UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20202023

or | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-38791

LUMINAR TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | 83-1804317 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 2603 Discovery Drive | Suite 100 | Orlando | Florida | 32826 |

| (Address of Principal Executive Offices) | (Zip Code) |

(407) 900-5259(800) 532-2417

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Class A common stock, par value of $0.0001 per share | | LAZR | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐☒ No ☒☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant:registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐☒ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☒☐ | Smaller reporting company | ☒☐ | |

| | | Emerging growth company | ☒☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. □

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). □

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $359.4 million$1.9 billion as of June 30, 20202023 (the last business day of the registrant’s most recently completed second fiscal quarter) based upon the closing sale price on The Nasdaq Stock Market reported for such date. Shares of Common Stock held by each officer and director and by each person who may be deemed to be an affiliate have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 23, 2021,February 15, 2024, the registrant had 234,573,372324,798,757 shares of Class A common stock, par value $0.0001 per share and 105,118,20397,088,670 shares of Class B common stock, par value $0.0001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates by reference certain information from the registrant’s definitive proxy statement (the “Proxy Statement”) relating to its 20212024 Annual Meeting of Stockholders. The Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

TABLE OF CONTENTS

PART I

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Form 10-K”) includes forward-looking statements in addition to historical information. These forward-looking statements are included throughout this Form 10-K, including in the sections entitled “Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and in other sections of this Form 10-K.10-K and include statements regarding product plans, future growth, sales estimates/Order Book numbers, market opportunities, strategic initiatives, industry positioning, customer acquisition and retention, revenue growth and anticipated impacts on our business of any future health epidemics and outbreaks. In some cases, you can identify these statements by forward-looking words such as “outlook,” “believes,” “expects,” “future,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words or phrases, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections of our future financial performance, our anticipated growth strategies and anticipated trends in our business.

These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including, our history of losses and our expectation that we will continue to incur significant expenses, including substantial R&D costs, and continuing losses for the foreseeable future as well as our limited operating history which makes it difficult to evaluate our future prospects and the risks and challenges we may encounter; our strategic initiatives which may prove more costly than we currently anticipate and potential failure to increase our revenue to offset these initiatives; whether our LiDAR products are selected for inclusion in autonomous driving or Advanced Driving Assistance Systems (“ADAS”) by automotive original equipment manufacturers (“OEMs”) or their suppliers, and whether we will be de-selected by any customers; the lengthy period of time from a major commercial win to implementation and the risks of cancellation or postponement of the contract or unsuccessful implementation; potential inaccuracies in our forward looking estimates of certain metrics, including Order Book, our future cost of goods sold (“COGS”) and bill of materials (“BOM”) and total addressable market;the discontinuation, lack of success of our customers in developing and commercializing products using our solutions or loss of business with respect to a particular vehicle model or technology package and whether end automotive consumers will demand and be willing to pay for such features; our ability to successfully fund our growth if there are considerable delays in product introductions by us or our customers; our inability to reduce and control the cost of the inputs on which we rely, which could negatively impact the adoption of our products and our profitability; the effect of continued pricing pressures, competition from other LiDAR manufacturers, OEM cost reduction initiatives and the ability of automotive OEMs to re-source or cancel vehicle or technology programs which may result in lower than anticipated margins, or losses, which may adversely affect our business; the effect of general economic conditions, including inflation, recession risks and rising interest rates, generally and on our industry and us in particular, including the level of demand and financial performance of the autonomous vehicle industry and the decline in fair value of available-for-sale debt securities in a rising interest rate environment; market adoption of LiDAR as well as developments in alternative technology and the increasingly competitive environment in which we operate, which includes established competitors and market participants that have substantially greater resources; our ability to achieve technological feasibility and commercialize our software products and the requirement to continue to develop new products and product innovations due to rapidly changing markets and government regulations of such technologies; our ability to build, launch, receive regulatory approval, sell, and service insurance products as well as market and differentiate the benefits of LiDAR-based ADAS to consumers; our ability to manage our growth and expand our business operations effectively, including into international markets, such as China, which exposes us to operational, financial, regulatory and geopolitical risks; changes in our government contracts business and our defense customers’ business due to political change and global conflicts; adverse impacts due to limited availability and quality of materials, supplies, and capital equipment, or dependency on third-party service providers and single-source suppliers; the project-based nature of our orders, which can cause our results of operations to fluctuate on a quarterly and annual basis; whether we will be able to successfully transition our engineering designs into high volume manufacturing, including our ability to transition to an outsourced manufacturing business model and whether we and our outsourcing partners and suppliers can successfully operate complex machinery; whether we can successfully select, execute or integrate our acquisitions; whether the complexity of our products results in undetected defects and reliability issues which could reduce market adoption of our new products, limit our ability to manufacture, damage our reputation and expose us to product liability, warranty and other claims; our ability to maintain and adequately manage our inventory; our ability to maintain an effective system of internal control over financial reporting; our ability to protect and enforce our intellectual property rights; availability of qualified personnel, loss of highly skilled personnel and dependence on Austin Russell, our Founder, President and Chief Executive Officer; the impact of inflation and our stock price on our ability to hire and retain highly skilled personnel; the amount and timing of future sales and whether the average selling prices of our products could decrease rapidly over the life of the product as well as our dependence on a few key customers, who are often large corporations with substantial negotiating power; our ability to establish and maintain confidence in our long-term business

prospects among customers and analysts and within our industry; whether we are subject to negative publicity; the effects of COVID-19 pandemic or other infectious diseases, health epidemics, pandemics and natural disasters on Luminar’s business; interruption or failure of our information technology and communications systems; cybersecurity risks to our operational systems, security systems, infrastructure, integrated software in our LiDAR solutions; market instability exacerbated by geopolitical conflicts, including the Israel-Hamas war and the conflict between Russia and Ukraine, as well as trade disputes with China and including the effect of sanctions and trade restrictions that may affect supply chain or sales opportunities; and those other factors discussed in the section entitled “Risk Factors” in this Form 10-K. You should specifically consider the numerous risks outlined in the section of this Form 10-K entitled “Risk Factors.” Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. We undertake no obligation to update any forward-looking statements made in this Form 10-K to reflect events or circumstances after the date of this Form 10-K or to reflect new information or the occurrence of unanticipated events, except as required by law.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report on Form 10-K, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements.

PART I

ITEM 1. BUSINESS.

Overview

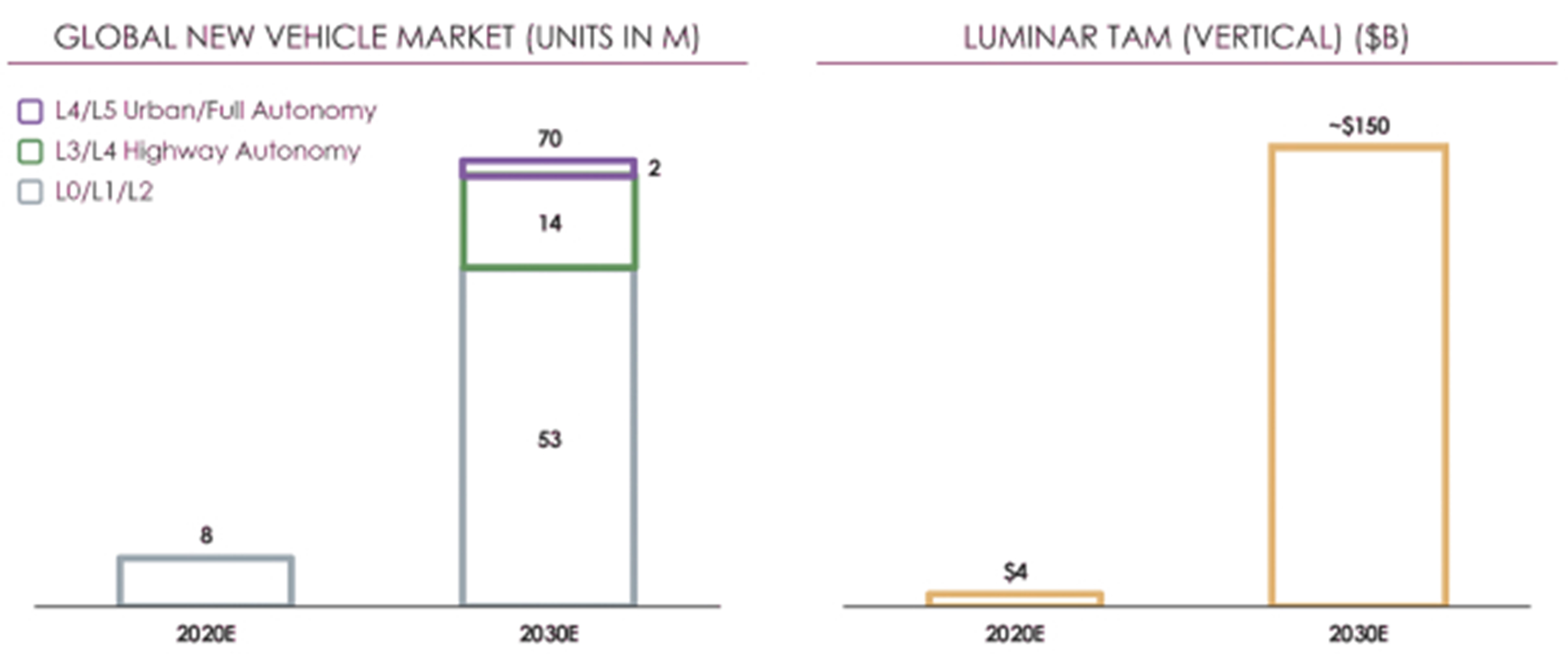

Our visionLuminar is to make autonomous transportation safe and ubiquitous. As a global leaderautomotive technology company ushering in lidar autonomous driving technology, we are enabling the world’s first autonomous solutions for automotive series production in passenger cars and commercial trucks.

Founded in 2012 by President and Chief Executive Officer Austin Russell, Luminar built a new typeera of lidarvehicle safety and autonomy. Over the past decade, Luminar has been building our light detection and ranging (LiDAR) sensor from the chip-level up, with technological breakthroughs across all core components. As a result, we have created what we believewhich is the only lidar sensor that meetsexpected to meet the demanding performance, safety, reliability and cost requirements for Level 3 through Level 5 autonomous vehicles in production, bypassing the traditional limitations of legacy lidar technology, while also enabling Level 0 through Level 2 (Advanced Driving Assistance Systems (“ADAS”) and/or Luminar Proactive Safety) with our Proactive Safety solution. Integrating this advanced hardware with our custom developed software stack enables a turn-key autonomous solution to accelerate widespread adoption across automakers at series production scale.

