As filed with the Securities and Exchange Commission on November 9, 201722, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

APTEVO THERAPEUTICS INC.

Aptevo Therapeutics Inc.

(Exact name of registrant as specified in its charter)charter)

Delaware |

| 81-1567056 |

(State or other jurisdiction ofincorporation or organization) |

| (I.R.S. EmployerIdentification Number) |

2401 4th Avenue, Suite 1050

Seattle, WA 98121

(206) 838-0500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Marvin L. White

President and Chief Executive Officer

Aptevo Therapeutics Inc.

2401 4th Avenue, Suite 1050

Seattle, WA 98121

(206) 838-0500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Sonya Erickson

Alan D. Hambelton

Cooley LLP

1700 Seventh Avenue, Suite 1900

Seattle, WA 98101

(206) 452-8700

Sean M. Donahue Paul Hastings LLP 2050 M Street, NW Washington, DC 20036 (202) 551-1704 | SoYoung Kwon Senior Vice President and General Counsel Aptevo Therapeutics Inc. 2401 4th Avenue, Suite 1050 Seattle, Washington, 98121 (206) 838-0500 |

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ |

| Accelerated filer | ☐ |

Non-accelerated filer |

|

| Smaller reporting company | ☒ |

|

|

| Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☒☐

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Per Unit | Proposed Maximum | Amount of Fee (1) |

Common Stock, par value $0.001 per share | (2) | (3) | (3) | — |

Preferred Stock, par value $0.001 per share | (2) | (3) | (3) | — |

Debt Securities | (2) | (3) | (3) | — |

Warrants | (2) | (3) | (3) | — |

Total | (2) |

| $150,000,000 | $18,675 |

|

|

|

|

|

|

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission,SEC, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement contains a prospectus covering the resale by the holders named herein, from time to time, of up to 32,026,068 shares of our Common Stock underlying common warrants issuable in connection with the Warrant Inducement Agreement, dated November 9, 2023 (the “Warrant Inducement Agreement”) with certain holders of our Series A and Series B common warrants (the “Existing Warrants”). The Existing Warrants were issued as part of our August 4, 2023 public offering.

This registration statement contains:

a base prospectus covering the offering, issuance and sale by us of up to $150,000,000 in the aggregate of the securities identified above from time to time in one or more offerings; and

an equity distribution agreement prospectus covering the offering, issuance and sale by us of up to a maximum aggregate offering price of $17,500,000 of our common stock that may be issued and sold under an equity distribution agreement, or the Equity Distribution Agreement, with Piper Jaffray & Co.

The base prospectus immediately follows this explanatory note. The specific terms of any securities to be offered pursuant to the base prospectus will be specified in a prospectus supplement to the base prospectus. The equity distribution agreement prospectus immediately follows the base prospectus. The $17,500,000 of common stock that may be offered, issued and sold by us under the equity distribution agreement prospectus is included in the $150,000,000 of securities that may be offered, issued and sold by us under the base prospectus. Upon termination of the Equity Distribution Agreement, any portion of the $17,500,000 included in the equity distribution agreement prospectus that is not sold pursuant to the Equity Distribution Agreement will be available for sale in other offerings pursuant to the base prospectus, and if no shares are sold under the Equity Distribution Agreement, the full $17,500,000 of securities may be sold in other offerings pursuant to the base prospectus and a prospectus supplement.

The information contained in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated November 9, 201722, 2023

PRELIMINARY PROSPECTUS

$150,000,000

Up to 32,026,068 Shares of Common Stock

Preferred Stock

Debt Securities

Issuable Upon the Exercise of Common Warrants

We may,This prospectus relates to the resale from time to time offer and sellby certain selling stockholders named herein (the “Holders”) of up to $150,000,000 of any combination32,026,068 shares of our common stock, preferred stock, debt securitiesCommon Stock par value $0.001 per share (“Common Stock”) of Aptevo Therapeutics Inc. (“Company,” “us” or warrants described in this prospectus, either individually or in combination with other securities, at prices and on terms described in one or more supplements to this prospectus. We may also offer common stock or preferred stock“we”), issuable upon conversion of debt securities, common stock upon conversion of preferred stock, or common stock, preferred stock or debt securities upon the exercise of warrants.Series A-1 Warrants (the “Series A-1 Warrants”), Series A-2 Warrants (the “Series A-2 Warrants,” together with the Series A-1 Warrants the “New Series A Warrants”), Series B-1 Warrants (the “Series B-1 Warrants”) and Series B-2 Warrants (the “Series B-2 Warrants,” together with the Series B-1 Warrants, the “New Series B Warrants,” together with the New Series A Warrants the “New Warrants”). The New Warrants were or may be issued pursuant to that certain Warrant Inducement Agreement, dated as of November 9, 2023, by and between the Company and the Holders (the “Warrant Inducement Agreement”). Such shares of Common Stock underlying the New Warrants are collectively referred to herein as the “Resale Shares.” We may also authorize one or more free writing prospectusesare registering the Resale Shares on behalf of the Holders, to be providedoffered and sold from time to you in connection with these offerings.time, to satisfy certain registration rights that we have granted to the Holders pursuant to the Warrant Inducement Agreement.

