 68.83 | % | 7/31/2020 | 1 | 30,816 | 771,788 | 3.999 | ||||||||||||

| 7/31/2016 | 70.70 | % | 7/31/2021 | 1 | 500 | 45,872 | .238 | ||||||||||||

| 7/31/2017 | 77.53 | % | 7/31/2022 | 2 | 16,069 | 525,326 | 2.722 | ||||||||||||

| 7/31/2018 | 84.22 | % | 7/31/2023 | 2 | 16,760 | 515,513 | 2.671 | ||||||||||||

| 7/31/2025 | 1 | 23,004 | 583,015 | 3.021 | |||||||||||||||

| 7/31/2028 | 1 | 5,000 | 150,439 | .779 | |||||||||||||||

| 7/31/2036 | 1 | 11,505 | 34,551 | .179 | |||||||||||||||

| 7/31/2037 | 1 | 17,425 | 567,234 | 2.939 | |||||||||||||||

| 7/31/2059 | 1 | 19,437 | 115,945 | .601 | |||||||||||||||

| 16 | 170,876 | $ | 4,134,856 | 21.424 | |||||||||||||||

As of July 31, The real estate taxes for this property are | |

| 3. | Jamaica, New York—Jamaica Avenue at 169th Street |

The building is owned and the land is leased from an affiliated company. The lease expires July 31, 2027. The property is currently leased to ten tenants:

It is the intention of the Company to negotiate the renewals of the expiring leases as they come due, providing the tenants maintain adequate finances. |

| Occupancy | Lease Expiration | Rent | |||||||||||||||

| Year | Year | Number of | Area | Annual | Percentage to | ||||||||||||

| Ended | Rate | Ended | Leases | Sq. Ft. | Rent | Gross Annual Rent | |||||||||||

| 7/31/2012 | 81.14% | 7/31/2017 | 3 | 71,825 | $1,446,126 | 8.303 | |||||||||||

| 7/31/2013 | 80.30% | 7/31/2019 | 1 | 40,109 | 887,715 | 5.097 | |||||||||||

| 7/31/2014 | 75.41% | 7/31/2020 | 1 | 42,250 | 1,127,530 | 6.474 | |||||||||||

| 7/31/2015 | 80.50% | 7/31/2021 | 2 | 472 | 47,200 | .271 | |||||||||||

| 7/31/2016 | 80.16% | 7/31/2024 | 1 | 25,954 | 406,706 | 2.335 | |||||||||||

| 7/31/2026 | 1 | 6,021 | 174,160 | 1.000 | |||||||||||||

| 7/31/2027 | 1 | 52,444 | 606,189 | 3.481 | |||||||||||||

| 10 | 239,075 | $4,695,626 | 26.961 | ||||||||||||||

| Occupancy | Lease Expiration | Rent | |||||||||||||||||

| Year | Year | Number of | Area | Annual | Percentage of | ||||||||||||||

| Ended | Rate | Ended | Leases | Sq. Ft. | Rent | Gross Annual Rent | |||||||||||||

| 7/31/2014 | 75.41 | % | 7/31/2019 | 1 | 47,100 | $ | 980,256 | 5.079 | |||||||||||

| 7/31/2015 | 80.50 | % | 7/31/2020 | 1 | 42,250 | 1,104,498 | 5.723 | ||||||||||||

| 7/31/2016 | 80.16 | % | 7/31/2021 | 2 | 472 | 70,800 | .367 | ||||||||||||

| 7/31/2017 | 80.50 | % | 7/31/2022 | 1 | 22,045 | 531,338 | 2.753 | ||||||||||||

| 7/31/2018 | 79.99 | % | 7/31/2023 | 2 | 40,109 | 1,000,816 | 5.185 | ||||||||||||

| 7/31/2024 | 1 | 28,634 | 622,116 | 3.223 | |||||||||||||||

| 7/31/2026 | 1 | 6,021 | 169,245 | .877 | |||||||||||||||

| 7/31/2027 | 1 | 52,444 | 796,278 | 4.126 | |||||||||||||||

| 10 | 239,075 | $ | 5,275,347 | 27.333 | |||||||||||||||

As of July 31, The real estate taxes for this property are | |

| 4. | Fishkill, New York—Route 9 at Interstate Highway 84 |

The Company owns the entire property. In October 2013, the Company leased 99,992 square feet to a retail tenant. Occupancy commenced in November 2013 and rent commenced in March 2014. This tenant planned to vacate the space, but in May 2017, an agreement was reached where they will continue occupancy. There are approximately 100,000 square feet of the building available for lease. There are plans to renovate vacant space upon the execution of future leases to tenants, although no assurances can be made as to when or if such leases will be entered into. |

| Occupancy | Lease Expiration | Rent | |||||||||||||||

| Year | Year | Number of | Area | Annual | Percentage of | ||||||||||||

| Ended | Rate | Ended | Leases | Sq. Ft. | Rent | Gross Annual Rent | |||||||||||

