1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSIONWashington,WASHINGTON, D.C. 20549

FORM 20-F

[ ]REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

or

[X]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended:May 31, 2006

2007 or

[ ]TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

or

[ ]SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIESEXCHANGE ACT OF 1934

Commission file number:0-31092

MEDICURE INC.

(Exact name of registrant as specified in its charter)

Canada

(Jurisdiction of incorporation or organization)

4 - 1200 Waverley Street, Winnipeg, Manitoba, Canada R3T 0P4

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:None

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares, without par value

______________________________________

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of

the close of the period covered by the annual report:

At May 31, 20062007 the registrant had 96,046,465116,314,509 common shares issued and outstanding

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act.

Yes _______________ No X

If this report is an annual or transition report, indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes _______________ No X

2

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period

that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Yes X No _______________

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-acceleratednon-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the

Exchange Act. (Check one):

Large Accelerated Filer _______________ Accelerated Filer X Non-Accelerated Filer _______________

Indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 X Item 18 No _______________

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act).

Yes _______________ No X

As of May 31, 2006,2007, the rate for Canadian dollars was US $0.9079$0.9349 for Cdn $1.00.

3

TABLE OF CONTENTS

4

5

GLOSSARY OF TERMS

The following words and phrases shall have the meanings set forth below:

"angina"means chest pain;

"angioplasty"means the surgical repair of a blood vessel;

"anti-hypertensive"means blood pressure reducing;

"arrhythmia" means irregular heart rhythm;

"bioavailability”means the degree to which a drug or other substance becomes available to the target in the body after administration;

"Computer Aided Drug Design" means a method for design of new therapeutic molecules using computer generated models of the drug and its molecular target;

"FDA"means the United States Food and Drug Administration;

"GCP"means Good Clinical Practices;

"GLP"means Good Laboratory Practice;

"GMP" means Good Manufacturing Practice;

"IND" means Investigative New Drug application to a regulatory authority for first human testing of a new drug;

"in-vitro" means test tube;

"in-vivo" means live animal;

"ischemia" means the lack of blood flow;

"myocardial infarction" means scarring and death to portions of the heart wall;

"myocardial ischemia" means blockages to parts of the heart muscle;

"NDA" means New Drug Application, which is a request made to the FDA for commencement of product sales and marketing;

"NDS" means New Drug Submission, which is a request made to the HPBTPD for commencement of product sales and marketing;

"NSAID" means non-steroidal anti-inflammatory drugs;

"pharmacodynamics" means the fundamental processes through which a drug(s) exerts its effects on living organisms;

"pharmacokinetics" means the uptake, biotransformation, distribution, metabolism and elimination of a drug(s) by the body, including both total amounts and tissue and organ concentrations;

"reperfusion" means the resumption of blood flow;

"TPD" means the Canadian Therapeutic Products Directorate, formerly the Canadian Health Protection Branch;

6

As used in this annual report, the “Corporation” or “Company” refers to “Medicure Inc.”, the company resulting from the amalgamation of Medicure Inc. and Lariat Capital Inc., and “Medicure” refers to “Medicure Inc.” prior to its amalgamation with Lariat Capital Inc. Unless otherwise indicated, all references to dollar amounts in this annual report are to Canadian dollars.

FORWARD LOOKING STATEMENTS

Medicure Inc. cautions readers that certain important factors (including without limitation those set forth in this Form 20-F) may affect the Corporation’s actual results in the future and could cause such results to differ materially from any forward-looking statements that may be deemed to have been made in this Form 20-F annual report, or that are otherwise made by or on behalf of the Corporation. These statements may include, but are not limited to, plans regarding the development and advancement of MC-1, statements about the Corporation’s AGGRASTAT® operations, statements concerning the Corporation’s partnering and regulatory discussions, future financial position, future revenues, projected costs, and management’s strategy. For this purpose, any statements contained in the annual report that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “except,” “believe,” “anticipate,” “intend,” “could,” “estimate,” or “continue,” or the negative or other variations of comparable terminology, are intended to identify forward-looking statements.

As used in this annual report, the “Corporation” or “Company” refers to “Medicure Inc.”, the company resulting from the amalgamation of Medicure Inc. and Lariat Capital Inc., “Medicure” refers to “Medicure Inc.” prior to its amalgamation with Lariat Capital Inc. and “Lariat” refers to Lariat Capital Inc. prior to its amalgamation with Medicure Inc. Unless otherwise indicated, all references to dollar amounts in this annual report are to Canadian dollars.

Additional information about the Corporation may be found atwww.sedar.com.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

Not applicable

B. Advisers

Not applicable

C. Auditors

Not applicable

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The selected financial data of the Corporation as at May 31, 20062007 and 20052006 and for the fiscal years ended May 31, 2007, 2006 and 2005 and 2004 was extracted from the audited consolidated financial statements of the Corporation included in this annual report on Form 20-F. The information contained in the selected financial data is qualified in its entirety by reference to the more detailed consolidated financial statements and related notes included in Item 17 - - Financial Statements, and should be read in conjunction with such financial statements and with the information appearing in Item 5 - Operating and Financial Review and Prospects. The selected financial data as at May 31, 2005, 2004 2003 and 20022003 and for the fiscal years ended May 31, 20032004 and 20022003 was extracted from the audited financial statements of the Corporation not included in this annual report. Reference is made to Note 1013 of the consolidated financial statements of the Corporation included herein for a discussion of the material measurement differences

7

between Canadian GAAP and U.S. GAAP, and their effect on the Corporation’s financial statements. Except where otherwise indicated, all amounts are presented in accordance with Canadian GAAP.

7

To date, the Corporation has not generated sufficient cash flow from operations to fund ongoing operational requirements and cash commitments. The Corporation has financed its operations principally through the sale of its equity securities. While the Corporation believes it has sufficient capital and liquidity to finance current operations, nevertheless, its ability to continue operations is dependent on the ability of the Corporation to obtain additional financing. See “Item 3 - Key Information - D. Risk Factors.” Based on the Corporation’s current plans and upon closing of the transactions disclosed in “Item 8B – Financial Information – Significant Changes” below, the Corporation’s available working capital will be sufficient into the first quarterhalf of fiscal 2008.2009.

Under Canadian Generally Accepted Accounting Principles (in Canadian dollars):

| Balance Sheet | May 31, | May 31, | May 31, | May 31, | May 31, | |||||||||||||||||||||||||

| Data | 2006 | 2005 | 2004 | 2003 | 2002 | |||||||||||||||||||||||||

| (as at period | $ | $ | $ | $ | $ | |||||||||||||||||||||||||

| end) | ||||||||||||||||||||||||||||||

| Balance Sheet Data | May 31, | May 31, | May 31, | May 31, | May 31, | |||||||||||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | ||||||||||||||||||||||||||

| (as at period end) | $ | $ | $ | $ | $ | |||||||||||||||||||||||||

| Current Assets | 35,841,573 | 8,658,888 | 21,342,820 | 4,465,048 | 8,783,318 | 35,827,187 | 35,841,573 | 8,658,888 | 21,342,820 | 4,465,048 | ||||||||||||||||||||

| Capital Assets | 50,663 | 81,002 | 66,202 | 67,497 | 84,571 | 196,521 | 50,663 | 81,002 | 66,202 | 67,497 | ||||||||||||||||||||

| Intangible Assets | 2,921,841 | 1,332,969 | 976,690 | 763,464 | 508,902 | 23,412,131 | 2,921,841 | 1,332,969 | 976,690 | 763,464 | ||||||||||||||||||||

| Other Assets | 349,963 | - | - | - | - | |||||||||||||||||||||||||

| Total Assets | 38,814,077 | 10,072,859 | 22,385,712 | 5,296,009 | 9,376,791 | 59,785,802 | 38,814,077 | 10,072,859 | 22,385,712 | 5,296,009 | ||||||||||||||||||||

| Total Liabilities | 1,644,339 | 2,732,754 | 817,575 | 353,908 | 389,663 | 25,479,333 | 1,644,339 | 2,732,754 | 817,575 | 353,908 | ||||||||||||||||||||