This prospectus describes some

The Holders may resell or dispose of the general terms that may apply to an offering of our securities. We will provide the specific terms of these offerings and securities in one or more supplements to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. The prospectus supplement and any related free writing prospectus may also add, update or change information contained or incorporated by reference in this prospectus. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as the documents incorporated by reference herein and therein, before buying any of the securities being offered.

Securities may be sold by usResale Shares to or through underwriters, or dealers, directly to purchasersbroker-dealers, agents, or through agents designated from time to time. For additional information onany other means described in the methodssection of sale, you should refer to the sectionthis prospectus entitled “Plan of Distribution”Distribution.” The Holders will bear the commissions and discounts, if any, attributable to the sale or disposition of the Resale Shares. We will bear all costs, expenses and fees in this prospectus and inconnection with the applicable prospectus supplement. Ifregistration of the Resale Shares. We will not receive any underwriters are involved inof the proceeds from the sale of any securities with respect to which this prospectus is being delivered, the names of such underwriters and any applicable discounts or commissions and over-allotment options will be set forth in a prospectus supplement. The price toResale Shares by the public of such securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.Holders.

Our common stockCommon Stock is listed on the NASDAQ GlobalNasdaq Capital Market under the symbol “APVO.” On November 8, 2017,21, 2023, the last reported sale price of our common stockCommon Stock on the NASDAQ GlobalNasdaq Capital Market was $2.86$0.1959 per share. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our common stock in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million. We have not offered any securities pursuant to General Instruction I.B.6 of Form S-3 during the 12 calendar months prior to and including the date of this prospectus.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 413 of this prospectus, and under similar headings in the applicable prospectus supplement, any free writing prospectuses we have authorized for use in connection with a specific offering and in the documents incorporated by reference herein and therein.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 22, 2023. .

| |

Page | |

i | |

1 | |

| |

7 | |

8 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

About this Prospectus

This prospectus is part of a resale registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC.

If information in this prospectus is inconsistent with any document incorporated by reference that was filed with the SEC before the date of this prospectus, you should rely on this prospectus. This prospectus and the documents incorporated by reference include important information about us, the securities being offered and other information you should know before investing in our securities. You should also read and consider information in the documents we have referred you to in the sections of this prospectus entitled “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference.”

You should rely only on the information contained in, or incorporated by reference ininto, this prospectus (as supplemented and the applicable prospectus supplement,amended), along with the information contained in any free writing prospectuses we have authorized for use in connection with a specific offering.prospectuses. We have not authorized anyone to provide you with different information. We are not making an offertake no responsibility for, and can provide no assurances as to sell or seeking an offer to buy securities under this prospectus or the applicable prospectus supplement andreliability of, any related free writing prospectus in any jurisdiction where the offer or sale is not permitted.other information that others may give you. The information contained in this prospectus the applicable prospectus(and in any supplement or amendment to this prospectus) or any related free writing prospectus, and the documents incorporated by reference herein and therein, are accurate only as of their respective dates, regardless of the time of delivery of this prospectus, theany applicable prospectus supplement or any related free writing prospectus, or the time of any sale of a security.

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf registration statement, we may sell from timesecurity. We urge you to time in one or more offerings up to a total dollar amount of $150,000,000 of common stock, preferred stock, various series of debt securities and/or warrants to purchase any of such securities, either individually or in combination with other securities as described in this prospectus. Each time we sell any type or series of securities underread carefully this prospectus we will provide a prospectus supplement that will contain more specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. A prospectus supplement(as supplemented and any related free writing prospectus may also add, update or change the information contained or incorporated by reference in this prospectus. This prospectus,amended), together with the applicable prospectus supplement, any related free writing prospectus and the documentsinformation incorporated herein by reference herein and therein, will include all material information relating to the applicable offering. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectus, together with the additional informationas described under “Where You Can Find Morethe heading “Incorporation of Certain Information” by Reference” before buyingdeciding whether to invest in any of the securitiesCommon Stock being offered.

