UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20142015

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ]X] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission file number0-31224

NORTHERN DYNASTY MINERALS LTD.

(Exact name of Registrant as specified in its charter)

BRITISH COLUMBIA, CANADA

(Jurisdiction of incorporation or organization)

15th Floor, 1040 West Georgia Street

Vancouver, British Columbia, Canada, V6E 4H1

(Address of principal executive offices)

Marchand Snyman, Chief Financial Officer

Facsimile No.: 604-684-8092

15th Floor, 1040 West Georgia Street

Vancouver, British Columbia, Canada, V6E 4H1

(Name,(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class:Not applicable | Name of each exchange on which registered:Not applicable |

Title of Each Class:Not applicableName of each exchange on which registered:Not applicable

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common shares with no par value

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report:

95,009,864221,939,376 common shares as of December 31, 20142015

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] Yes [X] No [X]

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes [ ] Yes [X] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [X] No [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[ ] Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (check one):

| Large accelerated filer [ ] | Accelerated filer [X][ ] | Non-accelerated filer [ ][X] |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S.GAAP [ ] | International Financial Reporting Standards as issued

by the International Accounting Standards Board [X] | Other [ ] |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 [ ] Item 18 [ ]

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] Yes [X] No [X]

| |

| Form 20-F Annual Report | P a g e| 2 |

-3 - |

| |

T A B L E O F C O N T E N T S

| |

| Form 20-F Annual Report | P a g e| 3 |

-4 - |

| |

GENERAL

In this Annual Report on Form 20-F, all references to "we", "Northern Dynasty" or the "Company" refer to Northern Dynasty Minerals Ltd.

The Company uses the Canadian Dollar as its reporting currency. All references in this document to "Dollars" or "$" are expressed in Canadian Dollars ("CAD", "C$"), unless otherwise indicated. See alsoItem 3 – Key Informationfor more detailed currency and conversion information.

Except as noted, the information set forth in this Annual Report is as of May 11, 2015April 29, 2016 and all information included in this document should only be considered correct as of such date.

GLOSSARY OF TERMS

Certain terms used herein are defined as follows:

| Alkalic | Igneous rock containing a relatively high percentage of sodium and potassium feldspar; alteration can also introduce alkali minerals. |

| Argillic | Hydrothermal alteration of wall rock which forms clay minerals including kaolinite, smectite, illite and other species. |

| CuEQ | Copper EquivalentEquivalent. |

| Comminution | Reduction of solid materials from one average particle size to a smaller average particle size by crushing, grinding, cutting, vibrating, or other means. |

| Deportment | Assessment of how minerals contribute to grade, as each mineral is likely to behave differently to comminution, flotation or leaching. |

| Diorite | Grey to dark-grey igneous intrusive rock of intermediate composition, composed principally of plagioclase feldspar along with biotite, hornblende and/or pyroxene. |

| Geometallurgy | Practice of combining geology and/or geostatistics with metallurgy. |

| Graben | Down-dropped block of land bordered by parallel faults. |

| Granodiorite | Medium- to coarse-grained acid igneous rock with quartz (>20%), plagioclase and alkali feldspar, commonly with minor hornblende and/or biotite. |

| HDGI | Is a reference to Hunter Dickinson Group Inc. (now renamed 3537137 Canada Inc.) which is the related party corporation which originally held the options to the Pebble Project, and which was acquired by the Company to become a 100% subsidiary in fiscal 2006. |

| Hypogene | Processes below the earth's surface which, in mineral deposits, result in precipitation of primary minerals like sulphides. |

Hydrothermal mineral deposit | Any concentration of metallic minerals formed by the precipitation of solids from |

| deposit | hot waters (hydrothermal solution). The solutions may be sourced from a magma or from deeply circulating water heated by magma. |

Intrusion (batholith, dyke, pluton) | Medium to coarse grained igneous bodies which crystallized at depth within the |

| (batholith, dyke, pluton) | Earth's crust. Large intrusive bodies are called batholiths; smaller bodies are plutons and linear bodies are dykes. |

| Leached Cap | Rock which originally contained mineralization that was subsequently removed due to weathering processes. |

| Locked Cycle Test | A repetitive batch flotation test used in mineral processing laboratories while developing a metallurgical flowsheet. |

| |

| Form 20-F Annual Report | P a g e| 4 |

| Elements | Au - Gold; Ag - Silver; Al - Aluminum; Cu - Copper; Fe - Iron; Mo - Molybdenum; Na - Sodium; O - Oxygen; Pb - Lead; S - Sulphur; Zn - Zinc. |

| Monzonite | Igneous intrusive rock with approximately equal amounts of plagioclase and alkali feldspar, and less than 5% quartz by volume. |

National Instrument 43- 10143-101 ("NI 43-101") | The Canadian securities rule which establishes disclosure standards for mineral projects of Canadian resource companies. |

| Kriging | A method of estimation of a variable value (such as metal grade) at an unmeasured location from measured values, weighted by distance and orientation, at nearby locations. |

| Porphyry deposit | A type of mineral deposit genetically related to igneous intrusions in which ore minerals are widely distributed, generally of low grade but commonly of large tonnage. |

| Potassic | Hydrothermal alteration which results in the production of potassium- bearingpotassium-bearing minerals such as biotite, muscovite or sericite, and/or orthoclase. |

| Pyrophyllite | Aluminosilicate hydroxide mineral that forms as a result of hydrothermal alteration or low grade metamorphism. |

| Sodic | In this report, refers to a type of hydrothermal alteration that contains sodium-bearing minerals, most commonly albite feldspar. |

| Subduction | Process by which one tectonic plate moves under another tectonic plate. |

| Supergene | Refers to processes which occur relatively near the surface of the earth which modify or destroy original (hypogene) minerals by oxidation and chemical weathering. |

| Superterrane | A group of physically connected and related geological terranes (group of related rock units). |

CURRENCY AND MEASUREMENT

All currency amounts in this Annual Report are stated in Canadian Dollars unless otherwise indicated. Approximate conversion of metric units into imperial equivalents is as follows:

| Metric Units | Multiply by | Imperial Units |

| hectares | 2.471 | = acres |

| meters | 3.281 | = feet |

| kilometers | 3281 | = feet |

| kilometers | 0.621 | = miles |

| grams | 0.032 | = ounces (troy) |

| tonnes | 1.102 | = tons (short) (2,000 lbs)pounds) |

| grams/tonne | 0.029 | = ounces (troy)/ton |

RESOURCE CATEGORY (CLASSIFICATION) DEFINITIONS

The discussion of mineral deposit classifications in this Annual Report adheres to the mineral resource and mineral reserve definitions and classification criteria developed by the Canadian Institute of Mining ("CIM") 2014. Estimated mineral resources fall into two broad categories dependent on whether the economic viability of them has been established and these are namely "resources" (potential for economic viability) and "reserves" (viable economic production is feasible). Resources are sub-divided into categories depending on the confidence level of the estimate based on level of detail of sampling and geological understanding of the deposit. The categories, from lowest confidence to highest confidence, are inferred resource, indicated resource and measured resource. Reserves are similarly sub-divided by order of confidence into probable (lowest) and proven (highest). These classifications can be more particularly described as follows:

| |

| Form 20-F Annual Report | P a g e| 5 |

| Mineral Resource | A concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. |

| Inferred Mineral Resource | That part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. It has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. |

| Indicated Mineral Resource | That part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. It has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve. |

| Measured Mineral Resource | That part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. It has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve. |

| |

| Form 20-F Annual Report | P a g e| 6 |

|

|

| Mineral Reserve | The economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at Pre- FeasibilityPre-Feasibility or Feasibility level as appropriate that include application of Modifying Factors, which are considerations used to convert Mineral Resources to Mineral Reserves and include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which Mineral Reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully informed as to what is being reported. The public disclosure of a Mineral Reserve must be demonstrated by a Pre-Feasibility Study or Feasibility Study. |

| Probable Mineral Reserve | The economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve. |

| Proven Mineral Reserve | The economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors. |

CAUTIONARY NOTES TO UNITED STATES INVESTORS CONCERNING MINERAL RESERVE AND RESOURCE ESTIMATES

This Annual Report on Form 20-F uses terms that comply with reporting standards in Canada and certain estimates are made in accordance with Canadianthe National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43-101"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this prospectus have been prepared in accordance with NI 43-101. These standards differ significantly from the requirements of the SEC, and resource information contained herein and incorporated by reference herein may not be comparable to similar information disclosed by companies in the United States (“US companies”).

In addition, this Annual Report on Form 20-F uses the terms “measured"measured mineral resources”resources", “indicated"indicated mineral resources”resources" and “inferred"inferred mineral resources”resources" to comply with the reporting standards in Canada.

We advise United States investors that while those terms are recognized and required by Canadian regulations, the SEC does not recognize them. United States investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into mineral reserves. These terms have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility.

Further, “inferred resources”"inferred resources" have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred resources exist. In accordance with Canadian rules, estimates of “inferred"inferred mineral resources”resources" cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

It cannot be assumed that all or any part of “measured"measured mineral resources”resources", “indicated"indicated mineral resources”resources", or “inferred"inferred mineral resources”resources" will ever be upgraded to a higher category. Investors are cautioned not to assume that any part of the reported “measured"measured mineral resources”resources", “indicated"indicated mineral resources”resources", or “inferred"inferred mineral resources”resources" in this prospectus is economically or legally mineable.

| |

| Form 20-F Annual Report | P a g e| 7 |

In addition, disclosure of “contained ounces”"contained ounces" is permitted disclosure under Canadian regulations; however, the SEC only permits issuers to report mineralization as in place tonnage and grade without reference to unit measures.

