UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

FORM 10-K

_______________________________________

(Mark One)

☒ | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20202023

orOR

☐ | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________________ to _____ .____________

Commission File Number: 001-37844

_______________________

Bioventus Inc.BIOVENTUS INC.

(Exact nameName of registrantRegistrant as specifiedSpecified in its charter)

_______________________Its Charter)

| | | | | | | | |

| Delaware | | | | | | | | 81-0980861 |

Delaware

(State or other jurisdictionOther Jurisdiction of incorporation Incorporation or organization)

Organization) | | 81-0980861

(I.R.S. Employer Identification No.) |

| | |

| 4721 Emperor Boulevard, Suite 100 | | |

| Durham, North Carolina | | 27703 |

(Address of principal executive offices)Principal Executive Offices) | | 27703

(Zip Code) |

(919) 474-6700

(Registrant’s telephone number, including area code)

_______________________Telephone Number, Including Area Code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, $0.001 par value $0.001 per share | BVS | The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

_______________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No☒No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐☒ No ☒☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§ (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ¨☐ | | Accelerated filer | ¨☒ |

| | | |

| Non-accelerated filer | ý☐ | | Smaller reporting company | ¨☒ |

| | | Emerging Growth Company | | | |

| | Emerging growth company | ý☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B)13(a) of the SecuritiesExchange Act. ý☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý☒

As of June 26, 2020,July 1, 2023, the last business dayend of the registrant's most recently completed second fiscal quarter, there was no public market for the registrant's common equity and, therefore, the registrant cannot calculate the aggregate market value of its voting and non-votingClass A common equitystock held by non-affiliates as(based upon the closing price of such date.these shares on the Nasdaq) was approximately $75.4 million.

As of March 22, 2021,February 27, 2024, there were 41,038,58963,378,803 shares of Class A common stock outstanding and 15,786,737 shares of Class B common stock outstanding.

BIOVENTUS INC.DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTSCertain of the information required to be furnished pursuant to Part III of this Annual Report on Form 10-K will be set forth in, and incorporated by reference from, the registrant’s definitive proxy statement for the 2024 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission no later than 120 days after the end of the fiscal year ended December 31, 2023.

| | | | | | | | |

| BIOVENTUS INC. | |

| | |

| TABLE OF CONTENTS | |

| | |

| | Page |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| |

FORWARD-LOOKING STATEMENTSTRADEMARKS, TRADE NAMES AND SERVICE MARKS

This Annual Report on Form 10-K (Annual Report)(“Annual Report”) includes our trademarks and trade names that we own or license, and our logos. This Annual Report also includes trademarks, trade names and service marks that are the property of other organizations. Solely for convenience, trademarks and trade names referred to in this Annual Report appear without any “™” or “®” symbol, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, trade names and service marks. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act)(“Exchange Act”), and Section 27A of the Securities Act of 1933, as amended (Securities Act)(“Securities Act”), concerning our business, operations and financial performance and condition, as well as our plans, objectives and expectations for our business operations and financial performance and condition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements including, without limitation, statements regarding our business strategy, including, without limitation,expectations relating to our integration of Misonix and Bioness, potential acquisitions, and expected expansion of our pipeline and research and development investment, cost savings initiatives, new therapy launches, expected timelines for clinical trial results and other development milestones, expected contractual obligations and capital expenditures, our operations and expected financial performance and condition, and impacts of the COVID-19 pandemic.condition. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words.

Forward-looking statements are based on management’s current expectations, estimates, forecasts and projections about our business and the industry in which we operate, and management’s beliefs and assumptions are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this Annual Report may turn out to be inaccurate. Furthermore, if the forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. FactorsImportant factors that may cause actual results to differ materially from current expectations include, among other things, those described in Part I, Item 1A. Risk factors.Factors, which are summarized in the list below. You are urged to consider these factors carefully in evaluating these forward-looking statements. These forward-looking statements speak only as of the date hereof. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This Annual Report includes our trademarks and trade names that we own or license, such as Bioventus, Cellxtract, Durolane, Exogen, Exponent, GELSYN-3, MOTYS, OsteoAMP, Prohesion, PureBone, SAFHS, Signafuse, SUPARTZ FX and our logo. This Annual Report also includes trademarks, trade names and service marks that are the property of other organizations. Solely for convenience, trademarks and trade names referred to in this Annual Report appear without any “™” or “®” symbol, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, trade names and service marks. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

SUMMARY OF PRINCIPAL RISK FACTORS

Summary of Principal Risk Factors

We are subject to several risks, including risks that may prevent us from achieving our business objectives or that may adversely affect our business, results of operations, financial condition, and cash flows. You should carefully consider the risks discussed in the section entitled Part I, Item 1A. Risk Factors, including the following principal risks:

•if we are unable to meet our current operating projections or secure other sources of liquidity, substantial doubt about our ability to continue as a going concern may arise, which may negatively affect the market value of our Class A common stock;

•our Amended 2019 Credit Agreement contains financial and operating restrictions that may limit our access to credit. If we fail to comply with its financial or other covenants, we may be required to repay the indebtedness on an accelerated basis, which we may be unable to do and may harm our liquidity and operations;

•failure to establish and maintain effective financial controls could adversely affect our business and stock price;

•we maintain our cash at financial institutions, often in balances that exceed federally insured limits;

•we might require additional capital to fund our current financial obligations and support business growth;

•we are currently subject to securities class action litigation and derivative shareholder lawsuits and may continuebe subject to experiencesimilar or other litigation in the future, which will require significant management time and attention, result in significant legal expenses and may result in unfavorable outcomes, which may have a material adverse impacts as a resulteffect on our business, operating results and financial condition, and negatively affect the price of the COVID-19 pandemic;our common stock;

•we are highly dependent on a limited number of products;

•our long-term growth depends on our ability to develop, acquire and commercialize new products, line extensions or expanded indications;

•we may be unable to successfully commercialize newly developed or acquired products or therapies in the United States;

•demand for our existing portfolio of products and any new products, line extensions or expanded indications depends on the continued and future acceptance of our products by physicians, patients, third-party payers and others in the medical community;

•our commercial success depends on our ability to differentiate the HA viscosupplementation therapies that we own or distribute from alternative therapies for the treatment of OA;

•the proposed down classificationdown-classification of non-invasive bone growth stimulators, including our Exogen, system, by the FDA could increase future competition for bone growth stimulators and otherwise adversely affect the Company’sour sales of Exogen;

•if we are unable to achieve and maintain adequate levels of coverage and/or reimbursement for our products, the procedures using our products, or any future products we may seek to commercialize, the commercial success of these products may be severely hindered;

•our business may be adversely affected if we chooseconsolidation in the healthcare industry leads to acquiredemand for price concessions or invest in new businesses, productsif one or technologies, more Group Purchasing Organizations (“GPO”), third-party payers or other similar entities exclude us from being a supplier;

•we may be unable to complete theseproposed acquisitions or to successfully integrate themproposed or recent acquisitions in a cost-effective and non-disruptive manner;

•if we fail to successfully enter into purchasing contracts for our Surgical Solutions products or engage in contract bidding processes internationally, we may not be able to receive access to certain hospital facilities and our sales may decrease;

•we compete and may compete in the future against other companies, some of which have longer operating histories, more established products or greater resources than we do, which may prevent us from achieving increased market penetration or improved operating results;

•the reclassification of our HA products from medical devices to drugs in the United States by the FDA could negatively impact our ability to market these products and may require that we conduct costly additional clinical studies to support current or future indications for use of those products;