| Net Assets | 37,169,738 | 7,340,105 | 21,568,137 | 4,942,101 | 8,987,128 | 34,306,469 | 37,169,738 | 7,340,105 | 21,568,137 | 4,942,101 | ||||||||||||||||||||

| Capital Stock and | 83,297,304 | 40,860,597 | 40,222,719 | 17,607,597 | 17,458,936 | 112,137,421 | 83,297,304 | 40,860,597 | 40,222,719 | 17,607,597 | ||||||||||||||||||||

| Contributed | ||||||||||||||||||||||||||||||

| Surplus | ||||||||||||||||||||||||||||||

| Contributed Surplus | ||||||||||||||||||||||||||||||

| Deficit | (77,830,952 | ) | (46,127,566 | ) | (33,520,492 | ) | (18,654,582 | ) | (12,665,496 | ) | ||||||||||||||||||||

| Accumulated | ||||||||||||||||||||||||||||||

| During the | ||||||||||||||||||||||||||||||

| Development Stage | (46,127,566 | ) | (33,520,492 | ) | (18,654,582 | ) | (12,665,496 | ) | (8,471,808 | ) | ||||||||||||||||||||

| Statement of | ||||||||||||||||||||||||||||||

| Operations | ||||||||||||||||||||||||||||||

| (for the fiscal year | ||||||||||||||||||||||||||||||

| ended on) | ||||||||||||||||||||||||||||||

| Gross Revenue | 299,737 | 394,784 | 445,461 | 241,281 | 183,912 | |||||||||||||||||||||||||

| Loss from | ||||||||||||||||||||||||||||||

| Continuing | ||||||||||||||||||||||||||||||

| Product Sales | 5,944,730 | - | - | - | - | |||||||||||||||||||||||||

| Interest and Other | 1,590,801 | 299,737 | 394,784 | 445,461 | 241,281 | |||||||||||||||||||||||||

| Income | ||||||||||||||||||||||||||||||

| Loss from Continuing | ||||||||||||||||||||||||||||||

| Operations | (12,607,074 | ) | (14,865,910 | ) | (5,989,086 | ) | (4,193,688 | ) | (3,875,087 | ) | (31,703,386 | ) | (12,607,074 | ) | (14,865,910 | ) | (5,989,086 | ) | (4,193,688 | ) | ||||||||||

| Net Loss for the | (12,607,074 | ) | (14,865,910 | ) | (5,989,086 | ) | (4,193,688 | ) | (3,875,087 | ) | (31,703,386 | ) | (12,607,074 | ) | (14,865,910 | ) | (5,989,086 | ) | (4,193,688 | ) | ||||||||||

| Period | ||||||||||||||||||||||||||||||

| Basic and Diluted | (0.17 | ) | (0.22 | ) | (0.11 | ) | (0.11 | ) | (0.14 | ) | (0.30 | ) | (0.17 | ) | (0.22 | ) | (0.11 | ) | (0.11 | ) | ||||||||||

| Loss per Share | ||||||||||||||||||||||||||||||

| Weighted-Average | ||||||||||||||||||||||||||||||

| Number of | ||||||||||||||||||||||||||||||

| Common Shares | 75,144,764 | 66,717,715 | 55,738,716 | 37,118,889 | 27,900,412 | 104,879,404 | 75,144,764 | 66,717,715 | 55,738,716 | 37,118,889 | ||||||||||||||||||||

| Outstanding | (1 | ) | ||||||||||||||||||||||||||||

8

Under U.S. Generally Accepted Accounting Principles (in Canadian dollars):

| Balance Sheet Data | May 31, | May 31, | May 31, | May 31, | May 31, | ||||||||||

| 2006 | 2005 | 2004 | 2003 | 2002 | |||||||||||

| (as at Period end) | $ | $ | $ | $ | $ | ||||||||||

| Current Assets | 35,841,573 | 8,658,888 | 21,342,820 | 4,465,048 | 8,783,318 | ||||||||||

| Capital Assets | 50,663 | 60,859 | 41,472 | 37,050 | 47,087 | ||||||||||

| Intangible Assets | - | - | - | - | - | ||||||||||

| Total Assets | 35,892,236 | 8,719,747 | 21,384,292 | 4,502,098 | 8,830,405 | ||||||||||

| Total Liabilities | 1,644,339 | 2,732,754 | 817,575 | 353,908 | 389,663 |

8

| Net Assets | 34,247,897 | 5,986,993 | 20,566,717 | 4,148,190 | 8,440,742 | ||||||||||

| Capital Stock and | 99,542,138 | 57,105,431 | 56,459,161 | 33,818,449 | 32,855,388 | ||||||||||

| Contributed Surplus | |||||||||||||||

| Deficit Accumulated | |||||||||||||||

| During the | |||||||||||||||

| Development Stage | (65,294,241 | ) | (51,118,438 | ) | (35,892,444 | ) | (29,670,259 | ) | (24,414,646 | ) | |||||

| Statement of | |||||||||||||||

| Operations | |||||||||||||||

| Gross Revenue | 299,737 | 394,784 | 445,461 | 241,281 | 183,912 | ||||||||||

| Loss from Continuing | |||||||||||||||

| Operations | (14,175,800 | ) | (15,225,994 | ) | (6,222,185 | ) | (5,255,613 | ) | (4,319,237 | ) | |||||

| Net Loss for the | (14,175,800 | ) | (15,225,994 | ) | (6,222,185 | ) | (5,255,613 | ) | (4,319,237 | ) | |||||

| Period | |||||||||||||||

| Basic and Diluted | (0.19 | ) | (0.23 | ) | (0.11 | ) | (0.14 | ) | (0.15 | ) | |||||

| Loss per Share | |||||||||||||||

| Weighted-Average | |||||||||||||||

| Number of | |||||||||||||||

| Common Shares | 75,144,764 | 66,717,715 | 55,738,716 | 37,118,889 | 27,900,412 | ||||||||||

| Outstanding | (1 | ) |

Note 1: Includes 1,280,000 Class A common shares outstanding. On March 1, 2003 all of the Corporation’s issued and outstanding Class A common shares – totalling 1,280,000 shares – were converted into common shares of the Corporation on the basis of one common share for each Class A common shares in accordance with the Corporation’s Articles of Continuance. Prior to the conversion, the Class A common shares were identical in all respects to the common shares, except that the holders were eligible for the Manitoba Equity Tax Credit until February 28, 2003.

| Balance Sheet Data | May 31, | May 31, | May 31, | May 31, | May 31, | ||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||

| (as at Period end) | $ | $ | |||||||||||||

| Current Assets | 35,827,187 | 35,841,573 | 8,658,888 | 21,342,820 | 4,465,048 | ||||||||||

| Capital Assets | 196,521 | 50,663 | 60,859 | 41,472 | 37,050 | ||||||||||

| Intangible Assets | 20,078,862 | - | - | - | - | ||||||||||

| Other Assets | 349,963 | - | - | - | - | ||||||||||

| Total Assets | 56,452,533 | 35,892,236 | 8,719,747 | 21,384,292 | 4,502,098 | ||||||||||

| Total Liabilities | 25,479,333 | 1,644,339 | 2,732,754 | 817,575 | 353,908 | ||||||||||

| Net Assets | 30,973,200 | 34,247,897 | 5,986,993 | 20,566,717 | 4,148,190 | ||||||||||

| Capital Stock and | 128,382,255 | 99,542,135 | 57,105,431 | 56,459,161 | 33,818,449 | ||||||||||

| Contributed Surplus | |||||||||||||||

| Deficit | (97,409,055 | ) | (65,294,238 | ) | (51,118,438 | ) | (35,892,444 | ) | (29,670,259 | ) | |||||

| Statement of | |||||||||||||||

| Operations | |||||||||||||||

| Product Sales | 5,944,730 | - | - | - | - | ||||||||||

| Interest and Other | 1,590,801 | 299,737 | 394,784 | 445,461 | 241,281 | ||||||||||

| Income | |||||||||||||||

| Loss from Continuing | |||||||||||||||

| Operations | (32,114,817 | ) | (14,175,800 | ) | (15,225,994 | ) | (6,222,185 | ) | (5,255,613 | ) | |||||