FORWARD LOOKING STATEMENTS

The Annual Report on Form 20-F includes or incorporates by reference certain statements that constitute “forward-looking statements”"forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995.

TheseForward-looking statements appear in a numberdescribe our future plans, strategies, expectations and objectives, and are generally, but not always, identifiable by use of places in this Form 20-F and include statements regarding our intent, belief or current expectation and that of our officers and directors. These forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. When used in this prospectus or in documents incorporated by reference in this prospectus,the words such as “believe”“may”, “will”, “should”, “continue”, “expect”, “anticipate”, “estimate”, “project”“believe”, “intend”, “expect”, “may”, “will”, “plan”, “should”, “would”, “contemplate”, “possible”, “attempts”, “seeks” and similar expressions are intended to identify or “project” or the negative of these forward-looking statements. All statements in documents incorporated herein,words or other than statements of historical facts that address future production, permitting, reserve potential, exploration drilling, exploitation activities and events or developments that the Company expects are forward-looking statements. These forward-looking statements are based on various factors and were derived utilizing numerous assumptions that could cause our actual results to differ materially from those in the forward-looking statements. Accordingly, you are cautioned not to put undue reliancevariations on these forward-looking statements. Additional forward-lookingwords or comparable terminology. Forward-looking statements contained or incorporated by reference into this Prospectus Supplement include, among others,without limitation, statements regarding:

| • | the outcome of our multi-dimensional strategy to address the Environmental Protection Agency’s pre- emptive regulatory process under Section 404(c) of the Clean Water Act and prepare the Pebble Project to initiate federal and state permitting under the National Environmental Policy Act ("Multi-Dimensional Strategy"); |

| |

| • | the outcome of legal proceedings in which we are engaged; |

| |

| • | our expectations regarding the potential for permitting of a mine at the Pebble Project; |

| |

| • | our expected financial performance in future periods; |

| |

| • | our plan of operations, including our plans to carry out and finance the Multi-Dimensional Strategy activities, exploration and development activities and legal proceedings; |

| |

| • | our ability to raise capital to fund the Multi-Dimensional Strategy activities, exploration and development activities and operational costs; |

| |

| • | our expectations regarding the exploration and development potential of the Pebble Project; and |

| |

| • | factors relating to our investment decisions. |

Forward-looking information is based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. We believe that the assumptions and expectations reflected in such forward-looking information are reasonable.

Key assumptions upon which the Company’s forward-looking information are based include:

| • | that we will be able to secure sufficient capital necessary for the Multi-dimensional Strategy activities, litigation, continued environmental assessment and permitting activities and engineering work which must be completed prior to any potential development of the Pebble Project which would then require engineering and financing in order to advance to ultimate construction; |

| |

| • | that the Company will ultimately be able to demonstrate that a mine at the Pebble Project can be developed and operated in an environmentally sound and socially responsible manner, meeting all relevant federal, state and local regulatory requirements andso that we will be ultimately able to obtain required operating permits;permits authorizing construction of a mine at the Pebble Project; |

| |

| Form 20-F Annual Report | P a g e| 8 |

| • | that the market prices of copper, gold, molybdenum and silver will not further significantly decline or stay depressed for a lengthy period of time; |

| |

| • | that key personnel will continue their employment with us; and |

| |

| • | that we will continue to be able to secure minimal adequate financing on acceptable terms. |

| |

| • | Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Forward looking statements are also subject to the Risk Factor facing the business, any of which could have a material impact on our outlook. |

Some of the risks we face and the uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements include:

| • | a negative outcome of the Multi-Dimensional Strategy, or other legal and political challenges with which we are engaged regarding the Pebble Project, which would have a material adverse effect on the Company; |

| | |

| • | our expected financial performance in future periods; |

| |

• | our plan of operations, including our plans to carry out exploration and development activities; and |

| |

• | our ability to raise capital for exploration and development activities. |

Certain of the assumptions we have made include assumptions regarding, among other things:

• | that we will be ultimately ablean inability to obtain permitting for a mine at the Pebble Project; |

| | |

| • | thatan inability to continue to fund the market prices of copperexploration and gold will not decline significantly nor for a lengthy period of time;development activities and other operating costs; |

| | |

| • | that we will be able to secure sufficient working capital necessary for the continued environmental assessment and permitting activities and engineering work which are preconditions to any potential development of the Pebble Project, which would then require engineering and financing in order to advance to ultimate construction;

|

| |

• | that key personnel will continue their employment with us; |

| |

• | our ability to obtain the necessary expertise in order to carry out our exploration and development activities within the planned time periods; and |

| |

• | our ability to obtain adequate financing on acceptable terms. |

Some of the risks and uncertainties that could cause our actual results to differ materially from those expressed in our forward-looking statements include:

• | we may never obtain permitting for a mine at the Pebble Project for technical, legal or political reasons; |

| |

• | the existence of concerted opposition to the Pebble Project; |

| |

• | our ability to continue to fund our exploration and development activities; |

| |

• | the costs of development and operation of the Pebble Project may be greater than we anticipate; |

| |

• | the speculativehighly cyclical nature of the mineral resource exploration business; |

| | |

| • | the pre-development stage economic and technical uncertainties of the Pebble Project and the lack of known reserves aton the Pebble Project; |

| | |

| • | ouran inability to establish that the Pebble Project contains commercially viable deposits of ore; |

| | |

| • | our ability to continue on a going concern basis; |

| |

• | our abilityan inability to recover the financial statement carrying values of ourthe Pebble Project if the Company ceases to continue on a going concern basis; |

| | |

| • | our historythe potential for loss of financial losses;the services of key executive officers; |

| | |

| • | a history of, and expectation of further, financial losses from operations impacting our ability to continue on a going concern basis; |

| |

| • | the volatility of copper, gold, coppermolybdenum and molybdenumsilver prices and mining share prices; |

| | |

| • | the inherent risk involved in the exploration, development and production of minerals;minerals, and the presence of unknown geological and other physical and environmental hazards at the Pebble Project; |

| | |

| • | the potential for changes in, or the introduction of new, government regulations relating to mining, including laws and regulations relating to the protection of the environment;environment and project legal titles; |

| | |

| • | the presence of unknown environmental hazards atpotential claims by third parties to titles or rights involving the Pebble Project; |

| | |

| • | ourthe possible inability to insure our operations against all risks; |

| | |

| • | the highly competitive nature of ourthe mining business; |

| | |

| • | litigation risksthe potential equity dilution to current shareholders from future equity financings is currently uncertain; and the inherent uncertainty of litigation; |

| | |

•Form 20-F Annual Report | the historical volatility in our share price;P a g e| 9 |

|

| | |

• | the potential dilution to the Company's shareholders resulting from any future equity financings; and |

| |

• | the potential dilution to the Company's shareholders from the exercise of share purchase options to purchase our shares. |

that we have never paid dividends and will not do so in the foreseeable future.

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Forward-looking statements or information are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements or information due to a variety of risks, uncertainties and other factors, including, without limitation, the risks and uncertainties described above.

The Company’sOur forward-looking statements and informationrisk factors are based on the assumptions,reasonable beliefs, expectations and opinions of management as ofon the date of this Prospectus Supplement. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There is no assurance that such statements are made. The Companyinformation will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. We do not undertake to update any forward-looking statements and information, if and when,except as, and to the extent required by, applicable securities laws. Readers should not place undue reliance on forward-looking statements. The forward-looking statements and information contained herein are expressly qualified by this cautionary statement.

For the above reasons, information contained in this Form on 20-F herein containing descriptions of our mineral deposits may not be comparable to similar information made public by US companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

The Company advises you that these cautionary remarks expressly qualify, in their entirety, all forward-looking statements attributable to Northern Dynasty or persons acting on the Company's behalf. The Company assumes no obligation to update the Company's forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such statements. You should carefully review the cautionary statements and risk factors contained in this and other documents that the Company files from time to time with the Securities and Exchange Commission.

STATUS AS AN EMERGING GROWTH COMPANY

The Company is an "emerging growth company" as defined in section 3(a) of the Exchange Act, and the Company will continue to qualify as an "emerging growth company" until the earliest of:

| (a) | the last day of the fiscal year during which the Company has total annual gross revenues of US$1,000,000,000 (as such amount is indexed for inflation every 5 years by the SEC) or more; |

| (b) | the last day of the Company's fiscal year following the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement under the Securities Act; |

| | |

| (c) | the date on which the Company has, during the previous 3-year period, issued more than US$1,000,000,000 in non-convertible debt; or |

| | |

| (d) | the date on which the Company is deemed to be a "large accelerated filer", as defined in Exchange Act Rule 12b–2. |

Northern Dynasty expects to continue to be an emerging growth company until December 31, 2020.

