UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM 10-Q

____________________________________________

|

| |

| (Mark One) |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2019March 31, 2020

OR

|

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-35714

_____________________________________________

MPLX LP

(Exact name of registrant as specified in its charter)

_____________________________________________

|

| | | | | | |

| | Delaware | | | 27-0005456 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

| | | | | |

| 200 E. Hardin Street, | Findlay, | Ohio | | 45840 | |

| (Address of principal executive offices) | | (Zip code) | |

(419) 421-2414

(Registrant’s telephone number, including area code)

_____________________________________________

|

| | |

| Securities Registered pursuant to Section 12(b) of the Act |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Units Representing Limited Partnership Interests | MPLX | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.) Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | |

| Large accelerated filer | x | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐ No x

MPLX LP had 1,058,355,3041,058,603,592 common units outstanding at October 31, 2019.May 1, 2020.

Table of Contents

Unless the context otherwise requires, references in this report to “MPLX LP,” “MPLX,” “the Partnership,” “we,” “our,” “us,” or like terms refer to MPLX LP and its subsidiaries. Additionally, throughout this Quarterly Report on Form 10-Q, we have used terms in our discussion of the business and operating results that have been defined in our Glossary of Terms.

Glossary of Terms

The abbreviations, acronyms and industry technology used in this report are defined as follows. |

| |

| ASC | Accounting Standards Codification |

| ASU | Accounting Standards Update |

| ATM Program | An at-the-market program for the issuance of common units |

| Barrel | One stock tank barrel, or 42 United States gallons of liquid volume, used in reference to crude oil or other liquid hydrocarbons |

| Bcf/d | One billion cubic feet per day |

| Btu | One British thermal unit, an energy measurement |

| Condensate | A natural gas liquid with a low vapor pressure mainly composed of propane, butane, pentane and heavier hydrocarbon fractions |

| DCF (a non-GAAP financial measure) | Distributable Cash Flow |

| EBITDA (a non-GAAP financial measure) | Earnings Before Interest, Taxes, Depreciation and Amortization |

| FASB | Financial Accounting Standards Board |

| GAAP | Accounting principles generally accepted in the United States of America |

Gal | Gallon |

Gal/d | Gallons per day |

| LIBOR | London Interbank Offered Rate |

| mbpd | Thousand barrels per day |

| Merger | MPLX acquisition by merger of Andeavor Logistics LP (“ANDX”) on July 30, 2019 |

| MMBtu | One million British thermal units, an energy measurement |

| MMcf/d | One million cubic feet of natural gas per day |

| NGL | Natural gas liquids, such as ethane, propane, butanes and natural gasoline |

| NYSE | New York Stock Exchange |

| Predecessor | Collectively:

- The related assets, liabilities and results of operations of Hardin Street Marine LLC (“HSM”) prior to the date of the acquisition, March 31, 2016, effective January 1, 2015

- The related assets, liabilities and results of operations of Hardin Street Transportation LLC (“HST”), Woodhaven Cavern LLC (“WHC”) and MPLX Terminals LLC (“MPLXT”) prior to the date of the acquisition, March 1, 2017, effective January 1, 2015 for HST and WHC and April 1, 2016 for MPLXT

- The related assets, liabilities and results of operations of Andeavor Logistics LP (“ANDX”) prior to the date of the acquisition, July 30, 2019, effective October 1, 2018

|

| Realized derivative gain/loss | The gain or loss recognized when a derivative matures or is settled |

| SEC | United States Securities and Exchange Commission |

| SMR | Steam methane reformer, operated by a third party and located at the Javelina gas processing and fractionation complex in Corpus Christi, Texas |

| Unrealized derivative gain/loss | The gain or loss recognized on a derivative due to changes in fair value prior to the instrument maturing or settling |

| VIE | Variable interest entity |

Part I—Financial Information

Item 1. Financial Statements

MPLX LP

Consolidated Statements of Income (Unaudited) | | | | Three Months Ended

September 30, | | Nine Months Ended

September 30, | Three Months Ended

March 31, |

| (In millions, except per unit data) | 2019 | | 2018 | | 2019 | | 2018 | 2020 | | 2019(1) |

