As filed with the Securities and Exchange Commission on July 14, 2023.March 20, 2024.

Registration No. 333- 273067

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

APTEVO THERAPEUTICS INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware |

| 2834 |

| 81-1567056 |

(State or Other Jurisdiction of Incorporation or Organization) |

| (Primary Standard Industrial Classification Code Number) |

| (I.R.S. Employer Identification Number) |

2401 4th Avenue, Suite 1050

Seattle, Washington, 98121

(206) 838-0500

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Marvin L. White

President and Chief Executive Officer

Aptevo Therapeutics Inc.

2401 4th Avenue, Suite 1050

Seattle, Washington, 98121

(206) 838-0500

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

Sean M. Donahue Paul Hastings LLP 2050 M Street, NW Washington, DC 20036 (202) 551-1704 |

| SoYoung Kwon Senior Vice President and General Counsel Aptevo Therapeutics Inc. 2401 4th Avenue, Suite 1050 Seattle, Washington, 98121 (206) 838-0500 |

|

New York, NY (212) |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated filer |

| ☐ | Accelerated filer | ☐ |

|

|

|

|

|

Non-accelerated filer |

| ☒ | Smaller reporting company | ☒ |

|

|

|

|

|

|

|

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant files a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED JULY 14, 2023March 20, 2024

PRELIMINARY PROSPECTUS

Up to 7,692,308 Shares of Common Stock or Common Stock Underlying Pre-Funded Warrants

Common Warrants to purchase up to 7,692,308 Shares of Common Stock

Pre-Funded Warrants to purchase up to 7,692,308922,509 Shares of Common Stock

Up to 7,692,308922,509 Pre-Funded Warrants to Purchase up to 922,509 Shares of Common Stock Underlying

Up to 1,845,018 Common Warrants to Purchase up to 1,845,018 Shares of Common Stock

Up to 2,767,527 Shares of Common Stock underlying the Pre-Funded Warrants and Common Warrants

This is a reasonable best efforts public offering of up to 7,692,308922,059 shares (the “Shares”“shares”) of our common stock, par value $0.001 per share ("Common Stock"common stock") includingtogether with up to 1,845,018 common warrants to purchase up to 1,845,018 shares of Common Stock underlying common warrants, and common stock purchase warrants (the “Common Warrants”) to purchase an aggregate of up to 7,692,308 shares of our Common Stock at an assumed combined public offering price of $1.56$5.42 per share and common warrant (the last reported sale price per share of Common Stock and Common Warrant (assuming a public offering price equal to the last sale price of our Common Stock as reported bycommon stock on the Nasdaq Capital Market, (“Nasdaq”) on July 13, 2023 of $1.56)March 15, 2024). Each Common Warrantshare of common stock is assumedbeing offered together with two common warrants, each to purchase one share of common stock. The common warrants will have an exercise price of $1.56$ per Share (100% of the public offering price per Share and Common Warrant),share, will be exercisable upon issuance and will expire five years from the date of issuance. The shares of common stock and common warrants will be separately issued. This prospectus also covers the shares of common stock issuable from time to time upon the exercise of the common warrants.

We are also offering pre-funded warrants to those purchasers, if any, whose purchase of Common Stockshares of common stock in this offering would otherwise result in any suchthe purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of suchthe purchaser, 9.99%) of our outstanding Common Stock immediatelycommon stock following the consummation of this offering the opportunity to purchase pre-funded warrants (the “Pre-Funded Warrants”) in lieu of the shares of our Common Stockcommon stock that would otherwise result in such purchaser’s beneficial ownership exceedingin excess of 4.99% (or, at the election of suchthe purchaser, 9.99%). Each pre-funded warrant will be exercisable for one share of our outstanding Common Stock.common stock at an exercise price of $0.0001 per share. Each pre-funded warrant is being offered together with the same two common warrants, each to purchase one share of common stock described above being offered with each share of common stock. The purchase price forof each Pre-Funded Warrantpre-funded warrant will equal the per sharecombined public offering price for the Common Stockper share of common stock and common warrants being sold in this offering, less the $0.001$0.0001 per share exercise price of each such Pre-Funded Warrant.pre-funded warrant. Each Pre-Funded Warrantpre-funded warrant will be exercisable upon issuance and will not expire prior to exercise.when exercised in full. The pre-funded warrants and common warrants will be separately issued. For each Pre-Funded Warrantpre-funded warrant that we sell, the number of shares of Common Stockcommon stock that we are offeringselling will be decreased on a one-for-one basis.

For purposes of clarity, each share of Common Stock or Pre-Funded Warrant to purchase one share of Common Stock is being sold together with a Common Warrant to purchase one share of Common Stock.

These securities are being sold in this offering to certain purchasers under a securities purchase agreement dated , 2023 between us and such purchasers. Pursuant to this This prospectus we are also offeringcovers the shares of Common Stockcommon stock issuable from time to time upon the exercise of Pre-Funded Warrantsthe pre-funded warrants.

There is no established public trading market for the pre-funded warrants or common warrants, and Common Warrants offered hereby.

The shares issuable upon exercisewe do not expect a market to develop. We do not intend to apply for listing of the Pre-Funded Warrantspre-funded warrants or Common Warrantscommon warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the pre-funded warrants and common warrants will be issued uponlimited.

We have engaged Roth Capital Partners, LLC, or the exercise thereof. Because thereplacement agent, to act as our exclusive placement agent in connection with this offering. The placement agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The placement agent is not purchasing or selling any of the

securities we are offering and the placement agent is not required to arrange the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay to the placement agent the placement agent fees set forth in the table below, which assumes that we sell all of the securities offered by this prospectus. There is no arrangement for funds to be received in escrow, trust or similar arrangement. There is no minimum number of shares of securities or minimum aggregate amount of proceeds that is a condition for this offering to close, weclose. We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event thatif we do not sell an amountall of the securities sufficient to pursue the business goals outlined in this prospectus.offered hereby. Because there is no escrow account and there is no minimum offeringnumber of securities or amount of proceeds, investors could be

in a position where they have invested in our company,us, but we are unable to fulfill our objectives due to a lack of interesthave not raised sufficient proceeds in this offering. Also, any proceeds fromoffering to adequately fund the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan.

The offeringintended uses of the Shares, Pre-Funded Warrants and Common Warrantsproceeds as described in this prospectus. We will terminatebear all costs associated with the offering. See “Plan of Distribution” on page 23 of this prospectus for more information regarding these arrangements. This offering will end no later than August 31, 2023; however,three trading days from the sharesdate of our Common Stock underlying the Pre-Funded Warrants and the Common Warrants will be offered on a continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”).this prospectus.

Our Common Stock tradescommon stock is listed on the Nasdaq Capital Market under the symbol “APVO.” On, July 13, 2023,March 15, 2024, the last reported sale price of our Common Stockcommon stock on the Nasdaq Capital Market was $1.56$5.42 per share. TheAll share, common warrant and pre-funded warrant numbers are based on an assumed combined public offering pricesprice of $5.42 per Shareshare or pre-funded warrant, as applicable, and accompanying Common Warrant orcommon warrants. The actual combined public offering price per Pre-Funded Warrantshare and accompanying Common Warrantcommon warrants and the actual combined public offering price per pre-funded warrant and common warrants will be determined between us and investors based on market conditions at the time of pricing, and may be at a discount to the current market price of our Common Stock.common stock. Therefore, the recent market price and resulting assumed public offering price used throughout this prospectus may differ substantially from the actual offering price. Nonenot be indicative of the Common Warrants or Pre-Funded Warrants are listedfinal public offering price.