•our ability to maintain our competitive position depends on our ability to attract, retain and motivate our senior management team and highly qualified personnel, and our failure to do so could adversely affect our business, results of operations and financial condition;

•actual or attempted breaches of security, unauthorized access to or disclosure of information, cyberattacks, or other incidents, or the perception that personal and/or other sensitive or confidential information in our possession or control or in the possession or control of our third-party vendors or service providers is not secure, could result in a material loss of business, substantial legal liability or significant harm to our reputation;

•our products and operations are subject to extensive governmental regulation, and our failure to comply with applicable requirements could cause our business to suffer;

•the FDA regulatory process is expensive, time-consuming and uncertain, and the failure to obtain and maintain required regulatory clearances and approvals could prevent us from commercializing our products;

•legislative or regulatory reforms, including those currently under consideration by FDA and the EU, could make it more difficult or costly for us to obtain regulatory clearance, approval or certification of any future products and to manufacture, market and distribute our products after clearance, approval or certification is obtained, which could adversely affect our competitive position and materially affect our business and financial results;

•our HCT/P, which is an acronym for human cell, tissue and cellular and tissue related products, are subject to extensive government regulation and our failure to comply with these requirements could cause our business to suffer;

•if clinical studies of our future products do not produce results necessary to support regulatory clearance, approval or certification in the United States or elsewhere, we will be unable to expand the indications for or commercialize these products;

•interim, “top-line” and preliminary data from our clinical trials that we announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final data;

•we may be subject to enforcement action if we engage in improper marketing or promotion of our products, and the misuse or off-label use of our products may harm our image in the marketplace, result in injuries that lead to product liability suits or result in costly investigations, fines and/or sanctions by regulatory bodies if we are deemed to have engaged in the promotion of these uses, any of which could be costly to our business;

•regulatory reforms, such as the EU Medical Devices Regulation, could limit our ability to market and distribute our products after clearance, approval or certification is obtained and make it more difficult or costly for us to obtain regulatory clearance, approval or certification of any future products, which could adversely affect our competitive position and materially affect our business and financial results;

•recent environmental regulatory actions regarding medical device sterilization facilities could result in disruptions in the supply of certain of our products and could adversely affect our business, results of operations and financial condition;

•if our facilities or those of our suppliers are damaged or become inoperable, we will be unable to continue to research, develop and manufacture our products and, as a result, our business, results of operations and financial condition may be adversely affected until we are able to secure a new facility;

•we depend on certain technologies that are licensed to us. We do not control the intellectual property rights covering these technologies and any loss of our rights to these technologies or the rights licensed to us could prevent us from selling our products, and operations are subject to extensive governmental regulation, and our failure to comply with applicable requirementswhich could causeadversely impact our business, results of operations and financial condition; and

•our principal asset is our interest in BV LLC, and, accordingly, we depend on distributions from BV LLC to suffer;

•wepay our taxes and expenses, including payments under the Tax Receivable Agreement. BV LLC’s ability to make such distributions may be subject to enforcement action if we engage in improper claims submission practicesvarious limitations and resulting audits or denials of our claims by government agencies could reduce our net sales or profits;

•the FDA regulatory process is expensive, time-consuming and uncertain, and the failure to obtain and maintain required regulatory clearances and approvals could prevent us from commercializing our products; our HCT/P products are subject to extensive government regulation and our failure to comply with these requirements could cause our business to suffer;

•if clinical studies of our future products do not produce results necessary to support regulatory clearance or approval in the United States or elsewhere, we will be unable to expand the indications for or commercialize these products; and

•we may be subject to enforcement action if we engage in improper marketing or promotion of our products, that could lead to costly investigations, fines or sanctions by regulatory bodies, any of which could be costly to our business.

restrictions.

PART I

Item 1.Business.

Bioventus Inc. is a Delaware corporation formed on December 22, 2015. Unless the context requires otherwise, in this Annual Report on Form 10-K (Annual Report)(“Annual Report”) the terms “we,” “us,” “our,” the “Company,” “Bioventus,” “Bioventus Inc.” and similar references refer to the combined operations of Bioventus Inc. and its consolidated subsidiaries and affiliates, including Bioventus LLC (BV LLC).

Initial public offering and organizational transactions

On February 16, 2021, we closed an initial public offering (IPO) of 9,200,000 shares of our Class A common stock at a public offering price of $13.00 per share, which included 1,200,000 shares issued pursuant to the underwriters' over-allotment option. We received $111.2 million in proceeds, net of underwriting discounts and commissions, which we used to purchase newly-issued membership interests from (“BV LLC at a price per interest equal to the IPO price of our Class A common stock of $13.00.

Bioventus is a holding company with no direct operations and our principal asset is the equity interest in BV LLC. In connection with the IPO, we completed a series of organizational transactions including, without limitation, the following:

•the limited liability company agreement of BV LLC was amended and restated (Bioventus LLC Agreement) to, among other things, (i) provide for a new single class of common membership interests in BV LLC (LLC Interests), (ii) exchange all of the then existing membership interests of the holders of BV LLC membership interests (Original LLC Owners) for LLC Interests and (iii) appoint Bioventus Inc. as the sole managing member of BV LLC; and

•the acquisition, by merger, of certain members of BV LLC (Former LLC Owners), for which we issued 31,838,589 shares of Class A common stock as merger consideration (Merger)LLC”).

Refer to Note 4 Subsequent events of the Bioventus, Inc. financial statements included in Part II, Item 8. Financial Statements and Supplementary Data of this Annual Report for more information about the above-mentioned transactions as well as the other transactions completed in connection with the IPO (Transactions). Following the completion of the Transactions, Bioventus owned 72.2% of BV LLC. Smith & Nephew, Inc. (Continuing LLC Owner) owned the remaining 27.8% of BV LLC. We have a majority economic interest, the sole voting interest in, and control the management of, BV LLC. As a result, we will consolidate the financial results of BV LLC and will report a non-controlling interest representing the LLC Interests held by the Continuing LLC Owners.

Company overview

We are a global medical device company focused on developing and commercializing clinically differentiated, cost efficient and minimally invasive treatments that engage and enhance the body’s natural healing process. Our devices are most often used to delay or replace the need for an elective surgical procedure and are focused on reaching patients early on in their treatment paradigm. The Company is headquartered in Durham, North Carolina. We have administrative facilities in the United States (U.S.), Canada, and the Netherlands, and a manufacturing facility in the U.S. We directly distribute products in the U.S., Canada, United Kingdom (U.K.), Germany and the Netherlands. In several of these and other markets, we also distribute our products through independent distributors.

We believe our non-invasive medical device and biologic products play a critical role in supporting the body’s own healing mechanisms to heal or eliminate the pain caused by orthopedic conditions and problems, which we define as our active healing products. These products address an estimated $6.0 billion market opportunity across osteoarthritic (OA) joint pain treatment and joint preservation, spinal fusion surgery and bone fractures, each of which is experiencing growth through multiple industry tailwinds, including an aging population, increased participation in sports and active lifestyles and a rise in obesity rates. Our devices are most often used to delay or replace the need for an elective surgical procedure and are focused on reaching patients early on in their treatment paradigm. Our products are widely reimbursed by both public and private health insurers and are sold in the physician’s office or clinic, in ambulatory surgical centers (ASCs), and in the hospital setting in the U.S. and across 37 countries. We manage our business by ourthrough two reporting segments, U.S. and International, which accounted for 91%88% and 9%12%, respectively, of our total net sales during the fiscal year ended December 31, 2020. 2023.