Generally, a registrant that registers any class of its securities under section 12 of the Exchange Act is required to include in the second and all subsequent annual reports filed by it under the Exchange Act, a management report on internal control over financial reporting and, subject to an exemption available to registrants that are neither an "accelerated filer" or a "larger accelerated filer" (as those terms are defined in Exchange Act Rule 12b-2), an auditor attestation report on management's assessment of internal control over financial reporting. However, for so long as the Company continues to qualify as an emerging growth company, the Company will be exempt from the requirement to include an auditor attestation report in its annual reports filed under the Exchange Act, even if it were to qualify as an "accelerated filer" or a "larger accelerated filer". In addition, auditors of an emerging growth company are exempt from the rules of the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor's report in which the auditor would be required to provide additional information about the audit and the financial statements of the registrant (auditor discussion and analysis).

The Company has irrevocably elected to comply with new or revised accounting standards even though it is an emerging growth company.

| |

| Form 20-F Annual Report | P a g e| 10 |

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

Not applicable for an Annual Report.

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable for an Annual Report.

| A. | SELECTED FINANCIAL DATA |

The following tables summarize selected financial data for Northern Dynasty derived from the Company's audited financial statements, expressed in thousands of Canadian Dollars, and which have been prepared in accordance with and using accounting policies in compliance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB"). This selected financial data should be read in conjunction with the Company's audited financial statements for the fiscal years then ended.

Statements of Financial Position Data

| ($ 000’s) | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Mineral property, plant and equipment, net | $ | 123,608 | | $ | 108,050 | | $ | 1,055 | | $ | 1,055 | | $ | 1,055 | | $ | 147,088 | | $ | 123,608 | | $ | 108,050 | | $ | 1,055 | | $ | 1,055 | |

| Total assets | | 135,510 | | | 141,784 | | | 132,934 | | | 145,241 | | | 144,247 | | | 157,704 | | | 135,510 | | | 141,784 | | | 132,934 | | | 145,241 | |

| Total liabilities | | 7,547 | | | 7,856 | | | 4,041 | | | 3,885 | | | 4,187 | | | 2,724 | | | 7,547 | | | 7,856 | | | 4,041 | | | 3,885 | |

| Working capital | | 5,869 | | | 29,681 | | | 32,134 | | | 42,474 | | | 43,332 | | | 7,892 | | | 5,869 | | | 29,681 | | | 32,134 | | | 42,474 | |

| Share capital | | 389,227 | | | 389,227 | | | 389,189 | | | 388,987 | | | 380,570 | | | 435,069 | | | 389,227 | | | 389,227 | | | 389,189 | | | 388,987 | |

| Reserves | | 84,031 | | | 58,649 | | | 51,129 | | | 48,132 | | | 35,114 | | | 99,035 | | | 84,031 | | | 58,649 | | | 51,129 | | | 48,132 | |

| Accumulated deficit | | (345,295 | ) | | (313,948 | ) | | (311,425 | ) | | (295,763 | ) | | (275,624 | ) | | (379,124 | ) | | (345,295 | ) | | (313,948 | ) | | (311,425 | ) | | (295,763 | ) |

| Net assets | | 127,963 | | | 133,928 | | | 128,893 | | | 141,356 | | | 140,060 | | | 154,980 | | | 127,963 | | | 133,928 | | | 128,893 | | | 141,356 | |

| Shareholders' equity | | 127,963 | | | 133,928 | | | 128,893 | | | 141,356 | | | 140,060 | | | 154,980 | | | 127,963 | | | 133,928 | | | 128,893 | | | 141,356 | |

| |

| Form 20-F Annual Report | P a g e| 11 |

-10 - |

| |

Statements of Comprehensive Loss (Income) Data

| ($ 000’s, except per share amounts and number of shares) | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Interest and other income | $ | (281 | ) | $ | (1,136 | ) | $ | (887 | ) | $ | (944 | ) | $ | (544 | ) | $ | (313 | ) | $ | (281 | ) | $ | (1,136 | ) | $ | (887 | ) | $ | (944 | ) |

| General and administrative expenses | | 17,384 | | | 6,245 | | | 6,780 | | | 6,168 | | | 4,456 | | |

| Exploration expenditures | | 12,877 | | | 1,991 | | | 4,461 | | | 819 | | | 1,800 | | | 8,718 | | | 12,877 | | | 1,991 | | | 4,461 | | | 819 | |

| General and administrative expenses(1)(2) | | | 8,272 | | | 9,059 | | | 5,970 | | | 6,525 | | | 5,840 | |

| Legal, accounting and audit(1) | | | 17,001 | | | 8,325 | | | 275 | | | 255 | | | 328 | |

| Share-based payments | | 3,877 | | | 641 | | | 5,225 | | | 14,205 | | | 8,373 | | | 903 | | | 3,877 | | | 641 | | | 5,225 | | | 14,205 | |

| Other | | (221 | ) | | (340 | ) | | 83 | | | (58 | ) | | – | | | 762 | | | (221 | ) | | (340 | ) | | 83 | | | (58 | ) |

| Gain on discontinuance of equity method | | – | | | (5,062 | ) | | – | | | – | | | – | | | – | | | – | | | (5,062 | ) | | – | | | – | |

| Deferred income tax | | (2,289 | ) | | 184 | | | – | | | (51 | ) | | 30 | | | (1,514 | ) | | (2,289 | ) | | 184 | | | – | | | (51 | ) |

| Net loss for the year | | 31,347 | | | 2,523 | | | 15,662 | | | 20,139 | | | 14,115 | | | 33,829 | | | 31,347 | | | 2,523 | | | 15,662 | | | 20,139 | |

| Other comprehensive (income) loss | | (9,953 | ) | | (6,887 | ) | | 2,123 | | | (2,153 | ) | | 5,428 | | | (23,187 | ) | | (9,953 | ) | | (6,887 | ) | | 2,123 | | | (2,153 | ) |

| Total comprehensive loss (income) | | 21,394 | | | (4,364 | ) | | 17,785 | | | 17,986 | | | 19,543 | | | 10,642 | | | 21,394 | | | (4,364 | ) | | 17,785 | | | 17,986 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted net loss per share | $ | 0.33 | | $ | 0.03 | | $ | 0.16 | | $ | 0.21 | | $ | 0.15 | | $ | 0.23 | | $ | 0.33 | | $ | 0.03 | | $ | 0.16 | | $ | 0.21 | |

| Weighted average number of common shares outstanding | | 95,009,864 | | | 95,007,374 | | | 94,993,717 | | | 94,851,589 | | | 93,778,967 | | | 146,313,397 | | | 95,009,864 | | | 95,007,374 | | | 94,995,127 | | | 94,851,589 | |

Note

| 1. | Comparative information in the statement of loss and comprehensive loss has been reclassified to separately reflect legal, accounting and audit expenditures as a separate line item. This line item is predominantly comprised of legal costs incurred by the Group in response to the EPA’s activities surrounding the Pebble Project. These expenditures were previously included under general and administrative expenditures. |

| |

| 2. | The breakdown of these costs are presented below. The latest three years are discussed under Item 5. |

| | General and administrative expenses | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| | Conference and travel | $ | 369 | | $ | 323 | | $ | 340 | | $ | 566 | | $ | 525 | |

| | Consulting | | 232 | | | 782 | | | 836 | | | 1,761 | | | – | |

| | Donations | | – | | | – | | | – | | | – | | | 866 | |

| | Insurance | | 398 | | | 384 | | | 342 | | | 343 | | | 296 | |

| | Office costs | | 1,188 | | | 1,964 | | | 670 | | | 702 | | | 980 | |

| | Management and administration | | 5,009 | | | 4,610 | | | 2,572 | | | 2,095 | | | 2,334 | |

| | Shareholder communication | | 759 | | | 772 | | | 983 | | | 830 | | | 517 | |

| | Trust and filing | | 317 | | | 224 | | | 227 | | | 228 | | | 322 | |

| | | | 8,272 | | | 9,059 | | | 5,970 | | | 6,525 | | | 5,840 | |

Currency and Exchange Rates

On May 11, 2015,April 18, 2016, the rate of exchange of the Canadian Dollar, based on the daily noon rate in Canada as published by the Bank of Canada, was US$1.00 = C$1.2107.1.2815. Exchange rates published by the Bank of Canada, available on its websitewww.bankofcanada.ca, are nominal quotations — not buying or selling rates — and are intended for statistical or analytical purposes.

| |

| Form 20-F Annual Report | P a g e| 12 |

The following tables set out the exchange rates, based on the daily noon rates in Canada as published by the Bank of Canada for the conversion of Canadian Dollars into U.S. Dollars.

| | Year Ended December 31 (Canadian Dollars per U.S. Dollar) |

| | 2014 | 2013 | 2012 | 2011 | 2010 |

| Rate at end of year | $ 1.1601 | $ 0.9402 | $ 1.0051 | $ 0.9833 | $ 0.9946 |

| Average rate for year | $ 1.1046 | $ 0.9711 | $ 1.0004 | $ 1.0110 | $ 1.0303 |

| High for year | $ 1.1656 | $ 1.0165 | $ 1.0299 | $ 1.0583 | $ 1.0745 |

| Low for year | $ 1.0639 | $ 0.9342 | $ 0.9599 | $ 0.9430 | $ 0.9946 |

| Monthly High and Low Exchange Rate (Canadian Dollar per U.S. Dollar) |

| | High | Low |

| May 2015 (to May 11, 2015) | $ 1.2192 | $ 1.2009 |

| April 2015 | $ 1.2612 | $ 1.1954 |

| March 2015 | $ 1.2803 | $ 1.2440 |

| February 2015 | $ 1.2635 | $ 1.2403 |

| January 2015 | $ 1.2717 | $ 1.1728 |

| December 2014 | $ 1.1643 | $ 1.1344 |

| | Year Ended December 31 (Canadian Dollars per U.S. Dollar) |

| | 2015 | 2014 | 2013 | 2012 | 2011 |

| Rate at end of year | $1.3840 | $1.1601 | $0.9402 | $1.0051 | $0.9833 |

| Average rate for year | $1.2787 | $1.1046 | $0.9711 | $1.0004 | $1.0110 |

| High for year | $1.3990 | $1.1656 | $1.0165 | $1.0299 | $1.0583 |

| Low for year | $1.1728 | $1.0639 | $0.9342 | $0.9599 | $0.9430 |

| Monthly High and Low Exchange Rate (Canadian Dollar per U.S. Dollar) |

| Month or Period | High | Low |

| April 2016 (to April 18, 2016) | $1.3170 | $1.2792 |

| March 2016 | $1.3468 | $1.2962 |

| February 2016 | $1.4040 | $1.3523 |

| January 2016 | $1.4589 | $1.3969 |

| December 2015 | $1.3990 | $1.3360 |

| November 2015 | $1.3360 | $1.3095 |

| B. | CAPITALIZATION AND INDEBTEDNESS |

Not applicable for an Annual Report.

