0001545772bpy:TrancheThreeMember2014-12-042014-12-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| | | | | |

| ☐ | |

¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | | | | |

| ☒ | |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20172023

OR

| | | | | |

| ☐ | |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | | | | |

| ☐ | |

¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-35505

Brookfield Property Partners L.P.

| | |

|

|

|

| (Exact name of Registrant as specified in its charter) |

| | |

| N/A |

|

N/A |

|

| (Translation of Registrant’s name into English) |

| | |

| Bermuda |

|

Bermuda |

|

| (Jurisdiction of incorporation or organization) |

| | |

|

| 73 Front Street, 5th Floor, Hamilton, HM 12 Bermuda |

|

(Address of principal executive office)

Bryan K. Davis

Brookfield Property Partners L.P.

73 Front Street, 5th Floor

Hamilton, HM 12, Bermuda

Tel: +441-294-3309

| | |

|

|

|

| (Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | | | | | | | | | | | | | |

| | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Limited Partnership | | | |

| | | | |

| | | | |

| 6.50% Class A Cumulative Redeemable Perpetual Units, Limited Partnership Units

Series 1 | | BPYPP | |

| 6.375% Class A Cumulative Redeemable Perpetual Units, Series 2 | | BPYPO | | Nasdaq Stock Market |

| 5.750% Class A Cumulative Redeemable Perpetual Units, Series 3 | | BPYPN | | Nasdaq Stock Market |

| 6.25% Class A Cumulative Redeemable Units, Series 1 | | BPYPM /BPYP.PR.A | | Nasdaq Stock Market / Toronto Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 254,989,192 Limited Partnership Units asAs of December 31, 2017.2023, there were outstanding 7,360,000 6.50% Class A Cumulative Redeemable Perpetual Units, Series 1, 10,000,000 6.375% Class A Cumulative Redeemable Perpetual Units, Series 2, 11,500,000 5.750% Class A Cumulative Redeemable Perpetual Units, Series 3, and 26,844,556 6.25% Class A Cumulative Redeemable Preferred Units, Series 1.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | | | | | |

Large accelerated filer x¨ | Accelerated filer ¨ | Non-accelerated filer ¨Filer x | Emerging growth company ¨ ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

| | | | | | | | | | |

U.S. GAAP ¨ | International Financial Reporting Standards as issued by the International Accounting Standards Board | x☒ | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Table of Contents

| | | | | | | | |

| | |

| | Page |

| |

| |

| |

| | |

| | |

| | |

| ITEM 1. | | |

| | |

| ITEM 2. | | |

| | |

| ITEM 3. | | |

| | |

| 3.A. | | |

| | |

| 3.B. | | |

| | |

| 3.C. | | |

| | |

| 3.D. | | |

| | |

| ITEM 4. | | |

| | |

| 4.A. | | |

| | |

| 4.B. | | |

| | |

| | | | | | | | |

| 4.C. | | |

| | |

| 4.D. | | |

| | |

| ITEM 4A. | | |

| | |

| ITEM 5. | | |

| | |

| 5.A. | | |

| | |

| 5.B. | | |

| | |

| 5.C. | | |

| | |

| 5.D. | | |

| | |

| 5.E. | | |

|

| | |

| | |

5.F. | | |

| | |

| | |

| | |

| ITEM 6. | | |

| | |

| 6.A. | | |

| | |

| 6.B. | | |

| | |

| 6.C. | | |

| | |

| 6.D. | | |

| | |

| 6.E. | | |

| | |

| 6.F | | |

| | |

| ITEM 7. | | |

| | |

| 7.A. | | |

| | |

| 7.B. | | |

| | |

| 7.C. | | |

| | |

| ITEM 8. | | |

| | |

| 8.A. | | |

| | |

| 8.B. | | |

| | |

| | | | | | | | |

| ITEM 9. | | |

| | |

| 9.A. | | |

| | |

| 9.B. | | |

| | |

| 9.C. | | |

| | |

| 9.D. | | |

| | |

| 9.E. | | |

| | |

| 9.F. | | |

| | |

| ITEM 10. | | |

| | |

| 10.A. | | |

|

| | |

| | |

| 10.B. | | |

| | |

| 10.C. | | |

| | |

| 10.D. | | |

| | |

| 10.E. | | |

| | |

| 10.F. | | |

| | |

| 10.G. | | |

| | |

| 10.H | | |

| | |

| 10.I. | | |

| | |

| 10.J. | | |

| | |

| ITEM 11. | | |

| | |

| ITEM 12. | | |

| | |

| | |

| | |

| ITEM 13. | | |

| | |

| ITEM 14. | | |

| | |

| | | | | | | | |

| ITEM 15. | | |

| | |

| ITEM 16. | | |

| | |

16A.16.A. | | |

| | |

16B.16.B. | | |

| | |

16C.16.C. | | |

| | |

16D.16.D. | | |

| | |

16E.16.E. | | |

| | |

16F.16.F. | | |

| | |

16G.16.G. | | |

| | |

|

| | |

16H.16.H. | | |

| | |

| 16.I. | | |

| | |

| 16.J. | | |

| | |

| 16.K. | | |

| | |

| | |

| | |

| ITEM 17. | | |

| | |

| ITEM 18. | | |

| | |

| ITEM 19. | | |

| | |

| | |

| | |

ITEM 17. | | |

| | |

ITEM 18. | | |

| | |

ITEM 19. | | |

| | |

| |

| |

| |

INTRODUCTION AND USE OF CERTAIN TERMS

We have prepared this Form 20-F using a number of conventions, which you should consider when reading the information contained herein. Unless otherwise indicated or the context otherwise requires, in this Form 20-F:

•all operating and other statistical information is presented as if we own 100% of each property in our portfolio, regardless of whether we own all of the interests in each property; and

•all information on financial results is presented in accordance with International Financial Reporting Standards or IFRS,(“IFRS”) as issued by the International Accounting Standards Board or IASB,(“IASB”), other than certain non-IFRS financial measures which are defined under “Use of Non-IFRS Measures” below.

In this Form 20-F, unless the context suggests otherwise, references to “we”, “us” and “our” are to Brookfield Property Partners L.P., the Property Partnership, the Holding Entities and the operating entities, each as defined below, taken together on a consolidated basis. Unless the context suggests otherwise, in this Form 20-F references to:

•“AO LTIP Units” are to the BPY AO LTIP Units of the Property Partnership;

•“Asset Management Company” are to Brookfield Asset Management ULC, which is owned 75% by Brookfield Corporation and 25% by Brookfield Asset Management;

•“assets under management” are to assets managed by us or by Brookfield on behalf of our third partythird-party investors, as well as our own assets, and also include capital commitments that have not yet been drawn. Our calculation of assets under management may differ from that employed by other asset managers and, as a result, this measure may not be comparable to similar measures presented by other asset managers;

•“BN” are to Brookfield Corporation;

•“BPYU” are to Brookfield Properties Retail Holding LLC, formerly known as Brookfield Property REIT Inc., a wholly-owned subsidiary of our company;

•“BPYU Units” are to the “BPYshares of Class A Stock of BPYU;

•“BPY General Partner” are to the general partner of our company, which is Brookfield Property Partners Limited, an indirect wholly-owned subsidiary of Brookfield Corporation;