Our portfolio of products is grouped into three areas:

•Pain Treatments is comprised of non-surgical pain injection therapies as well as peripheral nerve stimulation (“PNS”) products to help the patient get back to their normal activities.

•Surgical Solutions is comprised of bone graft substitutes (“BGS”) that increase bone formation to stimulate bone healing in spinal fusions and other orthopedic surgeries, as well as a portfolio of ultrasonic products used for precise bone cutting and sculpting, soft tissue management (i.e., tumor and liver resections) and tissue debridement, in various surgeries, including minimally invasive applications.

•Restorative Therapies is comprised of a bone stimulation system, as well as devices designed to help patients regain leg or hand function due to stroke, multiple sclerosis or other central nervous system disorders.

Financial information regarding our reportable business segments and certain geographic information is included in Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Annual Report. See also Note 15. Segments of the Notes to the Consolidated Financial Statements in and Part II,Item 8. Financial Statements and Supplementary DataData—Notes to the Consolidated Financial Statements—Note 14. Segments of this Annual Report for further information regarding our business segments.

Report. Our existing portfolio of products is grouped into three verticals based on our targeted customer focus:

•OA Joint Pain Treatment and Joint Preservation.We are the largest pure play orthopedics-focused company in the OA joint pain treatment and joint preservation market. We have been the fastest growing hyaluronic acid (HA) participant over the last three years, driving our share to number three by revenue in the U.S. market. We offer the only complete portfolio of HA viscosupplementation therapies, including single, three and five injection regimens, for patients experiencing pain related to OA in the knee. Our HA products are all approved by the U.S. Food and Drug Administration (FDA) through premarket approvals (PMAs), and include:

(a)Durolane, a single injection therapy, was launcheddescribed in the United States in 2018 and is also marketed outside the United States in more than 30 countries including Europe through a CE mark, which is an abbreviation for Conformité Européenne or European Conformity;

(b)GELSYN-3, a three injection therapy, was launched in the United States in 2016; and

(c)SUPARTZ FX, a five injection therapy, was launched in the United States in 2001.

•Bone Graft Substitutes. We are the fastest growing participant in the bone graft substitutes (BGSs) market and offer a broad portfolio of products including human tissue allografts and synthetics. Our BGS products can be used in conjunction with any orthopedic fixation and spinal fusion implant. They are designed to improve bone fusion rates following spinal fusion and other orthopedic surgeries and reduce the need for using the patient’s own bone, which is associated with additional cost and morbidity. Our products include an allograft-derived bone graft with growth factors (OsteoAMP), a demineralized bone matrix (DBM) (Exponent), a cancellous bone in different preparations (PureBone), bioactive synthetics (Signafuse and Interface), a collagen ceramic matrix (OsteoMatrix) and two bone marrow isolation systems (CellXtract and Extractor). Our products have received either 510(k) clearance from the FDA or are marketed pursuant to Section 361 of the Public Health Service Act (PHSA) as Section 361 HCT/Ps. HCT/Ps regulated solelydetail below under Section 361 are human cells, tissues and cellular and tissue-based products that do not require marketing authorization to be marketed in the United States.

•Minimally Invasive Fracture Treatment. Our Exogen system was the number one prescribed device in the bone growth stimulatory market in 2018 (the latest period for which data is available). It has had marketing authorization via a PMA through the FDA for over 25 years. We are the only company to utilize advanced, pulsed ultrasound technology for bone growth in delayed and nonunion fractures in all fracture locations except spine, as well as in fresh fractures of the tibia and radius. Our Exogen system offers significant advantages over electrical based long bone stimulation systems, including a documented mechanism of action, shorter treatment times and superior nonunion heal rates. The system is also sold internationally under a CE mark for nonunions and fresh fractures and is the market-leading bone healing treatment in the delayed union and nonunion market in Japan.

The COVID-19 pandemic and the measures imposed to contain the spread of the virus disrupted our business beginning in early March 2020 as healthcare systems across the U.S. were forced to limit patient visits and elective surgical procedures. The effects of the pandemic began to decrease in late April 2020 and we saw a very strong recovery for our products at the end of the second quarter as restrictions on orthopedic procedures were lifted across the United States and patients also returned to orthopedic offices. Refer to Part I, Item 1A. Risk Factors and Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for more information regarding the impact and related risks of the COVID-19 pandemic on our business.“Our products.”

Our growth strategy

We intend to pursue the following strategies to build a market-leading and customer-focused company centered on the OA joint pain treatmentour three product groupings, Pain Treatments, Surgical Solutions and joint preservation, BGSs and minimally invasive fracture treatments, andRestorative Therapies, to continue to grow our net sales and Adjusted EBITDA:deliver profitable growth:

•Continue to expand market share in HAHyaluronic Acid (“HA”) viscosupplementation.We intend to increase sales of our HA viscosupplementation therapies and extend our market leadership in this category by building on our unique positioning as the only company to offer a one, three and five injection treatment regimen and by expanding payer coverage, which weregimen. Our product, Durolane, is known to have done successfully, increasing the number of lives under contract from 6 million to 48 million between 2017 and 2020. This increase in lives, along with our differentiated portfolio and dedicated direct sales team, has allowed us to achieve significant market share gains over the last several years and positioned us as the largest pure play orthopedic-focused companyhighest molecular weight in the U.S. HA viscosupplementationsingle injection market, with a market share of approximately 17% as of September 26, 2020.which is an important differentiator.

•Introduce new OA joint pain treatment and joint preservation products. To expand our offering beyond HA viscosupplementation therapies and build a comprehensive portfolio for the OA joint pain treatment and joint preservation, we are planning to commercially launch a range of new therapies over the next several years, including:

(a)Agili-C. An off-the-shelf aragonite implant designed for implantation into osteochondral defects in the knee. The Agili-C implant received breakthrough device designation by the FDA in the fourth quarter of 2020. We have an option to acquire this technology from CartiHeal upon FDA approval. CartiHeal submitted the non-clinical module of the PMA in January 2021 and expects to submit the final, clinical module of a Modular PMA in the fourth quarter of 2021 seeking FDA approval.

(b)MOTYS. A placental tissue injectable biologic for knee OA, which we began selling in the cash pay market in the fourth quarter of 2020 as a Section 361 HCT/P pursuant to a temporary FDA policy of enforcement discretion. On October 29, 2020, we received FDA confirmation indicating its authorization of our investigational new drug application (IND), and a clinical trial for MOTYS has commenced in the first quarter of 2021. In parallel, we plan to pursue a required BLA premarket approval for this product, which we expect would expand insurance payment alternatives over time.

(c)PROcuff. A bio-inductive collagen implant for regeneration of tendon tissue in the rotator cuff. We expect to file a request for 510(k) clearance in either the second or third quarter of 2022.

•Further develop and commercialize our BGSsurgical solutions portfolio. We intend to grow our presence in the BGS marketSurgical Solutions target markets and expand our reach into the operating room in both ASCs and hospitals.as we look to commercialize recent product launches of Bone Scalpel Access for minimally invasive spine procedures. In the near-term, we plan to maintain and selectively expand our profitable product lines, by adding todriving profitability through the expansion of our U.S. distributor base in an effort to reach significantly underpenetrated markets. Over time, weand direct surgical sales team including the introduction of a Capital Sales Team. We intend to launch product line enhancements and invest in the development of next-generation BGSsurgical solution therapies to continue to grow our market share. Consistent with this strategy, we recently launched the Signafuse Bioactive Strip and anticipate launching the OsteoAmp Flowable in 2021.