| Net Loss for the | (32,114,817 | ) | (14,175,800 | ) | (15,225,994 | ) | (6,222,185 | ) | (5,255,613 | ) | |||||

| Period | |||||||||||||||

| Basic and Diluted | (0.31 | ) | (0.19 | ) | (0.23 | ) | (0.11 | ) | (0.14 | ) | |||||

| Loss per Share | |||||||||||||||

| Weighted-Average | |||||||||||||||

| Number of | |||||||||||||||

| Common Shares | 104,879,404 | 75,144,764 | 66,717,715 | 55,738,716 | 37,118,889 | ||||||||||

| Outstanding |

Comparability of Data

On November 22, 1999, Lariat acquired all of the issued and outstanding common shares of Medicure in consideration for the issuance of 9,500,000 common shares of Lariat. As control of Lariat passed to the former shareholders of Medicure resulting in a reverse acquisition, Medicure is deemed to be the acquirer for accounting purposes. Accordingly, the net assets of Medicure are included in the balance sheet at their book values and the deemed acquisition of Lariat is accounted for by the purchase method with the net assets of Lariat recorded at their fair value at the date of acquisition.

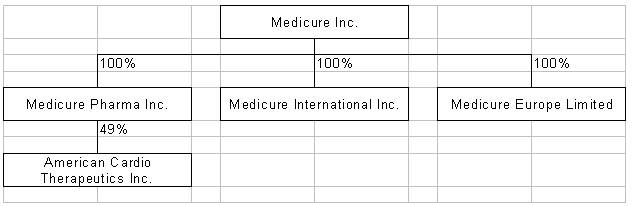

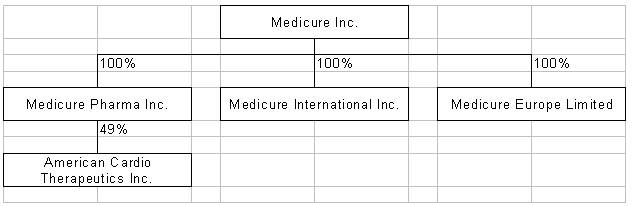

The selected financial data for the fiscal years ended May 31, 2007, 2006, 2005, 2004 2003 and 20022003 includes the operations of Medicure International Inc., a Barbados corporation (“Medicure International”), commencing June 1, 2000. The selected financial data for the year ended May 31, 2002 includes the operations of2000, and Medicure Pharma Inc., a United States corporation, and Medicure Europe Limited, a United Kingdom corporation, commencing SeptemberJune 1, 1999 combined with the activities of Lariat beginning on November 22, 1999, the effective date of the reverse takeover.2006.

Dividends

No cash dividends have been declared nor are any intended to be declared. The Corporation is not subject to legal restrictions respecting the payment of dividends except that they may not be paid to renderif the Corporation is, or would after the payment be, insolvent. Dividend policy will be based on the Corporation's cash resources and needs and it is anticipated that all available cash will be required to further the Corporation’s research and development activities for the foreseeable future.

Exchange Rates

Unless otherwise indicated, all reference to dollar amounts are to Canadian dollars. The following table sets out the exchange rates for one Canadian dollar expressed in terms of one U.S. dollar for the periods indicated. Rates of exchange are obtained from the Bank of Canada and believed by the Registrant to approximate closely the noon buying rates in New York City for cable transfers as certified for customs purposes by the Federal Reserve Bank in New York.

9

| May 31, 2006 | May 31, 2005 | May 31, 2004 | May 31, 2003 | May 31, 2002 | |

| Period End | 0.9079 | 0.7967 | 0.7335 | 0.7307 | 0.6545 |

| Average | 0.8588 | 0.7978 | 0.7453 | 0.6569 | 0.6380 |

| May 31, 2007 | May 31, 2006 | May 31, 2005 | May 31, 2004 | May 31, 2003 | ||||||||||||||||||||

| Period End | 0.9349 | 0.9079 | 0.7967 | 0.7335 | 0.7307 | |||||||||||||||||||

| Average | 0.8798 | 0.8588 | 0.7978 | 0.7453 | 0.6569 | |||||||||||||||||||

| June | May | April | March | February | January | June | May | April | March | February | January | |||||||||||||

| 2006 | 2007 | 2007 | 2007 | 2007 | 2007 | 2007 | ||||||||||||||||||

| High for | 0.9491 | 0.9376 | 0.9051 | 0.8696 | 0.8647 | 0.8598 | ||||||||||||||||||

| Month(1) | 0.9122 | 0.9134 | 0.8959 | 0.8850 | 0.8809 | 0.8794 | ||||||||||||||||||

| Low for | 0.9294 | 0.8958 | 0.8621 | 0.8462 | 0.8419 | 0.8440 | ||||||||||||||||||

| Month(1) | 0.8857 | 0.8869 | 0.8496 | 0.8513 | 0.8610 | 0.8479 | ||||||||||||||||||

Notes:

(1) Figures are extracted from daily exchange rates

As of June 30, 2006,July 31, 2007, the exchange rate to convert one Canadian dollar into the U.S. dollar was 0.8959.0.9374.

B. Capitalization and Indebtedness

Not applicable

C. Reasons for the Offer and Use of Proceeds

Not applicable

D. Risk Factors

The Corporation’s business entails significant risks. In addition to the usual risks associated with a business, the following is a general description of certain significant risk factors which are applicable to the Corporation.

We arePrior to the acquisition of AGGRASTAT®, the Corporation had no products in commercial production or use. As such, the Corporation was considered to be a development stage company and we expectdevelopment-stage enterprise for accounting purposes prior to the acquisition. The Corporation expects to continue to incur substantial losses and may never achieve profitability, which in turn may harm ourits future operating performance and may cause the market price of ourits stock to decline.

With the exception of Aggrastat® (see Item 4(B))AGGRASTAT®, the Corporation’s products are in the development stage and accordingly, its business operations are subject to all of the risks inherent in the establishment and maintenance of a developing business enterprise, such as those related to competition and viable operations management.

The Corporation has incurred net losses every year since inception in 1997 and as1997. As of May 31, 2006,2007, the date of its last audited financial statements, the Corporation had an accumulated deficit of $46,127,566.$77,830,952. The Corporation incurred net losses of $31,703,386 for the year ended May 31, 2007, $12,607,074 for the year ended May 31, 2006, $14,865,910 for the year ended May 31, 2005, $5,989,086 for the year ended May 31, 2004 and $4,193,688 for the year ended May 31, 2003 and $3,875,087 for the year ended May 31, 2002. 2003.

The Corporation anticipates that its losses will not only continue for the foreseeable future but will increase significantly, principally from expenditures relating to its research and development efforts and clinical trials. The long-term profitability of the Corporation’s operations is uncertain, and may never occur, andoccur. The Corporation’s long-term profitability will be directly related to the success of its research and development activities which dependability to develop a commercially viable drug product or products. This in turn depends on numerous factors, including the following:

| a) | the success of the Corporation’s research and development activities, including |

10

| b) | obtaining Canadian and United States regulatory approvals to market MC-1 and MC-4232, | |

| c) | the ability to contract for the manufacture of the Corporation’s products according to schedule and within budget, given that it has no experience in large scale manufacturing; |

10

| d) | the ability to successfully prosecute and defend | |

| e) | the ability to successfully market the Corporation’s products including |

If the Corporation does achieve profitability, it may not be able to sustain or increase profitability in the future.

The Corporation may never receive regulatory approval in Canada, the United States or abroad for any of ourits products developed. Therefore, the Corporation may not be able to sell any therapeutic products developed.

The Corporation’s failure to obtain necessary regulatory approvals to fully market ourits current and future therapeutic products in one or more significant markets may adversely affect ourits business, financial condition and results of operations. The procedure involved in obtaining regulatory approval from the competent authorities to market therapeutic products is long and costly and may delay product development. The approval to market a product may be applicable to a limited extent only or it may be refused entirely.