| 7/31/2012 | — | 7/31/2019 | 1 | 99,992 | $283,250 | 1.626 | |||||||||||

| 7/31/2013 | — | ||||||||||||||||

| 7/31/2014 | 29.62% | ||||||||||||||||

| 7/31/2015 | 47.39% | ||||||||||||||||

| 7/31/2016 | 47.39% | ||||||||||||||||

| Occupancy | Lease Expiration | Rent | |||||||||||||||||

| Year | Year | Number of | Area | Annual | Percentage of | ||||||||||||||

| Ended | Rate | Ended | Leases | Sq. Ft. | Rent | Gross Annual Rent | |||||||||||||

| 7/31/2014 | 29.62 | % | 7/31/2019 | 1 | 99,992 | $ | 299,000 | 1.549 | |||||||||||

| 7/31/2015 | 47.39 | % | |||||||||||||||||

| 7/31/2016 | 47.39 | % | |||||||||||||||||

| 7/31/2017 | 47.39 | % | |||||||||||||||||

| 7/31/2018 | 47.39 | % | |||||||||||||||||

As of July 31, The real estate taxes for this property are | |

| 5. | Levittown, New York—Hempstead Turnpike |

The Company owns the entire property. In October 2006, the Company entered into a lease agreement with a restaurant. The restaurant constructed a new 10,000 square foot building, which opened in May 2008. In October 2016, the restaurant extended its lease for an additional five years expiring May 3, 2023. Ownership of the building reverts to the Company at the conclusion of the leasing arrangement, currently |

| Occupancy | Lease Expiration | Rent | |||||||||||||||

| Year | Year | Number of | Area | Annual | Percentage of | ||||||||||||

| Ended | Rate | Ended | Leases | Sq. Ft. | Rent | Gross Annual Rent | |||||||||||

| 7/31/2012 | 100.00% | 7/31/2018 | Building | 10,000 | $396,889 | 2.279 | |||||||||||

| 7/31/2013 | 100.00% | Land | 75,800 | ||||||||||||||

| 7/31/2014 | 100.00% | 1 | 85,800 | ||||||||||||||

| 7/31/2015 | 100.00% | ||||||||||||||||

| 7/31/2016 | 100.00% | ||||||||||||||||

| Occupancy | Lease Expiration | Rent | |||||||||||||||||

| Year | Year | Number of | Area | Annual | Percentage of | ||||||||||||||

| Ended | Rate | Ended | Leases | Sq. Ft. | Rent | Gross Annual Rent | |||||||||||||

| 7/31/2014 | 100.00 | % | 7/31/2023 | Building | 10,000 | $ | 398,950 | 2.067 | |||||||||||

| 7/31/2015 | 100.00 | % | Land | 75,800 | |||||||||||||||

| 7/31/2016 | 100.00 | % | 1 | 85,800 | |||||||||||||||

| 7/31/2017 | 100.00 | % | |||||||||||||||||

| 7/31/2018 | 100.00 | % | |||||||||||||||||

The real estate taxes for this property are | |

| 6. | Massapequa, New York—Sunrise Highway |

The Company is the prime tenant of this leasehold. The lease expired May 14, 2009, and there was one renewal option for twenty-one years, which the Company exercised in April 2008. The leasehold is currently subleased to two tenants; one tenant |

| Occupancy | Lease Expiration | Rent | |||||||||||||||

| Year | Year | Number of | Area | Annual | Percentage of | ||||||||||||

| Ended | Rate | Ended | Leases | Sq. Ft. | Rent | Gross Annual Rent | |||||||||||

| 7/31/2012 | 89.38% | 7/31/2030 | 1 | 113,400 | $739,410 | 4.246 | |||||||||||

| 7/31/2013 | 100.00% | ||||||||||||||||

| 7/31/2014 | 98.75% | ||||||||||||||||

| 7/31/2015 | 85.01% | ||||||||||||||||

| 7/31/2016 | 85.01% | ||||||||||||||||

In March 2018, the Company leased the 20,000 square feet of area available at its Massapequa, New York property to a restaurant until May 2030. Rent is anticipated to commence in late 2018. | |

| Occupancy | Lease Expiration | Rent | |||||||||||||||||

| Year | Year | Number of | Area | Annual | Percentage of | ||||||||||||||

| Ended | Rate | Ended | Leases | Sq. Ft. | Rent | Gross Annual Rent | |||||||||||||

| 7/31/2014 | 98.75 | % | 7/31/2030 | 2 | 133,400 | $ | 775,256 | 4.017 | |||||||||||

| 7/31/2015 | 85.01 | % | |||||||||||||||||

| 7/31/2016 | 85.01 | % | |||||||||||||||||

| 7/31/2017 | 85.01 | % | |||||||||||||||||

| 7/31/2018 | 90.63 | % | |||||||||||||||||

The real estate taxes for this property are | |

The Company does not own this property. Improvements to the property, if any, are made by tenants. | |

| 7. | Circleville, Ohio—Tarlton Road |

The Company owns the entire property. The property is currently leased to two tenants. The tenants use these premises for warehouse and distribution facilities. One tenant’s lease agreement was executed for a five year period, with a right to cancel after three years, for 75,000 square feet to November 11, 2010 at which time the tenant occupied 30,000 square feet on a month to month basis. In October 2013, the tenant signed a lease agreement for a five year period to occupy 48,000 square feet and in May 2015 signed a modification of lease to occupy 72,000 square feet. In August 2016, this tenant signed a further modification of lease to occupy 84,000 square feet. The other tenant’s lease agreement was executed in May 2015, for a five-year period effective June 1, 2015, and allows the tenant to have permanent space of 108,000 square feet. In April 2018, the Company extended a lease with an existing tenant who occupies 84,000 square feet for warehouse space at the Company’s Circleville, Ohio building for an additional three years expiring on October 31, 2021. | |