•Expand indications for use for our Exogen system.We are focused on generating incremental clinical data and peer-reviewed publications to expand our indications and continue to grow our market leading share. We are currently underway with the B.O.N.E.S. clinical studies, which are aimed at generating data to support label expansion in additional bone types and expanded reimbursement for the treatment of fresh fractures in patients at risk of nonunion due to certain comorbidities, such as diabetes or obesity. We commenced patient enrollment to study three specific bones in 2017 and began a rolling release of data in late 2020. Depending on the results from our studies, we plan to submit a total of three PMA supplements to the FDA, the first of which was submitted in December 2020 seeking approval for the adjunctive treatment of acute and delayed metatarsal fractures to reduce the risk of non-union. We plan to submit the second PMA supplement in the second quarter of 2022 and the third PMA supplement in the second half of 2023.

•Invest in research and development. We are focused on internal researchbroadening and development to broadeninnovating our portfolio of therapies to manage OA joint painproducts, and joint preservation, expand our Exogen system product label and undertake clinical research to support commercialization of our next-generation of BGS products. We see significant opportunity to develop innovative and clinically differentiated products internally with our qualified research and development team. We rely on a small team of 40 highly trained individuals to develop new products, conduct clinical investigations and help educate health carehealth-care providers on using our products. Our researchproducts and development team is comprised of 13 members holding PhDs and 18 members with more than 20 years of experience inprioritize the medical device industry. We collaborate with academic centers of excellence, leading contract research organizations and other industrial groups to complement and expedite execution of our research and development programs and minimize fixed costs.

•Pursue business development opportunities. Consistent with our track record of partnerships and acquisitions of MOTYS, PROcuff and CartiHeal, we intend to continue to pursue business development opportunities that leveragecould drive the biggest benefit for patients, customers, and our significant customer presence across orthopedics, broaden our portfolio and increase our global footprint. We will continue to search for clinically differentiated and cost-effective products and technologies that also balance our portfolio in terms of risk and time to market.business.

•OpportunisticallyStrategically grow our international markets.We intend to focus our international business on current markets which present the greatest growth opportunities, and where our existing portfolio can maintain and increase profitable growth over time, either through direct or distributor based channels. For example, we launched OsteoAMP in Canada in 2020, where Durolane and Exogen had a market leading presence in 2016. We also plan to selectivelystrategically expand to new markets with Durolane, Exogen and our BGSsexisting portfolio and intend to pursue further new market opportunities in the Asia Pacific markets. In particular, China represents an attractive and exciting market given its large and aging population as well as its rising middle class. We have added management in China and will be creating a legal entity as we seek approval from the China Food and Drug Administration for Durolane, which we believe will be facilitated by the successful completion of our Chinese randomized controlled trial (RCT).

Recent Developments

Investment and Potential Acquisition

On January 4, 2021, we made a convertible debt investment of $1.5 million, (Investment), in a medical device company (Target), as a part of our exclusive negotiations with the Target regarding the Potential Transaction (as defined below). If the Potential Transaction is not consummated, the Investment will be convertible into equity of the Target at our discretion or upon a change of control of the Target, which we expect to result in approximately 2% equity ownership in the Target. The arrangement has allowed the parties to explore a possible acquisition of the Target (Potential Transaction) for a payment of $45.0 million to be paid at closing with contingent payments of up to $65.0 million to be paid upon achievement of certain key milestones. While still subject to due diligence, we believe the Target’s patent-protected portfolio of FDA approved products and its product development pipeline are highly complementary to our OA joint pain treatment and joint preservation vertical and would allow us to further leverage our claims processing infrastructure. For the year ended December 31, 2020, the Target generated approximately $40.0 million in revenue and had loss from operations of approximately $14.0 million. We expect the Target to be accretive to revenues immediately if the Potential Transaction closed, and to have a positive contribution to combined Company net income excluding purchase accounting and transaction costs by the end of year one post-close. We were notified that a minority shareholder of the Target filed a complaint with the Court of Chancery of the State of Delaware on February 4, 2021 contesting the Potential Transaction, as well as related motions to expedite proceedings and issue a temporary restraining order. We understand that the Target was successful defending the action and on March 4, 2021, the complaint and motions were dismissed, but there can be no assurance that this action will not impact the timing, terms, or likelihood of closing of the Potential Transaction. Any resulting acquisition will be funded through our current cash balance and, if necessary, proceeds from our existing line of credit. We cannot assure that the acquisition will occur on or before a certain time, on the terms described herein, or at all. See Part I, Item 1A. Risk Factors—Risks related to our business—If we choose to acquire or invest in new businesses, products or technologies, we may be unable to complete these acquisitions or to successfully integrate them in a cost-effective and non-disruptive manner.selectively.

Our products

We offer a diverse portfolio of active healing products to serve physicians spanning the orthopedic continuum, including sports medicine, total joint reconstruction,knee, hand and upper extremities, foot and ankle, podiatricpodiatry, trauma, general surgery, trauma, spine and neurosurgery, in the physician’s office or clinic, ASCsambulatory surgical centers (“ASCs”) or in the hospital setting.

Our portfolio of products is grouped into three verticalsareas based on clinical use: (i) OA joint pain treatment and joint preservation,Pain Treatments, (ii) BGSsSurgical Solutions and (iii) minimally invasive fracture treatment.

OA joint pain treatment and joint preservation

Knee OA is a degenerative condition that is chronic in nature and is characterized by gradual breakdown and destruction of the cartilage in the knee. This condition develops over years and is often found in patients who exhibit joint malalignment, have had a joint injury, or are overweight. The disease can involve joint inflammation and results in symptoms that include redness, warmth, swelling, stiffness, tenderness, limited range of motion and pain. As the condition advances, the knee joint gradually loses cartilage tissue and the cartilage layer attached to the bone deteriorates to the point where eventually the bone becomes exposed.

We have the only complete one, three and five injection portfolio in the HA viscosupplementation market in the United States with Durolane, GELSYN-3 and SUPARTZ FX.

| | | | | | | | | | | | | | | | | | | | |

Product | | Description | | Regulatory pathway | | Region where marketed(1)

|

| | Single injection HA

viscosupplementation therapy | | •PMA

•Device approval by Health Canada

•CE mark and other registrations(2)

| | •United States

•Canada

•Europe

|

| | | | | | |

| | Three injection HA

viscosupplementation therapy | | •PMA

| | •United States

|

| | | | | | |

| | Five injection HA

viscosupplementation therapy | | •PMA

| | •United States

|

__________________Restorative Therapies.

(1)We maintain exclusive distribution agreementsPain Treatments

Our Pain Treatment products include hyaluronic acid-based (“HA”) products for knee osteoarthritis and peripheral nerve stimulation (“PNS”) devices. Our HA products are designed to work with respectthe body’s biological processes, providing a natural lubricant into the joint and providing relief for mild to Durolane, GELSYN-3moderate pain, improving mobility, and SUPARTZ FXhelping the patient return to their normal activities. Our PNS product targets peripheral nerve pain at its source without the use of drugs and its small profile allows the system to be implanted in many locations on the United States. We maintain exclusive distribution agreements and own certain assets with respect to Durolane outside the United States.body, depending on patient needs.

(2)

Durolane is also approved for marketing in Argentina, Australia, Brazil, Columbia, India, Indonesia, Jordan, Malaysia, Mexico, New Zealand, Russia, Switzerland, Taiwan, Turkey and the United Arab Emirates (UAE).