| Revenues and other income: | | | | | | | | | | |

| Service revenue | $ | 632 |

| | $ | 456 |

| | $ | 1,865 |

| | $ | 1,248 |

| $ | 612 |

| | $ | 614 |

|

| Service revenue - related parties | 899 |

| | 568 |

| | 2,549 |

| | 1,588 |

| 928 |

| | 803 |

|

| Service revenue - product related | 26 |

| | 59 |

| | 86 |

| | 154 |

| 39 |

| | 34 |

|

| Rental income | 99 |

| | 89 |

| | 291 |

| | 252 |

| 96 |

| | 99 |

|

| Rental income - related parties | 293 |

| | 190 |

| | 904 |

| | 525 |

| 234 |

| | 325 |

|

| Product sales | 171 |

| | 239 |

| | 576 |

| | 652 |

| 169 |

| | 216 |

|

| Product sales - related parties | 32 |

| | 18 |

| | 109 |

| | 35 |

| 33 |

| | 41 |

|

| Income from equity method investments | 95 |

| | 64 |

| | 255 |

| | 175 |

| |

Income/(loss) from equity method investments(2) | | (1,184 | ) | | 77 |

|

| Other income | 2 |

| | 3 |

| | 6 |

| | 8 |

| 1 |

| | — |

|

| Other income - related parties | 31 |

| | 26 |

| | 84 |

| | 73 |

| 64 |

| | 26 |

|

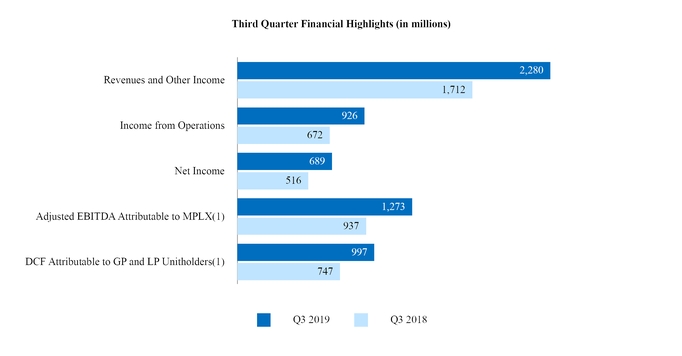

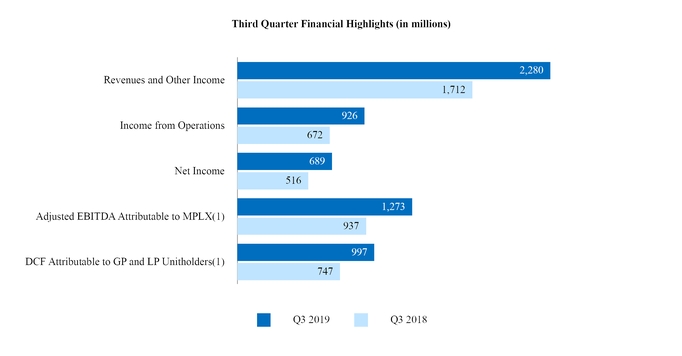

| Total revenues and other income | 2,280 |

| | 1,712 |

| | 6,725 |

| | 4,710 |

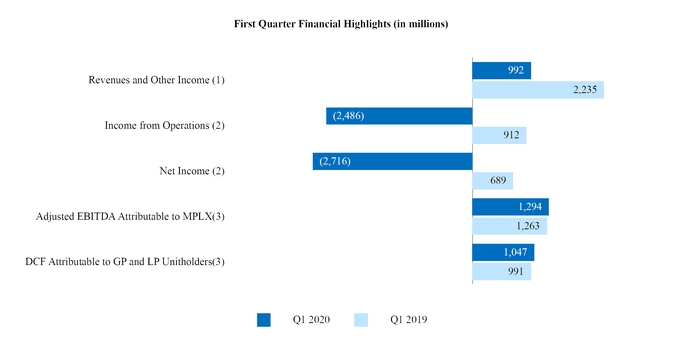

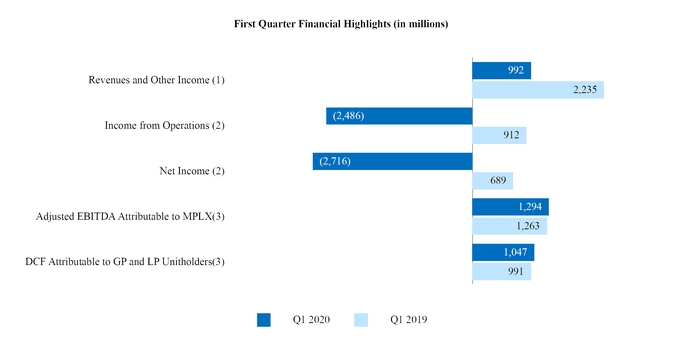

| 992 |

| | 2,235 |

|

| Costs and expenses: | | | | | | | | | | |

| Cost of revenues (excludes items below) | 407 |

| | 241 |

| | 1,099 |

| | 680 |

| 368 |

| | 339 |

|

| Purchased product costs | 129 |

| | 241 |

| | 489 |

| | 632 |

| 135 |

| | 194 |

|

| Rental cost of sales | 37 |

| | 32 |

| | 103 |

| | 94 |

| 35 |

| | 37 |

|

| Rental cost of sales - related parties | 45 |

| | 1 |

| | 124 |

| | 2 |

| 46 |

| | 43 |

|

| Purchases - related parties | 303 |

| | 228 |

| | 894 |

| | 628 |

| 276 |

| | 278 |

|

| Depreciation and amortization | 302 |

| | 201 |

| | 916 |

| | 565 |

| 325 |

| | 301 |

|

| Impairment expense | | 2,165 |

| | — |

|

| General and administrative expenses | 102 |

| | 76 |

| | 293 |

| | 217 |

| 97 |

| | 101 |

|

| Other taxes | 29 |

| | 20 |

| | 84 |

| | 55 |

| 31 |

| | 30 |

|

| Total costs and expenses | 1,354 |

| | 1,040 |

| | 4,002 |

| | 2,873 |

| 3,478 |

| | 1,323 |

|

| Income from operations | 926 |

| | 672 |

| | 2,723 |

| | 1,837 |

| |

| Income/(loss) from operations | | (2,486 | ) | | 912 |

|

| Related party interest and other financial costs | 5 |

| | 2 |

| | 8 |

| | 4 |

| 3 |

| | 1 |

|

| Interest expense (net of amounts capitalized of $13 million, $9 million, $36 million and $27 million, respectively) | 212 |

| | 134 |

| | 640 |

| | 381 |

| |

| Interest expense (net of amounts capitalized of $13 million and $11 million, respectively) | | 211 |

| | 214 |

|

| Other financial costs | 16 |

| | 17 |

| | 38 |

| | 49 |

| 16 |

| | 9 |

|

| Income before income taxes | 693 |

| | 519 |

| | 2,037 |

| | 1,403 |

| |

| Provision for income taxes | 4 |

| | 3 |

| | 2 |

| | 8 |

| |

| Net income | 689 |

| | 516 |

| | 2,035 |

| | 1,395 |

| |

| Income/(loss) before income taxes | | (2,716 | ) | | 688 |

|

| (Benefit)/provision for income taxes | | — |

| | (1 | ) |

| Net income/(loss) | | (2,716 | ) | | 689 |

|

| Less: Net income attributable to noncontrolling interests | 8 |

| | 6 |

| | 20 |

| | 11 |

| 8 |

| | 6 |

|

| Less: Net income attributable to Predecessor | 52 |

| | — |

| | 401 |

| | — |

| — |

| | 180 |

|

| Net income attributable to MPLX LP | 629 |

| | 510 |

| | 1,614 |

| | 1,384 |

| |

| Net income/(loss) attributable to MPLX LP | | (2,724 | ) | | 503 |

|

| Less: Series A preferred unit distributions | 20 |

| | 19 |

| | 61 |

| | 55 |

| 20 |

| | 20 |

|

| Less: Series B preferred unit distributions | 7 |

| | — |

| | 7 |

| | — |

| 11 |

| | — |

|

| Limited partners’ interest in net income attributable to MPLX LP | $ | 602 |

| | $ | 491 |

| | $ | 1,546 |

| | $ | 1,329 |

| |

| Limited partners’ interest in net income/(loss) attributable to MPLX LP | | $ | (2,755 | ) | | $ | 483 |

|

| Per Unit Data (See Note 6) | | | | | | | | | | |

| Net income attributable to MPLX LP per limited partner unit: | | | | | | | | |

| Net income/(loss) attributable to MPLX LP per limited partner unit: | | | | |

| Common - basic | $ | 0.61 |

| | $ | 0.62 |

| | $ | 1.78 |

| | $ | 1.77 |

| $ | (2.60 | ) | | $ | 0.61 |

|

| Common - diluted | $ | 0.61 |

| | $ | 0.62 |

| | $ | 1.78 |

| | $ | 1.77 |

| $ | (2.60 | ) | | $ | 0.61 |

|

| Weighted average limited partner units outstanding: | | | | | | | | | | |

| Common - basic | 974 |

| | 794 |

| | 855 |

| | 750 |

| 1,058 |

| | 794 |

|

| Common - diluted | 975 |

| | 794 |

| | 855 |

| | 750 |

| 1,058 |

| | 795 |

|

| |

| (1) | Financial information for the first quarter of 2019 has been retrospectively adjusted for the acquisition of ANDX. See Notes 1 and 3. |

| |

| (2) | The 2020 period includes $1,264 million of impairment expense. See Note 4. |

The accompanying notes are an integral part of these consolidated financial statements.

MPLX LP

Consolidated Statements of Comprehensive Income (Unaudited)

| | | | Three Months Ended

September 30, | | Nine Months Ended

September 30, | Three Months Ended

March 31, |

| (In millions) | 2019 | | 2018 | | 2019 | | 2018 | 2020 | | 2019(1) |

| Net income | $ | 689 |

| | $ | 516 |

| | $ | 2,035 |

| | $ | 1,395 |

| |

| Net income/(loss) | | $ | (2,716 | ) | | $ | 689 |

|

| Other comprehensive income/(loss), net of tax: | | | | | | | | | | |

| Remeasurements of pension and other postretirement benefits related to equity method investments, net of tax | — |

| | — |

| | 1 |

| | (2 | ) | (1 | ) | | 1 |

|

| Comprehensive income | 689 |

| | 516 |

| | 2,036 |

| | 1,393 |

| |

| Comprehensive income/(loss) | | (2,717 | ) | | 690 |

|

| Less comprehensive income attributable to: | | | | | | | | | | |

| Noncontrolling interests | 8 |

| | 6 |

| | 20 |

| | 11 |

| 8 |

| | 6 |

|

| Income attributable to Predecessor | 52 |

| | — |

| | 401 |

| | — |

| — |

| | 180 |

|

| Comprehensive income attributable to MPLX LP | $ | 629 |

| | $ | 510 |

| | $ | 1,615 |

| | $ | 1,382 |

| |

| Comprehensive income/(loss) attributable to MPLX LP | | $ | (2,725 | ) | | $ | 504 |

|

| |

| (1) | Financial information for the first quarter of 2019 has been retrospectively adjusted for the acquisition of ANDX. See Notes 1 and 3. |

The accompanying notes are an integral part of these consolidated financial statements.

MPLX LP

Consolidated Balance Sheets (Unaudited)

| | | (In millions) | September 30, 2019 | | December 31, 2018(1) | March 31, 2020 | | December 31, 2019 |

| Assets | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | $ | 41 |

| | $ | 77 |

| $ | 57 |

| | $ | 15 |

|

| Receivables, net | 570 |

| | 611 |

| 522 |

| | 593 |

|

| Current assets - related parties | 660 |

| | 556 |

| 600 |

| | 656 |

|

| Inventories | 104 |

| | 98 |

| 105 |

| | 110 |

|

| Other current assets | 65 |

| | 98 |

| 45 |

| | 110 |

|

| Total current assets | 1,440 |

| | 1,440 |

| 1,329 |

| | 1,484 |

|

| Equity method investments | 5,182 |

| | 4,901 |

| 3,992 |

| | 5,275 |

|

| Property, plant and equipment, net | 21,892 |

| | 21,525 |

| 21,829 |

| | 22,145 |

|

| Intangibles, net | 1,309 |

| | 1,359 |

| 1,055 |

| | 1,270 |

|

| Goodwill | 10,735 |

| | 10,016 |

| 7,722 |

| | 9,536 |

|

| Right of use assets | 366 |

| | — |

| |

| Right of use assets, net | | 352 |

| | 365 |

|

| Noncurrent assets - related parties | 302 |

| | 24 |

| 677 |

| | 303 |

|

| Other noncurrent assets | 55 |

| | 60 |

| 50 |

| | 52 |

|

| Total assets | 41,281 |

| | 39,325 |

| 37,006 |

| | 40,430 |

|

| Liabilities | | | | | | |

| Current liabilities: | | | | | | |

| Accounts payable | 196 |

| | 266 |

| 138 |

| | 242 |

|

| Accrued liabilities | 185 |

| | 272 |

| 135 |

| | 187 |

|

| Current liabilities - related parties | 562 |

| | 502 |

| 297 |

| | 1,008 |

|

| Accrued property, plant and equipment | 346 |

| | 399 |

| 234 |

| | 283 |

|

| Accrued interest payable | 226 |

| | 184 |

| 214 |

| | 210 |

|

| Operating lease liabilities | 61 |

| | — |

| 67 |

| | 66 |

|

| Other current liabilities | 656 |

| | 645 |

| 129 |

| | 136 |

|

| Total current liabilities | 2,232 |

| | 2,268 |

| 1,214 |

| | 2,132 |

|

| Long-term deferred revenue | 189 |

| | 132 |

| 241 |

| | 217 |

|

| Long-term liabilities - related parties | 293 |

| | 46 |

| 290 |

| | 290 |

|

| Long-term debt | 19,190 |

| | 17,922 |

| 20,467 |

| | 19,704 |

|

| Deferred income taxes | 15 |

| | 14 |

| 11 |

| | 12 |

|

| Long-term operating lease liabilities | 309 |

| | — |

| 284 |

| | 302 |

|

| Deferred credits and other liabilities | 193 |

| | 208 |

| 175 |

| | 192 |

|

| Total liabilities | 22,421 |

| | 20,590 |

| 22,682 |

| | 22,849 |

|

| Commitments and contingencies (see Note 20) |

| |

| |

| Commitments and contingencies (see Note 21) | |

| |

|

| Series A preferred units | 968 |

| | 1,004 |

| 968 |

| | 968 |

|

| Equity | | | | | | |

| Common unitholders - public (392 million and 289 million units issued and outstanding) | 11,289 |