•“Brookfield” are to Brookfield Corporation (formerly Brookfield Asset Management Inc.) and any subsidiary of Brookfield Corporation, other than us and, unless the context otherwise requires, includes Brookfield Asset Management;

•“Brookfield”Brookfield Asset Management” or “BAM” or “the Manager” are to Brookfield Asset Management and any subsidiary of Brookfield Asset Management, other than us;Ltd.;

•“Brookfield Asset Management” are to Brookfield Asset Management Inc.;

the “ClassClass A Preferred Unitholder” or “QIA” are to Qatar Investment Authority;

the “Classthird-party holder of the Class A Preferred Units” or “Preferred EquityUnits;

•“Class A Preferred Units” are to the Class A preferred limited partnership units of the Property Partnership, Series 1, 2 and 3, that arewere exchangeable for unitsLP Units of our company pursuant to the Preferred Unit Exchange Mechanism;

“our business” are to our business of owning, operating and investing in commercial property, both directly and through our operating entities;

•“commercial property” or “commercial properties” are to commercial and other real property that generates or has the potential to generate income, including office, retail, multifamily, logistics, hospitality, triple net lease, industrial, hospitality, self-storage,manufactured housing, mixed-use and student housing, and manufactured housing assets, but does not include, among other things, residential land development, home building, construction, real estate advisory and other similar operations or services;

“our company”, “BPY” or “our partnership” are to Brookfield Property Partners L.P., a Bermuda exempted limited partnership;

•“fully-exchanged basis” assume the exchange of all of thecertain issued and outstanding securities that are exchangeable into our units,LP Units, including the exchange of the issued and outstanding Redemption-Exchange Units in accordance with the Redemption-Exchange Mechanism,Mechanism;

•“FV LTIP Units” are to the exchangeFV LTIP Units of the issued and outstanding Class AProperty Partnership;

•“Guarantee” means the subordinated guarantee given by the Guarantors with respect to the New LP Preferred Units in accordance withand certain related obligations;

•“Guarantors” means our partnership, the Preferred Unit Exchange MechanismProperty Partnership, Brookfield BPY Holdings Inc., Brookfield BPY Retail Holdings II Inc., BPY Bermuda Holdings Limited, BPY Bermuda Holdings II Limited, BPY Bermuda Holdings IV Limited, BPY Bermuda Holdings V Limited and the exchange of the issued and outstanding exchangeable limited partnership units of Brookfield Office Properties Exchange LP not held by us;BPY Bermuda Holdings VI Limited;

“GGP” are to GGP Inc.;

•“Holding Entities” are to the primary holding subsidiaries of the Property Partnership, from time to time, through which it indirectly holds all of our interests in our operating entities;

•“our limited partnership agreement”LP Units” are to the second amended and restatednon-voting limited partnership agreementunits of our company;company, other than Preferred Units;

•“Master Services Agreement” are to the third amended and restated master services agreement among the Service Recipients, the Service Providers, and certain other subsidiaries of Brookfield Asset Management who are parties thereto;thereto, as may be amended from time to time;

•“New LP” means Brookfield Property Preferred L.P.;

•“New LP General Partner” are to the general partner of New LP, which is the Property Partnership, whose managing general partner is BPY, whose general partner is the BPY General Partner, an indirect wholly-owned subsidiary of Brookfield Corporation;

•“New LP Preferred Units” are to the Class A Cumulative Redeemable Preferred Units, Series 1 of Brookfield Property Preferred L.P.;

•“New LP Preferred Unitholders” are to the holders of New LP Preferred Units;

•“operating entities” are to the entities in which the Holding Entities hold interests and that directly or indirectly hold our real estate assets or that perform real estate management services for our real estate assets other than entities in which the Holding Entities hold interests for investment purposes only of less than 5% of the equity securities;

•“our business” are to our business of owning, operating and investing in commercial property, both directly and through our operating entities;

•“our company”, “BPY” or “our partnership” are to Brookfield Property Partners L.P., a Bermuda exempted limited partnership;

•“our limited partnership agreement” are to the second amended and restated limited partnership agreement of our company, as may be amended from time to time;

•“our portfolio” are to the commercial property assets in our Core Office, Core Retail and OpportunisticLP Investments segments, as applicable;

•“our preferred unitholders” are to the holders of Preferred Units and New LP Preferred Units;

•“our units” are to the non-voting limited partnership units in our company, including LP Units and Preferred Units and references to “our unitholders” are to the holders of our units. References to “Unitholders” are to holders of general partnership units of our partnership (“GP Units”), LP Units, Redemption-Exchange Units, special limited partnership units of the Property Partnership (“Special LP Units”), AO LTIP Units and FV LTIP Units;

•“Preferred Units” or “Preferred Equity Units” are to the preferred limited partnership units in the capital of BPY, currently consisting of the Class A Cumulative Redeemable Perpetual Units, Series 1 (“Preferred Units, Series 1”), the Class A Cumulative Redeemable Perpetual Units, Series 2 (“Preferred Units, Series 2”), and the Class A Cumulative Redeemable Perpetual Units, Series 3 (“Preferred Units, Series 3”);

•“Preferred Unit Exchange Mechanism” are to the mechanism by which the Class A Preferred Unitholder may exchange the Class A Preferred Units, for units of our company, as more fully described in Item 10.B. “Additional Information - Memorandum and Articles of Association - Description of the Property Partnership Limited Partnership Agreement - Preferred Unit-Exchange Mechanism”;

the “Preferred Units”•“Preferred Unitholders” are to the holders of Preferred Units;

•“Privatization” means the acquisition by Brookfield Corporation on July 26, 2021 of all LP Units and limited partnership units of the Property Partnership, including the Class A Preferred Units;Brookfield Office Properties Exchange LP (“Exchange LP”) that it did not previously own;

the “Preferred Unitholders” are to holders of Preferred Units;

the “Property•“Property Partnership” or the “Operating Partnership” are to Brookfield Property L.P.;, a Bermuda exempted limited partnership;

•“Property Partnership Preferred Units” are to the preferred limited partnership units of the Property Partnership, currently consisting of the Class A Preferred Units and the Class A Cumulative Redeemable Perpetual Units, Series 5, 6 and 7;

•“Property Special LP” are to Brookfield Property Special L.P., an indirect wholly-owned subsidiary of Brookfieldthe Asset Management Company, which is the sole special limited partner of the Property Partnership;

the “Redemption-Exchange•“Redemption-Exchange Mechanism” are to the mechanism by which Brookfield may request redemption of its Redemption-Exchange Units in whole or in part in exchange for cash, subject to the right of our company to acquire such interests (in lieu of such redemption) in exchange for unitsLP Units of our company, as more fully described in Item 10.B. “Additional Information - Memorandum and Articles of Association - Description of the Property Partnership Limited Partnership Agreement - Redemption-Exchange Mechanism”;

the “Redemption-Exchange•“Redemption-Exchange Units” or “Redeemable/Exchangeable Partnership Units” are to the non-voting limited partnership interests in the Property Partnership that are redeemable for cash, subject to the right of our company to acquire such interests (in lieu of such redemption) in exchange for unitsLP Units of our company, pursuant to the Redemption-Exchange Mechanism;

the “Service•“Service Providers” are to the subsidiaries of Brookfieldthe Asset Management Company that provide services to us pursuant to our Master Services Agreement, and unless the context otherwise requires, any other affiliate of Brookfield that is appointed from time to time to act as a service provider pursuant to our Master Services Agreement or to whom any service providerService Provider has subcontracted for the provision of such services;

the “Service•“Service Recipients” are to our company, the Property Partnership, the Holding Entities and, at the option of the Holding Entities, any wholly-owned subsidiary of a Holding Entity excluding any operating entity; and

•“Spin-off” are to the special dividend of our unitsLP Units by Brookfield Asset ManagementCorporation on April 15, 2013 as described under Item 4.A. “Information on the Company - History and Development of the Company”; and

.