| Occupancy | Lease Expiration | Rent | |||||||||||||||

| Year | Year | Number of | Area | Annual | Percentage of | ||||||||||||

| Ended | Rate | Ended | Leases | Sq. Ft. | Rent | Gross Annual Rent | |||||||||||

| 7/31/2012 | 77.75% | 7/31/2019 | 1 | 84,000 | $184,953 | 1.062 | |||||||||||

| 7/31/2013 | 72.41% | 7/31/2020 | 1 | 108,000 | 258,243 | 1.483 | |||||||||||

| 7/31/2014 | 78.36% | 2 | 192,000 | $443,196 | 2.545 | ||||||||||||

| 7/31/2015 | 91.54% | ||||||||||||||||

| 7/31/2016 | 96.72% | ||||||||||||||||

| Occupancy | Lease Expiration | Rent | |||||||||||||||||

| Year | Year | Number of | Area | Annual | Percentage of | ||||||||||||||

| Ended | Rate | Ended | Leases | Sq. Ft. | Rent | Gross Annual Rent | |||||||||||||

| 7/31/2014 | 78.36 | % | 7/31/2020 | 1 | 108,000 | $ | 258,700 | 1.340 | |||||||||||

| 7/31/2015 | 91.54 | % | 7/31/2022 | 1 | 84,000 | 221,951 | 1.150 | ||||||||||||

| 7/31/2016 | 96.72 | % | 2 | 192,000 | $ | 480,651 | 2.490 | ||||||||||||

| 7/31/2017 | 99.04 | % | |||||||||||||||||

| 7/31/2018 | 99.04 | % | |||||||||||||||||

As of July 31, | ||

The real estate taxes for this property are | ||

| 8. | Brooklyn, New York—Livingston Street | |

The City of New York through its Economic Development Administration constructed a municipal garage at Livingston Street opposite the Company’s Brooklyn properties. The Company has a long-term lease with the City of New York and another landlord which expired in 2013. The lease has two renewal options, the last of which expires in 2073. The Company exercised one of the renewal options in July 2012 for an additional thirty year period, expiring in 2043, under which: | ||

| (1) | Such garage provided truck bays and passage facilities through a tunnel, both for the exclusive use of the Company, to the structure referred to in (2) below. The truck bays, passage facilities and tunnel, totaling approximately 17,000 square feet, are included in the lease from the City of New York and another landlord referred to in the preceding paragraph. | |

On June 16, 2014, the Company entered into a Second Amendment of Lease (the “Amendment”) with 33 Bond St. LLC (“Bond”), its landlord, for certain truck bays and approximately 1,000 square feet located at the cellar level within a garage at Livingston and Bond Street (“Premises”). Pursuant to the Amendment, (1) a lease option for the Premises was exercised extending the lease until December 8, 2043, |

(2) the Company, simultaneously with the execution of the Amendment, vacated the Premises so that Bond may demolish the building in which the Premises is located in order to develop and construct a new building at the location, and (3) Bond agreed to redeliver to the Company possession of the reconfigured Premises after construction. As consideration under the Amendment, Bond agreed to pay the Company a total of $3,500,000. Upon execution of the Amendment, the Company recorded $3,500,000 to deferred revenue to be amortized to revenue to temporally vacate the premises over the expected vacate period of 36 months. Bond tendered $2,250,000 simultaneously with the execution of the Amendment, and the balance due of $1,250,000 on June 16, 2015 had been received by the Company. The Company re-occupied the premises in October 2017. In connection with the Amendment, the parties also agreed to settle a pending lawsuit in the Supreme Court of the State of New York, Kings County, Index No. 50796/13 (the “Action”), in which the Company sought, among other things, a declaratory judgment that it validly renewed the lease for the Premises, and Bond sought, among other things, a declaratory judgment that the lease expired by its terms on December 8, 2013. Pursuant to a stipulation of settlement, filed on June 16, 2014, the Action, including all claims and counterclaims, has been discontinued with prejudice, without costs or attorneys’ fees to any party as against the other. The stipulation of settlement also contains general releases by both parties of all claims. | ||

| The Company constructed a building of six stories and basement on a 20 x 75-foot plot (acquired and made available by the City of New York and leased to the Company for a term expiring in 2013 with renewal options, the last of which expires in 2073). The Company in July 2012, exercised the first renewal option for thirty years, ending in 2043. The plot is adjacent to and connected with the Company’s Brooklyn properties. | ||

In the opinion of management, all of the Company’s properties are adequately covered by insurance. See Note 10 to the Consolidated Financial Statements contained in the | ||

Due to defective workmanship and breach of contract, the Company continues to pursue damages and return in full of a $376,467 deposit paid a contractor when construction commenced to replace a roof and various other work on the Fishkill, New York building. Both the contractor and subcontractors have claimed the Company tortuously interfered with the construction contracts arguing for fees and costs which approximate $700,000. While the Company strongly disputes the claims, it is possible that the court may rule against the Company and may assess damages in amounts up to approximately $700,000. It is also possible that the court may rule in favor of the Company and that no damages would be awarded against the Company and the Company could obtain an order for the return of all or a portion of amounts previously paid. A charge to real estate operating expenses in the amount of $279,213 was recorded for the fiscal year ended July 31, 2016. Following initial court decisions, another $141,132 was charged to operating expenses on October 31, 2016 and this amount was ordered by the Court to be paid, plus interest, in a judgement dated September 14, 2017. The testimony phase of the trial has been completed and the parties await further decisions and orders of the court.