Single Injection Therapy

Durolaneis aan FDA-approved, sterile, transparent and viscoelastic gel that is a single injection therapy that is indicated in the United States for the symptomatic treatment of OAosteoarthritis (“OA”) in the knee in the United States.patients who have failed to respond adequately to conservative non-pharmacological therapy and simple analgesics. Durolane is also indicated in certain markets outside the United States for the hip, ankle and shoulder, as well as for treatment of other small orthopedic joints outside the United States.joints. Durolane contains high levels of HA and is injected directly into the joints affected by OA to relieve pain and restore lubrication and cushioning. This may improve joint function and help to potentially avoid or delay knee replacement surgery.

Physicians administer Durolane to the affected knee joint in a single injection and it has been observed to provide a benefit for pain reduction in patients with OA in the knee for up to 26 weeks. Durolane’s injection schedule results in economic advantages and greater patient convenience and compliance compared to other HA viscosupplementation therapies which require weekly injections over a period of three to five weeks. For example, we believe that changes in physician visiting patterns, as a result of the COVID-19 pandemic, have led to increased preference for single injection therapies.

Durolane is highly purified and based upon a natural and patented non-animal stabilized HA (NASHA)(“NASHA”), expanding use to patients who are allergic to animal derivedanimal-derived solutions.

Comparison of major FDA-approved single injection HA viscosupplementation therapies

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Product

Manufacturer or

distributor

| | Indication | | Source and process | | Active ingredient /

treatment dosage | | Duration |

Bioventus

| | OA of the knee | | Non-animalstabilized HA | | NASHA / (60 mg) | | Six months |

| | | | | | | | |

Synvisc-One

Sanofi S.A.

| | OA of the knee | | Animal sourced Hylan A and Hylan B polymers | | Hylan G-F 20 / (48 mg) | | Six months |

| | | | | | | | |

Monovisc

DePuy Orthopaedics,

Inc.

| | OA of the knee | | Non-animal cross-linked sourced HA | | 2.2% sodium hyaluronate / (88 mg) | | Six months |

| | | | | | | | |

Gel-One

Zimmer Biomet

Holdings, Inc.

| | OA of the knee | | Animal sourced HA | | 1.0% sodium hyaluronate /(30 mg) | | Three months |

Durolane clinical data

Durolane’s proprietary stabilizing technology substantially extends the amount of time it remains in the joint. Multiple studies have been conducted to determine Durolane’s half-life, which is the amount of time needed for 50% of the injected material to be broken down and excreted from the body.

In one study, Durolane’s half-life in the joint was studied in a rabbit model. Results showed the Durolane remained in the joint with an observable half-life of 32 days, substantially longer than the half-lives of Synvisc and unmodified HA, as determined in comparable studies, which were 1.5 days and less than 1 day, respectively.

The long half-life of Durolane was also observed in the 2002 Lindqvist et al. human study where six healthy volunteers were given a single injection of Durolane that contained a radioactive isotope that could be traced, allowing scientists to measure Durolane’s elimination from the body over time. The results showed a 30-day half-life, indicative of the expected long residence time in the joint due to Durolane’s proprietary stabilizing technology and preclinical studies.

In terms of efficacy, Durolane has been directly compared against the main intra-articular therapeutic options available for managing osteoarthritic pain: SUPARTZ FX, a five injection product, Synvisc One, a single injection product and methylprednisolone acetate, an intra-articular corticosteroid.

In a multi-center randomized, blinded, controlled trial of 349 patients with mild-to-moderate knee OA, Durolane was compared with SUPARTZ FX. This 2015 Zhang et al. study concluded that one injection of Durolane was non-inferior to five weekly injections of SUPARTZ FX in terms of pain, stiffness, physical function and global self-assessment.

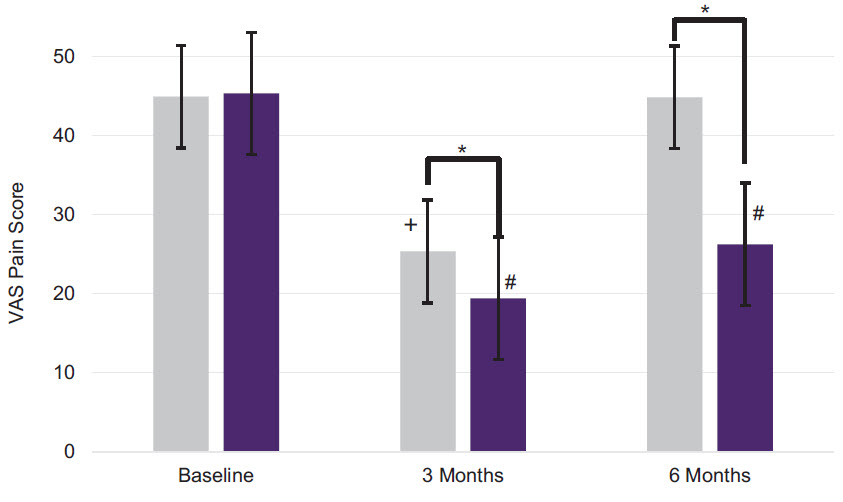

In an independent, investigator-initiated randomized, controlled study involving 213 patients with mild-to-moderate knee OA, Durolane was further compared to Synvisc-One. After following up with the patients over a span of 12 months following the treatment, the results from this 2013 McGrath et al. study showed that Durolane produced significantly more durable pain relief effects than Synvisc-One, while also providing longer-lasting improvements in range of motion and a reduction in the use of pain medication for study participants.

Greater Reduction in Knee Pain versus Synvisc-One

| | | | | |

| *p<0.000 compared to Synvisc

|

| #p<0.000 compared to DUROLANE baseline

|

| *p=0.008 compared to Synvisc baseline

|

(n=168)

Mean values +/- standard deviation

In a separate prospective, multi-center, randomized, active-controlled, double-blind, non-inferiority clinical trial with 442 enrolled patients with knee OA, it was observed that single injection Durolane was well tolerated and non-inferior compared to the corticosteroid methylprednisolone acetate at twelve weeks. Methylprednisolone acetate is a steroid injectable formulation used to treat pain and swelling that occurs with OA and other joint disorders. The effect size for pain, physical function and stiffness scores favored Durolane over methylprednisolone acetate from twelve to 26 weeks. The benefit of Durolane was maintained through 26 weeks, while that of methylprednisolone acetate declined during the same period. An additional injection of Durolane at 26 weeks conferred improvements through 52 weeks without increased sensitivity or risk of complications compared to the initial injection. One subset of 31 patients treated with Durolane remained pain free after six months from the first injection and did not elect to receive a second injection.

As of December 31, 2020, over 2 million injections of the Durolane formulation have been safely administered globally since its international launch in 2006. We launchedcurrently market Durolane in the United States in March 2018 and have owned certain Durolane assets outside of the United States relating to trademark, product registrations and clinical data since November 2015.Europe.

Three Injection Therapy

GELSYN-3GELSYN-3™ is an FDA-approved sterile, buffered solution of highly purified sodium hyaluronate that is administered as a three injection HA viscosupplementation therapy. It is indicated for the treatment of pain due to knee OA in patients who have failed to respond adequately to conservative non-pharmacologic therapy and simple analgesics. The solution treats knee OA by providing temporary replacement for the diseased synovial fluid and restoring the lubricity of bearing joint surfaces. Physicians administer GELSYN-3 to the affected knee joint once a week for three consecutive weeks. GELSYN-3 provides relief of knee pain and may help delay the need for total knee replacement surgery. GELSYN-3 is derived from bacterial fermentation, is highly purified and does not involve the use of animal products, thereby reducing the potential risk of an immune response following injection. We currently market GELSYN-3 in the United States. As of December 31, 2020, approximately 900,000 injections of the GELSYN-3 HA formulation have been safely administered in the United States since its launch in 2016.