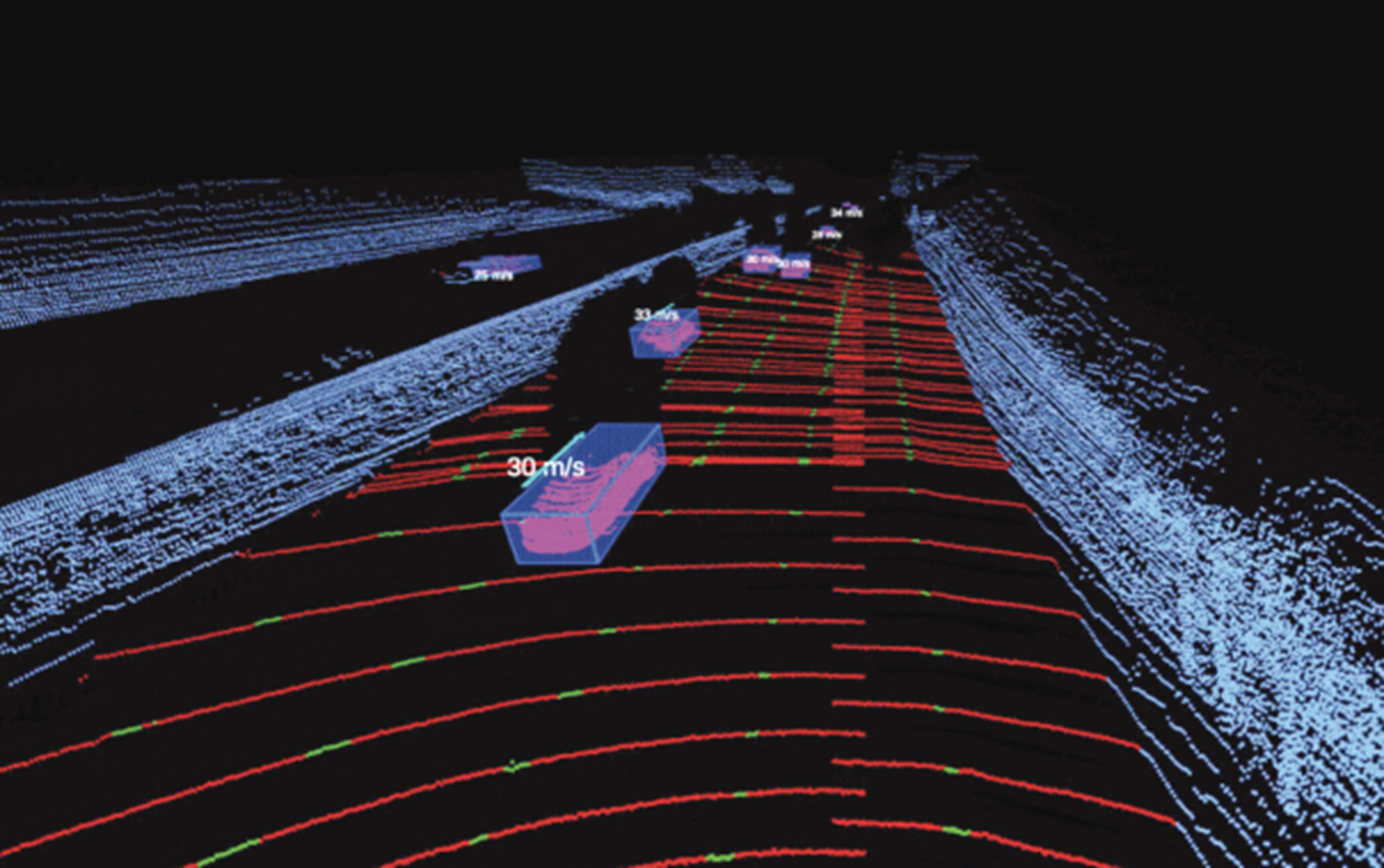

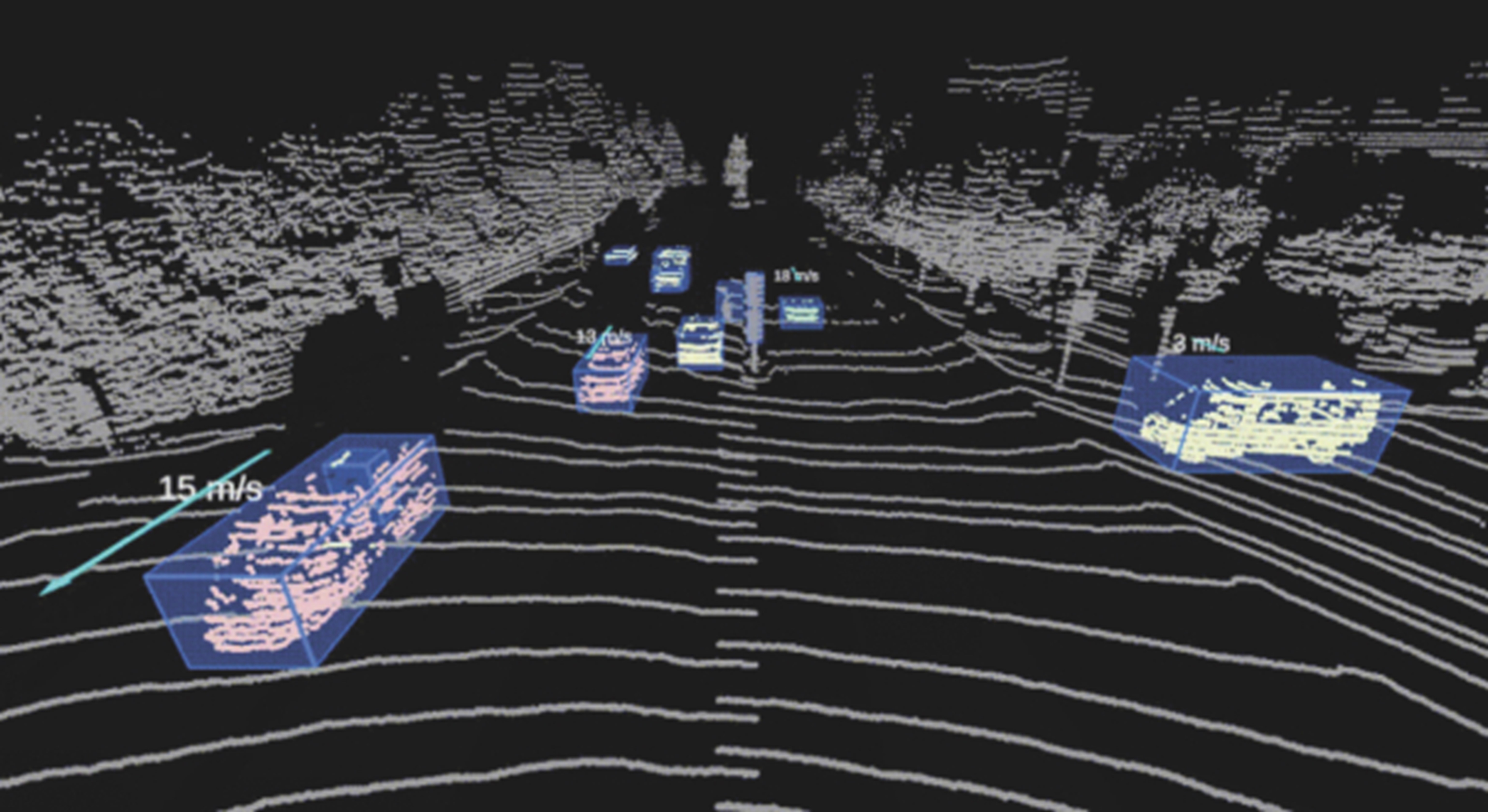

Our lidar hardware and software products help set the standard for safety in the industry, and are designed to enable accuratenext-generation safety and reliable detections of some of the most challenging “edge cases” autonomous vehicles can encounter on a regular basis. This is achieved by advancing existing lidar rangecapabilities for passenger and resolution to new levels, ensuring hard-to-see objects like a tire on the road ahead or a child that runs into the street are not missed,commercial vehicles, as well as by developing our software to interpret the data needed to inform autonomous and assisted driving decisions.

Our full-stack hardware and software autonomy solution for cars and trucks as well as our standalone lidar technology offerings have made us one of the leading partners for the world’s top OEMs. We are currently partnering with eight of the top-ten global automakers, by sales, and have the goal of being the first lidar company to produce highway self-driving and next-generation Proactive Safety systems for series production. With approximately 400 employees across eight global locations, we have scaled to over 50 partners in the last two years, including the first industry-wide automotive series production award in the autonomous space, awarded by Volvo Cars in May 2020, with series production expected to commence in 2022. We subsequently entered into a strategic partnership with Daimler Truck AG in October 2020 and with Mobileye Vision Technologies Ltd (“Mobileye”) in November 2020.other adjacent markets.

The Luminar Difference

We have established ourselves as a global leader in lidar autonomous driving technology,automotive and these are the strengths that not only set us apart today, but we believe will continue to differentiate us in the future:

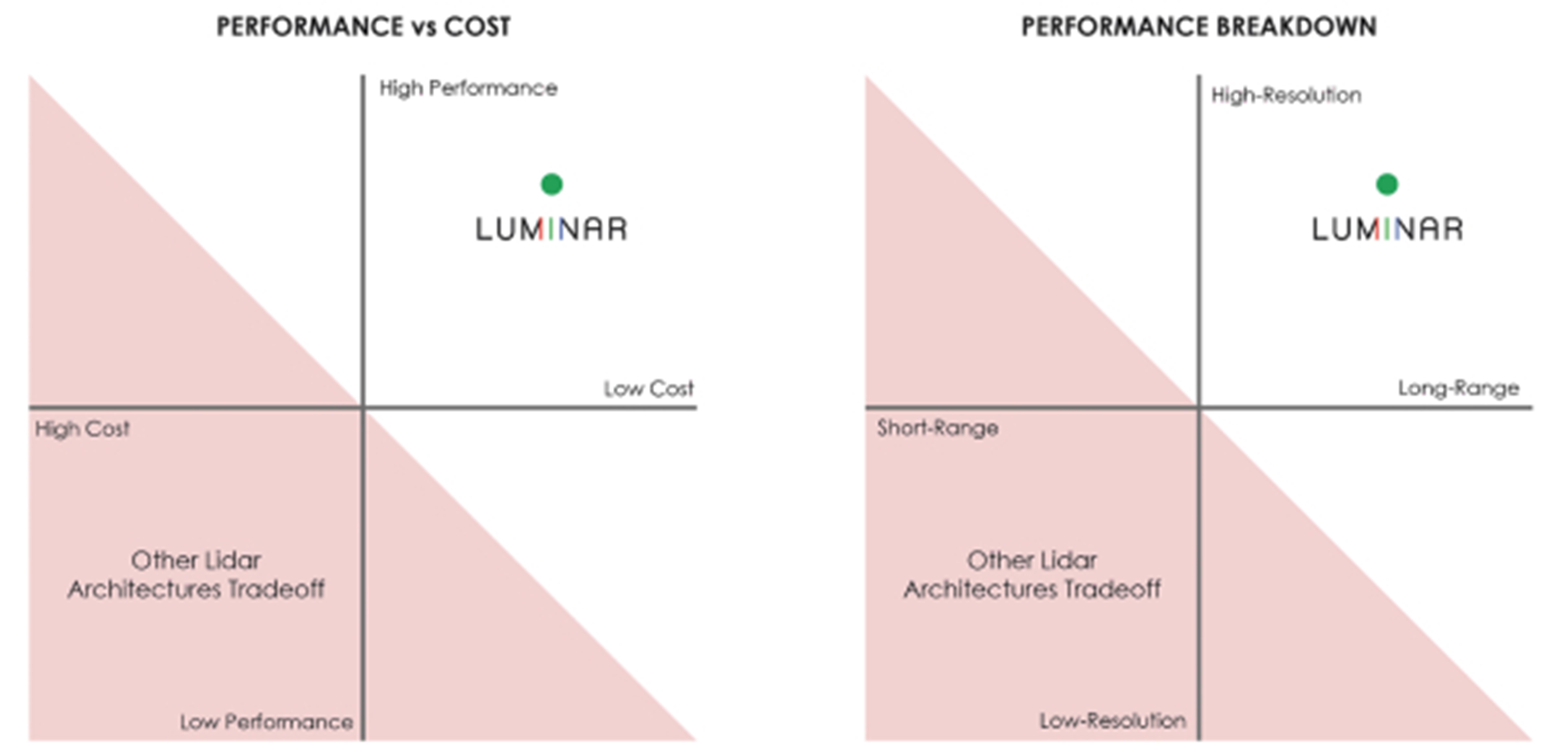

Breakthrough Technology Delivering What We Believemobility sector is the World’s First Auto-Grade Compliant Solution.Reflecting roughly nine years of development at this stage (the first five of which were in stealth), Luminar offers a unique lidar architecture and proprietary component-level innovation (built from the chip-level up), resulting in superior range and resolution capabilities, ensuring confidence in perception across a broad set of operational domains and unlocking the next

generation of vehicle safety. Our lidar and perception software are built upon a longer wavelength lidar design, which has been widely embraced as necessary to broadly deploy truly autonomous vehicles. As a result, we believe that we are the only provider of lidar for automotive autonomy applications that achieves the industry’s stringent requirements and perception capabilities. Our technological prowess and differentiated approach is supported by an extensive intellectual property portfolio of 93 issued patents, in addition to 84 pending or allowed patents as of February 2021.

Highway Autonomy. By developing and deploying the industry’s first lidar technology to meet the stringent requirements required to enable highway autonomy, Luminar will provide its key customers with a dramatic step-function in performance and help enable the first wave of autonomous vehicles—hands-off, eyes-off autonomy for highway-related use cases—which we envision to be rolled out beginning late next year.

Proactive Safety. In addition to enabling hands-off, eyes-off autonomy for highway-related use cases, we see a significant opportunity for our lidar sensing system and software to enhance current ADAS functionality and safety; and reduce collisions across a variety of other operating domains in a proactive rather than reactive capacity. As a result, we foresee insurance-related opportunities, which may either accelerate the adoption of our integrated solution and help to cross-subsidize the implied cost of our system, aided in part through improved economies of scale.

Deeply Integrated Hardware/Software Solution. We believe our Sentinel software offering provides our customers with a turnkey solution that accelerates the ability for OEMs to deliver high-speed highway autonomy and Proactive Safety at commercial series production scale. With over-the-air software updates, the product will be continually refined to ensure continued solution reliance and enhanced performance.

Volvo Series Production Contract. In May 2020, we announced a landmark deal with Volvo Cars for the first automotive series production award for autonomy in the industry. As a result, our hardware and software could power Volvo’s next-generation vehicle platform, called SPA2,increasingly focused on which its future consumer vehicle models will be based. The intent of the program is primarily to enable highway autonomous drive capability as an option on production consumer vehicles, with series production expected to start in 2022. Additionally, the program presents an opportunity to simultaneously enable next-generation Proactive Safety systems in a more widespread capacity at lower cost than autonomous drive upgrades.

Additional Commercial Success with Daimler Truck AG and Mobileye. In October 2020, we announced a strategic partnership with Daimler Truck AG, the world’s largest commercial vehicle manufacturer, to enable highly automated trucking, starting on highways. Our teams work closely together in order to enhance lidar sensing, perception, and system-level performance for Daimler trucks moving at highway speeds. To strengthen the partnership, Daimler Trucks has acquired a minority stake in Luminar. In November 2020, we executed a contract with Mobileye, an Intel company, to supply Luminar lidar for use in Mobileye’s first generation of its Level 4 Mobility-as-a-Service (MaaS) pilot and driverless fleet in key markets around the world.

Compelling Growth, Margin, and Cash Flow Profile. We believe that our robust customer base and growing list of commercial partnerships creates a compelling growth profile. This is further enhanced by the visibility to series production from existing and developing agreements that would enable rapid growth. Our product cost structure includes exclusive supply agreements for all three of our key lidar components (receiver, ASIC, and laser), enabling us to achieve significant material cost reductions as volume increases for such key hardware components. As we scale production and grow our revenue, we believe our strategy of low capital intensity provides the potential for high shareholder return.

Deep Bench of Industry Leaders. We have a visionary leadership team with a track record of innovation and execution, led by our President and Chief Executive Officer, Austin Russell, to develop a new kind of sensing technology to make autonomous vehicles both safe and ubiquitous. With approximately 400 employees across 8 global locations (including a millennia of man and woman years of lidar-related experience), Luminar has built a deeply experienced team of industry leaders from across the lidar, automotive, technologysafety and autonomy, sectors, including senior members from automotive companies such as Daimler-Benz, ZF, VW and Harman and technology companies such as Google, Uber, Motorola and Ocean Optics.

Our Market Position and Leadership

We were founded with the vision of making autonomous transportation safe and ubiquitous. As a global leader in lidar autonomous driving technology, we are enabling the world’s first autonomous solutions for automotive series production in passenger cars and commercial trucks.