There are various other lawsuits and claims pending against the Company. It is the opinion of management that the resolution of these matters will not have a material adverse effect on the Company’s Consolidated Financial Statements.

If the Company sells, transfers, disposes of or demolishes 25 Elm Place, Brooklyn, New York, then the Company may be liable to create a condominium unit for the loading dock. The necessity of creating the condominium unit and the cost of such condominium unit cannot be determined at this time.

Because of defective workmanship and breach of contract, the Company commenced litigation against a contractor to pay damages and return in full $376,467 of a deposit paid when work commenced to replace a roof on the Fishkill, New York building. As of July 31, 2015, this deposit was included in other assets on the consolidated balance sheet in security deposits. The Company cannot predict the outcome of this matter and expects to vigorously pursue this contractor until the deposit is returned and damages are paid. As there is a reasonable possibility the contractor will not pay the Company in full, a charge to real estate operating expenses in the amount of $279,213 was recorded as of July 31, 2016, the difference between the deposit amount when work commenced and outstanding invoices due the contractor.

ITEM 4. MINE SAFETY DISCLOSURES.

None

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

COMMON STOCK AND DIVIDEND INFORMATION

Effective November 8, 1999, the Company’s common stock commenced trading on The Nasdaq Capital Market tier of The Nasdaq Stock Market under the Symbol: “Mays”. Such shares were previously traded on The Nasdaq National Market. Effective August 1, 2006, NASDAQ became operational as an exchange in NASDAQ-Listed Securities. It is now known as The NASDAQ Stock Market LLC.

The following is the sales price range per share of J. W. Mays, Inc. common stock during the fiscal years ended July 31, 20162018 and 2015:2017:

| Sales Price | ||||||

| Three Months Ended | High | Low | ||||

| October 31, 2015 | $ | 63.20 | $ | 55.00 | ||

| January 31, 2016 | 57.90 | 54.91 | ||||

| April 30, 2016 | 55.00 | 46.00 | ||||

| July 31, 2016 | 57.87 | 47.62 | ||||

| October 31, 2014 | $ | 64.25 | $ | 46.00 | ||

| January 31, 2015 | 54.65 | 47.00 | ||||

| April 30, 2015 | 55.00 | 47.00 | ||||

| July 31, 2015 | 57.00 | 47.13 | ||||

| Sales Price | ||||||

| Three Months Ended | High | Low | ||||

| October 31, 2017 | $ | 47.00 | $ | 35.30 | ||

| January 31, 2018 | 42.45 | 35.50 | ||||

| April 30, 2018 | 38.00 | 37.25 | ||||

| July 31, 2018 | 43.50 | 37.70 | ||||

| October 31, 2016 | $ | 48.50 | $ | 42.50 | ||

| January 31, 2017 | 46.50 | 41.50 | ||||

| April 30, 2017 | 43.00 | 38.00 | ||||

| July 31, 2017 | 41.50 | 33.55 | ||||

The quotations were obtained for the respective periods from the National Association of Securities Dealers, Inc. There were no dividends declared in either of the two fiscal years.

On September 2, 2016,1, 2018, the Company had approximately 800 shareholders of record.

RECENT SALES OF UNREGISTERED SECURITIES

During the year ended July 31, 20162018 we did not sell any unregistered securities.

RECENT PURCHASES OF EQUITY SECURITIES

During the year ended July 31, 20162018 we did not repurchase any of our outstanding equity securities.

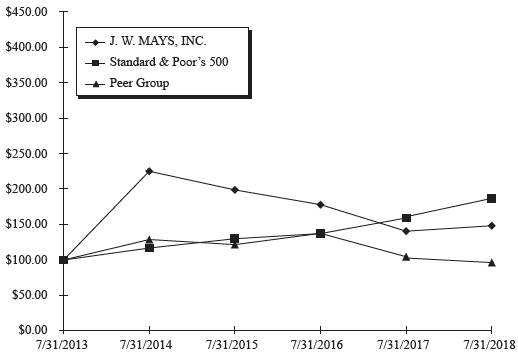

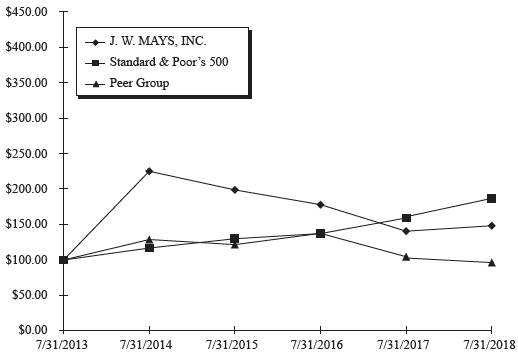

The following graph sets forth a five- yearfive-year comparison of cumulative total shareholder return for the Company, the Standard & Poor’s 500 Stock-Index (“S&P 500”), and a Peer Group. The graph assumes the investment of $100 at the close of trading July 31, 20112013 in the common stock of the Company, the S&P 500 and the Peer Group, and the reinvestment of all dividends, although the Company did not pay a dividend during this five-year period.