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable for an Annual Report.

The securities of Northern Dynasty are highly speculative and subject to a number of risks. A prospective investor or other person reviewing Northern Dynasty for a prospective investor should not consider an investment in Northern Dynasty unless the investor is capable of sustaining an economic loss of their entire investment. The risks associated with Northern Dynasty’s business include:

Inability to Achieve Mine Permitting of the Pebble Project

The principal risk facing the Company is that it will be ultimately be unable to secure the necessary permits under United States Federal and Alaskan State laws to build a mine at Pebble. There are prominent and well organized opponents of the Pebble Project and the Company may be unable, despite developing solid scientific and technical evidence of risk mitigation, to overcome such opposition and convince mining regulatory authorities that a mine should be permitted at Pebble. If we are unable to secure the necessary permits to build a mine at the Pebble Project, we may be unable to achieve revenues from operations and/or recover our investment in the Pebble Project.

| |

| Form 20-F Annual Report | P a g e| 13 |

The Company will be required to seek additional capital; the Company’s inability to obtain additional capital could have a material adverse effect on its operations

While the Company has prioritized the available resources in order to meet key corporate and Pebble Project expenditure requirements, the Company will seek to source significant additional financing. Such financing may include any of, or a combination of: debt, equity and/or contributions from possible new Pebble Project participants. In light of the recent significant depreciation of the Canadian dollar and that the vast majority of the Company’s expenditures are in United States dollars, that the Pebble Project will require additional engineering and technical expenditures beyond what is contemplated in the current budget, and the possibility that expenditures to pursue the Company’s Multi-Dimensional Strategy, including legal expenditures may exceed current budget expectations, it is possible that additional financing may well be required. There can be no assurances that the Company will be successful in obtaining any such additional financing. If the Company is unable to raise the necessary capital resources to meet obligations as they come due, the Company will at some point have to further reduce or curtail its operations.

Negative Operating Cash Flow

The Company currently has a negative operating cash flow and will continue to have that for the foreseeable future. Accordingly, the Company will require substantial additional capital in order to fund its future exploration and development activities. The Company does not have any arrangements in place for this funding and there is no assurance that such funding will be achieved when required. Any failure to obtain additional financing or failure to achieve profitability and positive operating cash flows will have a material adverse effect on its financial condition and results of operations.

The Company believes it is likely a "passive foreign investment company" which may have adverse U.S. federal income tax consequences for U.S. shareholders.

U.S. shareholders should be aware that the Company believes it was classified as a passive foreign investment company ("PFIC") during one or more previous tax years, and may be a PFIC in the current tax year and possibly in subsequent tax years. If the Company is a PFIC for any tax year during a U.S. shareholder's holding period, then such U.S. shareholder generally will be required to treat any gain realized upon a disposition of common shares, or any so-called "excess distribution" received on its common shares, as ordinary income, and to pay an interest charge on a portion of such gain or distributions, unless the shareholder makes a timely and effective "qualified electing fund" election or a "mark-to-market" election with respect to the common shares. A U.S. shareholder who makes a qualified electing fund election generally must report on a current basis its share of the Company's net capital gain and ordinary earnings for any tax year in which the Company is a PFIC, whether or not the Company distributes any amounts to its shareholders. A U.S. shareholder who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the common shares over the taxpayer's basis therein. This paragraph is qualified in its entirety by the discussion below under the heading "Certain United States Federal Income Tax Considerations." Each U.S. shareholder should consult its own tax advisor regarding the PFIC rules and the U.S. federal income tax consequences of the acquisition, ownership, and disposition of common shares.

| |

| Form 20-F Annual Report | P a g e| 14 |

The Pebble Project is Subject to Political and Environmental Regulatory Opposition

As is typical for a large scale mining project, the Pebble Project faces concerted opposition from many individuals and organizations who are motivated to preclude any possible mining in the Bristol Bay Watershed ("BBW"(“BBW”). The BBW is an important wildlife and salmon habitat area. The United States Environmental Protection Agency has gone so far as to suggest that it may peremptorily prevent the Pebble Project from proceeding even before a mine permitting application is filed. Accordingly one of the greatest risks to the Pebble Project is seen to be political/permitting risk which may ultimately preclude construction of a mine at Pebble.

In the event that we are unsuccessful in our litigation against the Environmental Protection Agency, or are otherwise unable to reach a settlement with the federal agency, we may never be able to proceed with permitting with respect to the Pebble Project.

The principal risk currently facing the Company is that we may be unable to settle our ongoing issues with the Environmental Protection Agency (the “EPA”) with respect to its regulatory action under Section 404(c) of the U.S. Clean Water Act. While we believe our position has merit, the proceedings have been lengthy and have required us to expend substantial funds and time. There can be no assurance that the funds allocated for combating the EPA action will be sufficient to bring our strategy to completion and we may be unable to raise additional funds, causing us to abandon our strategy. Further, even if we are able to raise sufficient funds to bring our strategy to completion, there is no assurance that we will ultimately be successful. In the event that we are unsuccessful, and the EPA’s regulatory action is upheld, we will be unable to proceed with permitting of the Pebble Project and the Company will be materially adversely affected.

Northern Dynasty will require additional funding to meet the development objectives of the Pebble Project.

Northern Dynasty will need to raise additional financing (share issuances, debt or asset level partnering) to achieve permitting and development of the Pebble Project. In addition, a positive production decision at the Pebble Project would require significant capital for project engineering and construction. Accordingly, the continuing development of the Pebble Project will depend upon Northern Dynasty’s ability to obtain financing through debt financing, equity financing, the joint venturing of the project, or other means.sources of financing. There can be no assurance that Northern Dynasty will be successful in obtaining the required financing, or that it will be able to raise the funds on terms that do not result in high levels of dilution to shareholders.

The Pebble Partnership’s mineral property interests do not contain any ore reserves or any known body of economic mineralization.

Although there are known bodies of mineralization on the Pebble Project, and the Pebble Partnership has completed core drilling programs within, and adjacent to, the deposits to determine measured and indicated resources, there are currently no known reserves or body of commercially viable ore and the Pebble Project must be considered an exploration prospect only. Extensive additional work is required before Northern Dynasty or the Pebble Partnership can ascertain if any mineralization may be economic and hence constitute "ore".

Mineral Resources disclosed by Northern Dynasty or the Pebble Partnership for the Pebble Project are estimates only.

Northern Dynasty has included mineral resource estimates that have been made in accordance with National Instrument 43-101. These resource estimates are classified as "measured resources", "indicated resources" and "inferred resources". Northern Dynasty advises investors that while these terms are mandated by Canadian securities administrators, the U.S. Securities and Exchange Commission does not recognize these terms. Investors are cautioned not to assume that any part or all of mineral deposits classified as "measured resources" or "indicated resources" will ever be converted into ore reserves. Further, "inferred resources" have a great amount of uncertainty as to their existence, and economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or prefeasibility studies, except in rare cases. Investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally mineable.

All amounts of mineral resources are estimates only, and Northern Dynasty cannot be certain that any specified level of recovery of metals from the mineralized material will in fact be realized or that the Pebble Project or any other identified mineral deposit will ever qualify as a commercially mineable (or viable) ore body that can be economically exploited. Mineralized material which is not mineral reserves does not have demonstrated economic viability. In addition, the quantity of mineral reserves and mineral resources may vary depending on, among other things, metal prices and actual results of mining. There can be no assurance that any future economic or technical assessments undertaken by the Company with respect to the Pebble Project will demonstrate positive economics or feasibility.

| |

| Form 20-F Annual Report | P a g e| 15 |

Northern Dynasty has no history of earnings and no foreseeable earnings, and may never achieve profitability or pay dividends.

Northern Dynasty has only had losses since inception and there can be no assurance that Northern Dynasty will ever be profitable. Northern Dynasty has paid no dividends on its shares since incorporation. Northern Dynasty presently has no ability to generate earnings as its mineral properties are in the pre-development stage.

Northern Dynasty’s consolidated financial statements have been prepared assuming Northern Dynasty willmay not be able to continue onas a going concern basis.concern.