| | 8,336 |

| |

| Common unitholder - MPC (666 million and 505 million units issued and outstanding) | 5,767 |

| | (1,612 | ) | |

| Series B preferred units | 601 |

| | — |

| |

| Equity of Predecessor | — |

| | 10,867 |

| |

| Common unitholders - public (393 million and 392 million units issued and outstanding) | | 9,509 |

| | 10,800 |

|

| Common unitholder - MPC (666 million and 666 million units issued and outstanding) | | 3,014 |

| | 4,968 |

|

| Series B preferred units (.6 million and .6 million units issued and outstanding) | | 601 |

| | 611 |

|

| Accumulated other comprehensive loss | (15 | ) | | (16 | ) | (16 | ) | | (15 | ) |

| Total MPLX LP partners’ capital | 17,642 |

| | 17,575 |

| 13,108 |

| | 16,364 |

|

| Noncontrolling interests | 250 |

| | 156 |

| 248 |

| | 249 |

|

| Total equity | 17,892 |

| | 17,731 |

| 13,356 |

| | 16,613 |

|

| Total liabilities, preferred units and equity | $ | 41,281 |

| | $ | 39,325 |

| $ | 37,006 |

| | $ | 40,430 |

|

(1) Financial information has been retrospectively adjusted for the acquisition of ANDX. See Notes 1 and 3.

The accompanying notes are an integral part of these consolidated financial statements.

MPLX LP

Consolidated Statements of Cash Flows (Unaudited) | | | | Nine Months Ended

September 30, | Three Months Ended

March 31, |

| (In millions) | 2019 | | 2018 | 2020 | | 2019(1) |

| Increase/(decrease) in cash, cash equivalents and restricted cash | | | | | | |

| Operating activities: | | | | | | |

| Net income | $ | 2,035 |

| | $ | 1,395 |

| |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Net income/(loss) | | $ | (2,716 | ) | | $ | 689 |

|

| Adjustments to reconcile net income/(loss) to net cash provided by operating activities: | | | | |

| Amortization of deferred financing costs | 29 |

| | 45 |

| 14 |

| | 7 |

|

| Depreciation and amortization | 916 |

| | 565 |

| 325 |

| | 301 |

|

| Impairment expense | | 2,165 |

| | — |

|

| Deferred income taxes | 1 |

| | 7 |

| — |

| | (2 | ) |

| Asset retirement expenditures | (1 | ) | | (7 | ) | |

| (Gain)/loss on disposal of assets | (3 | ) | | 1 |

| — |

| | 1 |

|

| Income from equity method investments | (255 | ) | | (175 | ) | |

Loss/(income) from equity method investments(2) | | 1,184 |

| | (77 | ) |

| Distributions from unconsolidated affiliates | 379 |

| | 279 |

| 119 |

| | 115 |

|

| Changes in: | | | | | | |

| Current receivables | 38 |

| | (157 | ) | 71 |

| | 6 |

|

| Inventories | (3 | ) | | (10 | ) | 3 |

| | 4 |

|

| Fair value of derivatives | (4 | ) | | 16 |

| (15 | ) | | 7 |

|

| Current accounts payable and accrued liabilities | (81 | ) | | 151 |

| (142 | ) | | (69 | ) |

| Current assets/current liabilities - related parties | (148 | ) | | (108 | ) | (52 | ) | | (157 | ) |

| Right of use assets/operating lease liabilities | 6 |

| | — |

| (4 | ) | | — |

|

| Deferred revenue | 58 |

| | 30 |

| 27 |

| | 13 |

|

| All other, net | 23 |

| | (5 | ) | 30 |

| | 15 |

|

| Net cash provided by operating activities | 2,990 |

| | 2,027 |

| 1,009 |

| | 853 |

|

| Investing activities: | | | | | | |

| Additions to property, plant and equipment | (1,720 | ) | | (1,383 | ) | (379 | ) | | (575 | ) |

| Acquisitions, net of cash acquired | 6 |

| | (451 | ) | — |

| | 1 |

|

| Disposal of assets | 14 |

| | 5 |

| 39 |

| | 7 |

|

| Investments in unconsolidated affiliates | (494 | ) | | (215 | ) | (91 | ) | | (135 | ) |

| Distributions from unconsolidated affiliates - return of capital | 2 |

| | 16 |

| 69 |

| | 2 |

|

| All other, net | 3 |

| | 1 |

| |

| Net cash used in investing activities | (2,189 | ) | | (2,027 | ) | (362 | ) | | (700 | ) |

| Financing activities: | | | | | | |

| Long-term debt - borrowings | 8,674 |

| | 10,735 |

| 1,325 |

| | 1,404 |

|

| - repayments | (7,423 | ) | | (4,781 | ) | (581 | ) | | (821 | ) |

| Related party debt - borrowings | 7,708 |

| | 2,395 |

| 1,667 |

| | 1,405 |

|

| - repayments | (7,583 | ) | | (2,781 | ) | (2,261 | ) | | (1,405 | ) |

| Debt issuance costs | (20 | ) | | (53 | ) | |

| Distributions to MPC for acquisitions | — |

| | (4,111 | ) | |

| Distributions to noncontrolling interests | (20 | ) | | (10 | ) | (9 | ) | | (6 | ) |

| Distributions to Series A preferred unitholders | (61 | ) | | (52 | ) | (20 | ) | | (20 | ) |

| Distributions to Series B preferred unitholders | (21 | ) | | — |

| (21 | ) | | — |

|

| Distributions to unitholders and general partner | (1,731 | ) | | (1,312 | ) | (717 | ) | | (515 | ) |

Distributions to common and Series B preferred unitholders from Predecessor

| (502 | ) | |

|

| — |

| | (259 | ) |

| Contributions from MPC | 52 |

| | — |

| 14 |

| | 12 |

|

| Contributions from noncontrolling interests | 94 |

| | 8 |

| — |

| | 94 |

|

| All other, net | (12 | ) | | (8 | ) | (2 | ) | | (5 | ) |

| Net cash used in financing activities | (845 | ) | | 30 |

| (605 | ) | | (116 | ) |

| Net (decrease)/increase in cash, cash equivalents and restricted cash | (44 | ) | | 30 |

| 42 |

| | 37 |

|

| Cash, cash equivalents and restricted cash at beginning of period | 85 |

| | 9 |

| 15 |

| | 85 |

|

| Cash, cash equivalents and restricted cash at end of period | $ | 41 |

| | $ | 39 |

| $ | 57 |

| | $ | 122 |

|

| |

| (1) | Financial information for the first quarter of 2019 has been retrospectively adjusted for the acquisition of ANDX. See Notes 1 and 3. |

| |

| (2) | The 2020 period includes $1,264 million of impairment expense. See Note 4. |

The accompanying notes are an integral part of these consolidated financial statements.

MPLX LP

Consolidated Statements of Equity (Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Partnership | | | | | | | | |