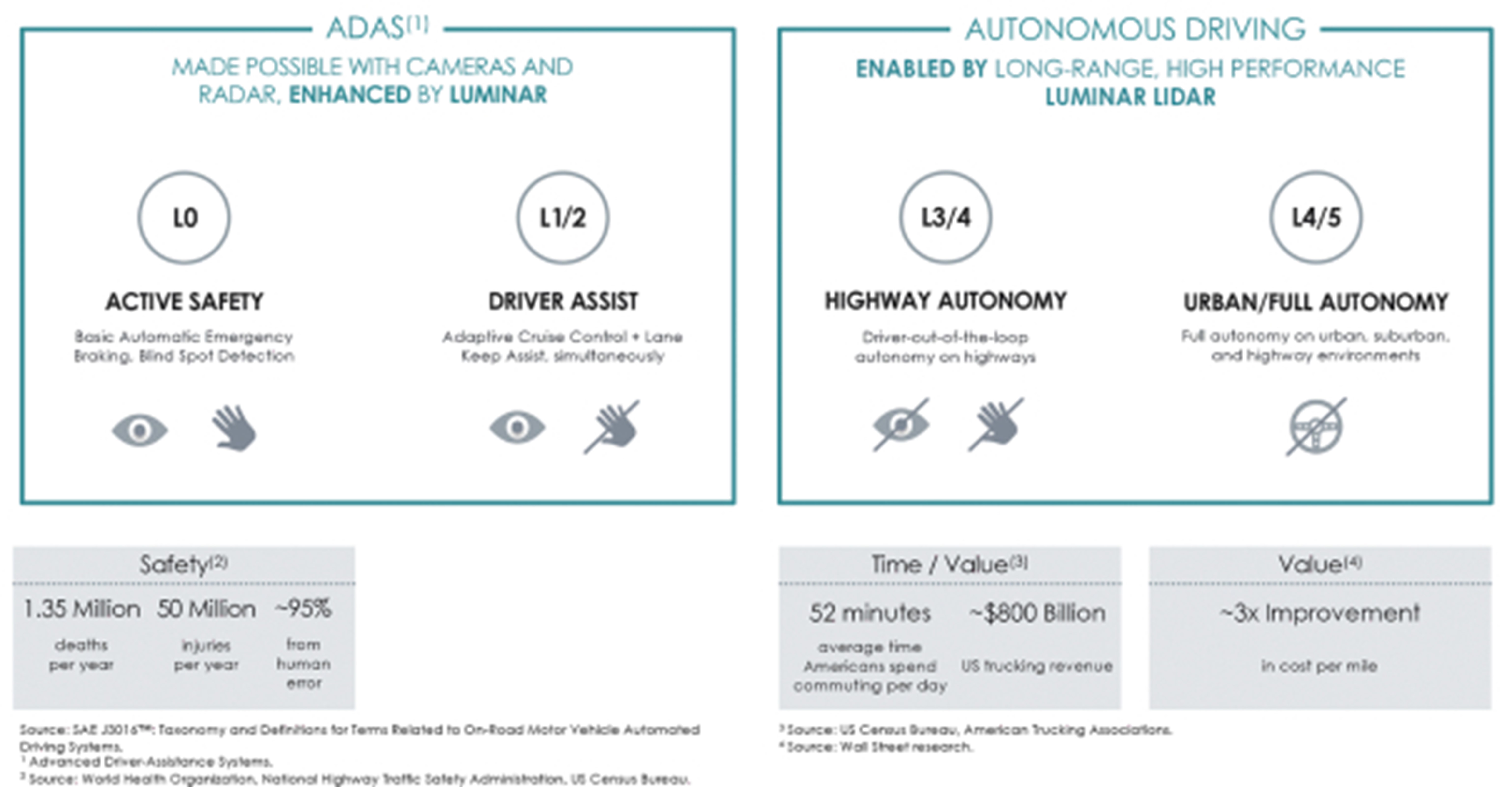

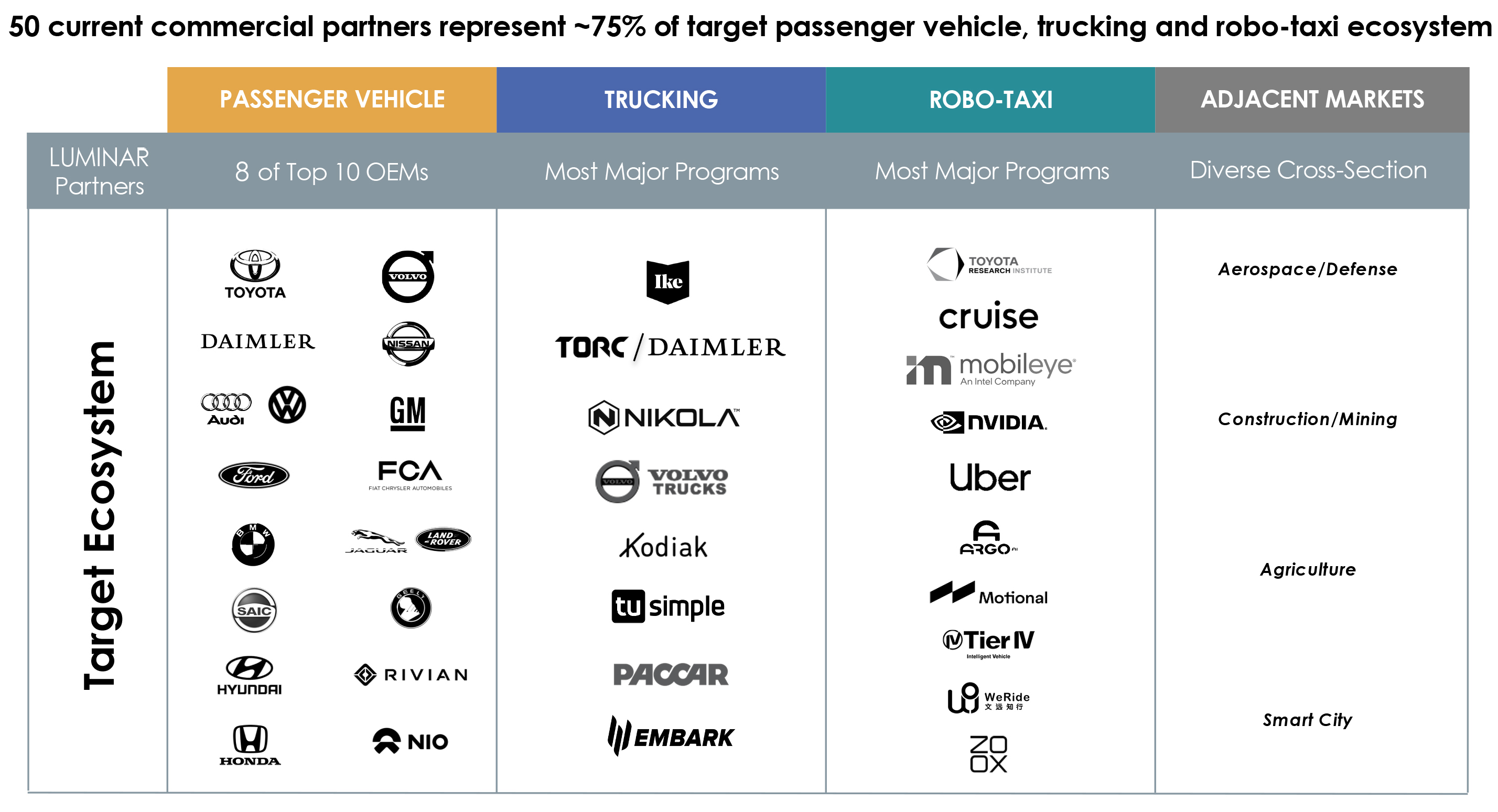

The automotive industry is among the largest in the world and features an estimated total addressable market opportunity (“TAM”) forspecifically next-generation advanced driver assistance systems, or ADAS, and autonomous solutions (Level 0 through Level 5) expected to exceed $150 billion by 2030. Our model to capture this opportunity is to directly partner with top established automotive companies in order to power their autonomous future. Correspondingly, we have successfully established partnerships with over 50 companies across three primary application verticals: passenger vehicles, commercial trucks, and robo-taxis. More than 75% of the companies listed in the target ecosystem

chart below are working with Luminar customers. Although not our primary focus, adjacent markets such as aerospace, defense and smart cities offer use cases uniquely suited for and potentially served by our technology.

An important benefit of our engagements with commercial partners is to have our products generally incorporated into our commercial partners’ development programs at the earliest stages. By securing these development wins in a competitive landscape, there is greater increased forward visibility into the long-term development cycle towards series production. This awards us with a significant competitive advantage by positioning us to convert existing development engagements with key automakers into series production awards in the near term, as we have with Volvo Cars and others we expect to finalize in the future.

We have a number of OEM, trucking and robo-taxi-related partners currently in the process of validating our technology, principally using our Hydra lidar sensors (described further below), which is geared toward research and development fleets. We also have a significant number of advanced development partners, in which we see an opportunity to convert into series production awards through 2022. We expect that all series production partners will use our Iris lidar sensors (described further below) for upwards of one million or more vehicles, building on the work already completed with Hydra.

A majority of autonomous vehicle companies have been primarily focused on robo-taxi research and development for urban low speed ridesharing applications (of which we work with many). We are, by comparison, focused for the time being on the highway autonomy use case for production vehicles and are powering the substantial majority of autonomous trucking programs. This presents a unique opportunity for us to enable near-term production deployments over the next few years, while it is expected that higher levels of autonomy for urban robo-taxi applications will take substantially longer to reach scale.

Driving further volume beyond highway autonomy is our Proactive Safety solution, with the goal of ultimately preventing the majority of forward collisions that occur on roads today. With over one million fatalities globally each year from vehicle accidents, there is a clear opportunity to set a new baseline standard for vehicle safety industry-wide.

Current industry ADAS capabilities are enabled primarily by camera and/or radar sensing technologies. Data from both sensor types are commonly merged to provide the vehicle system with some understanding of its driving environment. These systems, however, fall short of delivering substantial safety gains. Today’s ADAS works well under ideal circumstances—at low speed, in ideal weather conditions, and on a test track—however with our Proactive Safety solution, we believe we can decrease the reported collisions occurrence rates by up to seven times.

Launching this bold vision forward, we entered into a landmark deal with Volvo Cars for the first automotive series production award for autonomy in the industry, which was announced in May 2020. Our hardware and software is being integrated into Volvo’s global consumer vehicle platform to power autonomous highway driving and Proactive Safety features, with series production scheduled to take place in 2022. Volvo has historically been a leader in deploying new breakthrough safety-centric technologies into the automotive industry, ranging from the invention of the modern three-point seat belt to the launch of Mobileye’s vision-based ADAS product.

In October 2020, we also announced a strategic partnership with Daimler Truck AG, the world’s largest commercial vehicle manufacturer (through its Freightliner and Western Star Brands), to enable highly automated trucking, starting on highways. Experts at Daimler Truck AG, along with its U.S. subsidiary, Daimler Trucks North America (DTNA) and Torc Robotics, part of Daimler Trucks’ Autonomous Technology Group, are collaboratively pursuing with Luminar a common goal of bringing series-produced highly automated trucks (Level 4) to roads globally. Our teams work closely together in order to enhance lidar sensing, perception, and system-level performance for Daimler trucks moving at highway speeds. To strengthen the partnership, Daimler Trucks has acquired a minority stake in Luminar.

In November 2020, we executed a contract with Mobileye, an Intel company, to supply Luminar lidar for the company’s Autonomous Vehicle Series solution in its next phase of driverless car development and testing, in production volumes at sub-$1,000 cost. As part of the agreement, Mobileye will collaborate with us to use our lidar for the first generation of its Level 4 MaaS pilot and driverless fleet in key markets around the world. Our technology will be used to enable Mobileye’s TRUE REDUNDANCY capability, with multiple self-contained sensor systems to enable uncompromised safety and validation for Level 4 driving.

In March 2021, we announced a partnership with Zenseact to deliver autonomous software for series production vehicles. Volvo Cars is the first launch customer, representing both Luminar’s and Zenseact’s first production design win for software. Luminar’s new product suite, Sentinel, is the first full-stack autonomous solution for series production in the industry. It deeply integrates Zenseact’s OnePilot autonomous driving software solution alongside Luminar’s Iris lidar, perception software, and other components as a foundation, enabling every automaker to offer Highway Autonomy and Proactive SafetyTM capabilities on their production vehicles. While the wider autonomous industry largely focuses on robo-taxi applications, Luminar and Zenseact collectively remain focused on delivering systems into series production vehicles.

In March 2021, we entered into a relationship with SAIC Motor Corporation, the largest automaker in China, pursuant to which Luminar is expected to power the autonomous capabilities and advanced safety features in SAIC’s new R brand vehicles for series production with its industry-leading lidar as well as components of its Sentinel software system. The R brand program is expected to begin series production with Luminar starting in 2022, with the parties’ longer-term goal being widespread standardization across all vehicle lines. As part of the close collaboration, we will also be establishing an office in China to be located in Shanghai alongside SAIC Motor, where SAIC would also be providing local support. The parties expect to deliver the first autonomous production vehicles in China, establishing SAIC’s technology leadership position and Luminar’s production launch in the region.

Market Outlook

There is a worldwide trend towards mobility and e-mobility and a renewed focus on autonomy, specifically highway autonomy for passenger and commercial vehicles. As the market shifts toward electric and hydrogen drivetrains, along with software-defined vehicles delivering a new user experience and data capability, we see the potential of autonomy enabled by the sensing and computing technologies on vehicles and under advanced development today. The roadmap from existing driver assistance and comfort features all the way to self-driving value can be built through improved vehicle situational awareness.