With the exception of Aggrastat®AGGRASTAT®, all of the Corporation’s products are currently in the research and development stages (see Item 4(B)).stages. The Corporation may never have another commercially viable drug product approved for marketing. To obtain regulatory approvals for the Corporation’sits products and to achieve commercial success, human clinical trials must demonstrate that the products are safe for human use and that they show efficacy. Even the Corporation’s most clinically advanced product, MC-1, has not enteredis only currently being studied in critical Phase III clinical trials. Unsatisfactory results obtained from a particular study or clinical trial relating to one or more of the Corporation’s products may cause the Corporation to reduce or abandon its commitment to that program.

If the Corporation fails to successfully complete its clinical trials, the Corporationit will not obtain approval from the Canadian Therapeutic Products Directorate, formerly the Canadian Health Protection Branch (“TPD”), or from the U.S. Food and Drug Administration (“FDA”), to market ourits leading product, MC-1 or ourits second clinical candidate, MC-4232. Regulatory approvals also may be subject to conditions that could limit the market for MC-1 or MC-4232 or make either product or both products more difficult or expensive to sell than anticipated. Also, regulatory approvals may be revoked at any time, including the Corporation’sfor failure to comply with regulatory requirements or poor performance of MC-1 or MC-4232 in terms of safety and effectiveness.

The Corporation’s business, financial condition and results of operations may be adversely affected if the Corporationit fails to obtain regulatory approvals in Canada, the United States and abroad to market and sell MC-1 or MC-4232 or any current or future drug products, including any limitations imposed on the marketing of such products.

The Corporation may not be able to hire or retain the qualified scientific, technical and management personnel it requires.

The Corporation has a contract with CanAm Bioresearch Inc. (“CanAm”) and Clinical Development Research Institute Inc. (“CDRI”) to perform for it a significant amount of ourits research and development activities. Because of the specialized scientific nature of the Corporation’s business, the loss of services of CanAm or CDRI may require the Corporation to attract and retain replacement qualified scientific, technical and management personnel. Competition in the biotechnology industry for such personnel is intense and the Corporation may not be able to hire or retain a sufficient number of qualified personnel, which may compromise the pace and success of the Corporation’sits research and development activities.

Also, certain of the Corporation’s management personnel are officers and/or directors of other companies, some publicly-traded, and will only devote part of their time to the Corporation. The Corporation does

11

not have key person insurance in effect in the event of a loss of any management, scientific or other key personnel. The loss of any such personnel could pose serious challenges for the Corporation.

11

The Corporation faces substantial technological competition from many biotechnology companies with much greater resources, and it may not be able to effectively compete.

Technological and scientific competition in the pharmaceutical and biotechnology industry is intense. The Corporation competes with other companies in Canada, the United States and abroad to develop products designed to treat similar conditions. Many of these other companies have substantially greater financial, technical and scientific research and development resources, manufacturing and production and sales and marketing capabilities than the Corporation. Small companies may also prove to be significant competitors, particularly through collaborative arrangements with large pharmaceutical and biotechnology companies. Developments by other companies may adversely affect the competitiveness of the Corporation’s products or technologies or the commitment of the Corporation’sits research and marketing collaborators to its programs or even render its products obsolete.

The pharmaceutical and biotechnology industry is characterized by extensive drug discovery and drug research efforts and rapid technological and scientific change. Competition can be expected to increase as technological advances are made and commercial applications for biopharmaceutical products increase. The Corporation’s competitors may use different technologies or approaches to develop products similar to the products which the Corporationit is developing, or may develop new or enhanced products or processes that may be more effective, less expensive, safer or more readily available before or after the Corporation obtains approval of its products. The Corporation may not be able to successfully compete with its competitors or their products and, if the Corporationit is unable to do so, itsthe Corporation’s business, financial condition and results of operations may suffer.

The Corporation may be unable to establish collaborative and commercial relationships with third parties.

The Corporation’s success of the Corporation will depend partly on its ability to enter into and to maintain various arrangements with corporate partners, licensors, licensees and others for the research, development, clinical trials, manufacturing, marketing, sales and commercialization of its clinical and preclinical products. These relationships will be crucial to the Corporation’s intention to license to or contract with larger, international pharmaceutical companies the manufacturing, marketing, sales and distribution of any products it may commercialize for production. To date, the Corporation has not entered into any such arrangements and may never be able to establish such arrangements on favourable terms. There can be no assurance that any licensing or other agreements will be established on favourable terms, if at all. The failure to establish successful collaborative arrangements with respect to certain products may negatively impact the Corporation'sCorporation’s ability to develop and commercialize thoseits products, and may adversely affect the Corporation’sits business, financial condition and results of operations.

The Corporation has licensed certain technologies relating to products under development and may enter into future licensing agreements. The Corporation'sCorporation’s current licensing agreements contain provisions allowing the licensors to terminate such agreements if the Corporationit becomes insolvent or breachesbreach the terms and conditions of the licensing agreement,agreements without rectifying such event of default in accordance with the agreement terms.

The Corporation may fail to obtain acceptable prices or appropriate reimbursement for its products and the Corporation’sits ability to successfully commercialize its products may be impaired as a result.

Government and insurance reimbursements for healthcare expenditures play an important role for all healthcare providers, including physicians, medical device companies, drug companies, medical supply companies, and companies, such as the Corporation, that plan to offer various products in the United States and other countries in the future. The Corporation’s ability to earn sufficient returns on its products will depend in part on the extent to which reimbursement for the costs of such products, related therapies and related treatments will be available from government health administration authorities, private health coverage insurers, managed care organizations, and other organizations. In the United States, the Corporation’s ability to have its products and related treatments and therapies eligible for Medicare or

12

private insurance reimbursement will be an important factor in determining the ultimate success of its products. If, for any reason, Medicare or the insurance companies decline to provide reimbursement for

12

the Corporation’s products and related treatments, the Corporation’s ability to commercialize its products would be adversely affected. There can be no assurance that the Corporation’s products and related treatments will be eligible for reimbursement.

There has been a trend toward declining government and private insurance expenditures for many healthcare items. Third-party payors are increasingly challenging the price of medical products and services.

If purchasers or users of the Corporation’s products and related treatments are not able to obtain appropriate reimbursement for the cost of using such products and related treatments, they may forgo or reduce such use. Even if the Corporation’s products and related treatments are approved for reimbursement by Medicare and private insurers, of which there can be no assurance, the amount of reimbursement may be reduced at times, or even eliminated. This would have a material adverse effect on the Corporation’s business, financial condition, and results of operations.

Significant uncertainty exists as to the reimbursement status of newly approved healthcare products, and there can be no assurance that adequate third-party coverage will be available.

Substantial cash payments may be required under the terms of ourthe Corporation’s borrowings upon an event of default or change of control. Such cash payments may leave usthe Corporation with little or no working capital in ourthe business or make us insolvent.insolvent.

In August 2006, wethe Corporation entered into a term loan financing facility totallingtotaling approximately US$15.84 million with a syndicate of lenders, led by Merrill Lynch Capital a division of Merrill Lynch Business Financial ServicesCanada Inc., and including Silicon Valley Bank and Oxford Finance Corporation (the “Credit Facility”). Under the Credit Facility, ourthe Corporation’s lenders may require that all or a portion of the principal amount of the Credit Facility or that all or a portion of such principal amount be repaid in cash upon the occurrence of various customary events of default (subject to certain cure periods), including but not limited to:

the failure to pay principal, fees and/or interest due under the Credit Facility;

the suspension of ourthe Corporation’s common shares from trading on the TSX and Amex;AMEX;

the issuance of any judgments or orders against usthe Corporation for the payment of money (not paid or fully covered by insurance) in an aggregate amount in excess of US$375,000;

any material default under any indebtedness of oursthe Corporation in an aggregate principal amount exceeding US$375,000;

any breach of any term of the credit and security agreement under which the Credit Facility was extended;extended or in any other document delivered pursuant thereto;

a default under any guarantee of the Credit Facility;

an unpermitted payment by any obligor under the Credit Facility on account of any debt that has been subordinated to the Credit Facility;

the occurrence of any fact, event or circumstance that could reasonably be expected to result in a material adverse effect; and

actual or anticipated (such anticipation by the lenders to be based on their reasonable judgment based on information received from the Corporation) breach of certain financial covenants (including a requirement that athe Corporation achieve certain minimum net revenue targets from the sale of AGGRASTAT® as at December 31 of each year during the term of the Credit Facility).