THIS PROSPECTUS MAY NOT BE USED TO CONSUMMATE A SALE OF SECURITIES UNLESS IT IS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More Information.”

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “Aptevo,” “the Company,” “we,” “us,” “our” and similar references refer to Aptevo Therapeutics Inc., a corporation organized under the laws of the State of Delaware. Delaware, and its subsidiaries on a consolidated basis.

We are not making an offer or sale of our Common Stock in any jurisdiction where such offer or sale is not permitted. Neither we nor any of our representatives are making any representation to you regarding the legality of an investment in our Common Stock by you under applicable laws. We urge you to consult with your own advisors as to legal, tax, business, financial and related aspects of an investment in our Common Stock.

This prospectus and the information incorporated herein by reference herein include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference ininto this prospectus any applicable prospectus supplement or any related free writing prospectusand the information incorporated herein by reference are the property of their respective owners.

i

iForward-Looking Statements

This prospectus, any applicable prospectus supplement and any free writing prospectus, including the documents we incorporate by reference herein and therein, contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and involve substantial risks and uncertainties. All statements other than statements of historical fact are forward-looking statements. These statements include, but are not limited to, statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, our ongoing and planned preclinical development and clinical trials, the timing of and our ability to make regulatory filings and obtain and maintain regulatory approvals for our product candidates and any future product candidates, our intellectual property position, the degree of clinical utility of our product candidates, particularly in specific patient populations, our ability to develop and commercialize any product candidates, expectations regarding clinical trial data, statements regarding potential milestone payments, potential partnerships and collaborations, the advancement of our clinical and preclinical trials, our goals and milestones, our expectations regarding the size of the patient populations for our product candidates if approved for commercial use, our expectations regarding the effectiveness of our ADAPTIR and ADAPTIR-FLEX platforms, our ability to utilize any net operating losses, our results of operations, cash needs, financial condition, liquidity, prospects, growth and strategies, the industry in which we operate and the trends that may affect the industry or us. In some cases, you can identify forward-looking statements by terminology such as “believe,” “will,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “might,” “approximately,” “expect,” “predict,” “could,” “potentially” or the negative of these terms or other similar expressions, but the absence of these words does not mean that a statement is not forward looking.

These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or results of operations to differ materially from those expressed or implied by these forward-looking statements. These statements reflect our views with respect to future events as of the time they were made and are based on assumptions and subject to risks and uncertainties. You should read the matters described in “Risk Factors” in this prospectus, in our Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q which is incorporated by reference into this prospectus and the other cautionary statements made in this prospectus as being applicable to all related forward-looking statements wherever they appear in this prospectus or the documents incorporated by reference into this prospectus. In addition to factors identified under the section titled “Risk Factors” in this prospectus, factors that may impact such forward-looking statements include:

1

SummaryShould one or more of the risks or uncertainties described in this prospectus occur, additional material risks and uncertainties not currently known to us arise or should our underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

The following2

PROSPECTUS Summary

This summary highlights information contained elsewhere in this prospectus or incorporated by reference herein andprospectus. This summary does not contain all of the information that may be importantyou should consider before deciding to purchasers ofinvest in our securities. Prospective purchasers of our securities You should carefully read this entire prospectus the applicable prospectus supplement and any related free writing prospectus,carefully, including the risks of investing“Risk Factors” section in this prospectus, in our securities discussed undermost recent Annual Report on Form 10-K, in any subsequent Quarterly Reports on Form 10-Q and in our other reports filed from time to time with the heading “Risk Factors” and under similar headings in the applicable prospectus supplement, any related free writing prospectusSEC, as well as our historical financial statements and the notes thereto and the other documents incorporated by reference herein and therein. Prospective purchasers of our securities should also carefully read the informationthat are incorporated by reference in this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.prospectus.

Aptevo Therapeutics Inc.