“our units”, “LP Units” and “units of our company” are to the non-voting limited partnership units in our company and references to “our unitholders” and “our limited partners” are to the holders of our units. References to “Unitholders” are to holders of general partnership units of our partnership, or GP Units, LP Units, Redemption-Exchange Units, special limited partnership units of the Property Partnership, or Special LP Units, and exchangeable limited partnership units of Brookfield Office Properties Exchange L.P., or Exchange LP Units.

Historical Performance and Market Data

This Form 20-F contains information relating to our business as well as historical performance and market data for Brookfield Asset Management and certain of its business groups. When considering this data, you should bear in mind that historical results and market data may not be indicative of the future results that you should expect from us.

Financial Information

The financial information contained in this Form 20-F is presented in U.S. Dollars and, unless otherwise indicated, has been prepared in accordance with IFRS.IFRS as issued by the IASB. Amounts in “$” are to U.S. Dollars and amounts in Canadian Dollars (“C$”), Australian Dollars (“A$”), British Pounds (“£”), Euros (“€”), Brazilian Reais (“R$”), Indian Rupees (“₨”), Chinese Yuan (“C¥”), South Korean Won (“₩”) and, United Arab Emirates Dirham (“AED”), Hong Kong Dollar (“HK$”), Swedish Krona (“SEK”) and Polish Zloty (“zł”) are identified where applicable.

Use of Non-IFRS Measures

To measure our performance, against targets, we focus on net operating income or NOI, same-property NOI,(“NOI”), funds from operations or FFO,(“FFO”), Company FFO fair value changes, net income attributable to Unitholders(“CFFO”) and equity attributable to Unitholders. These performance metrics do not have standardized meanings prescribed by IFRS as issued by the IASB and therefore may differ from similar metrics used by other companies. We define each of these measures as follows:described under Item 5.A. “Operating and Financial Review and Prospects - Non-IFRS Financial Measures”.

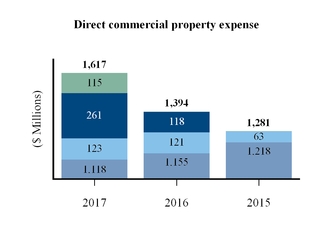

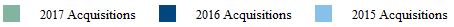

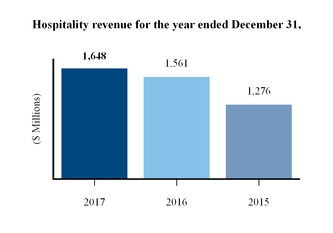

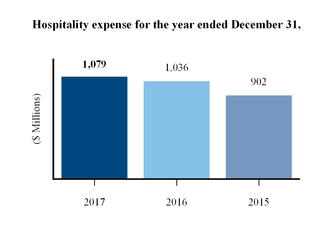

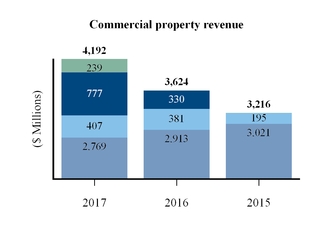

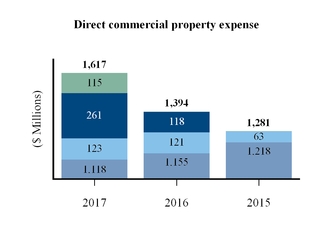

NOI: revenues from our commercial properties operations less direct commercial property expenses, or Commercial property NOI, and revenues from our hospitality operations less direct hospitality expenses, or Hospitality NOI.

Same-property NOI: a subset of NOI, which excludes NOI that is earned from assets acquired, disposed or developed during the periods presented, or not of a recurring nature, and from opportunistic assets.

FFO: net income, prior to fair value gains, net, depreciation and amortization of real estate assets, and income taxes less non-controlling interests of others in operating subsidiaries and properties share of these items. When determining FFO, we include our proportionate share of the FFO of unconsolidated partnerships and joint ventures and associates, as well as gains (or losses) related to properties developed for sale.

Company FFO: FFO before the impact of depreciation and amortization of non-real estate assets, transaction costs, gains (losses) associated with non-investment properties, imputed interest and the FFO that would have been attributable to the partnership’s shares of GGP if all outstanding warrants of GGP were exercised. Prior to the third quarter of 2017, the adjustment assumed net settlement of the outstanding warrants. For the third quarter of 2017, the adjustment is based on the cash settlement for all applicable warrants to reflect the partnership's settlement of the warrants on such basis which occurred in the fourth quarter of 2017.

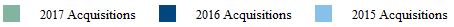

Fair value changes: includes the increase or decrease in the value of investment properties, as well as our proportionate share of the increase or decrease in the value of investment property held within our unconsolidated partnerships and joint ventures and associates, that is reflected in the consolidated statements of income.

Net Income Attributable to Unitholders: net income attributable to holders of GP Units, LP Units, Redeemable/Exchangeable Partnership Units, Special LP Units, and Exchange LP Units.

Equity Attributable to Unitholders: equity attributable to holders of our GP Units, LP Units, Redeemable/Exchangeable Partnership Units, Special LP Units and Exchange LP Units.

NOI is a key indicator of our ability to impact operating performance of our properties. We seek to grow NOI through pro-active management and leasing of our properties. Same-property NOI allows us to segregate the performance of leasing and operating initiatives on the portfolio from the impact to performance of investing activities and items not of a recurring nature, which for the historical periods presented consist primarily of lease termination income.

We also consider FFO an important measure of our operating performance. FFO is a widely recognized measure that is frequently used by securities analysts, investors and other interested parties in the evaluation of real estate entities, particularly those that own and operate income producing properties. Our definition of FFO includes all of the adjustments that are outlined in the National Association of Real Estate Investment Trusts, or NAREIT, definition of FFO, including the exclusion of gains (or losses) from the sale of investment properties, the add back of any depreciation and amortization related to real estate assets and the adjustment for unconsolidated partnerships and joint ventures. In addition to the adjustments prescribed by NAREIT, we also

make adjustments to exclude any unrealized fair value gains (or losses) that arise as a result of reporting under IFRS, and income taxes that arise as certain of our subsidiaries are structured as corporations as opposed to real estate investment trusts, or REITs. These additional adjustments result in an FFO measure that is similar to that which would result if our partnership was organized as a REIT that determined net income in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”), which is the type of organization on which the NAREIT definition is premised. Our FFO measure will differ from other organizations applying the NAREIT definition to the extent of certain differences between the IFRS and U.S. GAAP reporting frameworks, principally related to the recognition of lease termination income. Because FFO excludes fair value gains (losses), including equity accounted fair value gains (losses), realized gains (losses) on the sale of investment properties, depreciation and amortization of real estate assets and income taxes, it provides a performance measure that, when compared year-over-year, reflects the impact on operations from trends in occupancy rates, rental rates, operating costs and interest costs, providing perspective not immediately apparent from net income. We reconcile FFO to net income as we believe net income is the most comparable measure. We do not use FFO as a measure of cash flow generated from operating activities.