GELSYN-3 clinical data

The safety and efficacy of GELSYN-3 was assessed in a prospective, multicenter, randomized, controlled, double-blind, non-inferiority pivotal study that enrolled 381 adult patients with knee OA. Patients were randomized to receive three weekly injections of GELSYN-3 or three weekly injections of Synvisc 3, a three injection regimen commercialized in the United States by Sanofi S.A., with follow-up visits scheduled up to 26 weeks. GELSYN-3 was observed to be non-inferior to Synvisc 3 at the 26-week time point.

Five Injection Therapy

SUPARTZ FXSUPARTZ™ is an FDA-approved sterile and viscoelastic solution of HA that is administered as a five injection HA viscosupplementation therapy. It is indicated for the treatment of pain in patients with knee OA who failed to adequately respond to conservative nonpharmacological therapy and simple analgesics. The solution treats knee OA by providing temporary replacement for the diseased synovial fluid and restoring the lubricity of the bearing joint surfaces. Physicians administer SUPARTZ FX to the affected knee joint once a week for five consecutive weeks. SUPARTZ FX may also delay the need for total knee replacement. SUPARTZ FX is derived from HA extracted from certified and veterinary inspected chicken combs. Risks can include general knee pain, warmth and redness or pain at the injection site. We currently market SUPARTZ FX in the United States. As of December 31, 2020, over 410 million injections of the SUPARTZ FX HA formulation have been safely administered globally since its launch in 1987.

SUPARTZ FX clinical data

In a double blind, randomized, multi center, parallel group study conducted by Day et al. in 2004 of the effectiveness and tolerance of intra-articular SUPARTZ FX compared to control (saline) treatment for knee OA, it was observed that SUPARTZ FX reduced knee pain in patients during the post-injection period by about 50% from the baseline. Of 240 patients randomized for inclusion in the study, 223 patients were evaluable for the modified intention to treat analysis and the statistically significant difference from the control was apparent after the series of injections was complete. Intra-articular SUPARTZ FX therapy was shown to be more effective than saline in mild to moderate knee OA for the 13-week post injection period of the study.

The safety and efficacy of SUPARTZ FX was observed by Strand et al. in an integrated analysis. This integrated analysis included five separate double-blind, randomized, saline-controlled trials, and included a total of 1,155 patients comparing five weekly injections of SUPARTZ FX versus a saline placebo. The pooled results from this study showed that SUPARTZ FX produced statistically significantly greater reduction from baseline in total Lequesne scores, a measure of overall function including pain. The incidence of adverse events were observed to be minimal and similar in both treatment arms. Furthermore, none of the reported adverse events were observed to be deemed treatment-related suggesting that SUPARTZ FX was safe and well-tolerated.

Comparison

Our StimRouter® Peripheral Nerve Stimulation (“PNS”) system is a permanent option that provides relief for chronic peripheral pain, including nerve pain, neuroma, neuropathic pain, post-stroke shoulder pain and neuralgia. StimRouter is implanted during a minimally invasive outpatient procedure performed under local anesthetic and delivers gentle electrical pulses directly to target peripheral nerve pain at its source. Its small profile allows the system to be implanted in many locations around the body, depending on patient needs. StimRouter is ideally suited for patients with chronic pain of FDA-approved multi-injection HA viscosupplementation therapiesa peripheral origin who are unable to find sustained pain relief with other treatment options such as nerve blocks, nerve ablation, and other temporary treatments. StimRouter is programmed with up to eight different stimulation programs from which the patient is able to select, turn off/on and increase or decrease the stimulation intensity.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Product

Manufacturer or distributor

| | Indication | | Source and

process | | Active ingredient /

total treatment

dosage | | Number of

injections

per course | | Duration |

| | | | | | | | | | |

Bioventus

| | OA of the knee | | Fermented, bacterial derived HA | | 0.84% sodium hyaluronate

(50.4 mg) | | Three | | Six months |

| | | | | | | | | | |

Bioventus

| | OA of the knee | | Naturally derived, purified HA | | 1.0% sodium hyaluronate

(75/125 mg) | | Three to Five | | Six months |

| | | | | | | | | | |

Synvisc

Sanofi S.A.

| | OA of the knee | | Hylan polymers, purified HA | | 0.8% Hylan G-F

20 (48 mg) | | Three | | Six months |

| | | | | | | | | | |

Euflexxa

Ferring

Pharmaceuticals Inc.

| | OA of the knee | | Fermented, bacterial derived HA | | 1.0% sodium hyaluronate

(60 mg) | | Three | | Six months |

| | | | | | | | | | |

Hyalgan

Fidia Farmaceutici

S.p.A.

| | OA of the knee | | Naturally derived, purified HA | | 1.0% sodium hyaluronate

(60 mg/100 mg) | | Three to Five | | Six months |

| | | | | | | | | | |

Genvisc-850

OrthogenRx, Inc.

| | OA of the knee | | Fermented, bacterial derived HA | | 1.0% sodium hyaluronate

(75/125 mg) | | Three to Five | | Six months |

Developmental and clinical pipeline for Pain TreatmentsDevelopment and Clinical Pipeline

Amniotic tissue products for the treatment of OA

Collaboration and development agreement for MOTYS

On May 29, 2019, we entered into a Development Agreement with Musculoskeletal Transplant Foundation, Inc. (MTF) to develop an injectable placental tissue product, MOTYS, for use in the OA joint pain treatment and joint preservation.

The developmentTalisMann® Pulse Generator and commercialization of the product will take place in two stages, and we began limited commercialization of MOTYS to a cash pay only market in the fourth quarter of 2020 as a Section 361 HCT/P pursuantReceiver (not yet cleared by FDA) is an accessory to the FDA’s policy of enforcement discretion allowing for marketing without the required BLA approval until May 2021, while in parallel we pursue a BLA pre-market approval for the product. Once approved as a biologic, MOTYS will be eligible for health insurance reimbursementStimRouter® PNS system and hence gain access a broader patient population. We are planningis designed to conduct randomized clinical trials to ultimately support the submissionprovide more powerful stimulation to the FDAtargeted peripheral nerve, potentially enabling physicians to address chronic pain of a BLA for the use of MOTYSperipheral nerve origin in the OA joint pain treatment.

Based on our preclinical evidence, we believe the MOTYS formulation holds potential for mitigating OA joint pain while protectinglarger, deeper, or damaged cartilagenerves. TalisMann has a small profile and promoting anti-catabolic and pro-anabolic events that could ultimately result in delayed disease progression in OA. We have completed extensive in vitro and in vivo studies comparing the effect of MOTYSis attached to the clinical standard of care (steroid injections). MOTYS provided non-inferior pain relief effects to a steroid, but was superior in its effect on cartilage protectionStimRouter lead intraoperatively and in promotion of new tissue formation.pocketed under the skin after the StimRouter lead electrodes are placed near the targeted peripheral nerve.

In October 2020, we received FDA confirmation indicating its authorization of our IND and plan to initiate clinical studies by year end. Amniotic products have been extensively and safely used in clinical practice, and FDA has granted Regenerative Medicine Advanced Therapy (RMAT), designation to other amniotic tissue products being investigated for use in OA, which enables an expedited development pathway as well as eligibility for increased and earlier interactions with FDA. We intend to submit a request for RMAT designation for MOTYS in 2022.