Business Overview

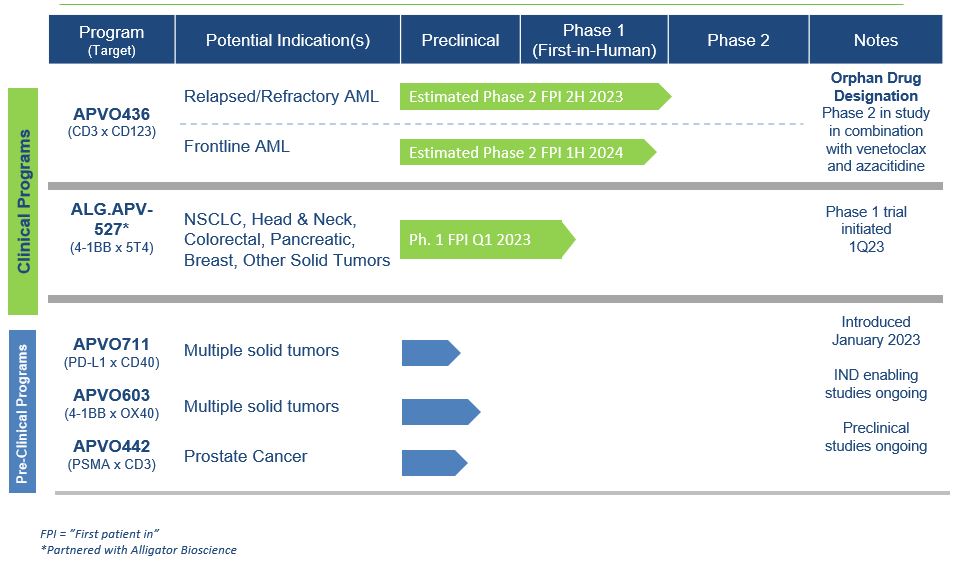

We are a clinical-stage, research and development biotechnology company focused on developing novel oncology (cancer) and hematology (blood disease) therapeutics to meaningfully improve patients’ lives. Our core technology isimmuno-oncology candidates for the ADAPTIR™ (modular protein technology) platform.treatment of different forms of cancer. We have one revenue-generating productdeveloped two versatile and enabling platform technologies for rational design of precision immune modulatory drugs. Our lead clinical candidates, APVO436 and ALG.APV-527, and preclinical candidates, APVO603 and APVO711, were developed using our ADAPTIR™ modular protein technology platform. Our preclinical candidate APVO442 was developed using our ADAPTIR-FLEX™ modular protein technology platform.

Our ADAPTIR and ADAPTIR-FLEX platforms are designed to generate monospecific, bispecific, and multi-specific antibody candidates capable of enhancing the human immune system against cancer cells. ADAPTIR and ADAPTIR-FLEX are both modular platforms, which gives us the flexibility to potentially generate immuno-oncology candidates with a variety of mechanisms of action. This flexibility in the area of hematology,design allows us to generate novel therapeutic candidates that may provide effective strategies against difficult to treat, as well as various investigational stageadvanced forms of cancer. We have successfully designed and constructed numerous investigational-stage product candidates in immuno-oncology.

Our pipeline is composed of one marketed product, IXINITY, and investigational stage candidates based on our ADAPTIRTM (modular protein technology) platform. The ADAPTIR platform technology can produceis designed to generate monospecific and multispecific immunotherapeuticbispecific immuno-oncology proteins that specifically bind to one or more targets, for example, bispecific therapeutic molecules, which may have structural and functional advantages over monoclonal antibodies. Our investigational stage product candidates otlertuzumab, APVO414, APVO210, and ALG.APV-527, a bispecific antibody candidate, featuring a novel mechanism of action targeting 4-1BB (CD137) and 5T4. The mechanisms of action for otlertuzumab, APVO414, APVO210, APVO436 and ALG.APV-527 include direct tumor cytotoxicity, antibody-dependent cell-cytotoxicity, redirected T-cell cytotoxicity (RTCC), costimulation of anti-tumor T cells and targeted cytokine delivery. The structural differences of ADAPTIR molecules over monoclonal antibodies allow for the development of other ADAPTIR immunotherapeuticsimmuno-oncology therapies that are designed to engage immune effector cells and disease targets to produce signaling responses that modulate the immune system to kill tumor cells.

We believe we are skilled at candidate generation, validation, and subsequent preclinical and clinical development using the ADAPTIR platform and the ADAPTIR-FLEX platform to generate multi-specific candidates or other candidates to our platform capabilities. We have developed a preclinical candidate based on the ADAPTIR-FLEX platform which is advancing in our pipeline. We are developing our ADAPTIR and ADAPTIR-FLEX molecules using our protein engineering, preclinical development, process development, and clinical development capabilities.

Our Strategy

We seek to grow our business by, among other things:

Advancing our lead clinical stage candidate, APVO436, through clinical development to evaluate its therapeutic potential alone and in combination with other therapies. Based on the positive results from our Phase 1 dose escalation and dose expansion study, we plan to initiate a Phase 2 clinical trial to continue to assess efficacy of APVO436 in combination with Venetoclax and Azacitidine for the treatment of acute myelogenous leukemia (AML). APVO436 is designed to engage CD3 and CD123 to redirect T-cells to destroy leukemia cells expressing the target CD123 molecule on their surface.