In addition, we consider Company FFO a useful measure for securities analysts, investors and other interested parties in the evaluation of our partnership’s performance. Company FFO, similar to FFO discussed above, provides a performance measure that reflects the impact on operations of trends in occupancy rates, rental rates, operating costs and interest costs. In addition, the adjustments to Company FFO relative to FFO allow the partnership insight into these trends for the real estate operations, by adjusting for non-real estate components.

Net income attributable to Unitholders and Equity attributable to Unitholders are used by the partnership to evaluate the performance of the partnership as a whole as each of the Unitholders participates in the economics of the partnership equally. In calculating Net income attributable to Unitholders per unit and Equity attributable to Unitholders per unit, the partnership excludes the impact of mandatorily convertible preferred units in determining the average number of units outstanding as the holders of mandatorily convertible preferred units do not participate in current earnings.

In addition to monitoring, analyzing and reviewing earnings performance, we also review initiatives and market conditions that contribute to changes in the fair value of our investment properties. These value changes, combined with earnings, represent a total return on the equity attributable to Unitholders and form an important component in measuring how we have performed relative to our targets.

Under Item 5.A. “Operating and Financial Review and Prospects - Operating Results - Financial Statements Analysis - Review of Consolidated Results - Reconciliation of Non-IFRS Measures”, we provide a reconciliation to net income (loss) for the periods presented. We urge you to review the IFRS financial measures in this Form 20-F, including the financial statements, the notes thereto and the other financial information contained herein, and not to rely on any single financial measure to evaluate our company.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 20-F contains “forward-looking information” within the meaning of Canadian provincialapplicable securities laws and applicable regulations and “forward-looking statements” within the meaning of “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995.regulations. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, include statements regarding our operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, strategies and outlook, as well as the outlook for North American and international economies for the current fiscal year and subsequent periods, and include words such as “expects”, “anticipates”, “plans”, “believes”, “estimates”, “seeks”, “intends”, “targets”, “projects”, “forecasts”, “likely”, or negative versions thereof and other similar expressions, or future or conditional verbs such as “may”, “will”, “should”, “would” and “could”.

Although we believe that our anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements and information because they involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause our actual results, performance or achievements to differ materially from anticipated future results, performance or achievement expressed or implied by such forward-looking statements and information.

Factors that could cause actual results to differ materially from those contemplated or implied by forward-looking statements include, but are not limited to: risks incidental to the ownership and operation of real estate properties including local real estate conditions; the impact or unanticipated impact of general economic, political and market factors in the countries in which we do business; the ability to enter into new leases or renew leases on favorable terms; business competition; dependence on tenants’ financial condition; the use of debt to finance our business; the behavior of financial markets, including fluctuations in interest and foreign exchanges rates; uncertainties of real estate development or redevelopment; global equity and capital markets and the availability of equity and debt financing and refinancing within these markets; risks relating to our insurance coverage; risks relating to trends in the office real estate industry; the possible impact of international conflicts and other developments including terrorist acts; potential environmental liabilities; changes in tax laws and other tax related risks; dependence on management personnel; illiquidity of investments; the ability to complete and effectively integrate acquisitions into existing operations and the ability to attain expected benefits therefrom; operational and reputational risks; risks related to climate change; catastrophic events, such as earthquakes, and hurricanes;hurricanes or pandemics/epidemics; and other risks and factors detailed from time to time in our documents filed with the securities regulators in Canada and the United States, as applicable.

We caution that the foregoing list of important factors that may affect future results is not exhaustive. When relying on our forward-looking statements or information, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements or information, whether written or oral, that may be as a result of new information, future events or otherwise.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT, AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

3.A. SELECTED FINANCIAL DATA

The following tables present selected financial data for our company as of and for the periods indicated:[Reserved]

|

| | | | | | | | | | | | | | | |

| | Years ended Dec. 31, |

| (US$ Millions, except per unit information) | 2017 |

| 2016 |

| 2015 |

| 2014 |

| 2013(3) |

|

| Total revenue | $ | 6,135 |

| $ | 5,352 |

| $ | 4,853 |

| $ | 4,473 |

| $ | 4,287 |

|

| Net income | 2,468 |

| 2,717 |

| 3,766 |

| 4,420 |

| 1,763 |

|

| Net income attributable to LP units | 136 |

| 660 |

| 1,064 |

| 1,154 |

| 118 |

|

| Net income attributable to GP Units | — |

| — |

| 1 |

| 1 |

| — |

|

| Net income attributable to Brookfield Asset Management | — |

| — |

| — |

| — |

| 232 |

|

Net income per LP Unit(1) | 0.48 |

| 2.30 |

| 3.72 |

| 5.59 |

| 1.41 |

|

| Distributions per LP Unit | 1.18 |

| 1.12 |

| 1.06 |

| 1.00 |

| 0.63 |

|

FFO(2) | 873 |

| 895 |

| 710 |

| 714 |

| 582 |

|

| |

(1)

| Net income per LP Unit has been presented effective for the period from the date of the Spin-off on April 15, 2013, as this is the date of legal entitlement of earnings to the LP Units. |

| |

(2)

| FFO is a non-IFRS measure. See “Introduction and Use of Certain Terms - Use of Non-IFRS Measures” and Item 5.A, “Operating Results - Financial Statements Analysis - Review of Consolidated Financial Results”. |

| |

(3)

| For periods prior to April 15, 2013, the date of the Spin-off, the financial information reflected is that of Brookfield Asset Management’s commercial property operations. |

|

| | | | | | | | | | | | | | | |

| (US$ Millions) | Dec. 31, 2017 |

| Dec. 31, 2016 |

| Dec. 31, 2015 |

| Dec. 31, 2014 |

| Dec. 31, 2013(2) |

|

| Investment properties | $ | 51,357 |

| $ | 48,784 |

| $ | 41,599 |

| $ | 41,141 |

| $ | 34,153 |

|

| Equity accounted investments | 19,761 |

| 16,844 |

| 17,638 |

| 10,356 |

| 9,281 |

|

| Total assets | 84,347 |

| 78,127 |

| 71,866 |

| 65,575 |

| 52,446 |

|

| Debt obligations | 36,884 |

| 33,519 |

| 30,526 |

| 27,006 |

| 21,640 |

|

| Capital securities | 4,165 |

| 4,171 |

| 4,031 |

| 4,011 |

| 2,369 |

|

| Total equity | 35,124 |

| 34,161 |

| 30,933 |

| 28,299 |

| 24,990 |

|

Equity attributable to Unitholders(1) | 22,186 |

| 22,358 |

| 21,958 |

| 20,208 |

| 13,624 |

|

| |

(1)

| As at December 31, 2017, 2016, 2015 and 2014, refers to holders of our units, GP Units, Redemption-Exchange Units, Special LP Units and Exchange LP Units. As of December 31, 2013, refers to holders of our units, GP units, Redemption-Exchange Units and Special LP Units. |

| |

(2)

| For periods prior to April 15, 2013, the date of the Spin-off, the financial information reflected is that of Brookfield Asset Management’s commercial property operations. |

3.B. CAPITALIZATION AND INDEBTEDNESS

Not applicable.