Comparison of Five-Year Cumulative Total Return*

J. W. MAYS, INC., Standard & Poor’s 500 And Peer Group

(Performance Results Through 7/31/16)18)

| 7/31/2011 | 7/31/2012 | 7/31/2013 | 7/31/2014 | 7/31/2015 | 7/31/2016 | 7/31/2013 | 7/31/2014 | 7/31/2015 | 7/31/2016 | 7/31/2017 | 7/31/2018 | |||||||||||||||||||

| J. W. MAYS, INC. | 100.00 | 116.67 | 161.52 | 364.12 | 321.52 | 287.88 | $ | 100.00 | $ | 225.44 | $ | 199.06 | $ | 178.24 | $ | 140.71 | $ | 148.41 | ||||||||||||

| Standard & Poor’s 500 | 100.00 | 109.13 | 138.53 | 162.00 | 180.16 | 190.27 | $ | 100.00 | $ | 116.94 | $ | 130.05 | $ | 137.35 | $ | 159.38 | $ | 185.27 | ||||||||||||

| Peer Group | 100.00 | 92.40 | 97.05 | 125.11 | 118.14 | 133.58 | $ | 100.00 | $ | 128.92 | $ | 121.74 | $ | 137.65 | $ | 104.64 | $98.17 | |||||||||||||

Assumes $100 invested at the close of trading 7/31/1113 in J. W. MAYS, INC. common stock, Standard & Poor’s 500 and Peer Group.

*Cumulative total return assumes reinvestment of dividends.

Source: Value Line Publishing LLC

Factual material is obtained from sources believed to be reliable, but the publisher is not responsible for any errors or omisions contained herein.

The Performance Graph shall not be deemed incorporated by reference by any general statement of incorporation by reference in any filing made under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, and shall not otherwise be deemed filed under such Acts.

ITEM 6. SELECTED FINANCIAL DATA.

The information appearing under the heading “Summary of Selected Financial Data” on page 2 of the Registrant’s 20162018 Annual Report to Shareholders is incorporated herein by reference.

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

The information appearing under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” on pages 27-31 of the Registrant’s 20162018 Annual Report to Shareholders is incorporated herein by reference.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

The Company uses fixed-rate debt to finance its capital requirements. These transactions do not expose the Company to market risk related to changes in interest rates. The Company does not use derivative financial instruments. At July 31, 2016,2018, the Company had fixed-rate debt of $6,786,525.$5,467,111.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The Registrant’s Consolidated Financial Statements, together with the report of D’Arcangelo & Co., LLP, independent registered public accounting firm, dated October 6, 2016,4, 2018, appearing on pages 4 through 2325 of the Registrant’s 20162018 Annual Report to Shareholders is incorporated herein by reference. With the exception of the aforementioned information and the information incorporated by reference in Items 2, 5, 6, and 7 hereof, the 20162018 Annual Report to Shareholders is not to be deemed filed as part of this Form 10-K Annual Report.

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. |

There are no disagreements between the Company and its accountants relating to accounting or financial disclosures.

ITEM 9A. CONTROLS AND PROCEDURES.

(A) EVALUATION OF DISCLOSURE CONTROLS AND PROCEDURES.

The Company’s management reviewed the Company’s internal controls and procedures and the effectiveness of these controls. As of July 31, 2016,2018, the Company carried out an evaluation, under the supervision of, and with the participation of the Company’s management, including its Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of the Company’s disclosure controls and procedures pursuant to Rules 13a-14(c) and 15d-14(c) of the Securities Exchange Act of 1934. Based upon that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and procedures are effective in timely alerting them to material information relating to the Company required to be included in its periodic SEC filings.

(B) CHANGE TO INTERNAL CONTROLS OVER FINANCIAL REPORTING.

There was no change in the Company’s internal controls over financial reporting or in other factors during the Company’s last fiscal quarter that materially affected, or is reasonably likely to materially affect, the Company’s internal controls over financial reporting. There were no significant deficiencies or material weaknesses noted, and therefore there were no corrective actions taken.

(C) MANAGEMENT’S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING.

The Company’s management is responsible for establishing and maintaining adequate internal control over financial reporting as such term is defined in Rule 13(a)-15(f). Our internal control system has been designed to provide reasonable assurance to the Company’s management and its Board of Directors regarding the preparation and fair presentation of published financial statements. All internal control systems, no matter how well designed, have inherent limitations. Even those systems that have been determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. The Company’s management assessed the effectiveness of our internal control over financial reporting as of July 31, 2016.2018. In making this assessment, the Company’s management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission in Internal Control – Integrated Framework published in 2013. Based on the Company’s assessments, we believe that, as of July 31, 2016,2018, its internal control over financial reporting is effective based on these criteria.