Advancing our solid tumor candidate, ALG.APV-527, developed in partnership with Alligator Bioscience AB (Alligator), further in the clinic. Aptevo and Alligator continue to investigate ALG.APV-527 for the treatment of multiple 5T4-tumor expressing antigens in multiple solid tumor indications in a first-in-human Phase I clinical study that started in the first quarter of 2023. We are currently enrolling new patients. ALG.APV-527 targets the 4-1BB co-stimulatory receptor (on T lymphocytes and NK cells) and 5T4 (solid tumor antigen) and is designed to promote anti-tumor immunity.

Continued development and advancement of our preclinical candidates, APVO603 (targeting 4-1BB (CD137) and OX40 (CD134), both members of the TNF-receptor family), APVO442 (targeting Prostate Specific Membrane Antigen (PSMA), a tumor antigen that is highly expressed on prostate cancer cells and CD3), and APVO711 (an anti-PD-L1 x anti-CD40 compound). We continue to advance APVO603 and APVO442 through preclinical and

3

IND-enabling studies. In January 2023, we filed a provisional patent with the U.S. Patent and Trademark Office (USPTO) pertaining to APVO711, with the potential to treat a range of solid malignancies such as head and neck cancer. APVO711 is a dual mechanism bispecific antibody candidate that is designed to provide synergistic stimulation of CD40 on antigen presenting cells while simultaneously blocking the PD-1/PD-L1 inhibitory pathway to potentially promote a robust anti-tumor response. Preclinical studies are planned to further evaluate the mechanism of action and efficacy of APVO711.

Development of novel mannerbispecific and multi-specific proteins for the treatment of cancer using our ADAPTIR and ADAPTIR-FLEX platforms. We have expertise in molecular and cellular biology, immunology, oncology, pharmacology, translational sciences, antibody engineering and the development of protein therapeutics. This includes target validation, preclinical proof of concept, cell line development, protein purification, bioassay and process development and analytical characterization. We focus on product development using our ADAPTIR and ADAPTIR-FLEX platforms. We plan to produce unique signaling responses.generate additional monospecific, bispecific, and multi-specific protein immunotherapies for development, potentially with other collaborative partners, to exploit the potential of the ADAPTIR and ADAPTIR-FLEX platforms. We will select novel candidates that have the potential to demonstrate proof of concept early in development. We expect to continue to expand the ADAPTIR and ADAPTIR-FLEX product pipelines to address areas of unmet medical need.

Establishing collaborative partnerships to broaden our pipeline and provide funding for research and development. We intend to pursue collaborations with other biotechnology and pharmaceutical companies, academia, and non-governmental organizations to advance our product portfolio.

Platform Technology and Product Candidates

Characteristics | Technology | |

ADAPTIR | ADAPTIR-FLEX | |

Drug Targeting | Bind up to two targets | Bind up to four targets |

Genetic and Structural Format | Single gene that assembles into a homodimer based on an antibody backbone | Two genes that assemble into a heterodimer based on a mutated antibody backbone |

Half-life | Contains Immunoglobulin Gamma 1 Fc Demonstrated antibody-like half-life in mice | |

Effector Function | Fc mutations may be utilized to eliminate binding to Fc Gamma Receptors or to enhance effector function | |

Manufacturing | Antibody-like manufacturing processes | |

Current Pipeline Candidates | APVO436 (CD123 x CD3) ALG.APV-527 (41BB x 5T4) APVO603 (41BB x OX40) APVO711 (PD-L1 x CD40) | APVO442 (PSMA x CD3) |

4

Product Portfolio

Our current product candidate pipeline is summarized in the table below:

Smaller Reporting Company

Additionally, we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. To the extent we qualify as a smaller reporting company, we may continue to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not smaller reporting companies, including, among other things, providing only two years of audited financial statements and we are also permitted to elect to incorporate by reference information filed after the effective date of the S-3 registration statement of which this prospectus forms a part. We will remain a smaller reporting company until the last day of the fiscal year in which (1) the market value of our shares of Common Stock held by non-affiliates exceeds $250 million as of the prior June 30, or (2) our annual revenues exceeded $100 million during such completed fiscal year and the market value of our shares of Common Stock held by non-affiliates exceeds $700 million as of the prior June 30.

Corporate Information

On August 6, 2015, Emergent BioSolutions Inc. (“Emergent”), or Emergent, announced a plan to separate into two independent publicly traded companies. To accomplish this separation, Emergent created Aptevo Therapeutics Inc. (“Aptevo”), or Aptevo, to be the parent company for the development-based biotechnology business focused on novel oncology and hematology therapeutics. Aptevo was incorporated in Delaware in February 2016 as a wholly owned subsidiary of Emergent. To effect the separation, Emergent made a pro rata distribution of Aptevo’s common stockCommon Stock to Emergent’s stockholders on August 1, 2016.