Implantable for the treatment of rotator cuff injuries

Development collaboration agreement for PROcuffTrice Medical, Inc.

On August 23, 2019, we entered into an exclusive Collaboration Agreement with Harbor Medtech Inc. (Harbor) to develop and license the rights to commercialize a woven-suture-collagen composite implant product, PROcuff, for the regeneration of tendon tissue. Concurrently with the execution of the agreement, we purchased $1.0 million of shares of Harbor. As a result of Harbor’s achievement of certain milestones, on October 5, 2020, we purchased $1.0 million of additional shares of Harbor. The sole use of proceeds from these investments is for the development of the woven-suture-collagen composite implant product and we have the right to purchase the product from Harbor once it is cleared for marketing by the FDA.

We have currently completed a pilot sheep implantation study through a collaboration with a prominent academic investigator. Results indicate that the material is well tolerated, rapidly integrated and promotes the formation of new tendon tissue at the bone tendon interface. We expect to file a request for 510(k) clearance in either the second or third quarter of 2022. We plan to conduct post-clearance human clinical studies with the composite implant to further demonstrate the safety and efficacy of the product, and facilitate reimbursement.

Treatment of Cartilage for Osteochondral defects

CartiHeal (developer of Agili-C) investment and option and equity purchase agreement

On July 15, 2020,2021, we made a $15.0 million equitystrategic investment in CartiHeal (2009) Ltd. (CartiHeal),Trice Medical, Inc. (“Trice”). Trice is a privately-heldprivately held company headquarteredthat develops and commercializes minimally invasive technologies for sports medicine and orthopedic surgical procedures. Trice combines its handheld arthroscope and portable ultrasound visualization technologies with its surgical devices to treat a range of sports medicine and orthopedic conditions, including tendinopathy, planter fasciitis and carpel tunnel, in Israelorder to improve patient recovery time, reduce pain, minimize scarring and developermove surgical procedures out of higher cost points of care. Trice’s established and growing presence in sports medicine and orthopedics is directly aligned with our strategy of expanding our offerings. Our investment resulted in exclusive sales and distribution rights to Trice’s products outside of the proprietary Agili-C implant for the treatmentUnited States.

Surgical Solutions

Our Surgical Solutions product portfolio is comprised of joint surface lesions in traumaticclinically efficacious and osteoarthritic joints.

We believe Agili-C is the only product in clinical development in the United States as an off-the-shelf scaffold implant that is designedcost-effective bone graft solutions to regenerate hyaline cartilage and subchondral bone simultaneously. The associated surgical procedure is similar to osteochondral allograft implantation, but ismeet a single-step process and is easier, faster and more cost-effective. We believe this is the first cartilage repair technology to be tested in trials designed for regulatory approval in the United States in non-OA and OA patients, potentially unlocking applications for millionsbroad range of patients with knee OA and cartilage defects. We also believe Agili-C will enable the treatment of cartilage lesions in a significant population of OA patients, including those younger, active patients for whom available treatment options are limited. The FDA’s grant of breakthrough device designation in the fourth quarter of 2020 for the treatment of an International Cartilage Repair Society (ICRS) grade III or above knee-joint surface lesions(s), with a total treatable area of 1-7cm2, without severe osteoarthritis (Kellgren-Lawrence grade 0-3) is a promising development, as such designation may help patients receive more timely access to Agili-C by expediting its development, assessment and review by the FDA. On January 12, 2021, the Centers for Medicare and Medicaid Services (CMS) issued a final rule under which a breakthrough device designation by the FDA also provides a streamlined pathway to national Medicare coverage for a period of four years, beginning as early as the FDA approval for the product. On March 12, 2021, CMS delayed by 60 days the effective date of the final rule on Medicare coverage for innovative technology, which was previously slated to become effective March 15, 2021. The agency also provided a 30-day public comment period, which ends April 16, 2021. We believe Agili-C also has the potential for broader indications for use in other joints, providing entrance into the global market for cartilage repair products designed to delay or eliminate the need for knee replacements.

In preclinical studies Agili-C was associated with osteochondral regeneration, good lateral integration and hyaline cartilage formation in critical size defects at 20 months when implanted in a goat, with the implant being fully resorbed between six to 20 months. The Agili-C implant has been implanted in more than 190 patients outside the United States with follow up of more than four years and is CE marked. The implant is currently being evaluated in a pivotal study pursuant to an IDE filed with the FDA. The trial’s objective is to demonstrate the superiority of the Agili-C implant over the surgical standard of care (microfracture and debridement) for the treatment of cartilage or osteochondral defects, in both osteoarthritic knees and knees without degenerative changes. The study’s protocol design, which is based on feedback from multiple pre-IDE interactions with the FDA, involves broad inclusionary criteria, such as defect size, age, and etiology, multiple controls, including microfracture and debridement, and multiple pre-planned secondary endpoints. The study has an adaptive design, which allows for a maximum of 500 planned patients, includes multiple interim analyses to estimate sample sizepatient needs and includes European Union (EU), Israeli and U.S. sites.

Our CartiHeal investment follows the recently completed enrollment and reporting of interim results in CartiHeal’s IDE multinational pivotal study for Agili-C. This investmentis expected to enable CartiHeal to complete the study, including all patient follow-up, and submit a PMA to the FDA. Under the equity purchase agreement, CartiHeal can secure an additional $5.0 million from us, if needed, for IDE study completion. We previously made an initial $2.5 million investment in CartiHeal in January 2018 and a subsequent investment of $0.2 million in January 2020 as part of prior CartiHeal financing rounds. Any additional investment we make will be subject to customary closing conditions.

Concurrent with the July 15, 2020 investment, we entered into an Option and Equity Purchase Agreement with CartiHeal and its shareholders, which provides us with an exclusive option to acquire 100% of CartiHeal’s shares, or the Call Option, and provides CartiHeal with a put option that would require us to purchase 100% of CartiHeal’s shares under certain conditions, or the Put Option. The Call Option is exercisable by us at any time after the closing of the investment. The Put Option is only exercisable by CartiHeal upon pivotal clinical trial success, including achievement of certain secondary endpoints and FDA approval of the Agili-C device with a label consistent in all respects with pivotal clinical trial success.

If not previously exercised, the Call Option and the Put Option terminate 45 days following the FDA approval of Agili-C or in the event of failure of the pivotal clinical trial. We also have the right to terminate the Call Option and Put Option at any time ending 30 days after receipt from CartiHeal of the statistical report regarding the final results of the pivotal clinical trial upon payment of a breakup fee of $30.0 million. Consideration for the acquisition of all of the shares of CartiHeal pursuant to the Call Option or Put Option would be $350.0 million, all of which would be payable at closing, with an additional $150.0 million payable upon achievement of certain sales milestones related to Agili-C.

Bone Graft Substitutes

BGSs in spinal fusion and other procedures

procedures. Bone grafting is a surgical procedure used to fusepromote fusion of spinal vertebrae, replace missing bones,fill bone voids, fix bones that are damaged from trauma or problem joints, or to facilitate growing bones around an implanted device, such as aspinal hardware (i.e., cages and rods), total knee replacement. The bones used in areplacements and long bone graft can come from a particular patient’s own body, referred to as an autograft, or from a donor, referred to as an allograft, or can be entirely man-made, referred to as a synthetic. Most bone grafts are expected to be reabsorbed and replaced as the natural bone heals over a few months.