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information By Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on a national securities exchange. We do not intend to apply to list the Common Warrants or Pre-Funded Warrants on any national securities exchange. Without an active trading market, the liquidity of the Common Warrants and Pre-Funded Warrants may be limited.

We expect this offering to be completed within two business days following the commencementpage 7 of this offeringprospectus and we will deliver all securities toin the documents incorporated by reference into this prospectus for a discussion of risks that should be issuedconsidered in connection with this offering delivery versus payment upon receipt of investor funds received by us.

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY READ AND CONSIDER THE RISKS AND UNCERTAINTIES DESCRIBED UNDER THE HEADING “RISK FACTORS” BEGINNING ON PAGE 12 OF THIS PROSPECTUS AND UNDER SIMILAR HEADINGS IN ANY AMENDMENTS OR SUPPLEMENTS TO THIS PROSPECTUS, INCLUDING OUR MOST RECENT ANNUAL REPORT ON FORM 10-K AND ANY SIMILAR SECTION CONTAINED IN ANY DOCUMENTS THAT ARE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS.

Neither the Securities and Exchange Commission (THE "SEC") nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

We have engaged A.G.P./Alliance Global Partners asan investment in our exclusive placement agent (“A.G.P.” or the “Placement Agent”) to use its reasonable best efforts to solicit offers to purchase our securities in this offering. The Placement Agent has no obligation to purchase any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. Because there is no minimum offering amount required as a condition to closing in this offering the actual public offering amount, placement agent’s fee, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above and throughout this prospectus. We have agreed to pay the Placement Agent the placement agent fees set forth in the table below and to provide certain other compensation to the Placement Agent. See “Plan of Distribution” beginning on page of this prospectus for more information regarding these arrangements.

| Per Share and Common Warrant |

| Per Pre-Funded Warrant and Common Warrant |

| Total | |

Public offering price | $ |

| $ |

| $ | |

Placement Agent fees(1) | $ |

| $ |

| $ | |

Proceeds to us, before expenses(2) | $ |

| $ |

| $ |

_________________________________________________

(2) The above summary of offering proceeds does not give effect to any proceeds from the exercisedelivery of the Common Warrants or Pre-Funded Warrant being issued in this offering.

Deliveryshares of the Sharescommon stock and Pre-Funded Warrants, together with accompanying Common Warrants,any pre-funded warrants and common warrants to purchasers is expected to be made on or about , 2023, subject to customary closing conditions.no later than April 20, 2024.

Sole Placement AgentNeither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

A.G.P.

Roth Capital Partners

The date of this prospectus is , 2023.2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC to register the securities offered hereby under the Securities Act. We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any securities, you should carefully read this prospectus, any post-effective amendment, and any applicable prospectus supplement, together with the additional information incorporatedincorporate by reference important information into this prospectus and described under the heading “Where You Can Find More Information.”prospectus. You may obtain the information incorporated by reference without charge by following the instructions under “Where“Where You Can Find More Information.” You should carefully read this prospectus as well as additional information described under “Information Incorporated“Incorporation of Certain Information by Reference,” before deciding to invest in our securities.

You should rely only on the information contained in this prospectus.

We have not, and the Placement Agentplacement agent has not, authorized anyone to provide you with any information or to make any representations other than thatthose contained in this prospectus.prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus mayis an offer to sell only be usedthe securities offered hereby, and only under circumstances and in jurisdictions where it is legallawful to offer and sell our securities.do so. The information contained in this prospectus or in any applicable free writing prospectus is accuratecurrent only as of theits date, of this prospectus, regardless of theits time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not,

The information incorporated by reference or provided in this prospectus contains statistical data and estimates, including those relating to market size and competitive position of the markets in which we participate, that we obtained from our own internal estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable. While we believe our internal company research is reliable and the Placement Agent is not, making an offerdefinitions of our market and industry are appropriate, neither this research nor these securities indefinitions have been verified by any jurisdiction where the offer is not permitted.independent source.

For investors outside the United States: We have not, and the Placement Agentplacement agent has not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside the United States.

For purposes of this prospectus, references to the terms “APVO,” “the Company,” “we,” “us” and “our” refer to Aptevo Therapeutics Inc., together with its subsidiaries, unless the context otherwise requires.

This prospectus and the information incorporated herein by reference includeinto this prospectus contain references to our trademarks service marksand to trademarks belonging to other entities. Solely for convenience, trademarks and trade names owned by us or other companies. All trademarks, service marksreferred to in this prospectus and trade names included orthe information incorporated by reference into this prospectus, including logos, artwork, and other visual displays, may appear without the information incorporated herein by reference® or TM symbols, but such references are the property of their respective owners.

We urge younot intended to read carefully this prospectus, as supplemented and amended, before deciding whether to investindicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the securities being offered.applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATIONSTATEMENTS

This prospectus, the applicable prospectus supplement and any free writing prospectus, including the documents we incorporate by reference, herein and therein, contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 andthat involve substantial risks and uncertainties. All statements contained in this prospectus and any documents we incorporate by reference, other than statements of historical factfacts, are forward-looking statements. These statements include, but are not limited to,including statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, our ongoing and planned preclinical development and clinical trials, the timing of and our ability to make regulatory filings and obtain and maintain regulatory approvals for our product candidates and anystrategy, future product candidates, our intellectual property position, the degree of clinical utility of our product candidates, particularly in specific patient populations, our ability to develop and commercialize any product candidates, expectations regarding clinical trial data, statements regarding potential milestone payments, potential partnerships and collaborations, the advancement of our clinical and pre-clinical trials, our goals and milestones, our expectations regarding the size of the patient populations for our product candidates if approved for commercial use, our expectations regarding the effectiveness of our ADAPTIR and ADAPTIR-FLEX platforms, our ability to utilize any net operating losses, our results of operations, cash needs, spending of the proceeds from the offering described in this prospectus, financial condition, liquidity, prospects, growth and strategies, the industry in which we operate and the trends that may affect the industry or us. In some cases, you can identify forward-looking statements by terminology such as “believe,” “will,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “might,” “approximately,” “expect,” “predict,” “could,” “potentially” or the negative of these terms or other similar expressions, but the absence of these words does not mean that a statement is not forward looking.