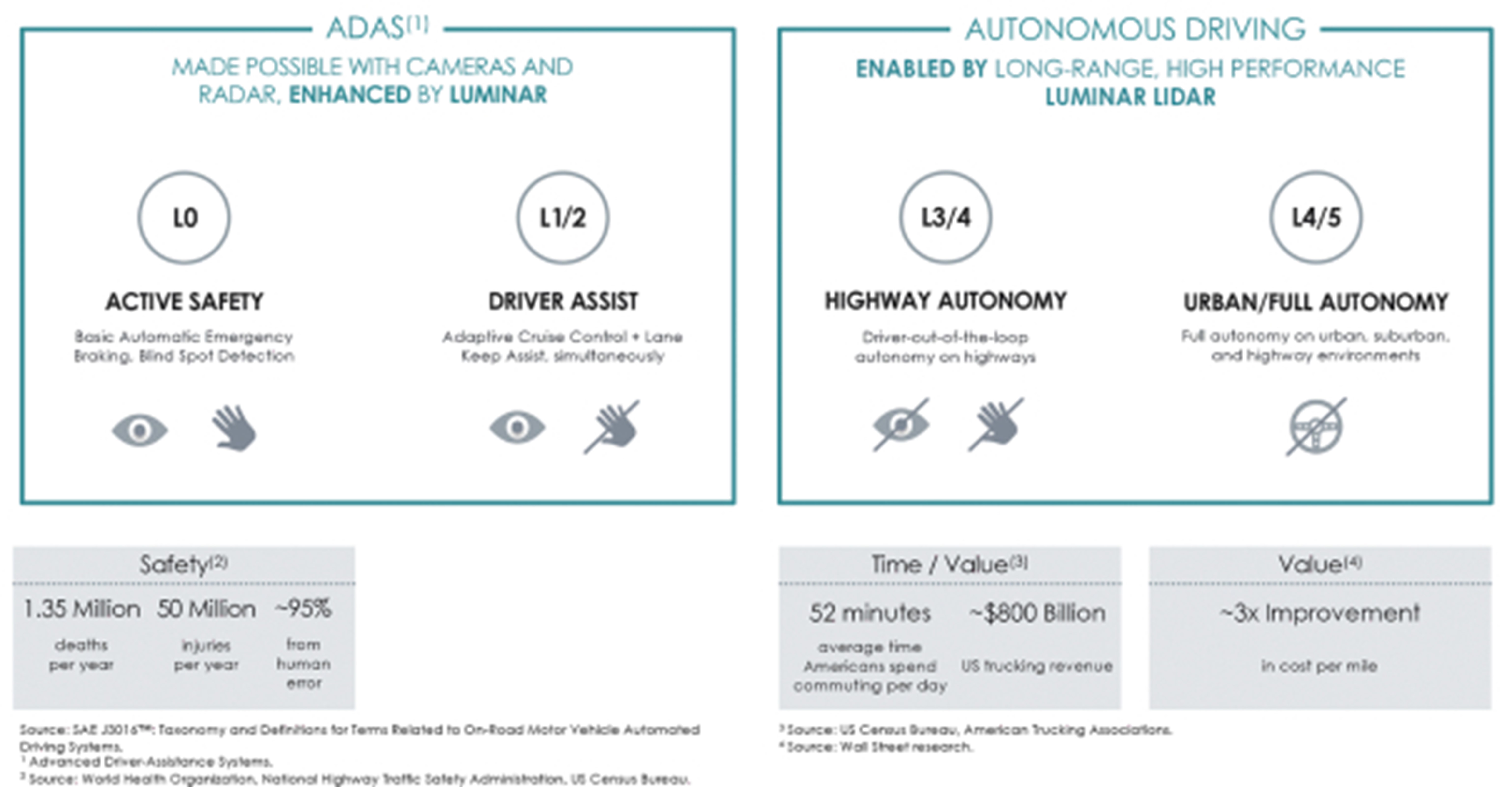

Our products provide thisLiDAR technology provides increased situational awareness in a broad range of driving environments through improved and allow for confidenthigher confidence detection and planning at all vehicle speeds. Our portfolio encompassesBeyond sensor hardware, andour product portfolio has expanded to include in-development perception and decision-making software, as well as high definition “3D” mapping that improve existing vehicle features and enable new levelswe anticipate will monetize the ecosystem of vehicle automation for consumer and commercial applications. To understand the ADASimproved safety and autonomy markets addressedcreated by our products, it is important to understand the levels of automation as defined by LiDAR.

Our Markets

The Society of Automotive Engineers (“SAE”).

Although SAE has clearly defined these levels, there continues to be inaccuracies and misuse of the levels leading to consumer misconceptions about the true capability of the vehicle which they purchase. We believe our lidar greatly enhances the lowest defines levels of autonomy and enables the deployment of the highest levels of autonomyvehicle automation as follows, which SAE updates from time to both the consumer and commercial markets. Below is a more detailed description of the levels of automation.time:

•Level 0—Active Safety:No Driving Automation: In this level, the human is fully responsible for all dynamic driving functionstasks (“DDT”) at all times.times, even if an active safety system assists in the task. “L0” is defined as driver support features that are limited to warnings or momentary driving assistance.emergency intervention. Examples of warnings include blind spot warning or lane departure warnings. Examples of features with momentary assistance include automated emergency braking (“AEB”) and lane keep assist (“LKA”). These features are viewed as the basis of active safety, with AEB designed to reduce and/or mitigate the severity of low speed accidents, and LKA designed to prevent vehicles from crossing over into neighboring lanes or even worse, oncoming traffic. These features apply to both passenger and commercial vehicles and are growing as standard features globally and represent the majority of the ADAS market today.

•Luminar value-add: Our lidar’s long range and high resolution capability enables the detection and classification of objects (vehicles, pedestrians, cyclists) in all lighting conditions and inclement weather. We expect this to greatly improve upon today’s systems, and to be much more effective at taking proactive measures to avoid accidents and extending the AEB capability to higher speed driving scenarios. Additionally, the ability to detect lanes out to 150 meters and do so in these same adverse environmental conditions adds to the robustness of LKA systems and helps prevent temporary loss of lanes or lack of detection altogether as often seen in today’s systems.

•Levels 1 and 2—Level 1—Driver AssistAssistance: These levels representIn this level, while the last levels in which the driverhuman is still fully responsible for all driving functionsDDT at all times. “L1” is defined astimes, an active safety system may assist by executing either the longitudinal or the lateral vehicle motion control subtask, and disengages immediately upon driver support features that provide steering or braking/acceleration assistance, but not both simultaneously.request. Examples include lane centering support (“LCS”) or the more widely adopted adaptive cruise control (“ACC”). These features are viewed as comfort features, easing the driving load from the driver during extended highway drives. “L2” captures multiple driving tasks,

•Level 2—Partial Driving Automation: In this level, the human is fully responsible for example bothall DDT at all times, even if an active safety system assists in the task. When the controls from an L1 system are operated by the vehicle simultaneously, such as LCS and ACC, and LCS simultaneously. In the near future, we expect an increased adoption of these systemssystem is then classified as safety protocols begin to require head-on collision assistance which will require simultaneous braking and steering control.L2.

The term L2+, while not an officially recognized term, is often used for today’s higher capability L2 systems, many of which add a driver monitoring system, such as camera or steering wheel sensing to ensure the human driver remains engaged, but allow themrequire that the driver remain attentive at all times. This is considered by safety experts as a challenging phase because the systems may work well for long periods of time, and can lull drivers into trust and complacency.

•Level 3—Conditional Driving Automation: In this level, the automated driving system (“ADS”) performs the entire DDT while engaged. The driver is responsible to remove their hands fromverify the wheel completely (eyes must remain on the road). These systems are currently restricted in Europe, but allowed in the United States and other regionsoperational readiness of the world inADS, determine whether to engage the restrictedsystem, and becomes the fallback-ready user when the ADS is engaged. The ADS permits engagement and operation only within its operational design domain (“ODD”) of divided expressways, high-ways, and typically only in systems with onboard high-definition maps of those expressways. The ramp up of these systems has been slower on. However, the market, mainly due to the additional sensing and compute costs for marginal value-add to the end consumer.

• Luminar value-add: Similar to L0, we expect to greatly improve upon today’s L1 and L2 in performance, robustness and availability. With the ability to detect lanes and precisely measure the distance to a lead vehicle in a single lidar sensor, we can independently give lane assignments to objects ahead. This helps prevent false braking events while driving in ACC mode, making the consumer experience safer and more enjoyable. Add this to the ability to detect lanes independent of lighting conditions, and we add confidence and robustness to nighttime driver support systems as well. As driver confidence in these features grows, we expect the utilization and adoption of such features to increase, leading to higher impact of vehicle safety systems.

•Levels 3 and 4—Highway Autonomy: In these levels, the vehicle can still be operated in normal driving mode. However, when the automated driving functionODD is engaged, the human is no longer responsible for the driving function. “L3” requires that the human driver must take back complete control of the vehicle when requested. “L4” assures the vehicle will continue to function without any human driver intervention, even if in a degraded state. Terms such as “chauffeur” are used for L3, while terms like “pilot” are used for L4, sometimes incorrectly. Further, robo-taxis today are aspiring to L4 but still rely on safety drivers behind the wheel making them L3 systems – including leaders like Waymo. To better quantify a vehicle’s autonomous capabilities, the market has started to assign an ODD and while many are trying to enable L4 for the urban environment, the most logical ODD for L3 and L4 driving is divided expressway or highway.

Subsequently, a vehicle may not have L4 capability from the garage or the docking facility to the highway, but from highway entranceoften limited to highway exit, the vehicle can provide L4 functionality forapplications within certain speed parameters. An example is a traffic jam assist feature that specific ODD. In 2020, the L3 and L4 markets only exist in development platforms and there are no serial production automotive L3 or L4 systems available. We believe, however, this segment represents significant growth potential and when correctly implemented, will prove valuable to both the consumer and society.

• Luminar value-add: Adding our lidar to these systems improves their robustness and availability, allows sensing redundancy to cameras and radar, and therefore enables true hands-off and eyes-off operation. This allows the driver to utilize theirstop paying attention for short periods of time for something other than supervising the driving function, which is the ultimate product purpose of autonomy.at lower speeds.

• Levels 4Level 4—High Driving Automation: In this level, the ADS performs the entire DDT while engaged. The driver is responsible to verify the operational readiness of the ADS, determine whether to engage the system, and becomes a passenger when the ADS is engaged (when physically present in the vehicle). The ADS permits engagement and operation only within its ODD. The ODD is expanded in this level to include numerous different driving environments, such as highway and urban.

•Level 5—Urban/Full Autonomy:Driving Automation: “L5” is essentiallyIn this level, the same as L4, but withoutADS performs the ODD restriction.entire DDT while engaged. It is the designation for vehicles that, when placed in automated driving mode, can drive everywhere and in all conditions without human intervention or even occupants. We group this L4/L5 functionality due to the current focus on urban and suburban driving in the form of robo-taxis. Commercial trucking also aspires to L5 capability but is focusing its L4 efforts on highways as this yields the highest benefit. An urban L4 is extremely complicated compared with highway L4. We do expect that robo-taxis and automated people movers will be a strong growth market, but the timeline is more uncertain and we expect this market growth to be limited while technology for both vehicles and infrastructure matures.

• Luminar value-add: Similar to L3 and L4, we believe lidar is required to deliver L5 sensing and perception needs. Sensing redundancy and multiple modalities are required and perhaps more important since the environment is the most complex, and our lidar’s sensing and perception capability supports the needs of detection and classification in dense, congested, and difficult environments at all hours of the day and night.

While these SAE levels are important to technology developers, weWe believe the market is currently segmented in two distinct categories: (1) ADAS or driver-assistance, where a human is in the driving loop and responsible, at minimum, to be a safety fallback and in most circumstances directly control part or all of driving tasks;(L0 / L1 / L2 / L2+) and (2) autonomous driving, where a human is “out-of-the-loop” (colloquially, “hands off” the steering wheel and “eyes off” the road), which generates real value propositions to consumers, such as allowing the driver to recover time, as opposed to mere comfort or novelty features.

AD, (L3 / L4 / L5). Within these two segments, we believe the largest near-term business opportunities exist for technologies that enhance, not replace, the driver, specifically in ADAS (L2+) and conditional highway autonomy

applications (L3). We believe our products meaningfully improve ADAS functionality and are also key enablers for highway autonomy.

ADAS and Proactive SafetyTM

ADAS standards are primarily driven by both the European and North American markets. The European New Car Assessment Program (“NCAP”), a voluntary vehicle safety performance assessment program that uses a star safety rating system, requires a minimum level of crash mitigation functionality such as automated emergency braking (“AEB”) (for vehicles, pedestrians, and cyclists), lane keep assist (“LKA”), speed alert systems and other ADAS features for a vehicle to have a 5-star rating. Furthermore, we believe the European Union may be moving toward mandates of certain of these advanced functions.

Until recently, the U.S. was less focused on mandates and instead allowed the U.S. New Car Assessment Program (known as the “Stars on Cars” program) and designations such as the Insurance Institute for Highway Safety “Top Safety Pick” and “Top Safety Pick+” to drive adoption of vehicles with ADAS technologies and provide consumers with an understanding of a vehicle’s advanced crash avoidance capability. In 2020, in conjunction with the National Highway Traffic Safety Administration (“NHTSA”), 20 automakers announced a voluntary effort to equip almost all new passenger vehicles sold in the areasUS with a low-speed AEB system, including forward-collision warning, by mid-2023.