Northern Dynasty’s consolidated financial statements have been prepared on the basis that Northern Dynasty will continue as a going concern. At December 31, 2014,2015, Northern Dynasty had working capital of approximately $9.4$7.9 million. Northern Dynasty has prioritized the allocation of available financial resources in order to meet key corporate and Pebble Project expenditure requirements in fiscal 2015.the near term. Additional financing will be required to pursue any materialfor continued corporate expenditures and expenditures at the Pebble Project. Northern Dynasty’s continuing operations and the underlying value and recoverability of the amounts shown for mineral property interest are entirely dependent upon the existence of economically recoverable mineral reserves at the Pebble Project, the ability of the Company to finance its operating costs, the completion of the exploration and development of the Pebble Project, the Pebble Partnership obtaining the necessary permits to mine, and on future profitable production at the Pebble Project. Furthermore, failure to continue as a going concern would require that Northern Dynasty's assets and liabilities be restated on a liquidation basis, which would likely differ significantly from their going concern assumption carrying values.

As the Pebble Project is Northern Dynasty’s principal mineral property interest, the failure to establish that the Pebble Project possesses commercially viable and legally mineable deposits of ore may cause a significant decline in the trading price of Northern Dynasty’s common shares and reduce its ability to obtain new financing.

The Pebble Project is, through the Pebble Partnership, Northern Dynasty’s principal mineral property interest. Northern Dynasty’s principal business objective is to carry out further exploration and related activities to establish whether the Pebble Project possesses commercially viable deposits of ore. If Northern Dynasty is not successful in its plan of operations, Northern Dynasty may have to seek a new mineral property to explore or acquire an interest in a new mineral property or project. Northern Dynasty anticipates that such an outcome would possibly result in further declines in the trading price of Northern Dynasty’s common shares. Furthermore, Northern Dynasty anticipates that its ability to raise additional financing to fund exploration of a new property or the acquisition of a new property or project would be impaired as a result of the failure to establish commercial viability of the Pebble Project.

If prices for copper, gold, molybdenum and molybdenumsilver decline, Northern Dynasty may not be able to raise the additional financing required to fund expenditures for the Pebble Project.

The ability of Northern Dynasty to raise financing to fund the Pebble Project, will be significantly affected by changes in the market price of the metals for which it explores. The prices of copper, gold, molybdenum and molybdenumsilver are volatile, and are affected by numerous factors beyond Northern Dynasty’s control. The level of interest rates, the rate of inflation, the world supplies of and demands for copper, gold, molybdenum and molybdenumsilver and the stability of exchange rates can all cause fluctuations in these prices. Such external economic factors are influenced by changes in international investment patterns and monetary systems and political developments. The prices of copper, gold, molybdenum and molybdenumsilver have fluctuated in recent years, and future significant price declines could cause investors to be unprepared to finance exploration of copper, gold, molybdenum and molybdenum,silver, with the result that Northern Dynasty may not have sufficient financing with which to fund its exploration activities

| |

| Form 20-F Annual Report | P a g e| 16 |

Northern Dynasty competes with larger, better capitalized competitors in the mining industry.

The mining industry is competitive in all of its phases, including financing, technical resources, personnel and property acquisition. It requires significant capital, technical resources, personnel and operational experience to effectively compete in the mining industry. Because of the high costs associated with exploration, the expertise required to analyze a project’s potential and the capital required to develop a mine, larger companies with significant resources may have a competitive advantage over Northern Dynasty. Northern Dynasty faces strong competition from other mining companies, some with greater financial resources, operational experience and technical capabilities than Northern Dynasty possesses. As a result of this competition, Northern Dynasty may be unable to maintain or acquire financing, personnel, technical resources or attractive mining properties on terms Northern Dynasty considers acceptable or at all.

Compliance with environmental requirements will take considerable resources and changes to these requirements could significantly increase the costs of developing the Pebble Project and could delay these activities.

The Pebble Partnership and Northern Dynasty must comply with stringent environmental legislation in carrying out work on the Pebble Project. Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Changes in environmental legislation could increase the cost to the Pebble Partnership of carrying out its exploration and, if warranted, development of the Pebble Project. Further, compliance with new or additional environmental legislation may result in delays to the exploration and, if warranted, development activities.

Changes in government regulations or the application thereof and the presence of unknown environmental hazards on Northern Dynasty’s mineral properties may result in significant unanticipated compliance and reclamation costs.

Government regulations relating to mineral rights tenure, permission to disturb areas and the right to operate can adversely affect Northern Dynasty. Northern Dynasty and the Pebble Partnership may not be able to obtain all necessary licenses and permits that may be required to carry out exploration at our projects. Obtaining the necessary governmental permits is a complex, time-consuming and costly process. The duration and success of efforts to obtain permits are contingent upon many variables not within our control. Obtaining environmental permits may increase costs and cause delays depending on the nature of the activity to be permitted and the interpretation of applicable requirements implemented by the permitting authority. There can be no assurance that all necessary approvals and permits will be obtained and, if obtained, that the costs involved will not exceed those that we previously estimated. It is possible that the costs and delays associated with the compliance with such standards and regulations could become such that we would not proceed with the development or operation of a mine at the Pebble Project. Refer to further discussion inItem 8 - A3. Legal Proceedings.

| |

| Form 20-F Annual Report | P a g e| 17 |

-14 - |

| |

Litigation

The Company is currently and may in future be subject to legal proceedings in the development of its Pebble Project. Given the uncertain nature of these actions, the Company cannot reasonably predict the outcome thereof. If the Company is unable to resolve these matters favorably it may have a material adverse effect of the Company.

Northern Dynasty is subject to many risks that are not insurable and, as a result, Northern Dynasty will not be able to recover losses through insurance should such certain events occur.

Hazards such as unusual or unexpected geological formations and other conditions are involved in mineral exploration and development. Northern Dynasty may become subject to liability for pollution, cave-ins or hazards against which it cannot insure. The payment of such liabilities could result in increase in Northern Dynasty’s operating expenses which could, in turn, have a material adverse effect on Northern Dynasty’s financial position and its results of operations. Although Northern Dynasty and the Pebble Partnership maintain liability insurance in an amount which we consider adequate, the nature of these risks is such that the liabilities might exceed policy limits, the liabilities and hazards might not be insurable against, or Northern Dynasty and the Pebble Partnership might elect not to insure itself against such liabilities due to high premium costs or other reasons, in which event Northern Dynasty could incur significant liabilities and costs that could materially increase Northern Dynasty’s operating expenses.

The market price of Northern Dynasty’s common shares is subject to high volatility and could cause investor loss.

The market price of a publicly traded stock, especially a resource issuer like Northern Dynasty, is affected by many variables in addition to those directly related to exploration successes or failures. Such factors include the general condition of markets for resource stocks, the strength of the economy generally, the availability and attractiveness of alternative investments, and the breadth of the public markets for the stock. The effect of these and other factors on the market price of the Company’s common shares suggests Northern Dynasty’s shares will continue to be volatile. Therefore, investors could suffer significant losses if Northern Dynasty’s shares are depressed or illiquid when an investor seeks liquidity and needs to sell Northern Dynasty shares.

If Northern Dynasty loses the services of the key personnel that it engages to undertake its activities, then Northern Dynasty’s plan of operations may be delayed or be more expensive to undertake than anticipated.

Northern Dynasty’s success depends to a significant extent on the performance and continued service of certain independent contractors, including Hunter Dickinson Services Inc. ("HDSI"). The Company has access to the full resources of HDSI, an experienced exploration and development firm with in-house geologists, engineers and environmental specialists, to assist in its technical review of the Pebble Project. There can be no assurance that the services of all necessary key personnel will be available when required or if obtained, that the costs involved will not exceed those that we previously estimated. It is possible that the costs and delays associated with the loss of services of key personnel could become such that we would not proceed with the development or operation of a mine at the Pebble Project.

| |

| Form 20-F Annual Report | P a g e| 18 |

| ITEM 4 | INFORMATION ON THE COMPANY |

| A. | HISTORY AND DEVELOPMENT OF THE COMPANY |

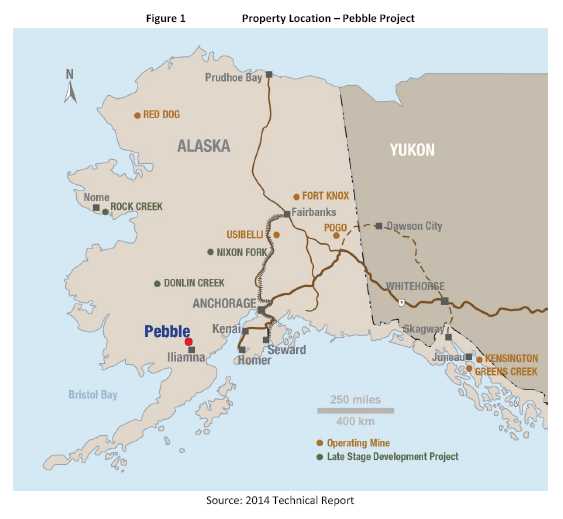

Incorporation

Northern Dynasty is a mineral exploration company incorporated on May 11, 1983 pursuant to the Company Act of the Province of British Columbia (predecessor statute to the British Columbia Corporations Act in force since 2004), under the name "Dynasty Resources Inc.". On November 30, 1983 the Company changed its name to "Northern Dynasty Explorations Ltd." and subsequently, on October 11, 1997, changed its name to Northern Dynasty Minerals Ltd. Northern Dynasty became a reporting company in the Province of British Columbia on April 10, 1984 and was listed on the Vancouver Stock Exchange (now the TSX Venture Exchange and herein generally "TSX Venture") from 1984-1987, listed on the Toronto Stock Exchange from 1987-1993, and unlisted but continued to comply with its continuous disclosure obligations from 1993 to 1994, and thereupon listed on TSX Venture from 1994 to October 30, 2007 when it began trading on the Toronto Stock Exchange ("TSX"). In November 2004, the common shares of Northern Dynasty were also listed on the American Stock Exchange ("AMEX"). AMEX was purchased by the New York Stock Exchange ("NYSE") and the Company now trades on the NYSE MKT Exchange ("NYSE MKT").