Our common stockCommon Stock currently trades on the NASDAQ Global MarketNasdaq under the symbol “APVO.” Our primary executive offices are located at 2401 4th Avenue, Suite 1050, Seattle, Washington and our telephone number is (206) 838-0500. Our website address is www.aptevotherapeutics.com. The information contained in, or that can be accessed through, our website is not a part of or incorporated by reference in this prospectus, and you should not consider it part of this prospectus or part of any prospectus supplementsupplement. We have included our website address in this prospectus solely as an inactive textual reference..

5

Risks Associated with our Business

Our business is subject to numerous risks, as described under the heading “Risk Factors” and under similar headings in theany applicable prospectus supplement, any related free writing prospectus and the documents incorporated by reference herein and therein.

6

The Securities We May OfferOffering

We may offer

Shares of Common Stock Offered By the Holders: | Up to 32,026,068 Resale Shares |

Common Stock outstanding prior to this offering | 15,657,772 |

Terms of the offering: | The Holders will determine when and how they will dispose of any shares of Common Stock registered under this prospectus for resale. |

Use of proceeds: | We will not receive any proceeds from the sale of shares of Common Stock by the Holders. |

Risk factors: | Investing in our Common Stock involves significant risks. Before deciding whether to invest in our Common Stock, please read the information contained and incorporated by reference in this prospectus, including under the heading “Risk Factors” on page 13 of this prospectus and under similar headings in any related free writing prospectus and the documents incorporated by reference herein and therein. |

Nasdaq Capital Market Symbol: | “APVO” |

Unless otherwise indicated, the number of shares of Common Stock to be outstanding after this offering is based on 15,657,772 shares of Common Stock outstanding as of November 9, 2023. The number of shares of Common Stock outstanding after this offering excludes:

7

Description of Capital Stock

As of the date of this prospectus, our certificate of incorporation, authorizes us to issue up to 500,000,000 shares of Common Stock, $0.001 par value per share, and 15,000,000 shares of preferred stock, various series of debt securities and/or warrants to purchase any of such securities, either individually or in combination with other securities, with a total$0.001 par value of up to $150,000,000 from time to timeper share. Our Common Stock is registered under this prospectus at prices and on terms to be determined at the time of any offering. This prospectus provides you with a general descriptionSection 12(b) of the securities we may offer. Each time we offer a type or seriesExchange Act and is listed on the Nasdaq under the trading symbol “APVO.” As of securities under this prospectus, we will provide a prospectus supplement that will describeNovember 9, 2023, 15,657,772 shares of Common Stock were outstanding and no shares of preferred stock were outstanding.

The following summary describes the specific amounts, prices and other importantmaterial terms of the securities, including, to the extent applicable:

designation or classification;

aggregate principal amount or aggregate offering price;

maturity;

original issue discount;

rates and times of payment of interest or dividends;

redemption, conversion, exercise, exchange or sinking fund terms;

ranking;

restrictive covenants;

voting or other rights;

conversion or exchange prices or rates and, if applicable, any provisions for changes to or adjustmentsour capital stock. The summary is qualified in the conversion or exchange prices or rates and in the securities or other property receivable upon conversion or exchange; and

a discussion of material U.S. federal income tax considerations, if any.

The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change information contained or incorporatedits entirety by reference in this prospectus. However, no prospectus supplement or free writing prospectus will offer a security that is not registered and described in this prospectus at the timeto our certificate of the effectiveness of the registration statement of which this prospectus is a part.

This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

We may sell the securities directly to investors or to or through agents, underwriters or dealers. We,incorporation and our agents, underwriters or dealers reserve the right to accept or reject all or part of any proposed purchase of securities. If we do offer securities to or through agents, underwriters or dealers, we will include in the applicable prospectus supplement:bylaws.

the names of those agents, underwriters or dealers;

applicable fees, discounts and commissions to be paid to them;

details regarding over-allotment options, if any; and

the net proceeds to us.

Common Stock.Stock

We may issue shares of our common stock from time to time.

Voting Rights.

Each holder of our common stockCommon Stock is entitled to one vote for each share on all matters submitted to a vote of the stockholders, including the election of directors. Under our amended and restated certificate of incorporation or certificate of incorporation, and amended and restated bylaws, or bylaws, our stockholders do not have cumulative voting rights. Because of this, the holders of a majority of the shares of common stockCommon Stock entitled to vote in any election of directors can elect all of the directors standing for election, if they should so choose.