In 2023, NHTSA introduced proposed rulemaking to mandate that passenger vehicles have AEB and Pedestrian AEB and the Federal Motor Carrier Safety Administration introduced proposed rulemaking to mandate AEB in heavy trucks.Final rules are expected soon, and these may require additional hardware and software to meet performance requirements.

With global safety rating programs being the main drivers of activeadoption and pressure on original equipment manufacturers (“OEMs”) competing to deliver more safety and comfort features to their customers, we believe it is reasonable to expect near complete adoption of at least some ADAS functionalities in new vehicles manufactured and sold in developed markets such as Europe, the United States, Japan, and South Korea by 2026. We expect adoption rates to increase significantly in China as well.

According to the World Health Organization, the number of fatalities globally on roadways still exceeds one million annually and the global macroeconomic costs of vehicle accidents has been estimated at more than $1 trillion globally. While the increasing application of existing ADAS technology should help reduce the number of accidents and fatalities, we believe there is significant room for improvement in these technologies. In particular, we believe there is a significant opportunity to reduce collisions with a capable LiDAR sensing system that increases the quality and reliability of the perception data collected by vehicles and enables improved ADAS functionality in a wider range of environmental conditions, including at higher speeds and at night. We have been developing a turn-key ADAS system known as Proactive SafetyTM which leverages our core sensor and software technologies. Intended functionality for Proactive SafetyTM that is currently under development includes Automatic Emergency Braking, Automatic Emergency Steering, and Adaptive Cruise Control. If implemented, these are expected to represent a new generation of vehicle safety functionalities that enable more accident avoidance rather than merely mitigation of crash severity.

Highway Autonomy

Our focus since inception has been to enable ubiquitous safety and autonomy. We view highway autonomy, duein combination with Proactive SafetyTM, as providing the most value to trendsthe end consumer for the foreseeable future. The market appears to be trending in safety technology standardizationthis direction, targeting hands-off and consumer pain-point priority. These two applications have well aligned technology requirementseyes-off operations in a more controlled setting than the urban environment. Historically, there has been a significant focus on investment and development of Level 4 robo-taxi solutions; however, this is proving to be a much more complex and expensive challenge to solve than many companies anticipated. In the past year, the industry has experienced a retrenching of efforts in the robo-taxi space, which we believe has validated our focus from the outset on improving ADAS functionality and enabling highway autonomy. We continue to believe that allow us to remain focused on a single product/solution that will allow OEM partners to achieve both. The broader autonomy market segment, specifically robo-taxis, represents strong long-term opportunity, but lidar technology must be seeded now during development even though high-volume production and deployment remains many years away.

These trends and safety needs apply to both the passenger vehicles and commercial vehicle markets. The autonomy use case and business case for commercial vehicles are simple: reduce operational costs and increase efficiencies. Passenger vehicles are more complex since the ability to deliver autonomy is moresectors focused on the consumer’s comfort and convenience. We are working to help OEMs and consumers achieve these goals, but with the proper level of safety included. Our lidar is also making traction in other markets, including defense and smart cities, that require high resolution and long-range sensing in uncontrolled operating conditions.

Source: Our estimates, incorporating data from IHS Markit and Wall Street research. Includes passenger and commercial vehicles (including robo-taxi) as well as hardware and software.

The charts above represent today’s market in 2020 for which scanning lidar is limited. The market, however, is expected to grow substantially by 2030 and our technology has the potential to improve or enable capability across the full spectrum of the market. Our initial focus for lidar technology is L3/L4, and we aim to offer the sensing, perception, and function turn-key system that will truly add value and give driving time back to the end consumer. This market is still developing, but represents significant growth, and we are the technology leader with the first L4 highway production platform win with Volvo. In addition, vehicles enabled with our lidarL2+/L3 applications will be capablethe greatest source of proactive safety in which accidents are potentially completely avoided, which can benefit other autonomy solutions such as L1/L2.demand for our products over the next several years.

Passenger VehiclesVehicle Market

The passenger vehicle market is very large. We expect that more than approximately 100 million new passenger and commercial vehicles will continue to be manufactured year-over-yearannually, on average, through 2030 and beyond. It is very difficult to replicatethe end of this volume in other markets, but it is also important to recognize that highway autonomy is not yet standard equipment. In order to realize a vehicle feature’s maximum societal benefits, the ultimatedecade. An exceptional goal in the automotive industry is to achieve widespread adoption of the highwaynext-generation safety and autonomous featurefeatures in all vehicles.vehicles for the benefits of safety, economics, and accessibility of transportation. We expect a ramp up of LiDAR and our technology adoption ramp-up over time as automated functionality

matures,ADAS and autonomous functionalities mature, hardware costs and pricingprices are reduced, and consumers become more familiar with the full benefits and capabilities of a safe autonomy system. We believe there is a substantial market opportunity for our products when proactive safety is coupled with autonomy due to the public benefitproducts.

ADAS

ADAS volumes are primarily driven by both the European and North American markets. The European New Car Assessment Program (“NCAP”) requires a minimum level of crash mitigation functionality such as AEB (for vehicles, pedestrians, and cyclists), LKA, speed alert systems and other ADAS features for a vehicle to have a 5-star rating. Furthermore, the European Union is moving toward mandates of these advanced functions.

The U.S. is less focused on mandates at this time and instead allows the U.S. NCAP (known as the “Stars on Cars” program) and designations such as the Insurance Institute for Highway Safety “Top Safety Pick” and “Top Safety Pick+” to drive adoption and provide consumers with an understanding of the vehicle’s advanced crash avoidance capability. Additionally, in working with the National Highway Traffic Safety Administration (“NHTSA”), 20 automakers pledged to voluntarily equip virtually all new passenger vehicles by September 1, 2022 with a low-speed AEB system that includes forward-collision warning. With global safety rating programs and the OEMs competing to deliver more safety and comfort features to their customers, it is reasonable to expect near complete adoption of ADAS functionalities in new vehicles produced by Europe, U.S., Japan, and South Korea by 2026. We expect adoption rates to increase significantly in China as well.

Tesla’s “Autopilot” is an example of establishing a driver support (as defined by SAE) platform as standard equipment. They developed a vehicle around the promise of future functionality which supports the production volume and cost reduction needed to spread technology beyond premium, low volume platforms. We expect more OEMs to demand proactive safety and limited autonomy with the ability to upgrade functionality over time without hardware change. This expectation aligns well with the increasing number of OEMs developing new vehicle platforms that span their lineups.

Proactive Safety

While the increased application of existing ADAS technology should help lessen the number of accidents and fatalities, we believe there is significant room for improvement concerning standard ADAS and crash avoidance. Today, the ADAS systems are designed to mitigate or lessen the severity of accidents and only avoid them under certain low-speed or ideal environmental conditions. Recent data suggests that the number of automotive fatalities globally still exceeds one million annually and the social costs of accidents continue to exceed $500 billion in the United States alone. As the autonomy market matures, we expect that OEMs and global NCAP programs will extend the functionality to intersection and crossing scenarios, which requires wider fields-of-view and faster detection. Global safety rating programs are also considering night and low-light performance in the future, further pushing the existing technology’s limits. We believe there is a significant opportunity to be able to reduce collisions with a capable lidar sensing system and software which can enable an understanding of the environment, which can help to avoid collisions by taking over the steering wheel and braking systems proactively. Our lidar is capable of significantly increasing the effectiveness of these active safety systems and supports proactive safety and greater crash avoidance measures using our long-range, high resolution, wide Field-of-view, and perception software to be able to detect pedestrians and cyclists in the most challenging and complicated environmental sensing conditions. Furthermore, high-speed safety performance, specifically AEB, is increasingly important as hands-free highway driving assist systems are further delivered to the market, and the vehicles take on more of the driving responsibility.

Highway Autonomy

Since inception, our focus has been to enable safe and ubiquitous autonomy and we view highway autonomy, in combination with proactive safety, as providing the most value to the end consumer for the foreseeable future. The market is also trending in this direction, targeting hands-off and eyes-off operations in a more controlled setting than the urban environment. While there is a significant focus on investment and development of robo-taxi solutions, passenger vehicles continue to be a voluminous market, and we expect the growth rate of highway automated functions to have a compound annual growth rate (CAGR) of nearly 40% from 2020 until 2030.

Commercial Trucking Market Outlook

The amount of goods transported by trucking globally continues to rise year-over-year. While the number of newly manufactured trucks has declined in recent years, theThe application of ADAS technology continues to grow and the interest in autonomy for commercial transport is at an all-timeremains high. The business case for trucking highway autonomy is simple:beyond improved safety also includes: lower operating costs, increased vehicle utilization, and increased availability of the vehicles andmore time spent on the road (trucking and fleet companies do not get paid to park at rest stops).road.

Robo-Taxi Market

The applicationrobo-taxi industry remains an area of AEB has been in the market for many years, with the first mandate for vehicle AEB in Europe in 2013, and growing application of the functionality since. Similar to passenger vehicles, Europe leads the market in a unified safety direction and has put mandates in place to drive lane keeping functions and expand the AEB functionality to include

pedestrians and cyclists. This leadership is also a result of a market driven by the trucking manufacturers who set the technology distribution of vehicles and the ADAS vehicles and systems architectures. Unfortunately, the trucking market in North America is heavily driven by the fleet operators’ specifications and is heavily fragmented. The lack of mandates from governing bodies has resulted in a market for ADAS that is very difficult to quantify and gain economies of scale across a small set of partners as is the case in Europe. As in passenger vehicles, our lidar technology and sensing capability could greatly improve the L0 and L1 functionality for the trucking market as well. However, our focus and the value add seen globally by the OEMs and fleet operators is L4 highway autonomous driving.

L4 highway autonomy is the target ODD for trucking because that is where their money is earned and where the majority of the physical truck’s time is spent. The sensing needs between Europe, North America, South Korea, Japan, and other regions globally all differ slightly, but have similarities in the requirement for (i) long range detection to aid in extra braking time, (ii) farther detection of lanes to aid in proper lane centering and placement of potential obstacles in the correct lanes, and (iii) the vertical field of view and high placement on the cab to support close proximity detection in front of the vehicle, as well as overhead obstacles (such as bridges and overhead signs).

Robo-Taxi and Delivery Market Outlook

The press announcements of large robo-taxi investment and partnerships betweendevelopment by leading technology companies both established and startup, and mainstays from the automotive industry dominateindustry. Despite the industry’s attention. This application is, however,timeline for widespread deployment of robo taxies continuing to be pushed out due to the most difficult vehicle autonomy feature to solve for technically. It requires the ability to detect and classify hundreds of objects and predict motion for many of those objects, including pedestrians, electric scooters, and bicycles—all of which present as pedestrians, but move in very different ways. The environment consists of dynamic weather, steam from manholes and exhaust pipes, and oftentimes construction equipment causing dust and debris. Given the economic benefit an automated robo-taxi driving system could unlock, billions of dollars in funding and engineering efforts have been focused on developing solutions. The majoritycomplexity of the autonomous vehicle companies are operating in this space, awaiting a market that requires complextechnical requirements and headwinds such as the near-term contraction and retrenchment of the industry, the need for regional and federal governmental support, funding for infrastructure, and a sensing and compute solution that must anticipate every possible mixed-traffic scenario.