These statements relate to future events or our future financial performanceposition, future revenue, projected costs, prospects, plans, objectives of management and expected market growth. These statements involve known and unknown risks, uncertainties and other important factors that couldmay cause our actual results, levels of activity, performance or achievements to be materially different from any future results, of operations to differ materially from thoseperformance or achievements expressed or implied by thesethe forward-looking statements. These statements reflect our views with respect

The words “anticipate”, “believe”, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”, “project”, “target”, “potential”, “will”, “would”, “could”, “should”, “continue” and similar expressions are intended to future events as of the time they were made and are based on assumptions and subject to risks and uncertainties. You should read the matters described in “Risk Factors” in this prospectus, in our Annual Report on Form 10-K and in our Quarterly Report on Form 10-Q which is incorporated by reference into this prospectus and the other cautionary statements made in this prospectus as being applicable to all relatedidentify forward-looking statements, wherever they appear in this prospectus or the documents incorporated by reference into this prospectus. In addition to factors identified under the section titled “Risk Factors” in this prospectus, factors that may impact suchalthough not all forward-looking statements include:contain these identifying words. These forward-looking statements include, among other things, statements about:

ii

These forward-looking statements are only predictions and we may not currently known to us ariseactually achieve the plans, intentions or shouldexpectations disclosed in our underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Given these uncertainties,statements, so you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have based these forward-looking statements. Except as required by law,statements largely on our current expectations and projections about future events and trends that we undertake nobelieve may affect our business, financial condition and operating results. We have included important factors in the cautionary statements included in this prospectus that could cause actual future results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

ii

You should read this prospectus with the understanding that our actual future results may be materially different from what we expect. We do not assume any obligation to update or revise publicly any forward-looking statements whether as a result of new information, future events or otherwise.otherwise, except as required by applicable law.

iii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire prospectus carefully, including the “Risk Factors” section in this prospectus and under similar captions in our most recent Annual Report on Form 10-K, in any subsequent Quarterly Reports on Form 10-Q and in our other reports filed from time to time with the SEC, as well as our historical financial statements and the notes thereto and the other documents that are incorporated by reference ininto this prospectus. In this prospectus, unless otherwise stated or the context otherwise requires, references to the terms “APVO,” “the Company,” “we,” “us” and “our” refer to Aptevo Therapeutics Inc., together with its subsidiaries, unless the context otherwise requires. This prospectus and the information incorporated herein by reference include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus and the information incorporated herein by reference are the property of their respective owners.

Business Overview

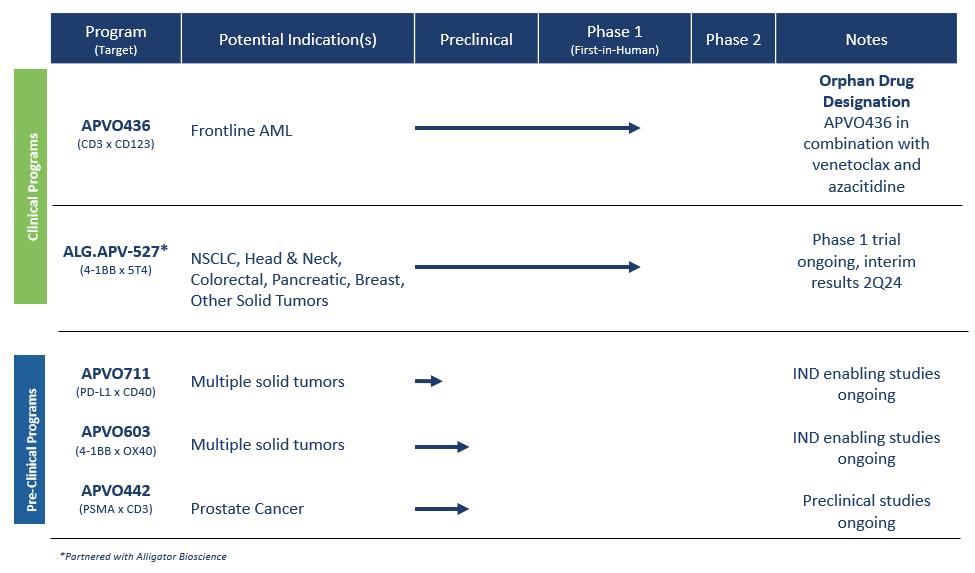

We are a clinical-stage, research and development biotechnology company focused on developing novel immunotherapy candidates for the treatment of different forms of cancer. We have developed two versatile and enabling platform technologies for rational design of precision immune modulatory drugs. Our leaddrugs and have two clinical candidates and three preclinical candidates currently in development. Clinical candidate APVO436 is a CD3xCD123 T-cell engager currently being clinically evaluated for the treatment of acute myelogenous leukemia (AML). Clinical candidate ALG.APV-527 targets 4-1BB (co-stimulatory receptor) and ALG.APV-527,5T4 (tumor antigen). The compound is designed to reactivate antigen-primed T-cells to specifically kill tumor cells and preclinicalis currently being evaluated for the treatment of multiple solid tumor types.

Preclinical candidates, APVO603 and APVO711, were also developed using our ADAPTIR™ modular protein technology platform. Our preclinical candidate APVO442 was developed using our ADAPTIR-FLEX™ modular protein technology platform.