Dividends.

Subject to preferences that may be applicable to any then-outstanding shares of preferred stock, holders of common stockCommon Stock are entitled to receive ratably those dividends, if any, as may be declared from time to time by our board of directors out of legally available funds.

Liquidation.

In the event of our liquidation, dissolution or winding up, holders of common stock are entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any then-outstanding shares of preferred stock. Holders of common stock have no preemptive, conversion or subscription rights and there are no redemption or sinking fund provisions applicable to the common stock. The rights, preferences and privileges of the holders of common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock that we may designate in the future.

We may issue shares of our preferred stock from time to time, in one or more series. Our board of directors will determine the designations, voting powers, preferences and rights of the preferred stock, as well as the qualifications, limitations or restrictions thereof, including dividend rights, conversion rights, preemptive rights, terms of redemption or repurchase, liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of any series. Convertible preferred stock will be convertible into our common stock or exchangeable for other securities. Conversion may be mandatory or at your option and would be at prescribed conversion rates.

If we sell any series of preferred stock under this prospectus, we will fix the designations, voting powers, preferences and rights of such series of preferred stock, as well as the qualifications, limitations or restrictions thereof, in the certificate of designation relating to that series. We will file as an exhibit to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of any certificate of designation that describes the terms of the series of preferred stock that we are offering before the issuance of the related series of preferred stock. We urge you to read the applicable prospectus supplement (and any free writing prospectus that we may authorize to be provided to you) related to the series of preferred stock being offered, as well as the complete certificate of designation that contains the terms of the applicable series of preferred stock.

Debt Securities.

We may issue debt securities from time to time, in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. The senior debt securities will rank equally with any other unsecured and unsubordinated debt. The subordinated debt securities will be subordinate and junior in right of payment, to the extent and in the manner described in the instrument governing the debt, to all of our senior indebtedness. Convertible debt securities will be convertible into or exchangeable for our common stock or other securities. Conversion may be mandatory or at your option and would be at prescribed conversion rates.

Any debt securities issued under this prospectus will be issued under one or more documents called indentures, which are contracts between us and a national banking association or other eligible party, as trustee. In this prospectus, we have summarized certain general features of the debt securities. We urge you, however, to read the applicable prospectus supplement (and any free writing prospectus that we may authorize to be provided to you) related to the series of debt securities being offered, as well as the complete indentures that contain the terms of the debt securities. A form of indenture has been filed as an exhibit to the registration statement of which this prospectus is a part, and supplemental indentures and forms of debt securities containing the terms of the debt securities being offered will be filed as exhibits to the registration statement of which this prospectus is a part or will be incorporated by reference from reports that we file with the SEC.

Warrants.

We may issue warrants for the purchase of common stock, preferred stock and/or debt securities in one or more series. We may issue warrants independently or together with common stock, preferred stock and/or debt securities, and the warrants may be attached to or separate from these securities. In this prospectus, we have summarized certain general features of the warrants. We urge you, however, to read the applicable prospectus supplement (and any free writing prospectus that we may authorize to be provided to you) related to the series of warrants being offered, as well as any warrant agreements and warrant certificates that contain the terms of the warrants. We have filed forms of the warrant agreements and forms of warrant certificates containing the terms of the warrants that may be offered as exhibits to the registration statement of which this prospectus is a part. We will file as exhibits to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of warrant and/or the warrant agreement and warrant certificate, as applicable, that contain the terms of the particular series of warrants we are offering, and any supplemental agreements, before the issuance of such warrants.

Any warrants issued under this prospectus may be evidenced by warrant certificates. Warrants also may be issued under an applicable warrant agreement that we enter into with a warrant agent. We will indicate the name and address of the warrant agent, if applicable, in the prospectus supplement relating to the particular series of warrants being offered.

Investing in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described under the heading “Risk Factors” in this prospectus and under similar headings in the applicable prospectus supplement, any related free writing prospectus and the documents incorporated by reference herein and therein (including our most recent Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC), together with other information contained and incorporated by reference in the foregoing. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below entitled “Forward-Looking Statements.”

This prospectus, the applicable prospectus supplement and any free writing prospectus including the documents we incorporate by reference herein and therein may contain, forward-looking statements, including statements regarding our future financial condition, business strategy and plans and objectives of management for future operations. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “believe,” “will,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “might,” “approximately,” “expect,” “predict,” “could,” “potentially” or the negative of these terms or other similar expressions. Forward-looking statements appear in a number of places throughout this prospectus and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, our outlook, financial performance or financial condition, our technology and related pipeline, collaboration and partnership opportunities, commercial portfolio, our future growth rates, our ability to timely manufacture its products, spending of the proceeds from this offering, financial condition, liquidity, prospects, growth and strategies, the industry in which we operate and the trends that may affect the industry or us.