3.C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

3.D. RISK FACTORS

Your holdingThe following summarizes some, but not all, of units of our company involves substantial risks.the risks provided below. You should carefully consider the following factors in addition to the other information set forth in this Form 20-F. If any of the following risks actually occur, our business, financial condition and results of operations and the value of yourour units and the New LP Preferred Units would likely suffer.

Risks Relating to Our Business

Our economic performance and the value of our assets are subject•Risks relating to the risks incidental to the ownership and operation of real estate assets.

Our economic performance, the value of our assets and, therefore, the value of our units are subject•Risks relating to the risks normally associated with the ownership and operation of real estate assets, including but not limited to:

downturns and trends in the national, regional and local economic conditions where our properties and other assets are located;

the cyclical nature of the real estate industry;

local real estate market conditions, such as an oversupply of commercial properties, including space available by sublease, or a reduction in demand for such properties;

changes in interest rates and the availability of financing;

competition from other properties;

changes in market rental rates and our ability to rent space on favorable terms;

the bankruptcy, insolvency, credit deterioration or other default of our tenants;

the need to periodically renovate, repair and re-lease space and the costs thereof;

increases in maintenance, insurance and operating costs;

civil disturbances, earthquakes and other natural disasters, or terrorist acts or acts of war which may result in uninsured or underinsured losses;

the decrease in the attractiveness of our properties to tenants;

the decrease in the underlying value of our properties; and

certain significant expenditures, including property taxes, maintenance costs, mortgage payments, insurance costs and related charges that must be made regardless of whether a property is producing sufficient income to service these expenses.

We are dependent upon the economic conditions of the markets where our assets are located.

We are affected by local, regional, national and international economic conditions and other events and occurrences that affect the markets in which we own assets. A protracted decline in economic conditions will cause downward pressure on our operating margins and asset values as a result of lower demand for space.

Our properties are largely located in North America, Europe and Australia but also include a growing presence in Brazil and Asia. A prolonged downturn in one or more of these economies or the economy of any other country where we own property would result in reduced demand for space and number of prospective tenants and will affect the ability of our properties to generate significant revenue. If there is an increase in operating costs resulting from inflation and other factors, we may not be able to offset such increases by increasing rents.

We are subject to foreign currency risk and our risk management activities may adversely affect the performance of our operations.

Some of our assets and operations are in countries where the U.S. Dollar is not the functional currency. These operations pay distributions in currencies other than the U.S. Dollar which we must convert to U.S. Dollars prior to making distributions on our units. A significant depreciation in the value of such foreign currencies may have a material adverse effect on our business, financial condition and results of operations.

When managing our exposure to such market risks, we may use forward contracts, options, swaps, caps, collars and floors or pursue other strategies or use other forms of derivative instruments. The success of any hedging or other derivative transactions that we enter into generally will depend on our ability to structure contracts that appropriately offset our risk position. As a result, while we may enter into such transactions in order to reduce our exposure to market risks, unanticipated market changes may result in poorer overall investment performance than if the transaction had not been executed. Such transactions may also limit the opportunity for gain if the value of a hedged position increases.

We are subject to interest rate risk and a rise in interest rates may adversely affect us and the value of an investment in our units.

A number of our assets are interest rate sensitive: increases in long-term interest rates will, absent all else, decrease the value of these assets by reducing the present value of the cash flows expected to be produced by the asset. If interest rates were to rise, it may affect the market perceived or actual value of our assets and/or distributions and consequently the market price of our units may decline in value. Additionally, an increase in interest rates could decrease the amount buyers may be willing to pay for our properties, thereby reducing the market value of our properties and limiting our ability to sell properties or to obtain mortgage financing secured by our properties. Further, increased interest rates may effectively increase the cost of properties we acquire to the extent we utilize leverage for those acquisitions and may result in a reduction in our acquisitions to the extent we reduce the amount we offer to pay for properties, due to the effect of increased interest rates, to a price that sellers may not accept.

We face risks associated with the use of debt to finance our business, including refinancing risk.

We incur debt in the ordinary course of our business and therefore are subject to the risks associated with debt financing. The risks associated with our debt financing, including the following, may adversely affect our financial condition and results of operations:

cash flows may be insufficient to meet required payments of principal and interest;

payments of principal and interest on borrowings may leave insufficient cash resources to pay operating expenses;

we may not be able to refinance indebtedness on our properties at maturity due to business and market factors, including: disruptions in the capital and credit markets; the estimated cash flows of our properties and other assets; the value of our properties and other assets; and financial, competitive, business and other factors, including factors beyond our control; and

if refinanced, the terms of a refinancing may not be as favorable as the original terms of the related indebtedness.

Our operating entities have a significant degree of leverage on their assets. Highly leveraged assets are inherently more sensitive to declines in revenues, increases in expenses and interest rates, and adverse market conditions. A leveraged company’s income and net assets also tend to increase or decrease at a greater rate than would otherwise be the case if money had not been borrowed. As a result, the risk of loss associated with a leveraged company, all other things being equal, is generally greater than for companies with comparatively less debt. Leverage may also result in a requirement for liquidity, which may force the sale of assets at times of low demand and/or prices for such assets.

We rely on our operating entities to provide our company with the funds necessary to make distributions on our units and meet our financial obligations. The leverage on our assets may affect the funds available to our company if the terms of the debt impose restrictions on the ability of our operating entities to make distributions to our company. In addition, our operating entities generally have to service their debt obligations before making distributions to our company or their parent entity. The Property Partnership is also required to make distributions to Preferred Unitholders before making distributions to us.

We have substantial indebtedness, and we may incur substantially more indebtedness in the future, and are subject to certain refinancing risks.

In addition to our $2.5 billion of corporate credit facilities, we may also incur indebtedness under future credit facilities or other debt-like instruments, in addition to any asset-level indebtedness. We may also issue debt or debt-like instruments in the market in the future, which may or may not be rated. Should such debt or debt-like instruments be rated, a credit downgrade will have an adverse impact on the cost of such debt.

In addition, Brookfield holds $1.25 billion of redeemable preferred shares of Brookfield BPY Holdings Inc., or CanHoldco, one of our Holding Entities. We have agreed to use our commercially reasonable efforts to, as soon as reasonably practical, subject to any restrictions in our credit facilities, issue debt or equity securities or borrow money from one or more financial institutions or other lenders,rating, current and future indebtedness, refinancing risks and compliance with restrictive covenants.

•Risks relating to reliance on terms reasonably acceptable to us, in an aggregate amount sufficient to fund the redemption of $500 million of these preferred shares. The terms of any such financing may be less favorable to us than the terms of the preferred shares.

If we are unable to refinance our indebtedness on acceptable terms, or at all, we may need to dispose of one or more of our properties or other assets upon disadvantageous terms. In addition, prevailing interest rates or other factors at the time of refinancing could increase our interest expense,significant tenants and if we mortgage property to secure payment of indebtedness and are unable to make mortgage payments, the mortgagee could foreclose upon such property or appoint a receiver to receive an assignment of our rents and leases. This may adversely affect our ability to make distributions or payments to our unitholders and lenders.