This Form 10-K Annual Report does not include an attestation report of our independent registered public accounting firm regarding internal controls over financial reporting. Management’s report was not subject to attestation by our independent registered public accounting firm pursuant to the permanent exemption for smaller reporting company filers from the internal control audit requirement of Section 404(b) of the Sarbanes-Oxley Act of 2002.

Reports on Form 8-K -- One report on Form 8-K was filed by the Company during the three months ended July 31, 2016.2018.

Item reported - The Company reported its financial results for the three and nine months ended April 30, 2016.2018.

Date of report filed - June 2, 20167, 2018.

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

The information relating to directors of the Company is contained in the Definitive Proxy Statement for the 20162018 Annual Meeting of Shareholders and such information is incorporated herein by reference.

Executive Officers of the Registrant

The following information is furnished with respect to each Executive Officer of the Registrant (each of whose position is reviewed annually but each of whom has a three-year employment agreement, effective August 1, 2011 and renewed August 1, 2014)2014 and August 1, 2017).

| First Became | ||||||

| Business Experience During | Such Officer | |||||

| Name | Age | the Past Five Years | or Director | |||

| Lloyd J. Shulman | President | November, 1978 | ||||

| Co-Chairman of the Board | ||||||

| and President | June, 1995 | |||||

| Chairman of the Board | ||||||

| and President | November, 1996 | |||||

| Director | November, 1977 | |||||

| Mark S. Greenblatt | Vice President | August, 2000 | ||||

| Treasurer | August, 2003 | |||||

| Director | August, 2003 | |||||

| Assistant Treasurer | November, 1987 | |||||

| Ward N. Lyke, Jr. | Vice President | February, 1984 | ||||

| Assistant Treasurer | August, 2003 | |||||

| George Silva | Vice President | March, 1995 |

All of the above mentioned officers have been appointed as such by the directors and have been employed as Executive Officers of the Company during the past five years.

The information required by this item appears under the heading “Compensation” in the Definitive Proxy Statement for the 20162018 Annual Meeting of Shareholders and such information is incorporated herein by reference.

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. |

The information required by this item appears under the headings “Security Ownership of Certain Beneficial Owners and Management” and “Information Concerning Nominees for Election as Directors” in the Definitive Proxy Statement for the 20162018 Annual Meeting of Shareholders and such information is incorporated herein by reference.

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. |

The information required by this item appears under the headings “Compensation”, “Certain Transactions,” and “Board Interlocks and Insider Participation” in the Definitive Proxy Statement for the 20162018 Annual Meeting of Shareholders and such information is incorporated herein by reference.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES.

The following table sets forth the fees paid by the Company (on a cash basis) to its independent registered public accounting firm, D’Arcangelo & Co., LLP, for the fiscal years 20162018 and 2015.2017.

| Fiscal Year | Fiscal Year | Fiscal Year | Fiscal Year | ||||||||||||

| 2016 | 2015 | 2018 | 2017 | ||||||||||||

| Audit fees | $ | 107,020 | $ | 136,006 | $ | 168,348 | $ | 214,000 | |||||||

| Tax fees | 51,060 | 63,260 | 60,050 | 21,653 | |||||||||||

| Other fees | 6,570 | 17,330 | 9,000 | 4,325 | |||||||||||

| Total | $ | 164,650 | $ | 216,596 | $ | 237,398 | $ | 239,978 | |||||||

Audit Fees for fiscal year 20162018 and fiscal year 20152017 were for professional services rendered for the audits of the consolidated financial statements of the Company, interim quarterly reviews of Form 10-Q information and assistance with the review of documents filed with the U. S. Securities and Exchange Commission.

Tax Fees and Other Fees for fiscal year 20162018 and fiscal year 20152017 were for services related to tax compliance and preparation of federal, state and local corporate tax returns and audit of real estate tax matters.

The officers of the Company consult with, and receive the approval of, the Audit Committee before engaging accountants for any services.

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES.

The following documents are filed as part of this report:

The Consolidated Financial Statements and report of D’Arcangelo & Co., LLP, independent registered public accounting firm, dated October | |||

| 2. | |||

See accompanying Index to the Company’s Consolidated Financial Statements and Schedules. |

3. | Exhibits: | |||||||

| (2) | Plan of acquisition, reorganization, arrangement, liquidation or succession—not applicable. | |||||||

| (3) | Articles of incorporation and by-laws: | |||||||

| (i) | Certificate of Incorporation | |||||||

| (ii) | By-laws, as amended | |||||||

| (4) | Instruments defining the rights of security holders, including indentures—see Exhibit (3) above. | |||||||

| (9) | Voting trust agreement—not applicable. | |||||||

| (10) | Material contracts: | |||||||

| (i) | The J.W. Mays, Inc. Retirement Plan and Trust, Summary Plan Description, effective August 1, | |||||||

| (ii) | Employment Agreements with Messrs. Shulman, Greenblatt, Lyke and Silva, each dated August 1, | |||||||

| (11) | Statement re computation of per share earnings—not applicable. | |||||||