13

In August 2007, the Corporation agreed to an amendment with its existing lenders to certain of the covenants provided for in its credit agreement, dated August 8, 2006. The lenders and the Corporation have agreed, subject to certain conditions:

| i) | From and after August 17, 2007, but no later than April 30, 2008, the Corporation shall receive additional cash for working capital in a total aggregate amount of at least US$35 million from any and/or a combination of any of the sources described above, provided that (1) at least US$15 million of such aggregate amount must be received by the Corporation no later than September 30, 2007 and (2) a further US$15 million of such aggregate amount must be received by the Corporation no later than February 28, 2008 and (3) a further US$5 million of such aggregate amount must be received by the Corporation no later than April 30, 2008. The Corporation intends that the additional cash to meet this test will come from the subscription agreement and term sheet described above. | |

| (ii) | To amend the credit agreement such that the Corporation is required to achieve the following minimum net revenue requirements from sales of AGGRASTAT®: | |

|

| (iii) | The Corporation will deposit US$10 million in a cash collateral account to be held by Merrill Lynch Capital Inc. (Merrill), for the benefit of Merrill and the lenders, on closing of the financing transactions described above. |

As disclosed in “Item 8B – Financial Information – Significant Changes” below, subsequent to May 31, 2007 the Corporation entered into two non-binding agreements that would, if they close, provide the Corporation with additional working capital is required to be raised bytotaling US$40 million. The Corporation anticipates that it will meet the Corporation by March 31, 2007 through a collaborative partnership or equity issuance), including financial covenantsworking capital covenant described above upon the lenders deemclosing of the Corporation likely to fail under the Credit Facility for the next succeeding financial reporting period.above financings.

Upon the occurrence and during the continuance of an event of default, the interest rate on the Credit Facility will be increased by 1.5% . The lenders under the Credit Facility may also require all or a portion

13

of the Credit Facility be redeemed in cash upon a change of control. We haveThe Corporation has not established a sinking fund for payment of the Credit Facility, nor do wedoes it anticipate doing so.

OurThe Corporation’s substantial debt could impair ourits financial condition. We areThe Corporation is highly leveraged and havehas substantial debt service obligations.

As of August 10, 2006, weMay 31, 2007, the Corporation had approximately US$15.84 million of principal indebtedness outstanding under the Credit Facility that bears interest at a floating rate.rate at one-month LIBOR plus 6.5% per annum. This substantial indebtedness could have important consequences for us.the Corporation. For example, it could:

increase ourthe Corporation’s vulnerability to general adverse economic and industry conditions;conditions, including increases to interest rates;

impair ourthe Corporation’s ability to obtain additional financing in the future for working capital needs, capital expenditures or general corporate purposes;

require usthe Corporation to dedicate a significant portion of ourits existing cash and proceeds from any future financing transactions to the payment of principal and interest on ourits debt, which would reduce the funds available for ourits operations;

14

limit ourthe Corporation’s flexibility in planning for, or reacting to, changes in the business and the industry in which we operate;it operates; and

place usthe Corporation at a competitive disadvantage compared to ourits competitors that have less debt.

Despite current indebtedness levels and the terms of the Credit Facility, wethe Corporation may still be able to incur substantially more debt. This could further exacerbate the risks associated with ourthe Corporation’s substantial leverage.

Despite current indebtedness levels and the terms of the Credit Facility, wethe Corporation may still be able to incur substantial additional indebtedness in the future. Under the Credit Facility, we arethe Corporation is permitted to incur, among other types of indebtedness, indebtedness that is subordinate to the Credit Facility. If new debt is added to ourthe Corporation’s current debt levels, the related risks that weit now facefaces could increase.

The Corporation has agreed to guarantee certain annual minimum payments and other obligations under the proposal letter with Manchester Securities Corp., an affiliate of Elliott Associates L.P. (“Elliott”).

On August 20, 2007, the Corporation executed a non-binding term sheet with Elliott (the “Term Sheet”) pursuant to which the Corporation would grant to Elliott the right to receive royalties on future sales of AGGRASTAT® for an upfront payment of US $25 million (the “Proposed Transaction”). Under the terms of the Proposed Transaction, Elliott would receive an escalating minimum annual return based on AGGRASTAT® revenue until 2019. The minimum annual returns start at US$2.5 million in 2007 and escalate to US$6.9 Million in 2016. The exact percentage of AGGRASTAT® or MC-1 revenue that Elliott will receive is tiered and declines as certain revenue levels are achieved. To secure its obligation pursuant to the Proposed Transaction, the Corporation will grant to Elliott a first priority security interest in the Corporation’s patents for AGGRASTAT® and MC-1. There is no assurance that the Corporation will have sufficient funds or assets to cover such payments. Failure to make minimum payments or perform other obligations pursuant to the Proposed Transaction may result in a default under the proposed security agreement with Elliott, which, if not cured, could impair the Corporation’s ownership of its patents. This would have a material adverse effect on the Corporation.

Under the Proposed Transaction, Elliott would have the option to convert its royalty interest from AGGRASTAT® to MC-1 within six months of successful commercialization of MC-1 by the Corporation, if achieved. Upon conversion to MC-1, Elliott is entitled to a blended return of approximately 7% on the first US$75 Million in MC-1 revenues and 3% thereafter.

The Proposed Transaction will also include an option for the Corporation to terminate the agreement for a payment of US $70 million to Elliott if the U.S. Food & Drug Administration approves MC-1 for sale to the public.

The closing of the Proposed Transaction will be subject to the receipt of all necessary regulatory approvals and other conditions of closing. There can be no assurance that the Proposed Transaction will close.

The Corporation does not have manufacturing or marketing experience and may never be able to successfully manufacture or market its products.

The Corporation has no experience in large-scale manufacturing and in marketing or selling its products and may never be able to successfully manufacture and market its products. If the TPD or FDA approves MC-1, MC-4232 or any other of its products, the Corporation’s products, itCorporation intends to contract with and rely on third parties to manufacture, market and sell its products. Accordingly, the quality, timing and ultimately the commercial success of such products may be outside of the Corporation’s control. Failure of or delay by a third party manufacturer of the Corporation’s products to comply with good manufacturing practices or similar quality control regulations or satisfy regulatory inspections may have a material adverse effect on the Corporation’s

15

its future prospects. Failure of or delay by a third party in the marketing or selling of the Corporation’s products likewise may have a material adverse effect on the Corporation’sits future prospects.

The Corporation has limited product liability insurance and may not be able to obtain adequate product liability insurance in the future.

The sale and use of products under development by the Corporation, and the conduct of clinical studies involving human subjects, may entail product and professional liability risks, which are inherent in the testing, production, marketing and sale of new drugs to humans. While the Corporation has taken, and will continue to take, what it believes are appropriate precautions, there can be no assurance that the Corporationit will avoid significant liability exposure. Although the Corporation currently carries product liability insurance for clinical trials, there can be no assurance that it has sufficient coverage, or can in the future obtain sufficient coverage at a reasonable cost. An inability to obtain insurance on economically feasible terms or to otherwise protect against potential product liability claims could inhibit or prevent the commercialization of products developed by the Corporation. The obligation to pay any product liability

14

claim or recall a product may have a material adverse effect on theits business, financial condition and future prospects of the Corporation.prospects. In addition, even if a product liability claim is not successful, adverse publicity and the time and expense of defending such a claim may significantly interfere with the Corporation’s business.

If the Corporation is unable to successfully protect its proprietary rights, the Corporation’sits competitive position will be adversely affected.

The Corporation’s success of the Corporation will depend partly on its ability to obtain and protect its patents and protect its proprietary rights in unpatented trade secrets.