Our BGS product portfolio is comprised of clinically efficacious and cost effective bone graft solutions to meet a broad range of patient needs and procedures.fixation. Our products are designed to improve bone fusion rates following spinalspine and other orthopedic surgeries, including trauma and reconstructive foot and ankle procedures. Our portfolio is also comprised of an ultrasonic surgical system. These products includeare used for precise bone cutting and sculpting, soft tissue management (i.e., tumor and liver resections) and tissue debridement, in various surgeries including minimally invasive applications, primarily in the areas of neurosurgery, orthopedic surgery, general surgery, wound, plastics/reconstruction, and cranio-maxillo-facial surgery.

OSTEOAMP® is an allograft-derived bone graft with growth factors (OsteoAMP)used for orthopedic, neurosurgical and reconstructive bone grafting procedures. OSTEOAMP is an allogeneic bone graft that is available in multiple formats (fibers, putty, sponge and granules) that is processed with bone marrow cells to maintain the wide array of growth factors present in native bone. We currently market OSTEOAMP in the United States. We launched OSTEOAMP Flowable in 2021, which is designed to be moldable and easy to use, with a convenient, ready to use syringe. Additionally, a customized cannula-based delivery system is currently in development, which is designed to enhance delivery of the product further enabling use in minimally invasive surgical procedures. FDA 510(k) submission for the cannula-based delivery system was accepted during the fourth quarter of 2023. We have successfully implanted almost half of the subjects for our Level-I study of OSTEOAMP vs. Infuse and continue to drive enrollment of the study.

EXPONENT provides an osteoconductive scaffold with osteoinductive potential while providing optimal handling characteristics indicated for posterolateral spine procedures. EXPONENT is derived from human allograft bone tissue and is combined with a migration-resistant resorbable carrier and formulated into a putty that is ready-to-use out of the syringe. EXPONENT is highly malleable and easy to mold and pack into the surgical defect. Donor bone is sourced from AATB-certified and FDA-registered tissue banks in the United States. All tissues are screened for the standard panel of infectious viruses. We currently market EXPONENT in the United States.

PUREBONE provides a natural osteoconductive scaffold that facilitates cellular ingrowth and revascularization which is indicated for orthopedic, neurosurgical and reconstructive bone grafting procedures. PUREBONE is 100% human bone, and is available as demineralized cortical fibers, demineralized cancellous strips and blocks, and mineralized cancellous chips. Demineralized cortical fibers are easy to mold, shape and pack, and provide osteoinductive potential. The fibers demonstrate high fluid retention and expansion properties, which potentially increases the opportunity for bone-on-bone contact. Demineralized block and strip formats provide interconnected porosity with compressible, sponge-like handling characteristics, and provide osteoinductive potential. Mineralized cancellous chips range from 1-4 mm and 4-10 mm granule size for optimal void packing capabilities. Demineralized PUREBONE formats provide osteoinductive potential to recruit and differentiate bone-forming cells. Donor bone is sourced from AATB-certified and FDA-registered tissue banks in the United States. All tissues are screened for the standard panel of infectious viruses. We currently market PUREBONE in the United States.

SIGNAFUSE contains a synergistic combination of biomaterials that supports new bone formation which is indicated for standalone posterolateral spine, extremities and pelvis, as well as a bone graft extender in the posterolateral spine. SIGNAFUSE is a synthetic bone graft made up of bioglass and a biphasic mineral (60% hydroxyapatite, 40% β-tricalcium phosphate) available in putty and strip formats. Bioactive synthetic bone graft substitute is comprised of a mixture of calcium phosphate granules and bioglass granules suspended in a resorbable polymer carrier that facilitates handling and delivery of the granule components to fill spaces of missing bone. The unique and synergistic combination of biomaterials in SIGNAFUSE is designed to help accelerate cellular activity and kick-start osteogenesis. Bioventus has recently received FDA clearance for expanded indications for the use of SIGNAFUSE in spinal procedures, specifically for filling cages. We expect this expanded indication will continue to drive sales of the product. We currently market SIGNAFUSE in the United States.

INTERFACE is designed to facilitate a rapid biologic response that stimulates the bone healing process and is used for posterolateral spine when mixed with autograft, extremities and pelvis. INTERFACE’s patented particle technology is designed for enhanced bone graft performance through irregularly shaped synthetic bioglass granules that provide an osteoconductive scaffold for new osseous ingrowth and tissue generation. The patented bioglass component stimulates the formation of an apatite layer as early as seven days after application on the surface of the granules. The apatite surface layer that is formed is equivalent in composition and structure to the hydroxyapatite found in bone and provides an osteoconductive bioactive scaffold that supports the generation of new osseous tissue. New bone infiltrates around the granules, allowing the repair of the defect as the granules are absorbed. The patented INTERFACE Bioactive Bone Graft particle size of 210-420 microns is designed for a faster speed of bone fill than glass particles with a broader particle size distribution of 90-710 microns and smaller particles below 210 microns. INTERFACE features consistent composition without variability inherently found in particle size and porosity of tissue based grafts. INTERFACE Bioactive Bone Graft conforms to ASTM specification F1538 for 45S5 bioactive glass. INTERFACE is packed in a sterile, single use vial. We currently market INTERFACE in the United States.

OSTEOMATRIX+ is a synthetic bone graft with exceptional handling, rapid hydration and a biphasic composition for sustained performance used on the posterolateral spine, extremities and pelvis. OSTEOMATRIX+ is a moldable bone graft substitute consisting of biphasic granules designed to produce a reliable, porous scaffold and sustained osteoconductivity throughout bone remodeling. The OSTEOMATRIX+ biphasic granules are composed of 60% hydroxyapatite and 40% beta-tricalcium phosphate (“β-TCP”), a DBM (Exponent), cancellousratio demonstrated to have advantageous bone remodeling properties. The long-term stability of hydroxyapatite and the solubility of β-TCP provide an osteoconductive graft with an optimal resorption profile. Interconnected macropores provide a porous, osteoconductive matrix that mimics a natural scaffold for cellular ingrowth and revascularization. Three-dimensional micropores enhance the flow and circulation of biological fluids. We currently market OSTEOMATRIX+ in different preparations (PureBone), bioactive synthetics (Signafusethe United States.

EXTRACTOR is a complementary and Interface),cost-effective solution designed to add needed cells and signals to aid in bone healing. EXTRACTOR provides a collagen ceramic matrix (OsteoMatrix)six-ported cannula with a simplistic design for more flexible positioning and twoenhanced marrow extraction. The large side port design of EXTRACTOR allows for better access and retrieval of the bone marrow isolation systems (CellXtractaspirate which contains the cells and Extractor)signals needed for solid bone formation. The “twin peaks” tip design allows for easy insertion through the hard wall of the cortical bone. An ergonomically designed handle allows the clinician to apply consistent pressure for greater control. We currently market EXTRACTOR in the United States.

Reficio Demineralized Bone Matrix (“Reficio DBM”) is a putty comprised of human demineralized bone matrix and a biocompatible bioabsorbable carrier, carboxymethylcellulose, mixed into a putty-like consistency for ease in surgical use. Reficio DBM is indicated for use as a bone void filler and bone graft substitute for voids or gaps that are not intrinsic to the stability to the bony structure, specifically for the treatment of surgically created osseous defects or osseous defects from traumatic injury to the bone. Reficio DBM can be used for extremities, posterolateral spine and pelvis.