| (In millions) | Common

Unit-holders

Public | | Common

Unit-holder

MPC | | General

Partner

MPC | | Accumulated Other Comprehensive Loss | | Non-controlling

Interests | | Equity of Predecessor | | Total |

| Balance at December 31, 2017 | $ | 8,379 |

| | $ | 2,099 |

| | $ | (637 | ) | | $ | (14 | ) | | $ | 146 |

| | $ | — |

| | $ | 9,973 |

|

| Net income (excludes amounts attributable to preferred units) | 180 |

| | 225 |

| | — |

| | — |

| | 2 |

| | — |

| | 407 |

|

| Allocation of MPC's net investment at acquisition | — |

| | 5,172 |

| | (4,126 | ) | | — |

| | — |

| | (1,046 | ) | | — |

|

| Distributions to: | | | | | | | | | | | | | |

| MPC for acquisition | — |

| | (936 | ) | | (3,164 | ) | | — |

| | — |

| | — |

| | (4,100 | ) |

| Unitholders and general partner | (176 | ) | | (171 | ) | | — |

| | — |

| | — |

| | — |

| | (347 | ) |

| Noncontrolling interests | — |

| | — |

| | — |

| | — |

| | (3 | ) | | — |

| | (3 | ) |

| Contributions from: | | | | | | | | | | | | | |

| MPC | — |

| | — |

| | — |

| | — |

| | — |

| | 1,046 |

| | 1,046 |

|

| Noncontrolling interests | — |

| | — |

| | — |

| | — |

| | 1 |

| | — |

| | 1 |

|

| Conversion of GP economic interests | — |

| | (7,926 | ) | | 7,926 |

| | — |

| | — |

| | — |

| | — |

|

| Other | 2 |

| | — |

| | 1 |

| | (2 | ) | | — |

| | — |

| | 1 |

|

| Balance at March 31, 2018 | 8,385 |

| | (1,537 | ) | | — |

| | (16 | ) | | 146 |

| | — |

| | 6,978 |

|

| Net income (excludes amounts attributable to preferred units) | 157 |

| | 276 |

| | — |

| | — |

| | 3 |

| | — |

| | 436 |

|

| Distributions to: | | | | | | | | | | | | | |

| Unitholders and general partner | (179 | ) | | (288 | ) | | — |

| | — |

| | — |

| | — |

| | (467 | ) |

| Noncontrolling interests | — |

| | — |

| | — |

| | — |

| | (3 | ) | | — |

| | (3 | ) |

| Contributions from: | | | | | | | | | | | | | |

| Noncontrolling interests | — |

| | — |

| | — |

| | — |

| | 4 |

| | — |

| | 4 |

|

| Other | 3 |

| | 1 |

| | — |

| | — |

| | — |

| | — |

| | 4 |

|

| Balance at June 30, 2018 | 8,366 |

| | (1,548 | ) | | — |

| | (16 | ) | | 150 |

| | — |

| | 6,952 |

|

| Net income (excludes amounts attributable to preferred units) | 179 |

| | 312 |

| | — |

| | — |

| | 6 |

| | — |

| | 497 |

|

| Distributions to: | | | | | | | | | | | | | |

| Unitholders and general partner | (182 | ) | | (316 | ) | | — |

| | — |

| | — |

| | — |

| | (498 | ) |

| Noncontrolling interests | — |

| | — |

| | — |

| | — |

| | (4 | ) | | — |

| | (4 | ) |

| Contributions from: | | | | | | | | | | | | | |

| Noncontrolling interests | — |

| | — |

| | — |

| | — |

| | 3 |

| | — |

| | 3 |

|

| Other | 4 |

| | (1 | ) | | — |

| | — |

| | — |

| | — |

| | 3 |

|

| Balance at September 30, 2018 | $ | 8,367 |

| | $ | (1,553 | ) | | $ | — |

| | $ | (16 | ) | | $ | 155 |

| | $ | — |

| | $ | 6,953 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Partnership | | | | | | | | |

| (In millions) | Common

Unit-holders

Public | | Common

Unit-holder

MPC | | Series B Preferred Unit-holders | | Accumulated Other Comprehensive Loss | | Non-controlling

Interests | | Equity of Predecessor | | Total(1) |

| Balance at December 31, 2018 | $ | 8,336 |

| | $ | (1,612 | ) | | $ | — |

| | $ | (16 | ) | | $ | 156 |

| | 10,867 |

| | $ | 17,731 |

|

| Net income (excludes amounts attributable to Series A preferred units) | 176 |

| | 307 |

| | — |

| | — |

| | 6 |

| | 180 |

| | 669 |

|

| Distributions to: | | | | | | | | | | | | | |

| Unitholders | (188 | ) | | (327 | ) | | — |

| | — |

| | — |

| | (261 | ) | | (776 | ) |

| Noncontrolling interests | — |

| | — |

| | — |

| | — |

| | (6 | ) | | — |

| | (6 | ) |

| Contributions from: | | | | | | | | | | | | | |

| MPC | — |

| | — |

| | — |

| | — |

| | — |

| | 15 |

| | 15 |

|

| Noncontrolling interests | — |

| | — |

| | — |

| | — |

| | 94 |

| | — |

| | 94 |

|

| Other | 2 |

| | — |

| | — |

| | 1 |

| | — |

| | — |

| | 3 |

|

| Balance at March 31, 2019 | 8,326 |

| | (1,632 | ) | | — |

| | (15 | ) | | 250 |

| | 10,801 |

| | 17,730 |

|

| | | | | | | | | | | | | | |

| Balance at December 31, 2019 | 10,800 |

| | 4,968 |

| | 611 |

| | (15 | ) | | 249 |

| | — |

| | 16,613 |

|

| Net income (excludes amounts attributable to Series A preferred units) | (1,022 | ) | | (1,733 | ) | | 11 |

| | — |

| | 8 |

| | — |

| | (2,736 | ) |

| Distributions to: | | | | | | | | | | | | | |

| Unitholders | (271 | ) | | (446 | ) | | (21 | ) | | — |

| | — |

| | — |

| | (738 | ) |

| Noncontrolling interests | — |

| | — |

| | — |

| | — |

| | (9 | ) | | — |

| | (9 | ) |

| Contributions from: | | | | | | | | | | | | | |

| MPC | — |

| | 225 |

| | — |

| | — |

| | — |

| | — |

| | 225 |

|

| Other | 2 |

| | — |

| | — |

| | (1 | ) | | — |

| | — |

| | 1 |

|

| Balance at March 31, 2020 | $ | 9,509 |

| | $ | 3,014 |

| | $ | 601 |

| | $ | (16 | ) | | $ | 248 |

| | $ | — |

| | $ | 13,356 |

|

The accompanying notes are an integral part of these consolidated financial statements.

MPLX LP

Consolidated Statements of Equity (Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Partnership | | | | | | | | |

| (In millions) | Common

Unit-holders

Public | | Common

Unit-holder

MPC | | Series B Preferred Unit-holders | | Accumulated Other Comprehensive Loss | | Non-controlling

Interests | | Equity of Predecessor | | Total(1) |

| Balance at December 31, 2018 | $ | 8,336 |

| | $ | (1,612 | ) | | $ | — |

| | $ | (16 | ) | | $ | 156 |

| | 10,867 |

| | $ | 17,731 |

|

| Net income (excludes amounts attributable to preferred units) | 176 |

| | 307 |

| | — |

| | — |

| | 6 |

| | 180 |

| | 669 |

|

| Distributions to: | | | | | | | | | | | | | |

| Unitholders | (188 | ) | | (327 | ) | | — |

| | — |

| | — |

| | (261 | ) | | (776 | ) |

| Noncontrolling interests | — |

| | — |

| | — |

| | — |

| | (6 | ) | | — |

| | (6 | ) |

| Contributions from: | | | | | — |

| | | | | | | | |

| MPC | — |

| | — |

| | — |

| | — |

| | — |

| | 15 |

| | 15 |

|

| Noncontrolling interests | — |

| | — |

| | — |

| | — |

| | 94 |

| | — |

| | 94 |

|

| Other | 2 |

| | — |

| | — |

| | 1 |

| | — |

| | — |

| | 3 |

|

| Balance at March 31, 2019 | 8,326 |

| | (1,632 | ) | | — |

| | (15 | ) | | 250 |

| | $ | 10,801 |

| | 17,730 |

|

| Net income (excludes amounts attributable to preferred units) | 168 |

| | 293 |

| | — |

| | — |

| | 6 |

| | 169 |

| | 636 |

|

| Distributions to: | | | | | | | | | | | | | |

| Unitholders | (191 | ) | | (332 | ) | | — |

| | — |

| | — |

| | (241 | ) | | (764 | ) |

| Noncontrolling interests | — |

| | — |

| | — |

| | — |

| | (6 | ) | | — |

| | (6 | ) |

| Contributions from: |

|

| |

|

| | | |

|

| |

|

| |

|

| |

|

|

| MPC | — |

| | — |

| | — |

| | — |

| | — |

| | 13 |

| | 13 |

|

| Other | 2 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 2 |

|

| Balance at June 30, 2019 | 8,305 |

| | (1,671 | ) | | — |

| | (15 | ) | | 250 |

| | $ | 10,742 |

| | 17,611 |

|

| Net income (excludes amounts attributable to Series A preferred units) | 222 |

| | 380 |

| | 7 |

| | — |

| | 8 |

| | 52 |

| | 669 |

|

| Allocation of MPC's net investment at acquisition | 2,983 |

| | 7,199 |

| | 615 |

| | — |

| | — |

| | (10,797 | ) | | — |

|

| Distributions to: | | | | | | | | | | | | | |

| Unitholders | (262 | ) | | (432 | ) | | (21 | ) | | — |

| | — |

| | — |

| | (715 | ) |

| Noncontrolling interests | — |

| | — |

| | — |

| | — |

| | (8 | ) | | — |

| | (8 | ) |

| Contributions from: | | | | | | | | | | | | | |

| MPC | — |

| | 292 |

| | — |

| | — |

| | — |

| | 3 |

| | 295 |

|

| Conversion of Series A preferred units | 36 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 36 |

|

| Other | 5 |

| | (1 | ) | | — |

| | — |

| | — |

| | — |

| | 4 |

|

| Balance at September 30, 2019 | $ | 11,289 |

| | $ | 5,767 |

| | $ | 601 |

| | $ | (15 | ) | | $ | 250 |

| | $ | — |

| | $ | 17,892 |

|

(1) Financial information has been retrospectively adjusted for the acquisition of ANDX for the first and second quarters of 2019. See Notes 1 and 3.

| |

| (1) | Financial information for the first quarter of 2019 has been retrospectively adjusted for the acquisition of ANDX. See Notes 1 and 3. |

The accompanying notes are an integral part of these consolidated financial statements.