The Corporation owns or jointly owns 1838 United States patents as at May 31, 2006.patents. The Corporation has additional pending United States patent applications. The Corporation’s pending and any future patent applications may not be accepted by the United States Patent and Trademark Office or any other jurisdiction in which applications may be filed. Also, processes or products that may be developed by the Corporation in the future may not be patentable.

The patent protection afforded to biotechnology and pharmaceutical companies is uncertain and involves many complex legal, scientific and factual questions. There is no clear law or policy involving the degree of protection afforded under patents. As a result, the scope of patents issued to the Corporation may not successfully prevent third parties from developing similar or competitive products. Competitors may develop similar or competitive products that do not conflict with the Corporation’s patents. Litigation may be commenced by the Corporation to prevent infringement of its patents. Litigation may also commence against the Corporation to challenge the Corporation’sits patents that, if successful, may result in the narrowing or invalidating of such patents. It is not possible to predict how any patent litigation will affect the Corporation'sCorporation’s efforts to develop, manufacture or market its products. However, the cost of litigation to prevent infringement or uphold the validity of any patents issued to the Corporation may be significant, in which case the Corporation’sits business, financial condition and results of operations may suffer. Patents provide protection for only a limited period of time, and much of such time can occur well before commercialization commences.

Disclosure and use of the Corporation'sCorporation’s proprietary rights in unpatented trade secrets not otherwise protected by patents are generally controlled by written agreements. However, such agreements will not provide the Corporation with adequate protection if they are not honoured, others independently develop an equivalent technology, disputes arise concerning the ownership of intellectual property, or the Corporation'sits trade secrets are disclosed improperly. To the extent that consultants or other research collaborators use intellectual property owned by others in their work with the Corporation, disputes may also arise as to the rights to related or resulting know-how or inventions.

Others could claim that the Corporation infringes on their proprietary rights, which may result in costly, complex and time consuming litigation.

The Corporation’s success of the Corporation will depend partly on its ability to operate without infringing upon the patents and other proprietary rights of third parties. The Corporation is not currently aware that any of its

16

products or processes infringe the proprietary rights of third parties. However, despite theits best efforts, of the Corporation it may be sued for infringing on the patent or other proprietary rights of third parties at any time in the future.

Such litigation, with or without merit, is time-consuming and costly and may significantly impact the Corporation’s financial condition and results of operations, even if the Corporationit prevails. If itthe Corporation does not prevail, the Corporationit may be required to stop the infringing activity or enter into a royalty or licensing agreement, in addition to any damages the Corporationit may have to pay. The Corporation may not be able to obtain such a license or the terms of the royalty or license may be burdensome for the Corporation,it, which may significantly impair the Corporation’s ability to market its products and adversely affect its business, financial condition and results of operations.

15

The Corporation is andsubject to stringent governmental regulation, in the future may become subject to additional stringent governmental regulations and if the Corporationit is unable to comply, with them, its business may be materially harmed.

Biotechnology, medical device, and pharmaceutical companies operate in a high-risk regulatory environment. The TPD, FDA, and other health agencies can be very slow to approve a product and can also withhold product approvals. In addition, these health agencies also oversee many other medical product operations, such as research and development, manufacturing, and testing and safety regulation of medical products. As a result, regulatory risk is normally higher than in other industry sectors.

The Corporation is or may become subject to various federal, provincial, state and local laws, regulations and recommendations. The Corporation is subject to various laws and regulations in Canada, relating to product emissions, use and disposal of hazardous or toxic chemicals or potentially hazardous substances, infectious disease agents and other materials, and laboratory and manufacturing practices used in connection with its research and development activities. If the Corporation fails to comply with these regulations, the Corporationit may be fined or suffer other consequences that could materially affect its business, financial condition or results of operations.

The Corporation is unable to predict the extent of future government regulations or industry standards. However, it should be assumed that government regulations or standards will increase in the future. New regulations or standards may result in increased costs, including costs for obtaining permits, delays or fines resulting from loss of permits or failure to comply with regulations.

The Corporation’s products may not gain market acceptance, and as a result it may be unable to generate significant revenues.

The Corporation does not currently have the required clinical data and results to successfully market its clinical and preclinical product candidates in any jurisdiction; future clinical or preclinical results may be negative or insufficient to allow the Corporationit to successfully market any of its product candidates; and obtaining needed data and results may take longer than planned, and may not be obtained at all.

Even if the Corporation’s product candidatesproducts are approved for sale, they may not be successful in the marketplace. Market acceptance of any of the Corporation’s products will depend on a number of factors, including demonstration of clinical effectiveness and safety; the potential advantages of its products over alternative treatments; the availability of acceptable pricing and adequate third-party reimbursement; and the effectiveness of marketing and distribution methods for the products. Providers, payors or patients may not accept the Corporation’s products, even if they prove to be safe and effective and are approved for marketing by the TPD, the FDA and other regulatory authorities. The Corporation estimates that it may take up to threetwo years or longer before ourits initial products may be sold commercially. If the Corporation’s products do not gain market acceptance among physicians, patients, and others in the medical community, the Corporation’sits ability to generate significant revenues from its products would be limited.

The Corporation may not achieve its projected development goals in the time frames it announces and expects.

The Corporation sets goals for and makemakes public statements regarding timing of the accomplishment of objectives material to its success, such as the commencement and completion of clinical trials, anticipated

17

regulatory approval dates, and time of product launch. The actual timing of these events can vary dramatically due to factors such as delays or failures in the Corporation’s clinical trials, the uncertainties inherent in the regulatory approval process, and delays in achieving product development, manufacturing or marketing milestones necessary to commercialize its products. There can be no assurance that the Corporation’s clinical trials will be completed, that it will make regulatory submissions or receive regulatory approvals as planned, or that it will be able to adhere to its current schedule for the scale-up of manufacturing and launch of any of ourits products. If the Corporation fails to achieve one or more of these milestones as planned, that could materially affect its business, financial condition or results of operations and the price of the Corporation’sits common shares could decline.

16

The Corporation’s business involves the use of hazardous material, which requires it to comply with environmental regulations.

Although the Corporation does not currently manufacture commercial quantities of its products, we producethe Corporation produces limited quantities of such products for the Corporation’sits clinical trials. The Corporation’s research and development processes involve the controlled storage, use, and disposal of hazardous materials and hazardous biological materials. The Corporation is subject to laws and regulations governing the use, manufacture, storage, handling, and disposal of such materials and certain waste products. Although the Corporation believes that its safety procedures for handling and disposing of such materials comply with the standards prescribed by such laws and regulations, the risk of accidental contamination or injury from these materials cannot be completely eliminated. In the event of such an accident, the Corporation could be held liable for any damages that result, and any such liability could exceed its resources. There can be no assurance that the Corporation will not be required to incur significant costs to comply with current or future environmental laws and regulations, or that its business, financial condition, and results of operations will not be materially or adversely affected by current or future environmental laws or regulations.

The Corporation’s insurance may not provide adequate coverage with respect to environmental matters.

Environmental regulation could have a material adverse effect on the results of the Corporation’s operations and its financial position.

The Corporation is subject to a broad range of environmental regulations imposed by federal, state, provincial, and local governmental authorities. Such environmental regulation relates to, among other things, the handling and storage of hazardous materials, the disposal of waste, and the discharge of contaminants into the environment. Although the Corporation believes that it is in material compliance with applicable environmental regulation, as a result of the potential existence of unknown environmental issues and frequent changes to environmental regulation and the interpretation and enforcement thereof, there can be no assurance that compliance with environmental regulation or obligations imposed thereunder will not have a material adverse effect on the Corporation in the future.

The Corporation will need to raise additional capital through the sale of its securities, resulting in dilution to its existing shareholders. Such funds may not be available, or may not be available on reasonable terms, adversely affecting the Corporation’s operations.

The Corporation has not to date generated any revenues from sales. The timing of generation of any sales is uncertain. The Corporation has limited financial resources and has financed its operations through the sale of securities, primarily common shares. The Corporation has significant on-going cash expenses and no ability to generate cash from operations. To meet its on-going cash needs the Corporation will need to continue its reliance on the sale of such securities for future financing, resulting in dilution to its existing shareholders. The Corporation’s long-term capital requirements may be notably significant and will depend on many factors, including continued scientific progress in its product discovery and development program, progress in its pre-clinical and clinical evaluation of products and product candidates, time and expense associated with filing, prosecuting and enforcing its patent claims and costs associated with obtaining regulatory approvals. In order to meet such capital requirements, the Corporation will consider contract fees, collaborative research and development arrangements, public financing or additional private financing (including the issuance of additional equity securities) to fund all or a part of particular programs.