Offices

The head office of Northern Dynasty is located at Suite 1500, 1040 West Georgia Street, Vancouver, British Columbia, Canada V6E 4H1, telephone (604) 684-6365, facsimile (604) 684-8092. The Company’s legal registered office is in care of its Canadian attorneys, McMillan LLP, Barristers & Solicitors, at Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia, Canada V6E 4N7, telephone (604) 689-9111, facsimile (604) 685-7084.

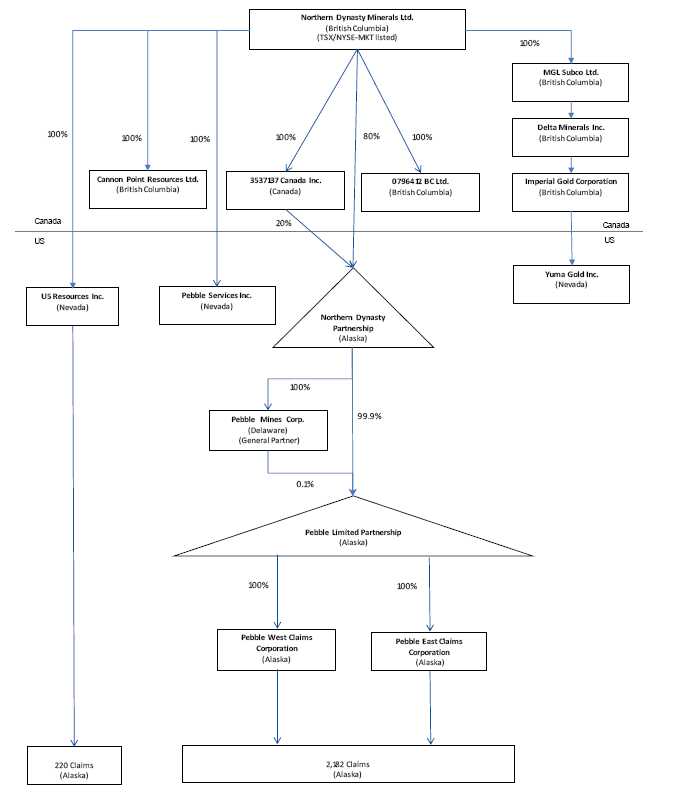

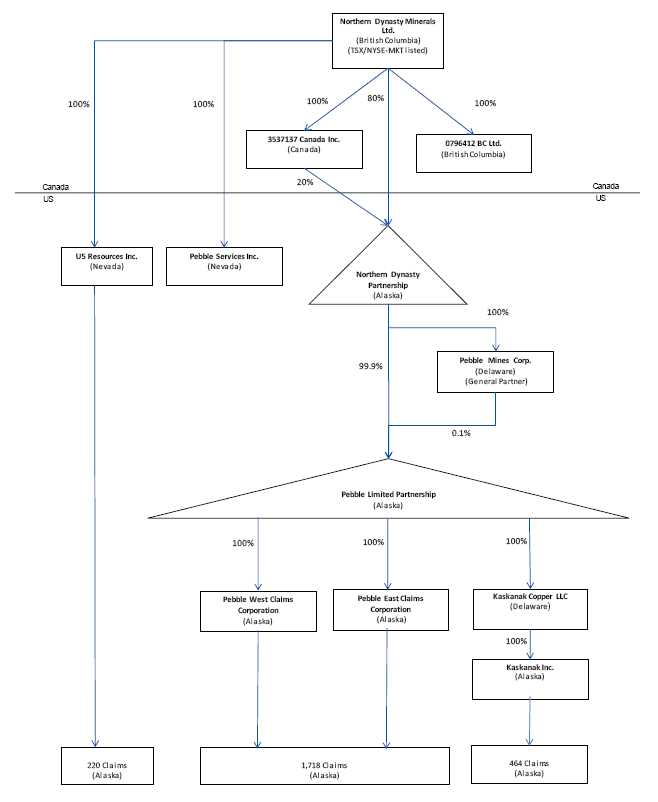

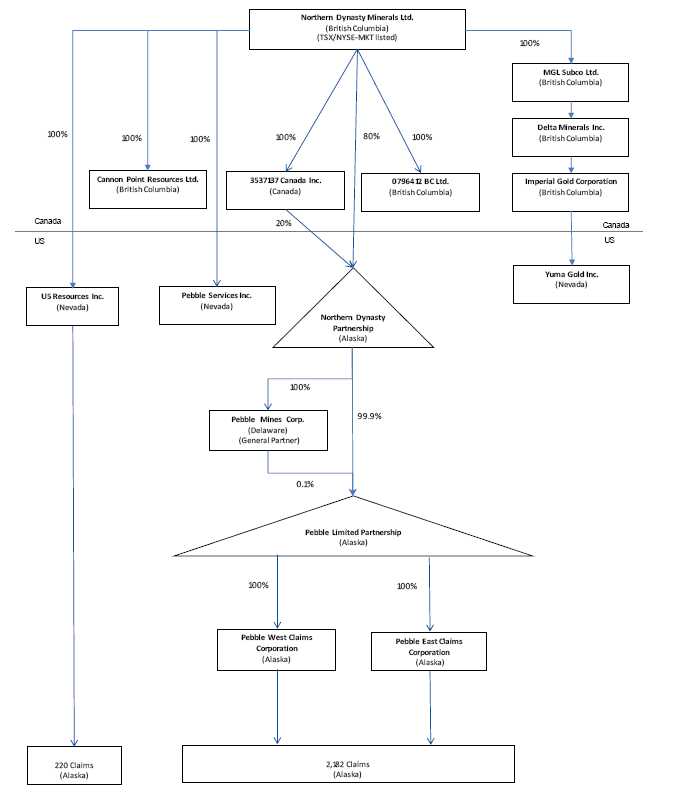

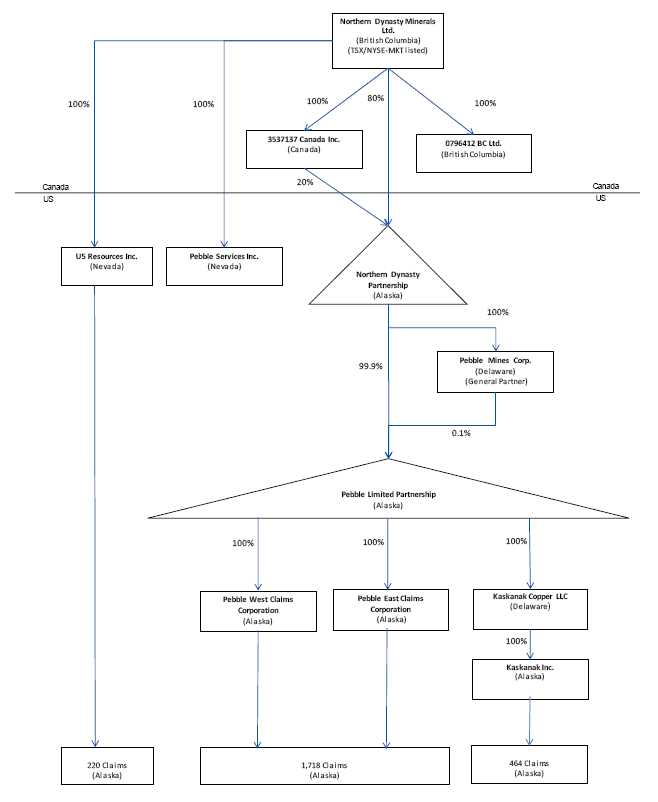

The Company’s Alaska mineral resource exploration business is operated through an Alaskan registered limited partnership, the Pebble Limited Partnership (the "Pebble Partnership" or "PLP"), in which the Company (since December 2013) owns a 100% interest through subsidiary entities. A 100% subsidiary of the Company, Pebble Mines Corp. is the general partner of the Pebble Partnership and responsible for its day-to-day operations. The business address of the Northern Dynasty Partnership is Suite 602, 3201 C Street, Anchorage, Alaska, USA, 99503.