Changes in our credit ratings may have an adverse effect on our financial position and ability to raise capital.

We cannot assure you that any credit rating assigned to our partnership, any of our subsidiaries or any of our subsidiaries’ securities will remain in effect for any given period of time or that any rating will not be lowered or withdrawn entirely by the relevant rating agency. A lowering or withdrawal of such ratings may have an adverse effect on our financial position and ability to raise capital.

Restrictive covenants in our indebtedness may limit management’s discretion with respect to certain business matters.

Instruments governing any of our indebtedness or indebtedness of our operating entities or their subsidiaries may contain restrictive covenants limiting our discretion with respect to certain business matters. These covenants could place significant restrictions on, among other things, our ability to create liens or other encumbrances, to make distributions to our unitholders or make certain other payments, investments, loans and guarantees and to sell or otherwise dispose of assets and merge or consolidate with another entity. These covenants could also require us to meet certain financial ratios and financial condition tests. A failure to comply with any such covenants could result in a default which, if not cured or waived, could permit acceleration of the relevant indebtedness.

If we are unable to manage our interest rate risk effectively, our cash flows and operating results may suffer.

Advances under credit facilities and certain property-level mortgage debt bear interest at a variable rate. We may incur further indebtedness in the future that also bears interest at a variable rate or we may be required to refinance our debt at higher rates. In addition, though we attempt to manage interest rate risk, there can be no assurance that we will hedge such exposure effectively or at all in the future. Accordingly, increases in interest rates above that which we anticipate based upon historical trends would adversely affect our cash flows.

We face potential adverse effects from tenant defaults, bankruptcies or insolvencies.

A commercial tenant may experience a downturn in its business, which could cause the loss of that tenant as a tenant or weaken its financial condition and result in its inability to make rental payments when due or, for retail tenants, a reduction in percentage rent payable. If a tenant defaults, we may experience delays and incur costs in enforcing our rights as landlord and protecting our investments.

We cannot evict a tenant solely because of its bankruptcy. In addition, in certain jurisdictions where we own properties, a court may authorize a tenant to reject and terminate its lease. In such a case, our claim against the tenant for unpaid, future rent would be subject to a statutory cap that might be substantially less than the remaining rent owed under the lease. In any event, it is unlikely that a bankrupt or insolvent tenant will pay the full amount it owes under a lease. The loss of rental payments from tenants and costs of re-leasing would adversely affect our cash flows and results of operations. In the case of our retail properties, the bankruptcy or insolvency of an anchor tenant or tenant with stores at many of our properties would cause us to suffer lower revenues and operational difficulties, including difficulties leasing the remainder of the property. Significant expenses associated

with each property, such as mortgage payments, real estate taxes and maintenance costs, are generally not reduced when circumstances cause a reduction in income from the property. In the event of a significant number of lease defaults and/or tenant bankruptcies, our cash flows may not be sufficient to pay cash distributions•Risks relating to our unitholders and repay maturing debtability to renew or other obligations.

Reliance on significant tenants could adversely affect our results of operations.

Many of our properties are occupied by one or more significant tenants and, therefore, our revenues from those properties are materially dependent on our relationships with and the creditworthiness and financial stability of those tenants. Our business would be adversely affected if any of those tenants failed to perform or renew certain of their significant leases for any reason, or otherwise became insolvent, declared bankruptcy or otherwise refused to pay rent in a timely fashion or at all. In the event of a default by one or more significant tenants, we may experience delays in enforcing our rights as landlord and may incur substantial costs in protecting our investment and re-leasing the property. If a lease of a significant tenant is terminated, it may be difficult, costly and time consuming to attract new tenants and lease the property for the rent previously received. In addition, the loss of a significant tenant (particularly if related to one of our signature projects, or if otherwise widely publicized) could cause harm to our reputation.

Our inability to enter into renewal or new leases with tenants on favorable terms or at all for all or a substantial portion of space that is subject to expiring leases would adversely affect our cash flowsleases.

•Risks relating to force majeure events, uninsurable losses and operating results.higher insurance premiums.

Our properties generate revenue through rental payments made by tenants of•Risks relating to trends in the properties. Upon the expiry of any lease, there can be no assurance that the lease will be renewed or the tenant replaced. The terms of any renewal or replacement lease may be less favorable to us than the existing lease. We would be adversely affected, in particular, if any major tenant ceases to be a tenant and cannot be replaced on similar or better terms or at all. Additionally, we may not be able to lease our properties to an appropriate mix of tenants. Retail tenants may negotiate leases containing exclusive rights to sell particular types of merchandise or services within a particular retail property. These provisions may limit the number and types of prospective tenants for the vacant space in such properties.

Our competitors may adversely affect our ability to lease our properties which may cause our cash flows and operating results to suffer.

Each segment of theoffice real estate industry, is competitive. Numerous other developers, managersincluding sustained changes in client preferences and ownersspace utilization, moving from full-time, collective in-person work environments to hybrid or remote work models and use of commercial properties compete with us in seeking tenantsbusinesses utilizing shared office and in the case of our multifamily properties, there are numerous housing alternatives which compete with our properties in attracting residents. Some of the properties of our competitors may be newer, better located or better capitalized. These competing properties may have vacancy rates higher than our properties, which may result in their owners being willing to make space available at lower prices than the space in our properties, particularly if there is an oversupply of space available in the market. Competition for tenants could have an adverse effect on our ability to lease our properties and on the rents that we may charge or concessions that we must grant, which may cause our cash flows and operating results to suffer.co-working spaces.

Our ability to realize our strategies and capitalize on our competitive strengths are dependent on the ability of our operating entities to effectively operate our large group of commercial properties, maintain good relationships with tenants, and remain well-capitalized, and our failure to do any of the foregoing would affect our ability to compete effectively in the markets in which we do business.

Our insurance may not cover some potential losses or may not be obtainable at commercially reasonable rates, which could adversely affect our financial condition and results of operations.

We maintain insurance on our properties in amounts and with deductibles that we believe are in line with what owners of similar properties carry; however, our insurance may not cover some potential losses or may not be obtainable at commercially reasonable rates in the future.

There also are certain types of risks (such as war, environmental contamination such as toxic mold, and lease and other contract claims) that are either uninsurable or not economically insurable. Should any uninsured or underinsured loss occur, we could lose our investment in, and anticipated profits and cash flows from, one or more properties, and we would continue to be obligated to repay any recourse mortgage indebtedness on such properties.

Possible terrorist activity could adversely affect our financial condition and results of operations and our insurance may not cover some losses due to terrorism or may not be obtainable at commercially reasonable rates.

Possible terrorist attacks in the markets where our properties are located may result in declining economic activity, which could reduce the demand for space at our properties, reduce the value of our properties and harm the demand for goods and services offered by our tenants.

Additionally, terrorist activities could directly affect the value of our properties through damage, destruction or loss. Our Core Office portfolio is concentrated in large metropolitan areas, some of which have been or may be perceived to be subject to terrorist attacks. Many of our office properties consist of high-rise buildings, which may also be subject to this actual or perceived threat. Our insurance may not cover some losses due to terrorism or may not be obtainable at commercially reasonable rates.

We are subject to risks•Risks relating to development and redevelopment projects.