18

The Corporation’s business, financial condition and results of operations will depend on its ability to obtain additional financing which may not be available under favourable terms, if at all. The Corporation’s ability of the Corporation to arrange such financing in the future will depend in part upon the prevailing capital market conditions as well as theits business performance of the Corporation.performance. If the Corporation’sits capital resources are exhausted and adequate funds are not available, itthe Corporation may have to reduce substantially or eliminate expenditures for research and development, testing, production and marketing of its proposed products, or obtain funds through arrangements with corporate partners that require the Corporationit to relinquish rights to certain of its technologies or products.

17As disclosed in “Item 8B – Financial Information – Significant Changes” below, subsequent to May 31, 2007 the Corporation entered into two non-binding agreements that would, if they close, provide the Corporation with additional working capital totaling US$40 million.

Future issuance of the Corporation’s common shares will result in dilution to its existing shareholders. Additionally, future sales of the Corporation’s common shares into the public market may lower the market price which may result in losses to the Corporation’sits shareholders.

As of May 31, 2006,2007, the Corporation had 96,046,465116,314,509, common shares issued and outstanding. A further 3,300,0284,235,528 common shares are issuable upon exercise of outstanding stock options and another 6,706,86010,691,468 common shares are issuable upon exercise of share purchase warrants, all of which may be exercised in the future resulting in dilution to the Corporation’s shareholders. The Corporation’s stock option plan allows for the issuance of stock options to purchase up to a maximum of 7,200,000 of the common shares issued and outstanding as of May 31, 2006. Under the plan the Corporation is able to grant an additional 2,954,667 share options as at May 31, 2006.any time. The common shares to be issued upon exercise of the outstanding options and warrants will be freely tradable and not subject to any hold period when issued.

Sales of substantial amounts of the Corporation’s common shares into the public market, or even the perception by the market that such sales may occur, may lower the market price of its common shares.

The Corporation’s common shares may experience extreme price and volume volatility which may result in losses to the shareholders of the Corporation.its shareholders.

On May 31, 2006,2007, the Corporation’s common shares closed at a price of $1.70 (US$1.59CDN$1.23 on the Amex).TSX and US$1.14 on the AMEX. For the period from June 1, 20052006 to May 31, 2006,2007, the high and low trading prices of the Corporation’s common shares on the TSX were $2.37CDN$1.88 and $0.83,CDN$1.10, respectively, with a total trading volume of 71,417,10034,840,400 shares. For the period from June 1, 20052006 to May 31, 2006,2007, the high and low trading prices of the Corporation’s common shares on the AmexAMEX were US$2.071.70 and US$0.66,0.91, respectively, with a total trading volume of 21,498,300.26,426,800.

Daily trading volume on the TSX inof the Corporation’s common stockshares for the period from June 1, 20052006 to May 31, 20062007 has fluctuated, with a high of 4,283,000617,500 shares and a low of 12,300 shares,13,800shares, averaging approximately 283,401138,256 shares. Daily trading volume on the AmexAMEX in the Corporation’s common stockshares for the period from June 1, 20052006 to May 31, 20062007 has fluctuated with a high of 3,207,600939,700 and a low of nil,3,800, averaging approximately 85,311.105,286. Accordingly, the trading price of the Corporation’s common stockshares may be subject to wide fluctuations in response to a variety of factors including announcement of material events by the Corporation such as the status of required regulatory approvals for the Corporation’sits products, competition by new products or new innovations, fluctuations in theits operating results, of the Corporation, general and industry-specific economic conditions and developments pertaining to patent and proprietary rights. The trading price of the Corporation’s common shares may be subject to wide fluctuations in response to a variety of factors and/or announcements concerning such factors, including:

actual or anticipated period-to-period fluctuations in financial results;

litigation or threat of litigation;

failure to achieve, or changes in, financial estimates by securities analysts;

new or existing products or services or technological innovations by the Corporation or its competitors;

19

comments or opinions by securities analysts or major shareholders;

conditions or trends in the pharmaceutical, biotechnology and life science industries;

significant acquisitions, strategic partnerships, joint ventures or capital commitments;

results of, and developments in, the Corporation’s research and development efforts, including results and adequacy of, and developments in, its clinical trials and applications for regulatory approval;

18

additions or departures of key personnel;

sales of the Corporation’s common shares, including by holders of the notes on conversion or repayment by the Corporation in common shares;

economic and other external factors or disasters or crises;

limited daily trading volume; and

developments regarding the Corporation’s patents or other intellectual property or that of its competitors.

In addition, the securities markets in the United States and Canada have recently experienced a high level of price and volume volatility, and the market price of securities of biotechnology companies have experienced wide fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. In addition, because of the limited public float, there may be limited liquidity for the Corporation’s common shares. It is expected that such fluctuations in price and limited liquidity will continue in the foreseeable future which may make it difficult for a shareholder to sell shares at a price equal to or above the price at which the shares were purchased.

There may not be an active, liquid market for the Corporation’s common shares.

There is no guarantee that an active trading market for the Corporation’s common shares will be maintained on AmexAMEX or the TSX. Investors may not be able to sell their shares quickly or at the latest market price if trading in the Corporation’sits common shares is not active.

If there are substantial sales of the Corporation’s common shares, the market price of theits common shares could decline.

Sales of substantial numbers of the Corporation’s common shares could cause a decline in the market price of theits common shares. Any sales by existing shareholders or holders of options or warrants may have an adverse effect on the Corporation’s ability to raise capital and may adversely affect the market price of theits common shares.

WeThe Corporation may be unable to meet ourits obligations under ourthe outstanding Credit Facility.

As of August 10, 2006,May 31, 2007, the CorporationCorporaton had approximately US$15.84 million of principal indebtedness outstanding under the Credit Facility, which bears interest at one-month LIBOR plus 6.5 percent per annum. The term of the Credit Facility is over 42 months, with interest due and payable at commencement of the loan payable on the first day of the month. Commencing in June 2007, principal is payable monthly on a straight-line amortization schedule over 33 consecutive monthly instalments.installments. There is no guarantee that the Corporation will have adequate resourcesbe able to meet theseits obligations on a timely basis.under the Credit Facility.

The Corporation has no history of paying dividends, does not intend to pay dividends in the foreseeable future and may never pay dividends.

Since incorporation, the Corporation has not paid any cash or other dividends on its common stockshares and doesdo not expect to pay such dividends in the foreseeable future as all available funds will be invested to

20

finance the growth of its business. The Corporation will need to achieve profitability prior to any dividends being declared, which may never happen.

The Corporation is likely to be classified as a “passive foreign investment company” for United States income tax purposes, which could have significant and adverse tax consequences to United States holders of its common shares.

The Corporation was a passive foreign investment company (“PFIC”) in the 20052006 taxable year and the Corporation believes there is a significant likelihood that it will be classified as a PFIC in the 2006

19

2007 taxable year and possibly in subsequent years. OurThe Corporation’s classification as a PFIC could have significant and adverse tax consequences for United States holders of the Corporation’sits common shares. It may be possible for United States holders of the Corporation’s common shares to mitigate these consequences by making a so-called “qualified electing fund” election. (See “Taxation”“Certain Income Tax Consequences” below.)

The Corporation has adopted a shareholder rights plan.