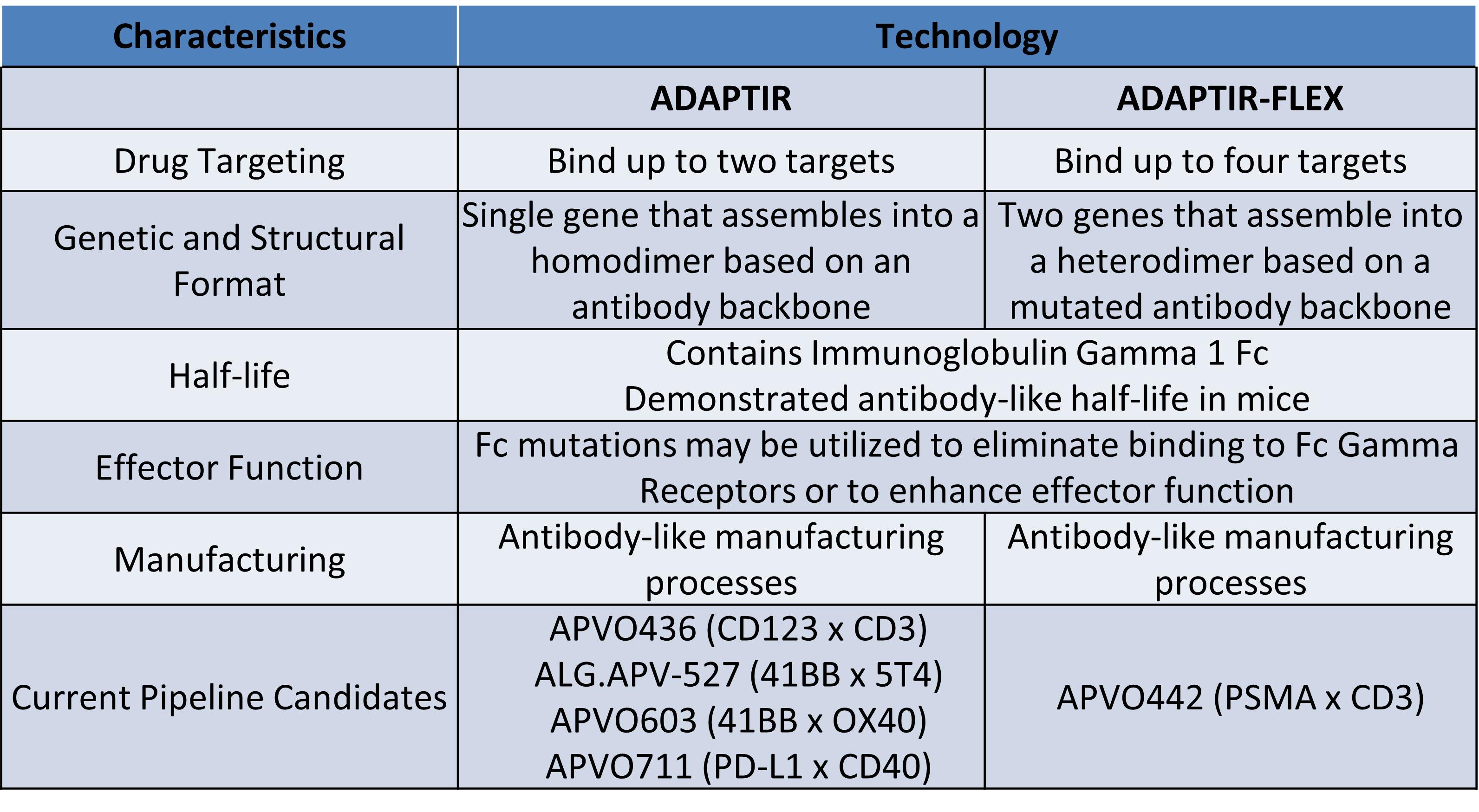

Our ADAPTIR and ADAPTIR-FLEX platforms are designed to generate monospecific, bispecific, and multi-specific antibody candidates capable of enhancing the human immune system against cancer cells. ADAPTIR and ADAPTIR-FLEX are both modular platforms, which gives us the flexibility to potentially generate immunotherapeutic candidates with a variety of mechanisms of action. This flexibility in design allows us to generate novel therapeutic candidates that may provide effective strategies against difficult to treat, as well as advanced forms of cancer. We have successfully designed and constructed numerous investigational-stage product candidates based on our ADAPTIR platform. The ADAPTIR platform technology is designed to generate monospecific and bispecific immunotherapeutic proteins that specifically bind to one or more targets, for example, bispecific therapeutic molecules, which may have structural and functional advantages over monoclonal antibodies. The structural differences of ADAPTIR molecules over monoclonal antibodies allow for the development of ADAPTIR immunotherapeuticsimmunotherapies that are designed to engage immune effector cells and disease targets to produce signaling responses that modulate the immune system to kill tumor cells.

We believe we are skilled at candidate generation, validation, and subsequent preclinical and clinical development using the ADAPTIR platform and the ADAPTIR-FLEX platform to generate bispecific and multi-specific candidates or other candidates to our platform capabilities. We have developed a preclinical candidate based on the ADAPTIR-FLEX platform which is advancing in our pipeline. We are developing our ADAPTIR and ADAPTIR-FLEX molecules using our protein engineering, preclinical development, process development, and clinical development capabilities.

Our Strategy

We seek to grow our business by, among other things:

Advancing our lead clinical stageblood cancer candidate, APVO436, through clinical development to evaluate its therapeutic potential alone and in combination with other therapies.Based on the positive results from our Phase 1 dose escalation and dose expansion study,studies, we plan to initiate a dose optimization Phase 1b/2 clinical trial in the secondfirst half of 20232024, in frontline AML patients who will receive a combination of APVO436 + Venetoclax + Azacitidine to continue to assess safety and efficacy of APVO436 in combination with Venetoclax and Azacitidine for the treatment of acute myelogenous leukemia (AML).to determine an optimal dose.

1

Advancing our lead solid tumor candidate, ALG.APV-527, developed in partnership with Alligator Bioscience AB (Alligator), further in the clinic. Aptevo and Alligator continue to investigate ALG.APV-527 for the treatment of multiple solid tumor types with 5T4-tumor expressing antigensantigens. This drug candidate is in multiple solid tumor indications in aan ongoing first-in-human Phase I clinical studytrial that started in the first quarter of 2023. We are currently enrolling new patients. ALG.APV-527 targets the 4-1BB co-stimulatory receptor (on T lymphocytes and NK cells) and 5T4 (solid tumor antigen) and is designed to promote anti-tumor immunity. Aptevo believes this compound has the potential to be clinically important because 4-1BB can stimulate the immune cells (tumor-specific T-cells and NK cells) involved in tumor control, making 4-1BB a particularly compelling target for cancer immunotherapy.

Continued development and advancement of our preclinical candidates, APVO603 (targeting 4-1BB (CD137) and OX40 (CD134), both members of the TNF-receptor family), APVO442 (targeting Prostate Specific Membrane Antigen (PSMA), a tumor antigen that is highly expressed on prostate cancer cells and CD3), and APVO711 (an anti-PD-L1 x anti-CD40 compound). We continue to advance APVO603 and APVO442 through preclinical and IND-enabling studies. In January 2023, we filed a provisional patent with the U.S. Patent and Trademark Office (USPTO)

1

pertaining to APVO711. In January 2024, the provisional patent was amended to include new preclinical data and a patent application under the Patent Cooperation Treaty ("PCT") was filed pertaining to APVO711, withwhich has the potential to treat a range of solid malignancies such as head and neck cancer. APVO711 is a dual mechanism bispecific antibody candidate that is designed to provide synergistic stimulation of CD40 on antigen presenting cells while simultaneously blocking the PD-1/PD-L1 inhibitory pathway to potentially promote a robust anti-tumor response. Preclinical studies are planned to further evaluate the mechanism of action and efficacy of APVO711.

Development of novel bispecific and multi-specific proteins for the treatment of cancer using our ADAPTIR and ADAPTIR-FLEX platforms. We have expertise in molecular and cellular biology, immunology, oncology, pharmacology, translational sciences, antibody engineering and the development of protein therapeutics. This includes target validation, preclinical proof of concept, cell line development, protein purification, bioassay and process development and analytical characterization. We focus on product development using our ADAPTIR and ADAPTIR-FLEX platforms. We plan to generate additional monospecific, bispecific, and multi-specific protein immunotherapies for development, potentially with other collaborative partners, to exploit the potential of the ADAPTIR and ADAPTIR-FLEX platforms. We will select novel candidates that have the potential to demonstrate proof of concept early in development. We expect to continue to expand the ADAPTIR and ADAPTIR-FLEX product pipelines to address areas of unmet medical need. Bispecific therapeutics are increasingly recognized as potent anti-cancer agents. Nine new bispecific agents have been approved for use by the FDA in the last three years and there is a total of 125 bispecific drug candidates currently in development. We believe our candidates in development and our future molecules derived from our ADAPTIR and ADAPTIR-FLEX platforms will be highly competitive in the market as they are rationally designed for safety and tolerability as well as efficacy.

Establishing collaborative partnerships to broaden our pipeline and provide funding for research and development. We intend to pursue collaborations with other biotechnology and pharmaceutical companies, academia, and non-governmental organizations to advance our product portfolio.

Platform Technology and Product Candidates

|

| |

|

| |

|

|

|

|

|

|

|

| |

|

| |

|

| |

|

|

|

2

Product Candidates and Platform Technology

Product Portfolio

Our current product candidate pipeline is summarized in the table below:

Platform Technologies

Recent Developments

3

On March 5, 2024, the Company completed a reverse split of its outstanding shares of common stock at a ratio of 1-for-44. In connection with the reverse stock split, every 44 shares of the Company’s issued and outstanding common stock was automatically converted into one share of the Company’s common stock. All common stock amounts and prices in this registration statement reflect the consummation of the reverse split. As of March 15, 2024, there are 4,978 shares in abeyance from the exercise of Series A and Series B common warrants related to our August 2023 public offering.