| (12) | Statement re computation of ratios—not applicable. | |||||||

| (13) | Annual Report to security holders. | |||||||

| (14) | Code of ethics—not applicable. | |||||||

| (16) | Letter re change in certifying auditors—not applicable. | |||||||

| (18) | Letter re change in accounting principles—not applicable. | |||||||

| (21) | Subsidiaries of the registrant. | |||||||

| (22) | Published report re matters submitted to vote of security holders—not applicable. | |||||||

| (24) | Power of attorney—none. | |||||||

| (28) | Information from reports furnished to state insurance regulatory authorities—not applicable. | |||||||

| (31) | Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |||||||

| 31.1—Chief Executive Officer | ||||||||

| 31.2—Chief Financial Officer | ||||||||

| (32) | Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002; 18 U.S.C. Sec. 1350. | |||||||

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| J.W. MAYS, INC. | |||||

| (Registrant) | |||||

| October | By: | LLOYD J. SHULMAN | |||

| Lloyd J. Shulman | |||||

| Chairman of the Board | |||||

| Principal Executive Officer | |||||

| President | |||||

| Principal Operating Officer | |||||

| October | By: | MARK S. GREENBLATT | |||

| Mark S. Greenblatt | |||||

| Vice President and Treasurer | |||||

| Principal Financial Officer | |||||

| October | By: | WARD N. LYKE, JR. | |||

| Ward N. Lyke, Jr. | |||||

| Vice President | |||||

| and Assistant Treasurer | |||||

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant in the capacities and on the date indicated.

| Signature | Title | Date | ||

| LLOYD J. SHULMAN | Chairman of the Board, Chief Executive | October | ||

| Lloyd J. Shulman | Officer, President, Chief Operating | |||

| Officer and Director | ||||

| MARK S. GREENBLATT | Vice President, Treasurer and Director | October | ||

| Mark S. Greenblatt | ||||

| ROBERT L. ECKER | Director | October | ||

| Robert L. Ecker | ||||

| STEVEN GURNEY-GOLDMAN | Director | October 4, 2018 | ||

| Steven Gurney-Goldman | ||||

| JOHN J. PEARL | Director | October | ||

| John J. Pearl | ||||

| DEAN L. RYDER | Director | October | ||

| Dean L. Ryder | ||||

| JACK SCHWARTZ | Director | October | ||

| Jack Schwartz | ||||

INDEX TO REGISTRANT’S FINANCIAL STATEMENTS AND SCHEDULES

Reference is made to the following sections of the Registrant’s Annual Report to Shareholders for the fiscal year ended July 31, 2016,2018, which are incorporated herein by reference:

Report of Independent Registered Public Accounting Firm (page 23)25)

Consolidated Balance Sheets (pages 4 and 5)

Consolidated Statements of Income and Retained Earnings (page 6)

Consolidated Statements of Comprehensive Income (page 7)

Consolidated Statements of Cash Flows (page 8)

Notes to Consolidated Financial Statements (pages 9-21)

Financial Statement Schedules

Valuation and Qualifying Accounts (page 22)

Real Estate and Accumulated Depreciation (page 23)

Report of Management (page 22)24)

All other schedules for which provision is made in the applicable regulations of the U. S. Securities and Exchange Commission are not required under the related instructions or are inapplicable and, accordingly, are omitted.

The separate financial statements and schedules of J.W. Mays, Inc. (not consolidated) are omitted because the Company is primarily an operating company and its subsidiaries are wholly-owned.

J.W. MAYS, INC.VALUATION AND QUALIFYING ACCOUNTS

| Year Ended July 31, | |||||||||

| 2016 | 2015 | 2014 | |||||||

| Allowance for net unrealized gains (losses) on marketable securities: | |||||||||

| Balance, beginning of year | $ | 297,031 | $ | 236,412 | $ | 333,633 | |||

| Additions (deletions) | 103,510 | 60,619 | (97,221 | ) | |||||

| Balance, end of year | $ | 400,541 | $ | 297,031 | $ | 236,412 | |||

J.W.MAYS, INC.REALESTATE ANDACCUMULATEDDEPRECIATIONJuly 31, 2016

| Col. A | Col. B | Col. C | Col. D | Col. E | Col. F | Col. G | Col. H | Col. I | |||||||||||||||||||||||||||

| Cost Capitalized | Life on Which | ||||||||||||||||||||||||||||||||||

| Subsequent to | Gross Amount at Which Carried | Depreciation in | |||||||||||||||||||||||||||||||||

| Initial Cost to Company | Acquisition | At Close of Period | Latest Income | ||||||||||||||||||||||||||||||||

| Building & | Carried | Building & | Accumulated | Date of | Date | Statement is | |||||||||||||||||||||||||||||

| Description | Encumbrances | Land | Improvements | Improvements | Cost | Land | �� | Improvements | Total | Depreciation | Construction | Acquired | Computed | ||||||||||||||||||||||

| Office and Rental Buildings | |||||||||||||||||||||||||||||||||||

| Brooklyn, New York | |||||||||||||||||||||||||||||||||||

| Fulton Street at Bond Street | $ | 5,786,525 | $ | 3,901,349 | $ | 7,403,468 | $ | 22,090,157 | $— | $ | 3,901,349 | $ | 29,493,625 | $ | 33,394,974 | $ | 11,589,363 | Various | Various | (1) (2) | |||||||||||||||