Notes to Consolidated Financial Statements (Unaudited)

1. Description of the Business and Basis of Presentation

Description of the Business – MPLX LP is a diversified, large-cap master limited partnership formed by Marathon Petroleum Corporation that owns and operates midstream energy infrastructure and logistics assets, and provides fuels distribution services. References in this report to “MPLX LP,” “MPLX,” “the Partnership,” “we,” “ours,” “us,” or like terms refer to MPLX LP and its subsidiaries. References to “MPC” refer collectively to Marathon Petroleum Corporation as our sponsor and its subsidiaries, other than the Partnership. We are engaged in the transportation, storage and distribution of crude oil, asphalt and refined petroleum products; the gathering, processing and transportation of natural gas; and the gathering, transportation, fractionation, storage and marketing of NGLs. MPLX’s principal executive office is located in Findlay, Ohio.

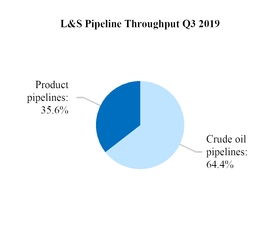

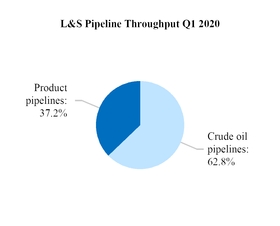

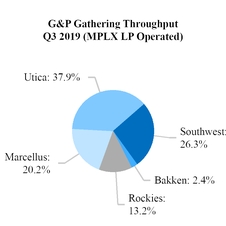

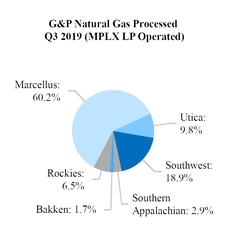

MPLX’s business consists of 2 segments based on the nature of services it offers: Logistics and Storage (“L&S”), which relates primarily to crude oil, asphalt and refined petroleum products; and Gathering and Processing (“G&P”), which relates primarily to natural gas and NGLs. See Note 9 for additional information regarding the operations and results of these segments.

On July 30, 2019, MPLX completed its acquisition by merger (the “Merger”) of Andeavor Logistics LP (“ANDX”). At the effective time of the Merger, each common unit held by ANDX’s public unitholders was converted into the right to receive 1.135 MPLX common units. ANDX common units held by certain affiliates of MPC were converted into the right to receive 1.0328 MPLX common units. See Note 3 for additional information regarding the Merger.

Impairments – The recent outbreak of COVID-19 and its development into a pandemic in March 2020 has resulted in significant economic disruption globally. Actions taken by various governmental authorities, individuals and companies around the world to prevent the spread of COVID-19 through social distancing have restricted travel, many business operations, public gatherings and the overall level of individual movement and in-person interaction across the globe. This has significantly reduced global economic activity and resulted in a decline in the demand for the midstream services we provide. Macroeconomic conditions and global geopolitical events have also resulted in significant price volatility related to those aforementioned products.

The overall deterioration in the economy and the environment in which MPLX and our customers operate, as well as a sustained decrease in unit price, were considered triggering events resulting in impairments of the carrying value of certain assets. During the first quarter of 2020 we recognized impairments related to goodwill, certain equity method investments and certain long-lived assets (including intangibles), within our G&P segment. Many of our producer customers have continued to refine and update production forecasts in response to the current environment, which has impacted their current and expected future demand for our services, including the future utilization of our assets. Additionally, certain of our contracts have commodity price exposure, including NGL prices, which have experienced increased volatility as noted above. The table below provides information related to the impairments recognized during the first quarter of 2020 as well as the corresponding footnote where additional information can be found.

|

| | | | | | |

| (In millions) | | Impairment | | Footnote Reference |

| Goodwill | | $ | 1,814 |

| | 12 |

| Equity method investments | | 1,264 |

| | 4 |

| Intangibles, net | | 177 |

| | 12 |

| Property, plant and equipment, net | | 174 |

| | 11 |

| Total impairments | | $ | 3,429 |

| | |

Basis of Presentation – The accompanying interim consolidated financial statements are unaudited; however, in the opinion of MPLX’s management, these statements reflect all adjustments necessary for a fair statement of the results for the periods reported. All such adjustments are of a normal, recurring nature unless otherwise disclosed. These interim consolidated financial statements, including the notes, have been prepared in accordance with the rules and regulations of the SEC applicable to interim period financial statements and do not include all of the information and disclosures required by GAAP for complete financial statements. Certain amounts in prior years have been reclassified to conform to current year presentation.

These interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Annual Report on Form 10-K for the year ended December 31, 2018.2019. The results of

operations for the three and nine months ended September 30, 2019March 31, 2020 are not necessarily indicative of the results to be expected for the full year.

In relation to the Merger described above and in Note 3, ANDX’s assets, liabilities and results of operations prior to the Merger are collectively included in what we refer to as the “Predecessor” from October 1, 2018, which was the date that MPC acquired Andeavor. MPLX’s acquisition of ANDX is considered a transfer between entities under common control due to MPC’s relationship with ANDX prior to the Merger. As an entity under common control with MPC, MPLX recorded the assets acquired and liabilities assumed on its consolidated balance sheets at MPC’s historical carrying value. Transfers of businesses between entities under common control require prior periods to be retrospectively adjusted for those dates that the entity was under common control. Accordingly, the accompanying financial statements and related notes of MPLX LP have been retrospectively adjusted to include the historical results of ANDX beginning October 1, 2018.

MPLX’s consolidated financial statements include all majority-owned and controlled subsidiaries. For non wholly-ownedwholly owned consolidated subsidiaries, the interests owned by third parties have been recorded as “Noncontrolling interests” on the accompanying Consolidated Balance Sheets. Intercompany investments, accounts and transactions have been eliminated. MPLX’s investments in which MPLX exercises significant influence but does not control and does not have a controlling financial interest are accounted for using the equity method. MPLX’s investments in a VIEVIEs in which MPLX exercises significant influence but does not control and is not the primary beneficiary are also accounted for using the equity method.

In preparing the Consolidated Statements of Equity, net income attributable to MPLX LP is allocated to Series A and Series B preferred unitholders based on a fixed distribution schedule. Distributions, although earned, are not accrued until declared. The allocation of net income attributable to MPLX LP for purposes of calculating net income per limited partner unit is described in Note 6.

2. Accounting Standards

Recently Adopted

ASU 2016-02, Leases2016-13, Credit Losses - Measurement of Credit Losses on Financial Instruments

WeEffective January 1, 2020, we adopted ASU No. 2016-02, Leases (Topic 842), as of January 1, 2019, electing the transition method which permits entities to adopt the provisions of the standard2016-13 using the modified retrospective approach without adjusting comparative periods. We also electedtransition method. This ASU requires entities to consider a broader range of information to estimate expected credit losses, which may result in earlier recognition of losses. The ASU requires the package of practical expedients permitted under the transition guidance within the new standard, which among other things, allowed uscompany to grandfather the historical accounting conclusions until a reassessment event is present. We have also elected the practical expedient to not recognize short-term leases on the balance sheet, the practical expedient related to right of way permits and land easements which allows us to carry forward our accounting treatment for those existing agreements, and the practical expedient to combine lease and non-lease components for the majority of our underlying classes of assets except for our third-party contractor service and equipment agreements and boat and barge equipment agreementsutilize an expected loss methodology in which we are the lessee. We did not elect the practical expedient to combine lease and non-lease components for arrangements in which we are the lessor. In instances where the practical expedient was not elected, lease and non-lease consideration is allocated based on relative standalone selling price.

Right of use (“ROU”) assets represent our right to use an underlying asset in which we obtain substantially allplace of the economic benefitsincurred loss methodology for financial instruments, including trade receivables, and the right to direct the use of the asset during the lease term. Lease liabilities represent our obligation to make lease payments arising from the lease. Operating lease ROU assets and lease liabilities are recognized at the commencement date based on the present value of lease payments over the lease term. We recognize ROU assets and lease liabilities on the balanceoff-balance sheet for leases with a lease term of greater than one year. Payments that are not fixed at the commencement of the lease are considered variable and are excluded from the ROU asset and lease liability calculations. In the measurement of our ROU assets and lease liabilities, the fixed lease payments in the agreement are discounted using a secured incremental borrowing rate for a term similar to the duration of the lease, as our leases do not provide implicit rates. Operating lease expense is recognized on a straight-line basis over the lease term.

credit exposures. Adoption of the new standard resulted in the recording of ROU assets and lease liabilities of approximately $629 million and $629 million, respectively, as of January 1, 2019. This is inclusive of ROU assets and lease liabilities related to ANDX of $124 million and $127 million respectively. The standard did not materiallyhave a material impact on our consolidated statements of income, cash flows or equityfinancial statements.

We are exposed to credit losses, primarily as a result of adoption.the midstream services that we provide. We assess each customer’s ability to pay through our credit review process, which considers various factors such as external credit ratings; a review of financial statements to determine liquidity, leverage, trends and business specific risks; market information; pay history and our business strategy. We monitor our ongoing credit exposure through timely review of customer payment activity. At March 31, 2020, we reported $522 million of accounts receivable, net of allowances of $1 million.

As a lessor under ASC 842, MPLX may be required

We are also exposed to re-classify existing operating leases to sales-type leases upon modification and related reassessmentcredit losses from off-balance sheet exposures, such as guarantees of the leases.joint venture debt. See Note 1921 for furthermore information regarding our ongoing evaluation of the impacts of lease reassessments as modifications occur.on these off-balance sheet exposures.