Additionally,scenario, the initial ODD only requires low to medium speed operation, which can be met with less capable sensors. We expect that ultimately, the ODD will need to expand to the highway as robo-taxisrobo-taxi market remains an important market for LiDAR, both for near-term validation and automated shuttle services move people from city centers to the airport and back, in particular. We expect limited robo-taxi R&D programs will continue to operate in varying levels of development and testing the rest of this decade.for long-term demand.

Adjacent Markets

Although not our primary focus, the adjacentAdjacent markets belowsuch as last mile delivery, aerospace and defense, robotics and security offer additional use cases uniquely suited for and potentially served bywhich our technology.technology is well suited. Our goal is to scale first within our core markets and utilize our robust solutions to best serve these adjacent markets where it makes sense for us and our partners.

•Smart Cities. Many government agencies are motivated to invest in smart cities solutions such as “Smart” intersections and “Intelligent” tolling systems due to macroeconomic trends such as usage of electric vehicles (and the subsequent reduction in fuel taxes) and growing city populations (and the subsequent need to manage assets more efficiently). As discussed above with trends of urban living and the need to manage traffic flow and congestion, not only is there a market for the vehicles themselves but also for the infrastructure to support such automation. Today, many global cities have a defined Smart City initiative to be delivered over the coming years, with over 50% of these initiatives being in Europe and North America. The market is broken up into segments: smart buildings, transportation, infrastructure, healthcare, energy, security, and education. We will focus on infrastructure and security: traffic flow and intersection management, tolling and traffic management, smart parking and security, pedestrian and crowd flow management and security, and large venue security.

•Aerospace and Defense. The aerospace and defense markets are intent on increasing their autonomous capability and lidar is a key component to enabling such automation, including for items such as an automated convoy for resupply or an automated refueling mission. These markets represent a small volume, but with very specific requirements that only certain technologies will be able to meet. We will utilize our sensing and system architecture from our core automotive system and provide solutions in this space and/or partner with companies who can help deliver specific solutions licensing our high performance technology.

Our Solution Overview

We bring opportunity and inspiration to an automotive industry that requires continuous technological and performance innovation, and play a critical role in making the future of mobility safer. The hope for autonomy is not just novelty – it is the critical feature required to transform the way people and goods move throughout the world transportation ecosystem. Autonomy presents an opportunity to save lives through enhanced safety, liberate those who struggle with transportation access,

and reoptimize value chains of logistics and vehicle ownership. We seize this opportunity by delivering what we believe is the world’s first autonomous solution for series production, powering highway autonomy and proactive safety.

High-performance lidar is not just another sensor. While it is true that lidar is a sensor, its value is more than just hardware and delivering a point cloud “image.” It is similar to radar and cameras in that these devices provide no direct value without the signal processing, detection, tracking, and perception software that gives an understanding of the vehicle’s surroundings. The next product offering levels are to provide route planning and command the steering, braking, and engine actuators to control the vehicle. This will require lidar producers to follow the precedents set by camera and radar, where sensor providers supply perception software (they are, after all, the experts in that sensor’s data).

Many companies have developed lidar sensors, but not all have developed lidar systems. A lidar product offering can be broken down as follows:

Lidar: For customers with a full complement of vehicle system software development, this product enables their development of vehicle functions through a sensor hardware product.

Highway Autonomy: A full vehicle function product combining hardware and software for driver out-of-the-loop on highways.

Proactive Safety: A full vehicle function product combining hardware and software that continuously monitors, but only momentarily acts to avoid collisions on all road types.

As the requirements of a lidar system increase, the number of competitors tends to quickly decrease. We were founded with the understanding that the most effective lidar solution will have perception that can deliver the complete desired solution through the OEM to the end consumer. Many OEMs, via their camera experience, have outsourced everything to the supply base, except function development. Many have outsourced even this functionality and are starting to weigh the benefit of having a proprietary solution to using a more standardized, off-the-shelf product that saves them time and money.

Commercial Overview

We partner with the majority of key OEMs focused across three verticals: passenger vehicles, trucking, and robo-taxi. More than 75% of the companies listed in the target ecosystem chart below are Luminar customers. Furthermore, we have strong demand for our products in multiple adjacent market verticals.

An important benefit of our engagements with commercial partners is to have our products generally incorporated into our commercial partners’ development programs at the earliest stages. By securing these development wins in a competitive landscape, there is greater increased forward visibility into the long-term development cycle towards series production. This awards us with a significant competitive advantage by positioning us to convert existing development engagements with key automakers into series production awards in the near term, as we have with Volvo Cars and others we expect to finalize in the future.

We have a number of OEM, trucking and robo-taxi-related partners currently in the process of validating our technology, principally using our Hydra lidar sensors (described further below), which is geared toward research and development fleets. We also have a significant number of advanced development partners, in which we see an opportunity to convert into series production awards through 2022. We expect that all series production partners will use our Iris lidar sensors (described further below) for upwards of one million or more vehicles, building on the work already completed with Hydra.

In the near term, we are focused on the passenger vehicle and trucking markets, which we believe will drive our ability to increase market share and achieve economies of scale.

Passenger Vehicles

Due to the complexity and challenging environment of urban driving, we believe that the industry will focus on highway autonomy in the near future. Our series production award with Volvo, a global leader in automotive safety, is a key example. Our lidar technology will power Volvo’s first fully self-driving technology for highways in their next-generation production passenger vehicles, enabling true driver out-of-the-loop functionality, which we expect will set new standards of safety for the industry.

By 2030, we anticipate we will have approximately 4% vehicle penetration rate across the industry. Today, a majority of our current partners have a highway autonomy program in development with an anticipated start of production year ranging from 2023 to 2025. Leveraging our hardware and software for series production also paves the way for future proactive safety use cases in vehicles. We believe our lidar unlocks greater crash avoidance capability than today’s active safety systems and will help deliver what it calls “proactive safety” to the consumer – higher speed emergency braking, enhanced lane keeping functionality, and significantly improved performance and availability in inclement weather and low-visibility conditions. Given our performance-differentiated products and Volvo’s safety DNA, Volvo is considering making our lidar standard on all vehicles in the future, which would further enable and accelerate the adoption of our technology to several automotive partners.

This, in turn, increases our ability to scale incorporation of our products into additional passenger vehicles relative to our competitors, which we believe is a significant advantage. With production expected to start with Volvo in 2022, we will have an industrialized, automotive-grade product ready to deploy and the ability to leverage existing capacity with an efficient use of capital to support our commercial partners globally.

Commercial Trucking

We work with a significant majority of self-driving truck start-ups and traditional truck OEMs. Our commercial partners greatly value the long perception range that our sensors enable while operating on highways. Our technology enables the detection of road debris such as tire remnants or stalled traffic at ranges greater than 250 meters, as well as motorcycles darting through traffic at highway speeds. We believe the short-range performance of the vast majority of lidar providers is insufficient against those and other scenarios and inadequate to provide the level of safety required by commercial trucking companies operating on public motorways.

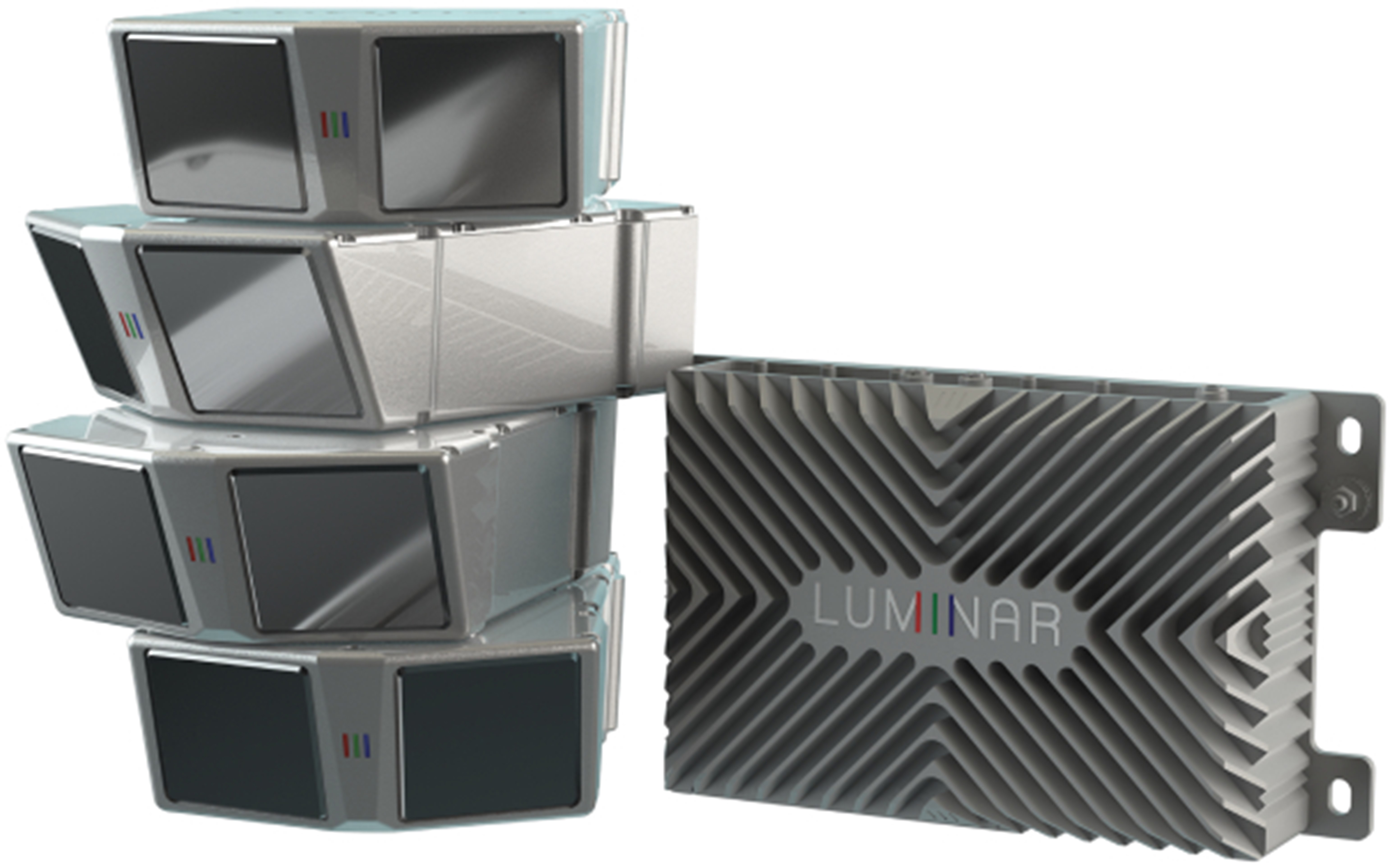

We work directly with our commercial partners to optimize our products for their applications. A few highlights of this optimization include our developments of unique scan patterns for maximized point density in specific areas of interest and models for sensor placement that minimize blind spots around the cab. Our commercial partners use between one to four lidar sensors per truck, and we expect that all will eventually integrate three or four if they move forward to series production.