The Corporation has adopted a shareholder rights plan. The provisions of such plan could make it more difficult for a third party to acquire a majority of the Corporation’s outstanding common shares, the effect of which may be to deprive itsthe Corporation’s shareholders of a control premium that might otherwise be realized in connection with an acquisition of theits common shares.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

On December 22, 1999, the Corporation was formed by the amalgamation of Medicure Inc. with Lariat was incorporated by Certificate of Incorporation issuedCapital Inc. pursuant to the provisions of theBusiness Corporations Act (Alberta) on June 3, 1997. On February 11, 1999, by Certificate of Amendment and Registration of Restated Articles, the Articles of Lariat were amended to remove the private company restriction. Lariat was formed as a Junior Capital Pool company, as defined by, and under the rules of the Alberta Stock Exchange with the expressed intent of acquiring a project or company through a reverse take over. With the exception of this intent and the associated search for potential acquisitions, Lariat had no substantial prior business activities.

Medicure was incorporated by Certificate of Incorporation issued pursuant to the provisions ofThe Corporations Act (Manitoba) on September 15, 1997. Medicure was continued from Manitoba to Alberta by Certificate of Continuance issued pursuant to the provisions of theBusiness Corporations Act(Alberta) on December 3, 1999. On December 22, 1999, Medicure and Lariat were amalgamated by Certificate of Amalgamation issued pursuant to the provisions of theBusiness Corporations Act (Alberta) as Medicure Inc.. The Corporation was continued from Alberta to the federal jurisdiction by Certificate of Continuance issued pursuant to the provisions of theCanada Business Corporations Acton February 23, 2000.

Medicure was formed as a private Manitoba company to advance the discoveries of Dr. Naranjan Dhalla of the University of Manitoba. Dr. Dhalla and Dr. Albert Friesen were the principal owners of the corporation as first formed, together with certain other individuals who contributed to the project. The first order of business was the completion of a licensing agreement to acquire the technology rights from the University of Manitoba, which owned the technology by virtue of the fact that it was invented by employees of the University. From that date until the merger with Lariat, the Corporation's primary focus was on the preclinical testing and development of the lead product, identified as MC-1. In 1998 other research involving synthesis and testing of other potential therapeutics was commenced through a research contract with the University of Manitoba. Various business activities were conducted in support of these primary research projects including but not limited to; (1) the application for and approval of government sponsored research awards, (2) the search for alternative sources of investment capital to fund operations, and (3) the ongoing search for other potential therapeutics. Business and administrative functions were handled by Genesys Venture Inc., a consulting corporation, that at the time, was owned entirely by Dr. Friesen. Operations and research, until the merger, were primarily funded by Dr. Friesen, with assistance from government grants. On November 22, 1999 Medicure was acquired by Lariat by way of a reverse takeover as Lariat’s “Major Transaction” as a Junior Capital Pool company within the meaning of the Alberta Securities Commission Rule 46-501, the Alberta Securities Commission Companion Policy 46-501CP and The Alberta Stock Exchange Circular 7. Pursuant to the terms of the Major Transaction, Lariat acquired all of the issued and outstanding shares of Medicure in exchange for 9,500,000 shares of Lariat, at a deemed price for securities regulatory purposes only of $0.20 per share for aggregate deemed value of $1,900,000. The Major Transaction was negotiated entirely at arm’s length. As a result of the share exchange, control of Lariat passed to the former shareholders of Medicure. This type of transaction is commonly referred to as a “reverse takeover”. Under reverse takeover accounting, for financial reporting purposes, the Corporation is considered to be a continuation of the operations formerly carried on by Medicure.

20

The Corporation’s current legal and commercial name is Medicure Inc. and its current registered office is 30th Floor, 360 Main Street, Winnipeg, Manitoba, Canada, R3C 4G1. The Corporation’s head office is located at 4-1200 Waverley Street, Winnipeg, Manitoba, Canada, R3T 0P4.

The MC-1 technology was originally licensed to Genesys Pharma Inc. by the University of Manitoba, on August 18, 1997. Genesys Pharma Inc., which had made a small investment on some preliminary research, transferred the technology without cost, except for costs designated in the license, to Medicure Inc. on September 26, 1997. On August 30, 1999 Medicure Inc. completed a new license agreement with the University of Manitoba in order to slightly modify the terms of the original license agreement transferred from Genesys Pharma Inc., and to have the documentation properly prepared in the Corporation’s own name.

On June 1, 2000 the Corporation licensed the world-wide development and marketing rights (except for Canada) for MC-1, the Corporation’s lead product, to the Corporation’s wholly owned subsidiary, Medicure International Inc.. Medicure International Inc. then entered into a development agreement with CanAm to perform research and development on MC-1 and other compounds at cost, plus a reasonable mark-up not to exceed ten percent of any amount invoiced. The parties to the development agreement have agreed that the aggregate amount of all invoiced expenditures shall not exceed $30,000,000 over the term of the agreement. CanAm is a private Canadian company owned by Marcus Enns, a former employee of the Corporation and Peter de Visser, a former director of the Corporation. Peter de Visser resigned as a director of the Corporation in December 2001.

On July 2, 2004, Medicure International Inc. also entered into a development agreement with CDRI to perform clinical development on MC-1 and other compounds at cost, plus a reasonable mark-up not to exceed ten percent of any amount invoiced. The parties to the development agreement have agreed that the aggregate amount of all invoiced expenditures shall not exceed $30,000,000 over the term of the agreement. CDRI is a private Canadian company owned by Jim Charlton, a former employee of the Corporation.

In August 2006, the Corporation acquired the U.S. rights to its first commercial product, Aggrastat® Injection (tirofiban hydrochloride) in the United States and its territories (Puerto Rico, Virgin Islands, and Guam) for US$19,000,000 plus inventory.19,000,000. To finance the acquisition, the Company entered into the Credit Facility totaling US$15.84 million with a syndicate of lenders, led by Merrill Lynch Capital, a division of Merrill Lynch Business Financial Services Inc., and including Silicon Valley Bank and Oxford Finance Corporation. The term of the Credit FacilityInterest is over 42 months, with interest due and payable at commencement of the loan payable on the first day of the monthmonthly at one-month LIBOR plus 6.5 percent per annum. Commencing in June 2007, principal of US$480,000 is payable monthly on a straight-line amortization schedule over 33 consecutive monthly installments.with the term loan maturing February 1, 2010. The Credit Facility is secured by a security interest in all existing and after-acquired assets of the Company including intellectual property. Subsequent to year end, the Corporation signed a non-binding term sheet dated August 20, 2007 to monetize a percentage of the Corporation’s current and potential future commercial revenues with Manchester Securities Corp., an affiliate of Elliott Associates, L.P. (Elliott) (see Item 8B – Financial Information – Significant Changes below). The proposed financing is subject to a number of closing conditions, including the amendment of the Corporation’s credit agreement dated August 8, 2006 and the execution of a definitive agreement. The transaction is expected to close in September 2007.

Since its amalgamation, the Corporation, directly and through certain research contracts, has been engaged in the research and development of human therapeutic drugs for cardiovascular disease. In certain instances, therapeutics developed by the Corporation may also provide benefit for other diseases. The Corporation’s lead product, MC-1, is based upon scientific discoveries led by Dr. Naranjan S. Dhalla of The Institute of Cardiovascular Sciences and the Department of Physiology, of the Faculty of Medicine, the University of Manitoba in Winnipeg, Manitoba, Canada. The Corporation’s focus is on the clinical development and commercialization of MC-1 for treatment of cardiovascular disease and on the discovery and development of other cardiovascular therapeutics. There is currently an aggregate of 39 full time scientific researchers and support staff who are retained as employees by CanAm and CDRI who are performing the Corporation’s scientific research pursuant to the development agreements.

21

B. Business Overview

Plan of Operation

The Corporation is a biopharmaceutical company focused on the discovery and development of therapeutics for various large-market, unmet cardiovascular needs.

21

The following table summarizes ourthe Corporation’s clinical product candidates, their therapeutic focus and their stage of development.

| Product Candidate | Therapeutic focus | Stage of Development |

| AGGRASTAT® | Acute Coronary Syndrome | Currently marketed |

| MC-1 | Coronary Artery Bypass | Phase |

| Graft Surgery | ||

| MC-1 | Acute Coronary Syndrome | Phase II complete* |

| MC-1 | Stroke | Phase I complete |

| MC-4232 | Diabetes/Hypertension | Phase II complete |

| MC-4262 | Metabolic Syndrome/Hypertension | Phase I complete |