We also adopted the following standardASU during the first ninethree months of 2019,2020, which did not have a material impact to our financial statements or financial statement disclosures:

|

| | | |

| ASU | | | Effective Date |

2017-122018-13 | Derivatives and HedgingFair Value Measurement (Topic 820): Disclosure Framework - Targeted ImprovementsChanges to Accountingthe Disclosure Requirements for Hedging ActivitiesFair Value Measurement | | January 1, 20192020 |

| | | |

Not Yet Adopted

ASU 2017-04, Intangibles - Goodwill and Other - Simplifying the Test for Goodwill Impairment

In January 2017, the FASB issued an ASU which simplifies the subsequent measurement of goodwill by eliminating Step 2 from the goodwill impairment test. Under the new guidance, the recognition of an impairment charge is calculated based on the amount by which the carrying amount exceeds the reporting unit’s fair value, which could be different from the amount calculated under the current method using the implied fair value of the goodwill; however, the loss recognized should not exceed the total amount of goodwill allocated to that reporting unit. The guidance should be applied on a prospective basis, and is effective for annual or any interim goodwill impairment tests in fiscal years beginning after December 15, 2019. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017.

ASU 2016-13, Credit Losses - Measurement of Credit Losses on Financial Instruments

In June 2016, the FASB issued an ASU related to the accounting for credit losses on certain financial instruments. The guidance requires that for most financial assets, losses be based on an expected loss approach which includes estimates of losses over the life of exposure that considers historical, current and forecasted information. Expanded disclosures related to the methods used

to estimate the losses as well as a specific disaggregation of balances for financial assets are also required. The change is effective for fiscal years beginning after December 15, 2019, and interim periods within those fiscal years, with early adoption permitted for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. We do not expect application of this ASU to have a material impact on our consolidated financial statements.

3. Acquisitions

Acquisition of Andeavor Logistics LP

As previously disclosed, on May 7, 2019, ANDX, Tesoro Logistics GP, LLC, then the general partner of ANDX (“TLGP”), MPLX, MPLX GP LLC, the general partner of MPLX (“MPLX GP”), and MPLX MAX LLC, a wholly-ownedwholly owned subsidiary of MPLX (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) that provided for, among other things, the merger of Merger Sub with and into ANDX. On July 30, 2019, the Merger was completed, and ANDX survived the Merger as a wholly-ownedwholly owned subsidiary of MPLX. At the effective time of the Merger, each common unit held by ANDX’s public unitholders was converted into the right to receive 1.135 MPLX common units. ANDX common units held by certain affiliates of MPC were converted into the right to receive 1.0328 MPLX common units. See Note 7 for information on units issued in connection with the Merger.

Additionally, as a result of the Merger, each ANDX TexNew Mex Unit issued and outstanding immediately prior to the effective time of the Merger was converted into a right for Western Refining Southwest, Inc. (“Southwest, Inc.”), a wholly-ownedwholly owned subsidiary of MPC, as the holder of all such units, to receive a unit representing a substantially equivalent limited partner interest in MPLX (the “MPLX TexNew Mex Units”). By virtue of the conversion, all ANDX TexNew Mex Units were cancelled and ceased to exist as of the effective time of the Merger. The MPLX TexNew Mex Units are a new class of units in MPLX substantially equivalent to the ANDX TexNew Mex Units, including substantially equivalent rights, powers, duties and obligations that the ANDX TexNew Mex Units had immediately prior to the closing of the Merger. As a result of the Merger, the ANDX Special Limited Partner Interest outstanding immediately prior to the effective time of the Merger was converted into a right for Southwest Inc., as the holder of all such interest, to receive a substantially equivalent special limited partner interest in MPLX (the “MPLX Special Limited Partner Interest”). By virtue of the conversion, the ANDX Special Limited Partner Interest was cancelled and ceased to exist as of the effective time of the Merger. For information on ANDX’s preferred units, please see Note 7.

The assets of ANDX consist of a network of owned and operated crude oil, refined product and natural gas pipelines; crude oil and water gathering systems; refining logistics assets; terminals with crude oil and refined products storage capacity; rail facilities; marine terminals including storage; bulk petroleum distribution facilities; a trucking fleet; and natural gas processing and fractionation systems and complexes. The assets are located in the western and inland regions of the United States and complement MPLX’s existing business and assets.

MPC accounted for its October 1, 2018 acquisition of Andeavor (including acquiring control of ANDX), using the acquisition method of accounting, which required Andeavor assets and liabilities to be recorded by MPC at the acquisition date fair value. The Merger was closed on July 30, 2019, and the results of ANDX have been incorporated into the results of MPLX as of October 1, 2018, which is the date that common control was established. As a result of MPC’s relationship with both MPLX and ANDX, the Merger has been treated as a common control transaction, which requires the recasting of MPLX’s historical results and the recognition of assets acquired and liabilities assumed using MPC’s historical carrying value. The fair value of assets acquired and liabilities assumed shown below represents MPC’s historical carrying values as of October 1, 2018.

|

| | | | | | | | | | | |

| (In millions) | As Originally Reported | | Adjustments(1) | | As Adjusted |

| Cash and cash equivalents | $ | 83 |

| | $ | (53 | ) | | $ | 30 |

|

| Receivables, net | 241 |

| | 256 |

| | 497 |

|

| Inventories | 21 |

| | — |

| | 21 |

|

Other current assets(2) | 59 |

| | (7 | ) | | 52 |

|

| Equity method investments | 731 |

| | (89 | ) | | 642 |

|

| Property, plant and equipment, net | 6,709 |

| | (427 | ) | | 6,282 |

|

| Intangibles, net | 960 |

| | 74 |

| | 1,034 |

|

Other noncurrent assets(3) | 31 |

| | (8 | ) | | 23 |

|

| Total assets acquired | 8,835 |

| | (254 | ) | | 8,581 |

|

| Accounts payable | 198 |

| | 265 |

| | 463 |

|

Other current liabilities(4) | 188 |

| | (41 | ) | | 147 |

|

| Long-term debt | 4,916 |

| | — |

| | 4,916 |

|

Deferred credits and other long-term liabilities(5) | 75 |

| | 1 |

| | 76 |

|

| Total liabilities assumed | 5,377 |

| | 225 |

| | 5,602 |

|

| Net assets acquired excluding goodwill | 3,458 |

| | (479 | ) | | 2,979 |

|

| Goodwill | 7,428 |

| | 727 |

| | 8,155 |

|

| Net assets acquired | $ | 10,886 |

| | $ | 248 |

| | $ | 11,134 |

|

(1)Inclusive of activity recorded subsequent to the acquisition of ANDX on July 30, 2019, a portion of which was recorded as a non-cash contribution from MPC.

(2)Includes both related party and third party other current assets.

(3) Includes both related party and third party other noncurrent assets.

(4) Includes accrued liabilities, operating lease liabilities and long-term debt due within one year, as well as related party and third party other current liabilities.

(5) Includes deferred revenue and deferred income taxes, as well as related party and third party other noncurrent liabilities.

Details of the valuation methodology and significant inputs for fair value measurements are included below. The fair value measurements for equity method investments; property, plant and equipment; intangible assets and long-term debt are based on significant inputs that are not observable in the market and, therefore, represent Level 3 measurements.

Goodwill

The purchase consideration allocation resulted in the recognition of $8.2 billion in goodwill, which has been allocated between the L&S segment and the G&P segment at $7.2 billion and $1.0 billion, respectively.

Inventory

The fair value of inventory was recorded at cost as of October 1, 2018, as these items are related to spare parts as well as materials and supplies and approximate fair value.

Equity Method Investments

The fair value of the equity method investments is $642 million, which was determined based on applying income and market approaches. The income approach relied on the discounted cash flow method and the market approach relied on a market multiple approach considering historical and projected financial results. Discount rates for the discounted cash flow models were based on capital structures for similar market participants and included various risk premiums that account for risks associated with the specific investments.

Property, Plant and Equipment

The fair value of property, plant and equipment is $6.3 billion, which is based primarily on the cost approach. Key assumptions in the cost approach include determining the replacement cost by evaluating recent purchases of similar assets or published data, and adjusting replacement cost for economic and functional obsolescence, location, normal useful lives, and capacity (if applicable).

Acquired Intangible Assets

The fair value of the acquired identifiable intangible assets is $1.0 billion, which represents the value of various customer contracts and relationships and other intangible assets. The fair value of customer contracts and relationships is $950 million, which was valued by applying the multi-period excess earnings method, which is an income approach. Key assumptions in the income approach include the underlying contract cash flow estimates, remaining contract term, probability of renewal, growth rates and discount rates. The intangible assets are all finite lived and will be amortized over 2 to 10 years.

Debt

The fair value of the ANDX unsecured notes was measured using a market approach, based upon the average of quotes for the acquired debt from major financial institutions and a third-party valuation service. Additionally, approximately $1.1 billion of borrowings under revolving credit agreements approximate fair value. The ANDX revolving credit facilities with total capacity of $2.1 billion were terminated upon closing of the Merger and were repaid with borrowings under the MPLX revolving credit facility.