Smaller Reporting Company

Additionally, we are a “smaller reporting company” as defined in Rule 10(f)(1) of Regulation S-K. To the extent we qualify as a smaller reporting company, we may continue to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not smaller reporting companies, including, among other things, providing only two years of audited financial statements and we are also permitted to elect to incorporate by reference information filed after the effective date of the S-1 registration statement of which this prospectus forms a part. We will remain a smaller reporting company until the last day of the fiscal year in which (1) the market value of our shares of Common Stock held by non-affiliates exceeds $250 million as of the prior June 30, or (2) our annual revenues exceeded $100 million during such completed fiscal year and the market value of our shares of Common Stock held by non-affiliates exceeds $700 million as of the prior June 30.

Corporate Information

On August 6, 2015, Emergent BioSolutions Inc. (“Emergent”), announced a plan to separate into two independent publicly traded companies. To accomplish this separation, Emergent created Aptevo Therapeutics Inc. (“Aptevo”), to be the parent company for the development-based biotechnology business focused on novel oncology and hematology therapeutics. Aptevo was incorporated in Delaware in February 2016 as a wholly owned subsidiary of Emergent. To effect the separation, Emergent made a pro rata distribution of Aptevo’s Common Stock to Emergent’s stockholders on August 1, 2016.

Our Common Stock currently trades on the Nasdaq under the symbol “APVO.” Our primary executive offices are located at 2401 4th Avenue, Suite 1050, Seattle, Washington and our telephone number is (206) 838-0500. Our website address is www.aptevotherapeutics.com. The information contained in, or that can be accessed through, our website is not a part of or incorporated by reference in this prospectus, and you should not consider it part of this prospectus or of any prospectus supplement. We have included our website address in this prospectus solely as an inactive textual reference.

34

THE OFFERING

Common Stock to be Offered |

| Up to 922,509 shares. | |||

Pre-funded Warrants to be Offered |

| ||||

|

| ||||

|

| ||||

| We are also offering to certain purchasers whose purchase of | ||||

| Common warrants to purchase up to 1,845,018 shares of our common stock. Each common warrant has an exercise price of $ The shares of common stock and pre-funded warrants, and the accompanying | ||||

Common |

| 673,430 shares. | |||

Common |

| 1,595,939 shares, (assuming we sell only shares of | |||

Use of Proceeds | We estimate that the net proceeds from this offering will be approximately | ||||

10

| ||

Risk Factors |

| An investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus and |

5

this prospectus for a discussion of the risk factors | ||

Nasdaq |

| Our common stock is listed on the Nasdaq Capital Market under the symbol “APVO.” There is no established public trading market for the pre-funded warrants or common warrants, and we do not expect a market to develop. In addition, we do not intend to apply to list the pre-funded warrants or common warrants on any national securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the pre-funded warrants and common warrants will be limited. |

Unless otherwise indicated, the number of shares of Common Stock to be outstanding after this offeringThe above discussion is based on 7,544,231673,430 shares of Common Stockour common stock outstanding as of July 11, 2023. The numberMarch 15, 2024, assumes no sale of sharespre-funded warrants and excludes, as of Common Stock outstanding after this offering excludes:that date, the following:

116

RISK FACTORS

An investment in our securities involves a significanthigh degree of risk. YouBefore deciding whether to purchase our securities, including the shares of common stock offered by this prospectus, you should carefully consider the risk factorsrisks and all of the other information included in this prospectus and the documents we have incorporated by reference into this prospectus, including those in “Item 1A. Riskuncertainties described under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and ourany subsequent Quarterly Report on Form 10-Q forand our other filings with the period ended March 31, 2023,SEC, all of which are incorporated herein by reference before making an investment decision. Anyherein. If any of these risks and uncertainties could have a material adverse effect onactually occur, our business, financial condition cash flows and results of operations could be materially and adversely affected and we may not be able to achieve our goals, the value of our securities could decline and you could lose some or all of your investment. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations. If any of these risks occur, our business, results of operations or financial condition and prospects could be harmed. In that occurs,event, the tradingmarket price of our Common Stockcommon stock and the value of the warrants could decline, materially, and you could lose all or part of your investment.

The risks included in this prospectus and the documents we have incorporated by reference into this prospectus are not the only risks we face. We may experience additional risks and uncertainties not currently known to us, or as a result of developments occurring in the future. Conditions that we currently deem to be immaterial may also materially and adversely affect our business, financial condition, cash flows and results of operations, and our ability to pay distributions to stockholders.

Risks Related to This Offering

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds, including for any of the purposes described in the section of this prospectus entitled “Use of Proceeds.” You will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the net proceeds are being used appropriately. The failure by our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business, cause the price of our securities to decline and delay the development of our product candidates. Pending the application of these funds, we may invest the net proceeds from this offering in a manner that does not produce income or that loses value.

You will experience immediate and substantial dilution in the net tangible book value per share of the Common Stockcommon stock you purchase. You may also experience future dilution as a result of future equity offerings.

The price per share, together with the number of shares of our Common Stockcommon stock we propose to issue and ultimately will issue if this offering is completed, may result in an immediate decrease in the market price of our Common Stock.common stock. Our historical net tangible book value as of MarchDecember 31, 2023 was $20.1$10.1 million, or approximately $2.78$22.73 per share of our Common Stock.common stock. After giving effect to the 7,692,308922,509 shares of our Common Stockcommon stock or the exercise of the Pre-Funded Warrantspre-funded warrants to be sold in this offering at a public offering price of $1.56$5.42 per share, (assuming a public offering price equal to the last sale price of our Common Stock as reported by Nasdaq on July 13, 2023, which was $1.56 per share), our as adjusted net tangible book value as of MarchDecember 31, 2023 would have been $31.2,$14.6 million, or approximately $2.09$10.70 per share of our Common Stock.common stock. This represents an immediate dilution in the net tangible book value of $0.69$12.03 per share of our Common Stockcommon stock to our existing stockholders and an immediate increase in net tangible book value of approximately $0.53$5.28 per share of our Common Stockcommon stock to new investors, representing the difference between the assumed public offering price and our as adjusted net tangible book value as of MarchDecember 31, 2023, after giving effect to this offering, and the assumed public offering price per share.

In addition, in order to raise additional capital, we may in the future offer additional shares of our Common Stockcommon stock or other securities convertible into or exchangeable for our Common Stockcommon stock at prices that may not be the same as the price per share in this offering. In the event that the outstanding options or warrants are exercised or settled, or that we make additional issuances of Common Stockcommon stock or other convertible or exchangeable securities, you could experience additional dilution. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders, including investors who purchase shares of Common Stockcommon stock in this offering. The price per share at which we sell additional shares of our Common Stockcommon stock or securities convertible into Common Stockcommon stock in future transactions, may be higher or lower than the price per share in this offering. As a result, purchasers of the shares we sell, as well as our existing stockholders, will experience significant dilution if we sell at prices significantly below the price at which they invested.

Resales of our Common Stock in the public market during this offering by our stockholders may cause the market price of our Common Stock to fall.