| Jamaica, New York | |||||||||||||||||||||||||||||||||||

| Jamaica Avenue at 169th Street | — | — | 3,215,699 | 16,319,534 | — | — | 19,535,233 | 19,535,233 | 10,171,768 | 1959 | 1959 | (1) (2) | |||||||||||||||||||||||

| Fishkill, New York | |||||||||||||||||||||||||||||||||||

| Route 9 at Interstate Highway 84 | — | 594,723 | 7,212,116 | 4,872,441 | — | 594,723 | 12,084,557 | 12,679,280 | 8,813,635 | 10/74 | 11/72 | (1) | |||||||||||||||||||||||

| Brooklyn, New York | |||||||||||||||||||||||||||||||||||

| Jowein Building Fulton Street | — | 1,324,957 | 728,327 | 14,552,304 | — | 1,324,957 | 15,280,631 | 16,605,588 | 4,852,873 | 1915 | 1950 | (1) (2) | |||||||||||||||||||||||

| and Elm Place | |||||||||||||||||||||||||||||||||||

| Levittown, New York Hempstead | |||||||||||||||||||||||||||||||||||

| Turnpike | — | 125,927 | — | — | — | 125,927 | — | 125,927 | — | 4/69 | 6/62 | (1) | |||||||||||||||||||||||

| Circleville, Ohio | |||||||||||||||||||||||||||||||||||

| Tarlton Road | — | 120,849 | 4,388,456 | 86,520 | — | 120,849 | 4,474,976 | 4,595,825 | 2,581,171 | 9/92 | 12/92 | (1) | |||||||||||||||||||||||

| Total(A) | $ | 5,786,525 | $ | 6,067,805 | $ | 22,948,066 | $ | 57,920,956 | $— | $ | 6,067,805 | $ | 80,869,022 | $ | 86,936,827 | $ | 38,008,810 | ||||||||||||||||||

| Year Ended July 31, | |||||||||

| 2016 | 2015 | 2014 | |||||||

| Investment in Real Estate | |||||||||

| Balance at Beginning of Year | $ | 84,474,345 | $ | 82,092,994 | $ | 78,547,467 | |||

| Improvements | 2,462,482 | 2,426,491 | 3,545,527 | ||||||

| Retirements | — | (45,140 | ) | — | |||||

| Balance at End of Year | $ | 86,936,827 | $ | 84,474,345 | $ | 82,092,994 | |||

| Accumulated Depreciation | |||||||||

| Balance at Beginning of Year | $ | 36,413,975 | $ | 34,773,376 | $ | 33,097,163 | |||

| Additions Charged to Costs and Expenses | 1,594,835 | 1,658,091 | 1,676,213 | ||||||

| Retirements | — | (17,492 | ) | — | |||||

| Balance at End of Year | $ | 38,008,810 | $ | 36,413,975 | $ | 34,773,376 | |||

EXHIBIT INDEX TO FORM 10-K

| (2) | Plan of acquisition, reorganization, arrangement, liquidation or succession—not applicable | |||||

| (3) | (i) | Certificate of | ||||

| (ii) | By-laws, as amended — incorporated by reference | |||||

| (4) | Instruments defining the rights of security holders, including indentures—see Exhibit (3) above | |||||

| (9) | Voting trust agreement—not applicable | |||||

| (10) | Material contracts: | |||||

| Retirement Plan and Trust, Summary Plan Description | ||||||

| (ii) | Employment agreements — incorporated by reference | |||||

| (11) | Statement re computation of per share earnings—not applicable | |||||

| (12) | Statement re computation of ratios—not applicable | |||||

| (13) | Annual Report to security holders | |||||

| (14) | Code of ethics—not applicable | |||||

| (16) | Letter re change in certifying auditors—not applicable | |||||

| (18) | Letter re change in accounting principles—not applicable | |||||

| (21) | Subsidiaries of the registrant | |||||

| (22) | Published report re matters submitted to vote of security holders—not applicable | |||||

| (24) | Power of attorney—none | |||||

| (28) | Information from reports furnished to state insurance regulatory authorities—not applicable | |||||

| (31) | Certifications Pursuant to Section 302 of the Sarbanes-Oxley Act—1 and 2 | |||||

| 31.1—Chief Executive Officer | ||||||

| 31.2—Chief Financial Officer | ||||||

| (32) | Certification Pursuant to Section 906 of the Sarbanes-Oxley Act | |||||

| EX-101.INS | XBRL INSTANCE DOCUMENT | |||

| EX-101.SCH | XBRL TAXONOMY EXTENSION SCHEMA | |||

| EX-101.PRE | XBRL TAXONOMY EXTENSION PRESENTATION LINKBASE | |||

| EX-101.LAB | XBRL TAXONOMY EXTENSION LABEL LINKBASE | |||

| EX-101.CAL | XBRL TAXONOMY EXTENSION CALCULATION LINKBASE | |||

| EX-101.DEF | XBRL TAXONOMY EXTENSION DEFINITION LINKBASE | |||

1917