On a strategic and selective basis, we may develop and redevelop properties. The real estate development and redevelopment business involves significant risks that could adversely affect our business, financial condition and results of operations, including the following:

we may not be able to complete construction on schedule or within budget, resulting in increased debt service expense and construction costs and delays in leasing the properties;

we may not have sufficient capital to proceed with planned redevelopment or expansion activities;

we may abandon redevelopment or expansion activities already under way, which may result in additional cost recognition;

we may not be able to obtain, or may experience delays in obtaining, all necessary zoning, land-use, building, occupancy and other governmental permits and authorizations;

we may not be able to lease properties at all or on favorable terms, or occupancy rates and rents at a completed project might not meet projections and, therefore, the project might not be profitable;

construction costs, total investment amounts and our share of remaining funding may exceed our estimates and projects may not be completed and delivered as planned; and

upon completion of construction, we may not be able to obtain, or obtain on advantageous terms, permanent financing for activities that we have financed through construction loans.

We are subject to risks that affect the retail environment.

We are subject to risksfactors that affect the retail environment, including unemployment, weak income growth, lack of available consumer credit, inflation, industry slowdowns, and plant closures, low consumer confidence, increased consumer debt, poor housing market conditions adverse weather conditions, natural disasters and the need to pay down existing obligations. Any of these factors could negatively affect consumer spending

•Risks relating to business disruptions, cybersecurity failures and adversely affect the sales of our retail tenants. This could have an unfavorable effect on our operationsdata security incidents.

•Risks relating to businesses and our ability to attract new retail tenants.

In addition, our retail tenants face competition from retailers at other regional malls, outlet malls and other discount shopping centers, discount shopping clubs, catalogue companies, and through internet sales and telemarketing. Competition of these types could reduce the percentage rent payable by certain retail tenants and adversely affect our revenues and cash flows. Additionally, our retail tenants are dependent on perceptions by retailers and shoppers of the safety, convenience and attractiveness of our retail properties. If retailers and shoppers perceive competing properties and other retailing options such as the internet to be more convenient or of a higher quality, our revenues may be adversely affected.

Some of our retail lease agreements include a co-tenancy provision which allows the mall tenant to pay a reduced rent amount and, in certain instances, terminate the lease, if we fail to maintain certain occupancy levels at the mall. In addition, certain of our tenants have the ability to terminate their leases prior to the lease expiration date if their sales do not meet agreed upon thresholds. Therefore, if occupancy, tenancy or sales fall below certain thresholds, rents we are entitled to receive from our retail tenants would be reduced and our ability to attract new tenants may be limited.

The computation of cost reimbursements from our retail tenants for common area maintenance, insurance and real estate taxes is complex and involves numerous judgments including interpretation of lease terms and other tenant lease provisions. Most tenants make monthly fixed payments of common area maintenance, insurance, real estate taxes and other cost reimbursements and, after the end of the calendar year, we compute each tenant’s final cost reimbursements and issue a bill or credit for the full amount, after considering amounts paid by the tenant during the year. The billed amounts could be disputed by the tenant or become the subject of a tenant audit or even litigation. There can be no assurance that we will collect all or any portion of these amounts.

We are subject to risks associated with the multifamily residential industry.

We are subject to risks associated with the multifamily residential industry, including the level of mortgage interest rates which may encourage tenants to purchase rather than lease and housing and governmental programs that provide assistance and rent subsidies to tenants. If the demand for multifamily properties is reduced, income generated from our multifamily residential properties and the underlying value of such properties may be adversely affected.

In addition, certain jurisdictions regulate the relationship of an owner and its residential tenants. Commonly, these laws require a written lease, good cause for eviction, disclosure of fees, and notification to residents of changed land use, while prohibiting unreasonable rules, retaliatory evictions, and restrictions on a resident’s choice of landlords. Apartment building owners have been the subject of lawsuits under various “Landlord and Tenant Acts” and other general consumer protection statutes for coercive, abusive or unconscionable leasing and sales practices. If we become subject to litigation, the outcome of any such proceedings may materially adversely affect us for long periods of time. A few jurisdictions may offer more significant protection to residential tenants. In addition to state or provincial regulation of the landlord-tenant relationship, numerous towns and municipalities impose rent control on apartment buildings. The imposition of rent control on our multifamily residential units could have a materially adverse effect on our results of operations.

We are subject to risks associated with the hospitality industry.

We are subject to risks associated with the hospitality industry, including: the relative attractiveness of our hotel properties and the level of services provided to guests; dependence on business and leisure travel and tourism; the seasonality of the hotel industry, which may cause our results of operations to vary on a quarterly basis; perceptions regarding the safety and conditions at our hospitality properties; and the appeal to travelers of the local markets in which our hotels are located which could have an adverse effect on our financial condition and results of operations.

A business disruption may adversely affect our financial condition and results of operations.

Our business is vulnerable to damages from any number of sources, including computer viruses, unauthorized access, energy blackouts, natural disasters, terrorism, war and telecommunication failures. Any system failure or accident that causes interruptions in our operations could result in a material disruption to our business. If we are unable to recover from a business disruption on a timely basis, our financial condition and results of operations would be adversely affected. We may also incur additional costs to remedy damages caused by such disruptions, which could adversely affect our financial condition and results of operations.

Our failure to maintain effective internal controls could have a material adverse effect on our business.

Pursuant to Section 404 of the Sarbanes-Oxley Act, our management has delivered a report that assesses the effectiveness of our internal controls over financial reporting (in which they concluded that these internal controls are effective) and our independent registered public accounting firm has delivered an attestation report on our management’s assessment of, and the operating effectiveness of, our internal controls over financial reporting in conjunction with their opinion on our audited consolidated financial statements. Any failure to maintain adequate internal controls over financial reporting or to implement required, new or improved controls, or difficulties encountered in their implementation, could cause us to report material weaknesses in our internal controls over financial reporting and could result in errors or misstatements in our consolidated financial statements that could be material. If we or our independent registered public accounting firm were to conclude that our internal controls over financial reporting were not effective, investors could lose confidence in our reported financial information and the price of our units could decline. Our failure to achieve and maintain effective internal controls could have a material adverse effect on our business in the future, our access to the capital markets and investors’ perception of us. In addition, material weaknesses in our internal controls could require significant expense and management time to remediate.

The failure of our information technology systems, or an act of deliberate cyber terrorism, could adversely impact our reputation and financial performance.

We operate in businesses that are dependent on information systems and technology. Our information systems and technology may not continue to be able to accommodate our growth, and the cost of maintaining such systems may increase from its current level, either of which could have a material adverse effect on us.

We rely on third-party service providers to manage certain aspects of our business, including for certain information systems and technology, data processing systems, and the secure processing, storage and transmission of information. Any interruption or deterioration in the performance of these third parties or failures of their information systems and technology could impair the quality of our operations and could adversely affect our business and reputation.

We rely on certain information technology systems which may be subject to cyber terrorism intended to obtain unauthorized access to our proprietary information, destroy data or disable, degrade or sabotage our systems, through the introduction of computer viruses, cyber-attacks and other means, and could originate from a variety of sources including our own employees or unknown third parties. Any such breach or compromise could also go undetected for an extended period. There can be no assurance that measures implemented to protect the integrity of our systems will provide adequate protection or enable us to detect and remedy any such breaches or compromises in a timely manner or at all. If our information systems are compromised, we could suffer a disruption in one or more of our businesses. This could have a negative impact on our financial condition and results of operations or, or result in reputational damage.