Company Development

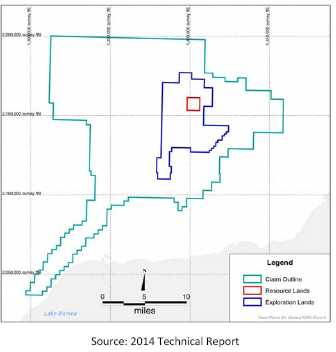

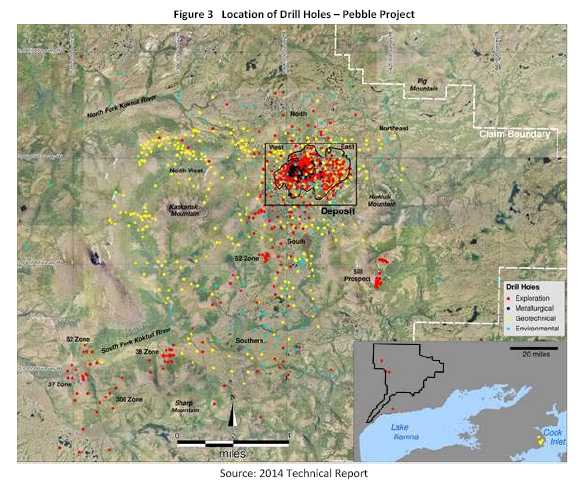

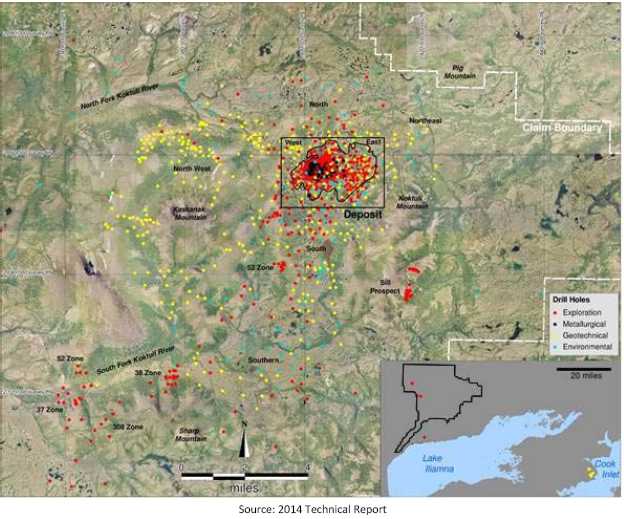

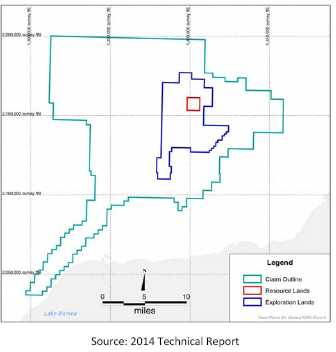

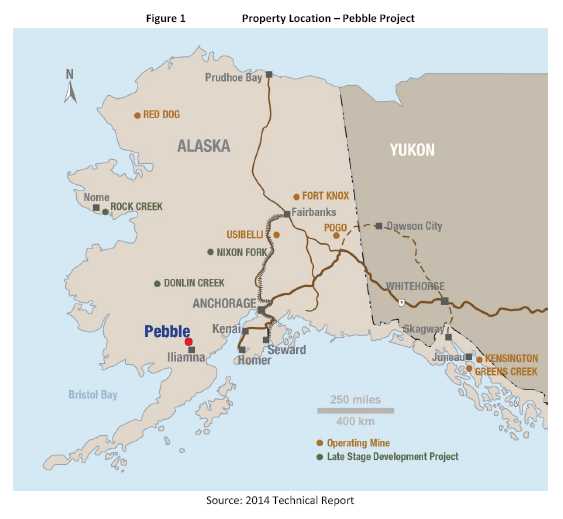

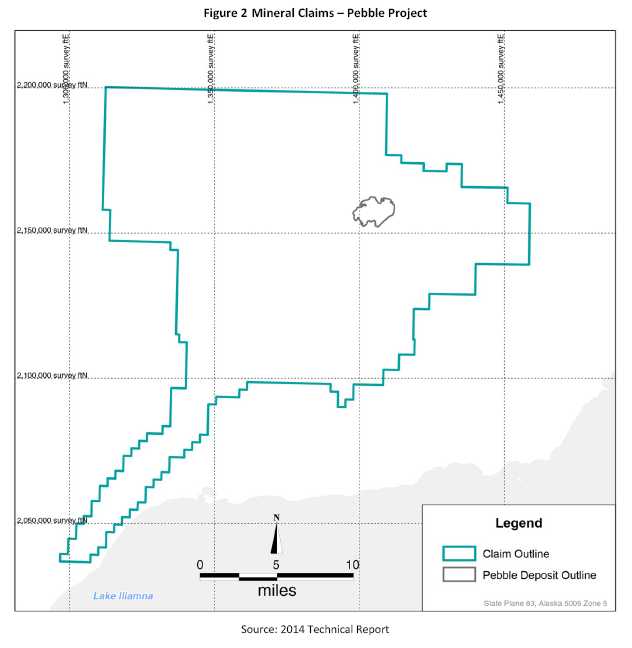

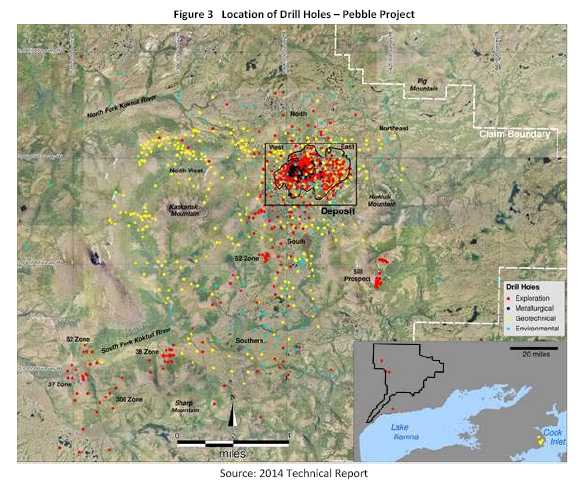

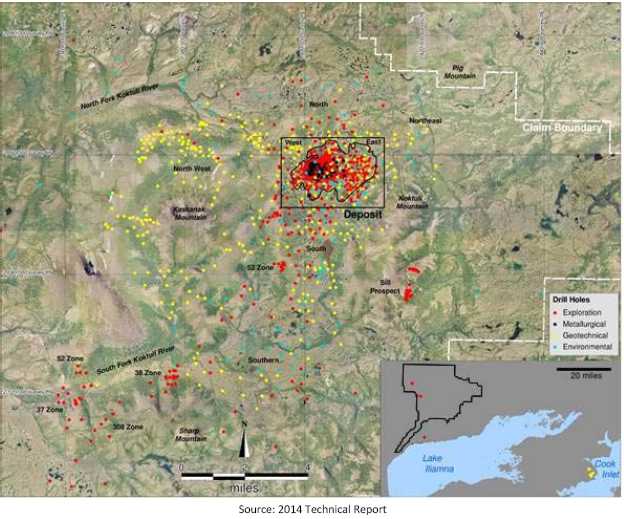

Northern Dynasty is a mineral exploration company focused on developing the Pebble Project, a copper-gold-molybdenumcopper-gold-molybdenum-silver mineral project. The Pebble Project is located in southwest Alaska, approximately 200 miles (320 kilometers) southwest of the city of Anchorage.

To December 31, 2014,2015, approximately $797$806 million (US$744752 million)1 in expenditures have been incurred on the Pebble Project. Of this amount, approximately $595 million (US$573 million) in funding was provided to the Pebble Partnership by an affiliate of Anglo American plc ("Anglo American") and expended from 2007 to December 10, 2013 after which time Northern Dynasty re-acquired Anglo American’s 50% ownership interest in the Pebble Partnership on the latter’s withdrawal. Prior to the formation of the Pebble Partnership in 2007, Northern Dynasty had spent approximately $188 million on exploration activities and a further $106 million in acquisition costs on the Pebble Project.

_____________________________

1 During the period 2007 to 2013, the Pebble Partnership expended several hundred million dollars on the Pebble Project, a major portion of which was spent on exploration programs, resource estimates, environmental data collection and technical studies, with a significant portion spent on engineering of various possible mine development models, as well as related infrastructure, power and transportation systems. As a consequence of several factors, including the Environmental Protection Agency Clean Water Act 404(c) action on the Pebble Project, the withdrawal of Anglo American plc from the project and the passage of time, technical and engineering studies related to mine-site and infrastructure development are considered to have very uncertain and perhaps little value at this time. Environmental baseline studies and data collection remains a significant legacy asset of the Company from this period.

| |

| Form 20-F Annual Report | P a g e| 19 |

Northern Dynasty does not have any operating revenue, although currently and historically it has had non-material annual interest revenue as a consequence of investing its surplus funds.