Acquisition Costs

We recognized $14$1 million in acquisition costs during the first quarter of 2019 related to the Merger, which are reflected in general and administrative expenses.

ANDX Revenue and Net Income

For the three and nine months ended September 30,March 31, 2019, we recognized $612 million and $1,789$589 million of revenues and other income respectively, related to ANDX. For the three and nine months ended September 30, 2019, we recognized $191 million and $539$180 million of net income respectively, related to ANDX.

Pro Forma Financial Information

The following unaudited pro forma information combines the historical operations of MPLX and ANDX, giving effect to the Merger as if it had been consummated on January 1, 2018, the beginning of the earliest period presented.

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (In millions) | 2019 | | 2018 | | 2019 | | 2018 |

| Total revenues and other income | $ | 2,280 |

| | $ | 2,312 |

| | $ | 6,725 |

| | $ | 6,371 |

|

| Net income attributable to MPLX LP | $ | 681 |

| | $ | 679 |

| | $ | 2,015 |

| | $ | 1,840 |

|

The pro forma information includes adjustments to align accounting policies, which include adjustments for capitalization of assets and treatment of turnaround and planned major maintenance costs. The pro forma information also includes adjustments related to: eliminating transactions between MPLX and ANDX which previously would have been recorded as transactions between related parties; basis differences on equity method investments as a result of recognition of MPC’s investments in ANDX’s equity method investments; depreciation and amortization expense to reflect the increased fair value of property, plant and equipment and increased amortization expense related to identifiable intangible assets; as well as adjustments to interest expense for the amortization of fair value adjustments over the remaining term of ANDX’s outstanding debt, reversal of ANDX’s historical amortization of debt issuance costs and debt discounts and to adjust for the difference in the weighted average interest rate between MPLX’s revolving credit facility and the ANDX revolving credit facilities.

The following table presents MPLX’s previously reported Consolidated Balance Sheet Data as of December 31, 2018 retrospectively adjusted for the Merger:

|

| | | | | | | | | | | |

| | December 31, 2018 |

| (In millions) | MPLX LP (Previously Reported) | | Predecessor | | MPLX LP (Currently Reported) |

| Assets | | | | | |

| Current assets: | | | | | |

| Cash and cash equivalents | $ | 68 |

| | $ | 9 |

| | $ | 77 |

|

| Receivables, net | 417 |

| | 194 |

| | 611 |

|

| Current assets - related parties | 290 |

| | 266 |

| | 556 |

|

| Inventories | 77 |

| | 21 |

| | 98 |

|

| Other current assets | 45 |

| | 53 |

| | 98 |

|

| Total current assets | 897 |

| | 543 |

| | 1,440 |

|

| Equity method investments | 4,174 |

| | 727 |

| | 4,901 |

|

| Property, plant and equipment, net | 14,639 |

| | 6,886 |

| | 21,525 |

|

| Intangibles, net | 424 |

| | 935 |

| | 1,359 |

|

| Goodwill | 2,586 |

| | 7,430 |

| | 10,016 |

|

| Noncurrent assets - related parties | 24 |

| | — |

| | 24 |

|

| Other noncurrent assets | 35 |

| | 25 |

| | 60 |

|

| Total assets | 22,779 |

| | 16,546 |

| | 39,325 |

|

| Liabilities | | | | | |

| Current liabilities: | | | | | |

| Accounts payable | 162 |

| | 104 |

| | 266 |

|

| Accrued liabilities | 250 |

| | 22 |

| | 272 |

|

| Current liabilities - related parties | 254 |

| | 248 |

| | 502 |

|

| Accrued property, plant and equipment | 294 |

| | 105 |

| | 399 |

|

| Accrued interest payable | 143 |

| | 41 |

| | 184 |

|

| Other current liabilities | 83 |

| | 562 |

| | 645 |

|

| Total current liabilities | 1,186 |

| | 1,082 |

| | 2,268 |

|

| Long-term deferred revenue | 80 |

| | 52 |

| | 132 |

|

| Long-term liabilities - related parties | 43 |

| | 3 |

| | 46 |

|

| Long-term debt | 13,392 |

| | 4,530 |

| | 17,922 |

|

| Deferred income taxes | 13 |

| | 1 |

| | 14 |

|

| Deferred credits and other liabilities | 197 |

| | 11 |

| | 208 |

|

| Total liabilities | 14,911 |

| | 5,679 |

| | 20,590 |

|

| Commitments and contingencies (see Note 20) | | | | | |

| Series A preferred units | 1,004 |

| | — |

| | 1,004 |

|

| Equity | | | | | |

| Common unitholders - public | 8,336 |

| | — |

| | 8,336 |

|

| Common unitholder - MPC | (1,612 | ) | | — |

| | (1,612 | ) |

| Equity of Predecessor | — |

| | 10,867 |

| | 10,867 |

|

| Accumulated other comprehensive loss | (16 | ) | | — |

| | (16 | ) |

| Total MPLX LP partners’ capital | 6,708 |

| | 10,867 |

| | 17,575 |

|

| Noncontrolling interests | 156 |

| | — |

| | 156 |

|

| Total equity | 6,864 |

| | 10,867 |

| | 17,731 |

|

| Total liabilities, preferred units and equity | $ | 22,779 |

| | $ | 16,546 |

| | $ | 39,325 |

|

Mt. Airy Terminal

On September 26, 2018, MPLX acquired an eastern U.S. Gulf Coast export terminal (the “Mt. Airy Terminal”) from Pin Oak Holdings, LLC for total consideration of $451 million. At the time of the acquisition, the terminal included tanks with 4 million barrels of third-party leased storage capacity and a dock with 120 mbpd of capacity. The Mt. Airy Terminal is located on the Mississippi River between New Orleans and Baton Rouge, is in close proximity to several Gulf Coast refineries including MPC’s Garyville Refinery and is near numerous rail lines and pipelines. The Mt. Airy Terminal is accounted for within the L&S segment. In the first quarter of 2019, an adjustment to the initial purchase price was made for approximately $5 million related to the final settlement of the acquisition, which was paid in the first six months of 2019 as shown on the statement of

cash flow. This reduced the total purchase price to $446 million and resulted in $336 million of property, plant and equipment, $121 million of goodwill and the remainder being attributable to net liabilities assumed.

Goodwill represents the significant growth potential of the terminal due to the multiple pipelines and rail lines which cross the property, the terminal’s position as an aggregation point for liquids growth in the region for both ocean-going vessels and inland barges, the proximity of the terminal to MPC’s Garyville refinery and other refineries in the region as well as the opportunity to construct an additional dock at the site.

Refining Logistics and Fuels Distribution Acquisition

On February 1, 2018, MPC and MPLX closed on an agreement for the dropdown of refining logistics assets and fuels distribution services to MPLX. MPC contributed these assets and services in exchange for $4.1 billion in cash and a fixed number of MPLX common units and general partner units of 111,611,111 and 2,277,778, respectively. The fair value of the common and general partner units issued as of the acquisition date was $4.3 billion based on the closing common unit price as of February 1, 2018, as recorded on the Consolidated Statements of Equity, for a total purchase price of $8.4 billion. The equity issued consisted of: (i) 85,610,278 common units to MPLX GP, (ii) 18,176,666 common units to MPLX Logistics Holdings LLC and (iii) 7,824,167 common units to MPLX Holdings Inc. MPLX also issued 2,277,778 general partner units to MPLX GP in order to maintain its 2 percent general partner interest (“GP Interest”) in MPLX. MPC agreed to waive approximately one-third of the first quarter 2018 distributions on the common units issued in connection with this transaction. As a result of this waiver, MPC did not receive $23.7 million of the distributions that would have otherwise accrued on such common units with respect to the first quarter of 2018. Immediately following this transaction, the GP Interest was converted into a non-economic general partner interest.

MPLX recorded this transaction on a historical basis as required for transactions between entities under common control. No effect was given to the prior periods as these entities were not considered businesses prior to the February 1, 2018 dropdown. In connection with the dropdown, approximately $830 million of net property, plant and equipment was recorded in addition to $85 million and $130 million of goodwill allocated to MPLX Refining Logistics LLC (“Refining Logistics”) and MPLX Fuels Distribution LLC (“Fuels Distribution”), respectively. Both the refining logistics assets and the fuels distribution services are accounted for within the L&S segment.

As of the transaction date, the Refining Logistics assets included 619 tanks with approximately 56 million barrels of storage capacity (crude, finished products and intermediates), 32 rail and truck racks, 18 docks, and gasoline blenders. These assets generate revenue through storage services agreements with MPC. Refining Logistics provides certain services to MPC related to the receipt, storage, throughput, custody and delivery of petroleum products in and through certain storage and logistical facilities and assets associated with MPC’s refineries.

Fuels Distribution, which is a wholly-owned subsidiary of MPLXT, generates revenue through a fuels distribution services agreement with MPC. Fuels Distribution is structured to provide a broad range of scheduling and marketing services as MPC’s agent.