Because certain of our assets are illiquid, we may not be able to sell these assets when appropriate or when desired.

Large commercial properties like the ones that we own can be hard to sell, especially if local market conditions are poor. Such illiquidity could limit our ability to diversify our assets promptly in response to changing economic or investment conditions.

Additionally, financial difficulties of other property owners resulting in distressed sales could depress real estate values in the markets in which we operate in times of illiquidity. These restrictions reduce our ability to respond to changes in the performance of our assets and could adversely affect our financial condition and results of operations.

We face risks associated with property acquisitions.

Competition from other well-capitalized real estate investors, including both publicly traded real estate investment trusts and institutional investment funds, may significantly increase the purchase price of, or prevent us from acquiring, a desired property. Acquisition agreements will typically contain conditions to closing, including completion of due diligence to our satisfaction or other conditions that are not within our control, which may not be satisfied. Acquired properties may be located in new markets where we may have limited knowledge and understanding of the local economy, an absence of business relationships in the area or unfamiliarity with local government and applicable laws and regulations. We may be unable to finance acquisitions on favorable terms or newly acquired properties may fail to perform as expected. We may underestimate the costs necessary to bring an acquired property up to standards established for its intended market position or we may be unable to quickly and efficiently integrate new acquisitions into our existing operations. We may also acquire properties subject to liabilities and without any recourse, or with only limited recourse, with respect to unknown liabilities. Each of these factors could have an adverse effect on our results of operations and financial condition.

We do not control certain of our operating entities, including GGP and certain businesses in the opportunistic funds that we are invested in, and therefore we may not be able to realize someeither solely or all of the benefits that we expect to realize from those entities.

We do not have control of certain of our operating entities, including GGP and certain businesses in the opportunistic funds that we are invested in. Our interests in those entities subject us to the operating and financial risks of their businesses, the risk that the relevant company may make business, financial or management decisions that we do not agree with, and the risk that we may have differing objectives than the entities in which we have interests. Because we do not have the ability to exercise control over those entities, we may not be able to realize some or all of the benefits that we expect to realize from those entities. For example, we may not be able to cause such operating entities to make distributions to us in the amount or at the time that we need or want such distributions. In addition, we rely on the internal controls and financial reporting controls of the companies in which we invest and the failure of such companies to maintain effective controls or comply with applicable standards may adversely affect us. Although we have recently made a non-binding proposal to acquire all of the outstanding shares of GGP not owned by us, we cannot provide any assurance that this transaction will be completed on the terms contemplated, or at all.

We do not have sole control over the properties that we ownconnection with co-venturers, partners, fund investors or co-tenants or over the revenues and certain decisions associated with those properties, which may limit our flexibility with respect to these investments.co-tenants.

We participate in joint ventures, partnerships, funds and co-tenancies affecting many of our properties. Such investments involve risks not present were a third party not involved, including the possibility that our co-venturers, partners, fund investors or co-tenants might become bankrupt or otherwise fail to fund their share of required capital contributions. The bankruptcy of one of our co-venturers, partners, fund investors or co-tenants could materially and adversely affect the relevant property or properties. Pursuant to bankruptcy laws, we could be precluded from taking some actions affecting the estate of the other investor without prior court approval which would, in most cases, entail prior notice to other parties and a hearing. At a minimum, the requirement to obtain court approval may delay the actions we would or might want to take. If the relevant joint venture or other investment entity has incurred recourse obligations, the discharge in bankruptcy of one of the other investors might result in our ultimate liability for a greater portion of those obligations than would otherwise be required.

Additionally, our co-venturers, partners, fund investors or co-tenants might at any time have economic or other business interests or goals that are inconsistent with those of our company, and we could become engaged in a dispute with any of them that might affect our ability to develop or operate a property. In addition, we do not have sole control of certain major decisions•Risks relating to these properties, including decisions relating to: the sale of the properties; refinancing; timingdisputes, governmental and amount of distributions of cash from such properties;regulatory policies and capital improvements. For example, when we participate with institutional investors in Brookfield-sponsored or co-sponsored consortiums for asset acquisitionsinvestigations and as a partner in or alongside Brookfield-sponsored or co-sponsored partnerships, there is often a finite term to the investment which could lead to the investment being sold prior to the date we would otherwise choose.possible litigation.

In some instances, where we are the property manager for a joint venture, the joint venture retains joint approval rights over various material matters such as the budget for the property, specific leases and our leasing plan. Moreover, in certain property management arrangements the other venturer can terminate the property management agreement in limited circumstances

•Risks relating to enforcement of the property managers’ obligations. In addition, the sale or transfer of interests in some of our joint venturesclimate change and partnerships is subject to rights of first refusal or first offer and some joint venture and partnership agreements provide for buy-sell or similar arrangements. Such rights may be triggered at a time when we may not want to sell but we may be forced to do so because we may not have the financial resources at that time to purchase the other party’s interest. Such rights may also inhibit our ability to sell an interest in a property or a joint venture or partnership within our desired time frame or on any other desired basis.

We have interests in public companies, and changes in the market prices of the stock of such public companies, particularly during times of increased market volatility, could have a negative impact on our financial condition and results of operations.

We hold interests in public companies, such as GGP, and changes in the market prices of the stock of such public companies could have a material impact on our financial condition and results of operations. Global securities markets have been highly volatile, and continued volatility may have a material negative impact on our consolidated financial position and results of operations.

We have significant interests in Brookfield-sponsored real estate funds, and poor investment returns in these funds could have a negative impact on our financial condition and results of operations.

We have, and expect to continue to have in the future, significant interests in Brookfield-sponsored real estate funds, and poor investment returns in these funds, due to either market conditions or underperformance (relative to their competitors or to benchmarks), could negatively affect our financial condition and results of operations. In addition, interests in such funds are subject to the risks inherent in the ownership and operation of real estate and real estate-related businesses and assets generally.

We are subject to risks associated with commercial property loans.

We have, and expect to continue to have in the future, significant interests in Brookfield-sponsored real estate finance funds which have interests in loans or participations in loans, or securities whose underlying performance depends on loans made with respect to a variety of commercial real estate. Such interests are subject to normal credit risks as well as those generally not associated with traditional debt securities. The ability of the borrowers to repay the loans will typically depend upon the successful operation of the related real estate project and the availability of financing. Any factors that affect the ability of the project to generate sufficient cash flow could have a material effect on the value of these interests. Security underlying such interests will generally be in a junior or subordinate position to senior financing. These investments will not always benefit from the same or similar financial and other covenants as those enjoyed by the debt ranking ahead of these investments or benefit from cross-default

provisions. Moreover, it is likely that these funds will be restricted in the exercise of their rights in respect of their investments by the terms of subordination agreements with the debt ranking ahead of the mezzanine capital. Accordingly, we may not be able to take the steps necessary to protect our investments in a timely manner or at all and there can be no assurance that the rate of return objectives of any particular investment will be achieved. To protect our original investment and to gain greater control over the underlying assets, these funds may elect to purchase the interest of a senior creditor or take an equity interest in the underlying assets, which may require additional investment requiring us to expend additional capital.

Our ownership of underperforming real estate properties involves significant risks and potential additional liabilities.