Sales of a substantial number of shares of our Common Stock could occur at any time. The issuance of new shares of our Common Stock could result in resales of our Common Stock by our current stockholders concerned about the potential ownership dilution of their holdings. In turn, these resales could have the effect of depressing the market price for our Common Stock.

You may experience future dilution as a result of future equity offerings.

7

In order to raise additional capital, we may in the future offer additional common shares or other securities convertible into or exchangeable for our common shares that could result in further dilution to the investors purchasing our common shares in this offering or result in downward pressure on the price of our common shares. We may sell our common shares or other securities in any other offering at prices that are higher or lower than the prices paid by the investors in this offering, and the investors purchasing shares or other securities in the future could have rights superior to existing shareholders. Moreover, to the extent that we issue options or warrants to purchase, or securities convertible into or exchangeable for, our common shares in the future and those options, warrants or other securities are exercised, converted or exchanged, stockholders may experience further dilution.

We will have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

We currently intend to use the net proceeds from the offering of securities under this prospectus for the continued clinical development of our product candidates and for working capital, and other general corporate purposes, as described in the section of this prospectus entitled “Use of Proceeds.” We will have broad discretion in the application of the net proceeds in the category of general corporate purposes and investors will be relying on the judgment of our management regarding the application of the proceeds of this offering.

The precise amount and timing of the application of these proceeds, if any, will depend upon a number of factors, such as the timing and progress of our research and development efforts, our funding requirements and the availability and costs of other funds. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds to us from this offering. Depending on the outcome of our efforts and other unforeseen events, our plans and priorities may change and we may apply the net proceeds of this offering in different manners than we currently anticipate.

The failure by our management to apply these funds effectively could harm our business, financial condition and results of operations. Pending their use, we may invest the net proceeds from this offering in short-term, interest-bearing instruments. These investments may not yield a favorable return to our stockholders.

This offering may cause the trading price of our Common Stock to decrease.

The price per share, together with the number of shares of Common Stock we propose to issue and ultimately will issue if this offering is completed, may result in an immediate decrease in the market price of our Common Stock. This decrease may continue after the completion of this offering.

There is no public market for the Pre-Funded Warrants and Common Warrantscommon warrants or pre-funded warrants being offered by us in this offering.

There is no established public trading market for the Pre-Funded Warrants and Common Warrants being offered in this offering,common warrants or the pre-funded warrants, and we do not expect a market to develop. In addition, we do not intend to apply to list the Pre-Funded Warrants and Common Warrantscommon warrants or pre-funded warrants on any national securities exchange or other nationally recognized trading system. Without an active market, the liquidity of the Pre-Funded Warrantscommon warrants and Common Warrantspre-funded warrants will be limited.

Holders of our Pre-Funded Warrants and Common Warrants will have no rights as common stockholders until they acquire our Common Stock.

Until you acquire shares of Common Stock upon exercise of your Pre-Funded Warrants or the Common Warrants, you will have no rights with respect to the shares of Common Stock issuable upon exercise of your Common Warrants. Upon exercise of your Pre-Funded Warrants or the Common Warrants, you will be entitled to exercise the rights of a holder of shares only as to matters for which the record date occurs after the issuance date for such shares of Common Stock.

The Pre-Funded Warrantscommon warrants and the Common Warrantspre-funded warrants are speculative in nature.

The Pre-Funded Warrantscommon warrants and Common Warrantspre-funded warrants offered hereby do not confer any rights of Common Stockshare of common stock ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of Common Stockcommon stock at a fixed price. Specifically, commencing on the date of issuance, holders of the Pre-Funded Warrantscommon warrants may acquire the Common Stockshares of common stock issuable upon exercise of such warrants at an exercise price of $0.001$5.42 per share of common stock, and holders of the Common Warrantspre-funded warrants may acquire the Common Stockshares of common stock issuable upon exercise of such warrants at an exercise price of $0.0001 per share equal to the public offering price of shares of Common Stock in this offering.common stock. Moreover, following this offering, the market value of the Pre-Funded Warrantscommon warrants and the Common Warrants

pre-funded warrants is uncertain and there can be no assurance that the market value of the Pre-Funded Warrantscommon warrants or the Common Warrantspre-funded warrants will equal or exceed their respective public offering price.

The Common Warrants may not have any value.

Each Common Warrant has an exercise price per share equal toprices. There can be no assurance that the public offeringmarket price of the Shares in this offering and expires on the fifth anniversaryshares of its original issuance date. In the event the market price per share of Common Stock does notcommon stock will ever equal or exceed the exercise price of the Common Warrants duringcommon warrants or pre-funded warrants, and consequently, whether it will ever be profitable for holders of common warrants to exercise the period whencommon warrants or for holders of the Common Warrants are exercisable,pre-funded warrants to exercise the Common Warrants may notpre-funded warrants.

Holders of the warrants offered hereby will have any value.no rights as common stockholders with respect to the shares of our common stock underlying the warrants until such holders exercise their warrants and acquire our common stock, except as otherwise provided in the warrants.

Until holders of the common warrants and the pre-funded warrants acquire shares of our common stock upon exercise thereof, such holders will have no rights with respect to the shares of our common stock underlying such warrants, except to the extent that holders of such warrants will have certain rights to participate in distributions or dividends paid on our common stock as set forth in the warrants. Upon exercise of the common warrants and the pre-funded warrants, the holders will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

This is a reasonable best efforts offering, in which no minimum number or dollar amount of securities is required to be sold, and we may not raise the amount of capital we believe is required for our business plans, including our near-term business plans.

The Placement Agentplacement agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The Placement Agentplacement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. There is no required minimum number of securities that must be sold as a condition to completion of this offering. Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, placement agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth herein.above. We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund.refund in the event that we do not sell an amount of securities sufficient to support our continued operations, including our near-term continued operations. Thus, we may not raise the amount of capital we believe is required for our operations in the short-term and may need to raise additional funds, to complete such short-term operations. Such additional fundraiseswhich may not be available or available on terms acceptable to us.

Purchasers who purchase our securities in this offering pursuant to a securities purchase agreement may have rights not available to purchasers that purchase without the benefit of a securities purchase agreement.

In addition to rights and remedies available to all purchasers in this offering under federal securities and state law, the purchasers that enter into a securities purchase agreement will also be able to bring claims of breach of contract against us. The Placement Agent isability to pursue a claim for breach of contract provides those investors with the means to enforce the covenants uniquely available to them under the securities purchase agreement including, but not limited

8

to: (i) timely delivery of securities; (ii) agreement to not enter into any financings for 60 days from closing; and (iii) indemnification for breach of contract.

Resales of our common stock in the public market during this offering by our stockholders may cause the shares onmarket price of our common stock to fall.

Sales of a “reasonable best efforts” basis and the Placement Agent is under no obligation to purchase any shares for its own account. The Placement Agent is not required to sell any specificsubstantial number or dollar amount of shares of Common Stockour common stock could occur at any time. The issuance of new shares of our common stock could result in resales of our common stock by our current stockholders concerned about the potential ownership dilution of their holdings. In turn, these resales could have the effect of depressing the market price for our common stock.

This offering may cause the trading price of our common stock to decrease.