We enable our commercial trucking partners to consider three and four sensor configurations because of our expected unit economics. While the trucking market has less price sensitivity than the passenger vehicle market to support a multiple sensor configuration, it still benefits from the economies of scale achieved in the higher volume passenger vehicle market. Our commercial trucking development partners also appreciate that our passenger vehicle development comes with automotive-grade standards implemented in our product design and manufacturing processes. This enables our commercial trucking development partners to leverage our success with passenger vehicles and access the technology required to deploy much sooner than if they had worked with our competitors. We believe this is significant to them as the economic incentive for self-driving trucks is more compelling than for passenger vehicles since truckload carriers in North America and Western Europe aggressively compete for freight down to a difference of tens of dollars. Self-driving technology will enable truckload carriers to eliminate drivers on their terminal to terminal lanes and subsequently eliminate 25% to 30% of their costs for hauling freight. They will use that savings to win more desirable freight business. Adding to truckload carriers’ sense of urgency to deploy self-driving truck technologies is the chronic shortage of drivers. For these reasons, we believe self-driving trucks will start to operate on highways as early as 2023 and steadily ramp up through the remainder of the decade.

Autonomy is a true economic enabler for the logistics market, including terminal to terminal, drayage and even last-mile delivery. The benefits of proactive safety discussed as part of our consumer vehicle products also apply to trucking.

Robo-Taxi and Delivery Vehicle Market

While robo-taxi and self-driving shuttle development primarily focus on low-speed urban environments today, their full value will only be met if they can also operate at higher speeds to expand their operating area, such as highways leading to airports. Our technology helps them achieve those goals by expanding this operating area to include roadways with speeds greater than 45 mph. Moreover, by using our perception software, our commercial partners can utilize their limited engineering resources more efficiently and enable them to focus on solving issues associated with vehicle system integration and driving in complex, urban environments. Our technology complements their work and will enable them to deploy their fleets sooner.

We expect there will be a number of locally dedicated robo-taxi R&D fleets continuing to launch through the next decade, which will begin with human safety drivers monitoring operation at all times and then transition to no human monitor as the fleet gains confidence in the safety of the system.

Adjacent Markets

The on-road vehicle markets are what drive our product development decision-making, especially in sensor hardware development, but the need for nearly identical performance exists in other markets as well. These markets commonly cannot match the economies of scale that automotive markets offer, but together they represent strong business opportunities. Therefore, we take an opportunistic approach to the broader lidar and perception markets, with particular near-term focus on the following.

•Smart Cities. We are working with our partners to integrate our sensors and perception software into existing solutions to make those solutions perform at high levels. Our technology enables those systems to detect and respond to vehicles at much greater ranges than legacy technology, and its perception software enables more reliable classification and prediction of objects within the area of interest. For example, cities will be able to reduce accidents at troublesome intersections and avoid expensive redesign projects, and tolling agencies can reduce the number of missed vehicles and increase their revenue yield. Many other applications benefit from our technologies’ superior performance, and we are working with partners to enable new benefits for their customers.

•Aerospace & Defense. Aligned with our mission of enabling the autonomous movement of people and goods, we work with large aerospace/defense contractors on applications that extend off-road. While our products are used in many different applications, most involve enabling some form of autonomous drive capability. We anticipate entering into multi-year supply agreements with our defense contractor partners in this market to generate a significant number of sensor sales in the future. We also expect that most of our defense contractor partners will integrate our perception software into their solutions.

There is a significant difference between a development platform project and automotive-grade production. Many lidar companies have created development products. These products are used for multiple applications, including environmental mapping for autonomous driving perception. Some of these development products began with huge spinning lidar sensors placed on top of vehicles that were ideal for viewing 360° around the vehicle, in order to better understand the challenges associated with autonomy and help solve those challenges. They were deployed in robo-taxi and autonomous trucking applications, and a myriad of off-road applications to scope the role of 3D sensing. While relatively successful to date at establishing incumbent positions in all applicable markets, almost none of these products have transitioned to automotive-qualification or military standardization specification, which is required for series production. Many lidar companies have elected to shift their focus from automotive to other adjacent markets due to the deficiencies in their technical approach to lidar or the sheer organizational difficulty and cost in delivering automotive-grade products. Many of those adjacent markets are looking to leverage scale and reuse from the automotive market, with the understanding that it is very difficult to replicate a potential market of approximately 100 million units per year (passenger vehicles and commercial vehicles combined worldwide). With a clear roadmap and a development platform that seamlessly transitions into the production platform, we believe we are well-positioned to establish the mass-scale market for lidar as the key markets’ leadership position.

Our Products

We believe we have established a dominant position in a crowded lidar market for three critical reasons: product, thought leadership, and deployment. Our products are designed and built from the ground up for the automotive market, and our performance exceeds those of our competitors. Our lidar and perception software forges a path for consumer 1550nm technology, which has been widely embraced as the long-range wavelength region necessary to widely deploy truly autonomous vehicles. We believe we are the only lidar company with deeply integrated hardware and software products, and this depth is supported by an extensive intellectual property portfolio of 93 issued patents, in addition to 84 pending or allowed patents as of February 2021.

We believe our products meet or exceed the requirements to enable safe autonomy at all levels, and we have turned this capability into a position of thought leadership in the market. From small technology companies to global OEMs, our over 50 commercial partners look to us for guidance on how to specify, test, and integrate lidar into their products. Our broad technical competency spans hardware, software, and system safety disciplines. This leadership role often begins with our product as a reference sensor in validating lesser performing sensors, including other lidar, radar, and cameras. From this, we have been successful in converting to platform deployments as our roadmap to series production has become more immediate.

Vehicle platform deployments determine the scope and design of a partner’s series production vehicle system, and are therefore our anchor for future growth. Sensor changes in these development platforms are not taken lightly by the industry, and the closer these test vehicles get to feature demonstration, the more difficult it will become to displace our technology. Our products have won platform development positions in most of the world’s top automakers and autonomous trucking programs, in both cases often displacing legacy lidar providers. Broad deployments in a host of different vehicles and countries provide us with a global fleet multiplier, which will unlock future capabilities as we seek to broaden automation capabilities. With a clear roadmap to an automotive-qualified product expected by 2022 as part of Volvo’s next generation consumer vehicles based on Volvo’s SPA2 platform, the rest of the market now has direct line of sight to our first wave of driver out-of-the loop vehicle features and services. Once partners scope their series production vehicle system based on their development platforms with us embedded, we believe there is a higher likelihood of successfully closing a design win for the series production.

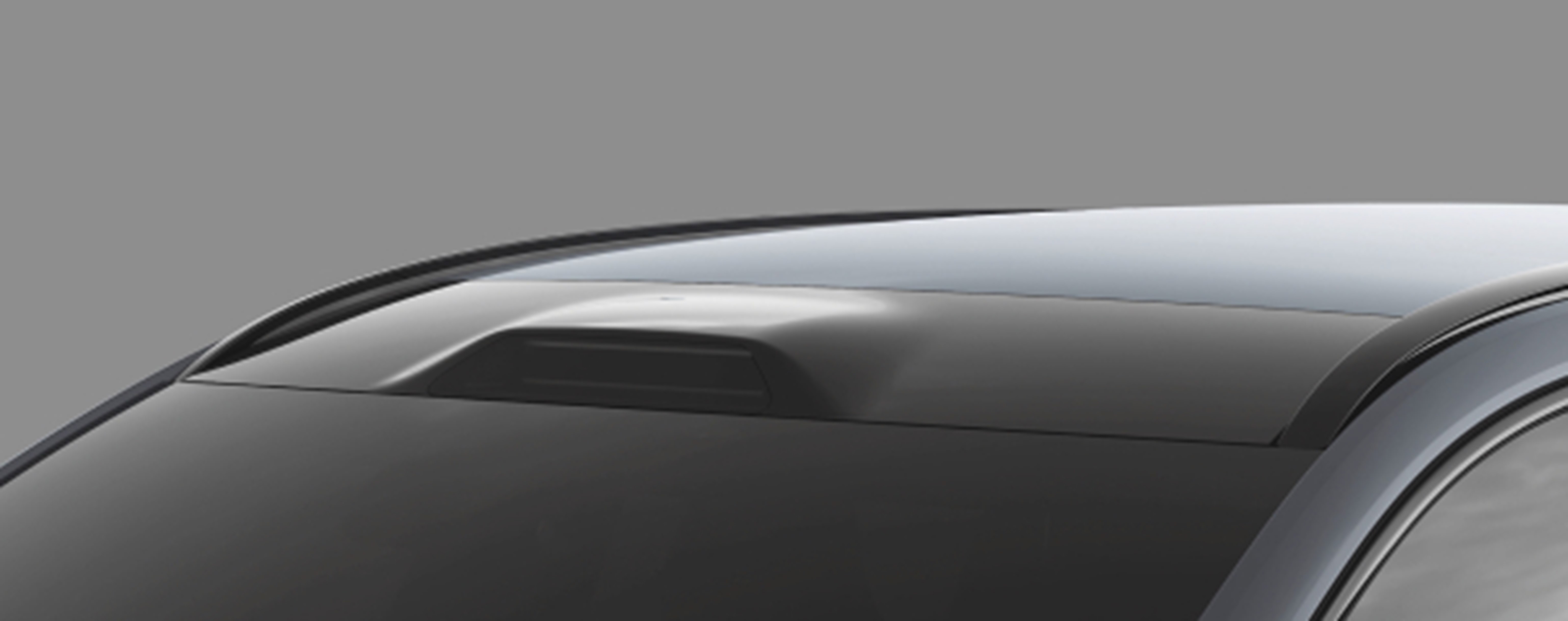

Our Iris lidar sensor integrated into Volvo SPA2 platform with expected production in 2022

ADAS has commoditized the idea of vehicle safety, but has not delivered the full promise of this technology, as discussed further in the section entitled “Technology Comparison” located below. Therefore, a large opportunity exists to build on this foundation of vehicle features. We plan to use our market position and technology leadership to create a new class of vehicle features aimed at maximizing the safety impacts of high-performance sensory perception. Given more than 90% of motor vehicle accidents in the U.S. are due to driver perception or action failure, our proactive safety initiative addresses crash avoidance features instead of merely severity mitigation features. To support and accelerate the delivery of a complete lidar-based ADAS and Level 4 highway autonomy program, we are expanding our software team. This expansion began with the addition of former members of Samsung’s Munich-based DRVLINE platform team previously responsible for delivering ADAS functionality for its mobility enterprise.

Whole-Products for Growth