Significant Acquisitions, Dispositions and Group Reorganization

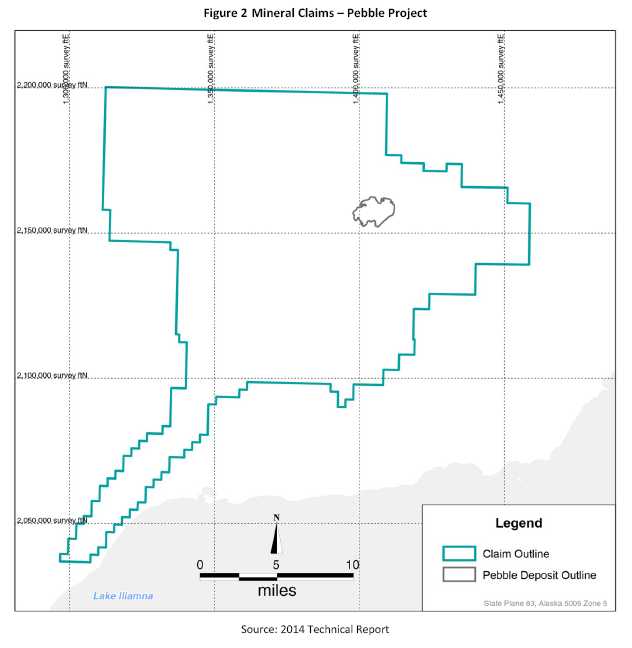

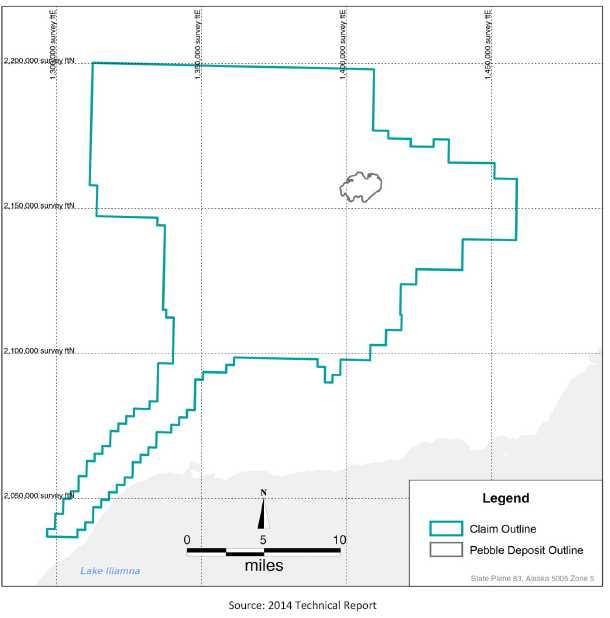

Northern Dynasty via 100% owned subsidiaries and other entities holds indirect interests in mineral claims on State land in southwest Alaska, USA. These claims (including certain area claims) form what is referred to as the Pebble Copper-Gold-MolybdenumCopper-Gold-Molybdenum-Silver Project (the "Pebble Project").

Pebble Limited Partnership and Pebble Project

On July 26, 2007, the Company converted a wholly-owned general partnership that held its Pebble Project interests into a limited partnership, the Pebble Partnership. The purpose of the Pebble Partnership is to engineer, permit, construct and operate a modern, long-life mine at the Pebble Project.

1 During the period 2007 to 2013, the Pebble Partnership expended several hundred million dollars on the Pebble Project, a major portion of which was spent on exploration programs, resource estimates, environmental data collection and technical studies, with a significant portion spent on engineering of various possible mine development models, as well as related infrastructure, power and transportation systems. As a consequence of several factors, including the Environmental Protection Agency (the "EPA") opposition to the Pebble Project, the withdrawal of Anglo American plc from the project and the passage of time, technical and engineering studies related to mine-site and infrastructure development are considered to have very uncertain and perhaps little value at this time. Environmental baseline studies and data collection remains a significant legacy asset of the Company from this period.

Anglo American through a wholly-owned affiliate subscribed for 50% of the Pebble Partnership's equity effective July 31, 2007. To maintain its 50% interest in the Pebble Partnership, Anglo American was required to commit staged cash investments into the Pebble Partnership aggregating to US$1.5 billion. On September 15, 2013, Anglo American gave notice to the Company of its withdrawal from the Pebble Partnership. In December 2013, the Company exercised its right to acquire Anglo American’s 50% interest and consequently holds a 100% interest in the Pebble Partnership and Pebble Mines Corp. (the General Partner of the Pebble Partnership which administers the Pebble Project).

Under the Pebble Partnership Agreement and applicable tax regulations, neither the Company nor its affiliated general partnership will be entitled to the benefits for tax purposes of the expenditures incurred by the Pebble Partnership from Anglo American’s investment, as these benefits accrued exclusively to Anglo American under the Pebble Partnership Agreement and applicable tax regulations.

2006 Equity Investment by Rio Tinto Affiliate

In 2006, the Company issued 8,745,845 common shares in connection with a share purchase agreement with Kennecott Canada Exploration Inc. ("Kennecott", a subsidiary of Rio Tinto plc) for $10.00 per share for proceeds of approximately $87 million. In January 2007, Northern Dynasty was advised by Galahad Gold plc ("Galahad"), a significant shareholder of the Company that QIT-Fer Et Titane Inc., an affiliate of Rio Tinto, agreed to purchase 9.4 million shares of Northern Dynasty from Galahad at a price of $10.00 per share. The share purchase, which closed February 1, 2007, increased Rio Tinto’s indirect ownership in Northern Dynasty to approximately 19.8% . In early 2014, this holding represented approximately 19.1% of Northern Dynasty’s outstanding and issued common shares. Rio Tinto plc divested of its shares in April 2014.

| |

| Form 20-F Annual Report | P a g e| 20 |

Special Warrant FinancingFinancings

In late December 2014 and early January 2015, the Company completed a financing to raise proceeds of $15.5 million through the issuance of 35,962,735 Special Warrants, each convertible into one Common Sharecommon share without payment of additional consideration. All the Special Warrants were automatically converted or converted upon election by warrantholders according to their terms into common shares by September 2015. SeeItem 10 - C. Material Contracts.

In September 2015, the Company completed a financing and raised gross proceeds of approximately $15 million through the issuance of 37,600,000 Special Warrants, each convertible into one common share without payment of additional consideration. These Special Warrants were automatically converted into common shares in November 2015. SeeItem 10 - C. Material Contracts.

Acquisition of Inactive Listed Issuer – Cannon Point Resources Ltd. ("Cannon Point")

In October 2015, the Company issued 12,881,344 common shares to acquire Cannon Point, a company with a primary asset of $4.25 million in cash.

Acquisition of Listed Issuer – Mission Gold Ltd.("Mission Gold")

In December 2015, the Company issued 27,593,341 common shares to acquire Mission Gold, a company with primary assets of approximately $9 million in cash and a 100% interest in a titanium project that was sold by Mission Gold to a third party for $1.5 million in marketable securities as part of the transaction with Northern Dynasty. SeeItem 10 - C. Material Contracts.

Private Placement

In December 2015, the Company completed a private placement of 12,573,292 common shares at a price of $0.412 per share for gross proceeds of approximately $5.2 million.

The Company’s business is the exploration and advancement towards feasibility, permitting and ultimately development of a copper-gold-molybdenumcopper-gold-molybdenum-silver mineral resource in Alaska, USA known as the "Pebble Project".

The Pebble Project is Subject to State and Federal Laws

The Pebble Partnership is required to comply with all Alaska statutes in connection with the Pebble Project. These statutes govern titles, operations, environmental, development, operating and generally all aspects of exploration and development of a mine in Alaska.

Alaska Statute 38.05.185 among others establishes the rights to mining claims and mineral leases on lands owned by the State of Alaska and open to mineral entry. This group of statutes also covers annual labor and rental requirements, and royalties.

Operations on claims or leases on state owned land must be permitted under a plan of operations as set out in Title 11 of the Alaska Administrative Code, Chapter 86, Section 800. This regulation generally provides that the State Division of Mining can be the lead agency in coordinating the comments of all agencies which must consent to the issuance of a plan of operations, and sets the requirements for the approval of a plan of operations.

| |

| Form 20-F Annual Report | P a g e| 21 |

Environmental conditions are controlled by Alaska Statute 46.08 (which prohibits release of oil and hazardous substances), Alaska Statute 46.03.060 (which sets water quality standards), and Alaska Statute 46.14 (which sets air quality standards).

Once a decision is made to enter permitting, the Pebble Project will be required to satisfy permitting requirements at three levels: federal, state and local (borough). The process takes approximately 3-4 years to complete and involves 11 regulatory agencies, 60+ categories of permits and significant ongoing opportunities for public involvement. The Alaska Department of Natural Resources Large Mine Permitting Team is responsible for coordinating permitting activities for large mine projects.

To satisfy permitting requirements under the National Environmental Policy Act ("NEPA") and other regulatory statutes, a project must provide a comprehensive project design and operating plan for mine-site and infrastructure facilities; documentation of development alternatives investigated; mitigation and compensation strategies, and identification of residual effects; and environmental monitoring, reclamation and closure plans. The first step is to provide the required information for an Environmental Impact Statement ("EIS") under NEPA, including a Project Description and Environmental Baseline Document Preparedprepared by a third-party contractor under the direction of a lead federal agency, expected to be the US Army Corps of Engineers. The EIS will determine whether sufficient evaluation of the project's environmental effects and development alternatives has been undertaken. It will also provide the basis for federal, state and local government agencies to make individual permitting decisions.

Under the U.S. Clean Water Act, Section 404(c), the Administrator of the Environmental Protection Agency ("EPA") is given the right to disallow the specification (including the withdrawal of specification) of any defined area as a disposal site if he or she determines that the release of such material will have an unacceptable adverse effect on municipal water supplies, local wildlife, spawning and breeding areas of fisheries, shellfish beds, and/or recreational areas. Such decisions made by the Administrator require notice and opportunity for public hearings, and consultation with the Secretary of the Army Corp of Engineers. The Administrator shall set forth in writing and make public his or her findings and reasons for making any determination under this subsection.

Ownership History