The price per share, together with the number of shares of common stock we propose to issue and ultimately will issue if this offering but will use its reasonable best efforts to sellis completed, may result in an immediate decrease in the securities offered inmarket price of our common stock. This decrease may continue after the completion of this prospectus. As a “reasonable best efforts” offering, there can be no assurance that the offering contemplated hereby will ultimately be consummated.offering.

9

USE OF PROCEEDS

We estimate that we will receivethe net proceeds of approximately $12.0 million from the sale of the securities by us in this offering based on an assumed combined public offering price of $1.56 per share and accompanying Common Warrant (assuming a public offering price equal to the last sale price of our Common Stock as reported by Nasdaq on July 13, 2023, which was $1.56),will be approximately $4.6 million, after deducting the Placement Agentplacement agent fees and estimated offering expenses payable by us, assuming no sale of any fixed combinations of pre-funded warrants and excludingwarrants offered hereunder. If the common warrants are exercised in full for cash, the estimated net proceeds if any, received fromwill increase to $9.2 million. However, because this is a reasonable best-efforts offering and there is no minimum offering amount required as a condition to the exerciseclosing of warrants issued in this offering.offering, the actual offering amount, the placement agent’s fees and net proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth on the cover page of this prospectus.

We currently intend to use the net proceeds we receive from this offering for working capital to fund our clinical programs and general corporate purposes, including the continued clinicalfurther development of our product candidates and for working capital, and other general corporate purposes. Ourcandidates. This expected use of net proceeds from this offering represents our intentions based onupon our presentcurrent plans and prevailing business conditions, which could change in the future as our plans and prevailing business conditions evolve. The amountamounts and timing of our actual expendituresuse of proceeds will dependvary depending on numerousa number of factors, including the timing and successamount of clinical studiescash generated or clinical studies we may commence in the future, the timing of regulatory submissions and the feedback from regulatory authorities.used by our operations. As a result, our managementwe will haveretain broad discretion overin the useallocation of the net proceeds fromof this offering. Pending our use of the net proceeds from this offering, we may temporarily invest the net proceeds in investment-grade, interest-bearing securities.

Predicting the cost necessary to develop product candidates can be difficult and we anticipate we will need additional funds to complete the development work generally required for obtaining regulatory approval to commercialize a drug. We have based these estimates on assumptions that may prove to be wrong, and we could use our available capital resources sooner than we currently expect.

10

MARKET FOR COMMON STOCK AND DIVIDEND POLICY

Our Common Stock is traded on the Nasdaq under the symbol “APVO.” The last reported sale price of our Common Stock on July 13, 2023 on the Nasdaq was $1.56 per share. As of July 13, 2023, there were 114 stockholders of record of our Common Stock.

We have never declared or paid, and do not anticipate declaring, or paying in the foreseeable future, any cash dividends on our capital stock. Future determinations as to the declaration and payment of dividends, if any, will be at the discretion of our board of directors and will depend on then existing conditions, including our operating results, financial conditions, contractual restrictions, capital requirements, business prospects and other factors our board of directors may deem relevant.

CAPITALIZATION

The following table presents a summary of our cash and cash equivalents and capitalization as of MarchDecember 31, 2023:

The unaudited as adjusted information below is prepared for illustrative purposes only and our capitalization following the completion of this offering will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. You should read the following table in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations and the historical financial statements and related notes in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and our Quarterly Report on Form 10-Q for the period ended March 31, 2023, incorporated herein by reference.

|

| As of March 31, 2023 |

|

| As of December 31, 2023 |

| ||||||||||

(in thousands) |

| Actual |

|

| As adjusted |

|

| Actual |

|

| As adjusted |

| ||||

Cash and cash equivalents |

| $ | 25,328 |

|

| $ | 36,388 |

|

| $ | 16,904 |

|

| $ | 21,454 |

|

Common stock: $0.001 par value; 500,000,000 shares authorized; 7,239,471 shares issued and outstanding, actual; 15,236,539 shares issued and outstanding, as adjusted |

|

| 49 |

|

|

| 57 |

| ||||||||

Common stock: $0.001 par value; 500,000,000 shares authorized; 442,458 shares issued and outstanding, actual; 1,364,967 shares issued and outstanding, as adjusted |

|

| 61 |

|

|

| 62 |

| ||||||||

Additional paid-in capital |

|

| 226,470 |

|

|

| 237,522 |

|

|

| 235,607 |

|

|

| 240,156 |

|

Accumulated deficit |

|

| (203,263 | ) |

|

| (203,263 | ) |

|

| (223,447 | ) |

|

| (223,447 | ) |

Total stockholders' equity |

| $ | 23,256 |

|

| $ | 34,316 |

|

| $ | 12,221 |

|

| $ | 16,771 |

|

Each $0.25$1.00 increase (decrease) in the assumed public offering price of $1.56$5.42 per share would increase (decrease) each of cash and cash equivalents, additional paid-in capital and total shareholders’ equity by approximately $1.8$0.9 million, assuming the number of shares of Common Stockcommon stock and Common Warrantscommon warrants offered, as set forth on the cover page of this prospectus, remains the same, and after deducting estimated placement agent fees and estimated offering expenses. Similarly, each increase (decrease) of 100,000 shares in the number of shares of Common Stockcommon stock and Common Warrantscommon warrants offered would increase (decrease) cash and cash equivalents, additional paid-in capital and total shareholders’ equity by approximately $0.1$0.5 million, assuming the assumed public offering price remains the same, and after deducting estimated placement agent fees and estimated offering expenses payable by us. The pro forma as adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

The number ofabove discussion is based on 442,458 shares of our Common Stock outstanding before and after this offering is based on 7,239,471 shares of our Common Stockcommon stock outstanding as of MarchDecember 31, 2023:2023, assumes no sale of pre-funded warrants and excludes, as of that date, the following:

11

12

DILUTION

If you purchase shares of our Common Stock,common stock, your interest will be diluted immediately to the extent of the difference between the offering price per share you will pay in this offering and the as adjusted net tangible book value per share of our Common Stockcommon stock after this offering. Net tangible book value per share represents our total tangible assets less total liabilities, divided by the number of shares of our Common Stockcommon stock outstanding.

The Company underwent a reverse stock split on March 5, 2024, at a ratio of 1-for-44, whereby every 44 shares of the Company’s issued and outstanding common stock was automatically combined into one issued and outstanding share of common stock, without any change in par value per share. As a result of the reverse stock split, proportionate adjustments will be made to the per share exercise price and/or the number of shares issuable upon the exercise or vesting of all then outstanding stock options, restricted stock units and warrants, which will result in a proportional decrease in the number of shares of the Company’s common stock reserved for issuance upon exercise or vesting of such stock options, restricted stock units and warrants, and, in the case of stock options and warrants, a proportional increase in the exercise price of all such stock options and warrants.

As of MarchDecember 31, 2023, our net tangible book value was $20.1$10.1 million, or $2.78$22.73 per share of Common Stock.Stock, as adjusted for the reverse stock split.