4. Investments and Noncontrolling Interests

The following table presents MPLX’s equity method investments at the dates indicated:

| | | | Ownership as of | | Carrying value at | Ownership as of | | Carrying value at |

| | September 30, | | September 30, | | December 31, | March 31, | | March 31, | | December 31, |

| (In millions, except ownership percentages) | 2019 | | 2019 | | 2018 | 2020 | | 2020 | | 2019 |

| L&S | | | | | | | | |

| MarEn Bakken Company LLC | 25% | | $ | 483 |

| | $ | 498 |

| 25% | | $ | 479 |

| | $ | 481 |

|

| Illinois Extension Pipeline Company, L.L.C. | 35% | | 275 |

| | 275 |

| 35% | | 271 |

| | 265 |

|

| LOOP LLC | 41% | | 239 |

| | 226 |

| 41% | | 239 |

| | 238 |

|

Andeavor Logistics Rio Pipeline LLC(1) | 67% | | 201 |

| | 181 |

| 67% | | 200 |

| | 202 |

|

Minnesota Pipe Line Company, LLC(1) | 17% | | 192 |

| | 197 |

| 17% | | 190 |

| | 190 |

|

Whistler Pipeline LLC(1) | | 38% | | 163 |

| | 134 |

|

W2W Holdings LLC(1)(2) | | 50% | | 76 |

| | — |

|

Wink to Webster Pipeline LLC(1)(2) | | 15% | | — |

| | 126 |

|

| Explorer Pipeline Company | 25% | | 83 |

| | 90 |

| 25% | | 81 |

| | 83 |

|

Other(1) | | 199 |

| | 51 |

| | 55 |

| | 55 |

|

| Total L&S | | 1,672 |

| | 1,518 |

| | 1,754 |

| | 1,774 |

|

| G&P | | | | | | | | |

| MarkWest Utica EMG, L.L.C. | 56% | | 2,017 |

| | 2,039 |

| |

| Sherwood Midstream LLC | 50% | | 502 |

| | 366 |

| |

| MarkWest EMG Jefferson Dry Gas Gathering Company, L.L.C. | 67% | | 291 |

| | 236 |

| |

MarkWest Utica EMG, L.L.C.(1) | | 57% | | 712 |

| | 1,984 |

|

Sherwood Midstream LLC(1) | | 50% | | 546 |

| | 537 |

|

MarkWest EMG Jefferson Dry Gas Gathering Company, L.L.C.(1) | | 67% | | 302 |

| | 302 |

|

Rendezvous Gas Services, L.L.C.(1) | 78% | | 174 |

| | 248 |

| 78% | | 167 |

| | 170 |

|

| Sherwood Midstream Holdings LLC | 54% | | 159 |

| | 157 |

| |

Sherwood Midstream Holdings LLC(1) | | 52% | | 155 |

| | 157 |

|

| Centrahoma Processing LLC | 40% | | 155 |

| | 160 |

| 40% | | 150 |

| | 153 |

|

Other(1) | | 212 |

| | 177 |

| | 206 |

| | 198 |

|

| Total G&P | | 3,510 |

| | 3,383 |

| | 2,238 |

| | 3,501 |

|

| Total | | $ | 5,182 |

| | $ | 4,901 |

| | $ | 3,992 |

| | $ | 5,275 |

|

| |

| (1) | These investments as well as certainInvestments deemed to be VIE’s. Some investments included within “Other” for both L&S and G&P are investments acquired as part ofhave also been deemed to be VIE’s. |

| |

| (2) | During the Merger. The September 30, 2019 balance reflects all purchase accounting adjustments identified by MPC as part of its acquisition of Andeavor.three months ended March 31, 2020, we contributed our ownership in Wink to Webster Pipeline LLC to W2W Holdings LLC. |

As a result of the Merger, MPLX LP acquired an ownership interest in Rendezvous Gas Services, L.L.C. (“RGS”), Minnesota Pipe Line Company, LLC (“MNPL”) and Andeavor Logistics Rio Pipeline LLC (“ALRP”), among others. RGS and ALRPFor those entities that have been deemed to be VIEs, however,VIE’s, neither MPLX nor any of its subsidiaries have been deemed to be the primary beneficiary due to voting rights on significant matters. For all of the investments acquired through the Merger,While we have the ability to exercise influence through participation in the management committees which make all significant decisions. However,decisions, since we have equal or proportionate influence over each committee as a joint interest partner and all significant decisions require the consent of the other investors without regard to economic interest, we have determined that these entities should not be consolidated and apply the equity method of accounting with respect to our investments in each entity.

In addition to the investments acquired through the Merger, MarkWest Utica EMG, L.L.C. (“MarkWest Utica EMG”), Sherwood Midstream LLC (“Sherwood Midstream”), MarkWest EMG Jefferson Dry Gas Gathering Company, L.L.C. (“Jefferson Dry Gas”) and Sherwood Midstream Holdings LLC (“Sherwood Midstream Holdings”) are also deemed to be VIEs. However, consistent with the investments above, neither MPLX nor any of its subsidiaries are deemed to be the primary beneficiary due to voting rights on significant matters. Sherwood Midstream has been deemed the primary beneficiary of Sherwood Midstream Holdings due to its controlling financial interest through its authority to manage the joint venture. As a result, Sherwood Midstream consolidates Sherwood Midstream Holdings. Therefore, MPLX also reports its portion of Sherwood Midstream Holdings’ net assets as a component of its investment in Sherwood Midstream. As of September 30, 2019,March 31, 2020, MPLX has a 22.924.1 percent indirect ownership interest in Sherwood Midstream Holdings through Sherwood Midstream.

MPLX’s maximum exposure to loss as a result of its involvement with equity method investments includes its equity investment, any additional capital contribution commitments and any operating expenses incurred by the subsidiary operator in excess of its compensation received for the performance of the operating services. MPLX did not provide any financial support to equity method investments that it was not contractually obligated to provide during the ninethree months ended September 30, 2019.March 31, 2020.

During the first quarter of 2020, we assessed certain of our equity method investments for impairment as a result of a number of first quarter events and circumstances as discussed in Note 1. During the first quarter of 2020, we recorded an other than temporary impairment for three joint ventures in which we have an interest. Impairment of these investments was $1,264 million, of which $1,251 million was related to MarkWest Utica EMG, L.L.C. and its investment in Ohio Gathering Company, L.L.C. The fair value of the investments was determined based upon applying the discounted cash flow method, which is an income approach. The discounted cash flow fair value estimate is based on known or knowable information at the interim measurement date. The significant assumptions that were used to develop the estimate of the fair value under the discounted cash flow method include management’s best estimates of the expected future cash flows, including prices and volumes, the weighted average cost of capital and the long-term growth rate. Fair value determinations require considerable judgment and are sensitive to changes in underlying assumptions and factors. As such, the fair value of these equity method investments represents a Level 3 measurement. As a result, there can be no assurance that the estimates and assumptions made for purposes of the impairment test will prove to be an accurate prediction of the future. The impairment was recorded through “Income from equity method investments.” The impairments were largely due to a reduction in forecasted volumes gathered and processed by the systems operated by the joint ventures.

Summarized financial information for MPLX’s equity method investments for the ninethree months ended September 30,March 31, 2020 and 2019 and 2018 is as follows:

|

| | | | | | | | | | | |

| | Nine Months Ended September 30, 2019(1) |

| (In millions) | VIEs | | Non-VIEs | | Total |

| Revenues and other income | $ | 479 |

| | $ | 1,116 |

| | $ | 1,595 |

|

| Costs and expenses | 251 |

| | 434 |

| | 685 |

|

| Income from operations | 228 |

| | 682 |

| | 910 |

|

| Net income | 192 |

| | 605 |

| | 797 |

|

Income from equity method investments(2) | $ | 89 |

| | $ | 166 |

| | $ | 255 |

|

| | | | Nine Months Ended September 30, 2018(1) | Three Months Ended March 31, 2020 |

| (In millions) | VIEs | | Non-VIEs | | Total | VIEs | | Non-VIEs | | Total |

| Revenues and other income | $ | 340 |

| | $ | 967 |

| | $ | 1,307 |

| $ | (217 | ) | | $ | 337 |

| | $ | 120 |

|

| Costs and expenses | 202 |

| | 495 |

| | 697 |

| 104 |

| | 132 |

| | 236 |

|

| Income from operations | 138 |

| | 472 |

| | 610 |

| (321 | ) | | 205 |

| | (116 | ) |

| Net income | 135 |

| | 417 |

| | 552 |

| (337 | ) | | 186 |

| | (151 | ) |

Income from equity method investments(2) | $ | 44 |

| | $ | 131 |

| | $ | 175 |

| |

(Loss)/income from equity method investments(1) | | $ | (1,222 | ) | | $ | 38 |

| | $ | (1,184 | ) |

| |

| (1) | The financial information for equity method investments for the nine months ended September 30, 2019 includes the financial information of equity method investments acquired as part of the Merger while the financial information for the nine months ended September 30, 2018 does not. See Note 3 for additional details. |

| |

(2) | Includes the impact of any basis differential amortization or accretion.accretion in addition to the impairment of $1,264 million. |

|

| | | | | | | | | | | |

| | Three Months Ended March 31, 2019(1) |

| (In millions) | VIEs | | Non-VIEs | | Total |

| Revenues and other income | $ | 155 |

| | $ | 391 |