After giving effect to the foregoing pro forma adjustments and the sale by us of 7,692,3080.9 million shares of Common Stockcommon stock and accompanying Common Warrantscommon warrants at an assumed public offering price of $1.56$5.42 per share and $1.56$0.0001 per Pre-Funded Warrantpre-funded warrant and accompanying Common Warrant,common warrant, and after deducting the placement agent fees and estimated offering expenses payable by us, our as adjusted net tangible book value as of MarchDecember 31, 2023, would have been $31.2$14.6 million, or $2.09$10.70 per share. This represents an immediate dilution in as adjusted net tangible book value of approximately $0.69$12.03 per share to our existing stockholders, and an immediate increase of $0.53$5.28 per share to purchasers of shares in this offering, as illustrated in the following table:

Assumed public offering price per Share |

| $ | 1.56 |

|

| $ | 5.42 |

|

Net tangible book value per share as of March 31, 2023 |

| $ | 2.78 |

| ||||

Net tangible book value per share as of December 31, 2023 |

| $ | 22.73 |

| ||||

Net dilution in net tangible book value per share attributable to existing shareholders |

| $ | 0.69 |

|

| $ | 12.03 |

|

As adjusted net tangible book value per share after this offering |

| $ | 2.09 |

|

| $ | 10.70 |

|

Dilution in net tangible book value per share to new investors in the offering |

| $ | 0.53 |

|

| $ | 5.28 |

|

The number ofabove discussion is based on 442,458 shares of our Common Stock outstanding before and after this offering is based on 7,239,471 shares of our Common Stockcommon stock outstanding as of MarchDecember 31, 2023:2023, assumes no sale of pre-funded warrants and excludes, as of that date, the following:

13

DESCRIPTION OF SECURITIESCAPITAL STOCK

The following descriptionsummary of the rights of our capital stock is not complete and is subject to and qualified in its entirety by reference to our Charter and Bylaws, copies of which are filed as exhibits to our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 5, 2024, and the Certificate of Designations and forms of securities, copies of which are filed as exhibits to the registration statement of which this prospectus forms a part , which are incorporated by reference herein.

As of the date of this prospectus, our certificate of incorporation, authorizes us to issue up to 500,000,000 shares of Common Stock, which$0.001 par value per share, and 15,000,000 shares of preferred stock, $0.001 par value per share. Our Common Stock is the only security of the Company registered under Section 1212(b) of the Securities Exchange Act and is listed on the Nasdaq under the trading symbol “APVO.” As of 1934, as amended (the “Exchange Act”), is intended as aMarch 15, 2024, 673,430 shares of Common Stock were outstanding and no shares of preferred stock were outstanding.

The following summary anddescribes the material terms of our capital stock. The summary is qualified in its entirety by reference to our amended and restated certificate of incorporation and our amended and restated bylaws, applicable provisions of the Delaware General Corporation Law (the “DGCL”) and pursuant to our rights plan, which are available in our filings with the SEC.

In this offering, we are offering 7,692,308 Shares and Common Warrants to purchase up to 7,692,308 shares of Common Stock at an exercise price of $1.56 per Share and related Common Warrants to purchase up to 7,692,308 shares of Common Stock at an exercise price of $1.56 per share. This prospectus supplement also relates to the offering of shares of our Common Stock upon the exercise, if any, of the warrants issued in this offering.bylaws.

Authorized Shares

Our authorized Shares consists of 500,000,000 shares of Common Stock and 15,000,000 shares of preferred stock, $0.001 par value per share (the “Preferred Stock”). Our Common Stock is registered under Section 12(b) of the Exchange Act and is listed on the Nasdaq under the trading symbol “APVO.”

Common Stock

Voting Rights

Each holder of our Common Stock is entitled to one vote for each share on all matters submitted to a vote of the stockholders, including the election of directors. Under our amended and restated certificate of incorporation and amended and restated bylaws, our stockholders do not have cumulative voting rights. Because of this, the holders of a majority of the shares of Common Stock entitled to vote in any election of directors can elect all of the directors standing for election, if they should so choose.

Dividends

Subject to preferences that may be applicable to any then-outstanding shares of preferred stock, holders of Common Stock are entitled to receive ratably those dividends, if any, as may be declared from time to time by our board of directors out of legally available funds.

Liquidation

In the event of our liquidation, dissolution or winding up, holders of Common Stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any then-outstanding shares of preferred stock.

Rights and Preferences

Each share of Common Stock includes an associated right pursuant to and as set forth in the Rights Agreement that we entered into with Broadridge Corporate Issuer Solutions, Inc. on November 8, 2020 (the “rights agreement”). Each right initially represents the right to purchase from us one one-thousandth of a share of our Series A Junior Participating Preferred Stock, par value $0.001 per share. This right is not exercisable until the occurrence of certain events specified in such rights agreement. The value attributable to these rights, if any, is reflected in the value of our Common Stock. The rights agreement and the rights granted thereunder will expire upon the earliest to occur of (i) the date on which all of such rights are redeemed, (ii) the date on which such rights are exchanged, and (iii) the close of business on November 8, 2021.4, 2024.

Fully Paid and Nonassessable.

All of our outstanding shares of Common Stock are fully paid and nonassessable.

14

Preferred Stock

Pursuant to our amended and restated certificate of incorporation, our board of directors has the authority, without further action by our stockholders, to designate up to 15,000,000 shares of preferred stock in one or more series and to fix the rights, preferences, privileges and restrictions thereof. These rights, preferences and privileges could include dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting, or the designation of, such series, any or all of which may be greater than the rights of common stock.

The Delaware General Corporation Law (“DGCL”) provides that the holders of preferred stock will have the right to vote separately as a class on any proposal involving fundamental changes in the rights of holders of that preferred stock. This right is in addition to any voting rights that may be provided for in the applicable certificate of designation.

Warrants Outstanding

Series A and Series B Common Warrants 2023 - As of July 11, 2023, there wereMarch 15, 2024, we have issued and outstanding Series A common warrants to purchase 350,58942,555 shares of Common Stock outstanding. These warrants were issued on March 11, 2019 as part of our public offering of Common Stock and warrants.

Pre-Funded Warrants

The following summarySeries B common warrants to purchase 1,316 shares of certain terms and provisions of Pre-Funded Warrants that are being offered hereby is not complete and is subject to, and qualified in its entirety by, the provisions of the Pre-Funded Warrant, the form of which is filed asour Common Stock at an exhibit to the registration statement of which this prospectus forms a part. Prospective investors should carefully review the terms and provisions of the form of Pre-Funded Warrant for a complete description of the terms and conditions of the Pre-Funded Warrants.

Duration and Exercise Price. Each Pre-Funded Warrant offered hereby will have an initial exercise price of $27.28 per share equalshare. As of March 15, 2024, there are 4,978 shares in abeyance from the exercise of Series A and Series B common warrants related to $0.001.our August 2023 public offering. The Pre-Funded Warrants will beSeries A common warrants and Series B common warrants are immediately exercisable and may be exercised at any time until the Pre-Funded Warrants are exercisedexpire in full.August 2028 and February 2025, respectively. The exercise price and the number of shares of Common Stock issuablepurchasable upon the exercise isof the warrants are subject to appropriate adjustment inupon the eventoccurrence of specific events, including sales of additional shares of Common Stock, stock dividends, stock splits, reorganizations or similar events affecting our Common Stockreclassifications and the exercise price. The Pre-Funded Warrants will be issued separately from the accompanying Common Warrants and may be transferred separately immediately thereafter.