Discussions containing these forward-looking statements may be found, among other places, in the Sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” incorporated by reference from our most recent Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q, as well as any amendments thereto, filed with the SEC. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

If we offer debt securities and/or preference stock under this prospectus, then we will, if required at that time, provide a ratio of earnings to fixed charges and/or ratio of combined fixed charges and preference dividends to earnings, respectively, in the applicable prospectus supplement for such offering.

We will retain broad discretion over the use of the net proceeds from the sale of the securities offered hereby. Except as described in any prospectus supplement or in any related free writing prospectus that we may authorize to be provided to you, we currently intend to use the net proceeds from the sale of the securities offered by us hereunder primarily for research, development and manufacturing of product candidates, and for other general corporate purposes. Pending these uses, we expect to invest the net proceeds in short-term, interest-bearing securities.

As of the date of this prospectus, our certificate of incorporation, authorizes us to issue up to 500,000,000 shares of common stock, $0.001 par value per share, and 15,000,000 shares of preferred stock, $0.001 par value per share. As of November 8, 2017, 21,428,468 shares of common stock were outstanding and no shares of preferred stock were outstanding.

The following summary describes the material terms of our capital stock. The summary is qualified in its entirety by reference to our certificate of incorporation and our bylaws.

Common Stock

Voting Rights.

Each holder of our common stock is entitled to one vote for each share on all matters submitted to a vote of the stockholders, including the election of directors. Under our certificate of incorporation and bylaws, our stockholders do not have cumulative voting rights. Because of this, the holders of a majority of the shares of common stock entitled to vote in any election of directors can elect all of the directors standing for election, if they should so choose.

Dividends.

Subject to preferences that may be applicable to any then-outstanding preferred stock, holders of common stock are entitled to receive ratably those dividends, if any, as may be declared from time to time by our board of directors out of legally available funds.

Liquidation.

In the event of our liquidation, dissolution or winding up, holders of common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any then-outstanding shares of preferred stock.

Rights and Preferences.

Holders

Each share of common stock have no preemptive, conversion or subscriptionCommon Stock includes an associated right pursuant to and as set forth in the Rights Agreement that we entered into with Broadridge Corporate Issuer Solutions, Inc. on November 8, 2020 (the “rights agreement”). Each right initially represents the right to purchase from us one one-thousandth of a share of our Series A Junior Participating Preferred Stock, par value $0.001 per share. This right is not exercisable until the occurrence of certain events specified in such rights and there are no redemption or sinking fund provisions applicableagreement. The value attributable to these rights, if any, is reflected in the value of our common stock.Common Stock. The rights preferencesagreement and privileges of the holders of common stock are subject to, and may be adversely affected by, the rights granted thereunder will expire upon the earliest to occur of (i) the holdersdate on which all of sharessuch rights are redeemed, (ii) the date on which such rights are exchanged, and (iii) the close of any series of preferred stock that we may designate in the future.business on November 4, 2023.

Fully Paid and Nonassessable.

All of our outstanding shares of common stockCommon Stock are fully paid and nonassessable.

Preferred Stock

Under our certificate of incorporation, our board of directors is authorized by resolution to divide the preferred stock into one or more series and, with respect to each series, to determine the designations, powers, preferences, rights, qualifications, limitations and restrictions thereof, including the dividend rights, conversion or exchange rights, voting rights, redemption rights and terms, liquidation preferences, sinking fund provisions and the number of shares constituting the series. Our board of directors can, without stockholder approval but subject to the terms of our

8

certificate of incorporation, issue preferred stock with voting and other rights that could adversely affect the voting power of the holders of our common stockCommon Stock and which could have certain anti-takeover effects. Before we may issue any series of preferred stock, our board of directors will be required to adopt resolutions creating and designating such series of preferred stock.

The following summary of terms of our preferred stock is not complete. You should refer to the provisions of our certificate of incorporation, our bylaws and the resolutions containing the terms of each series of preferred stock, which have been or will be filed with the SEC at or prior to the time of issuance of such series and described in the applicable prospectus supplement. The applicable prospectus supplement may also state that any of the terms set forth herein are inapplicable to such series of preferred stock, provided that the information set forth in such prospectus supplement does not constitute a material change to the information herein such that it alters the nature of the offering or the securities being offered.

We will fix the designations, voting powers, preferences and rights of each series of preferred stock that we issue under this prospectus, as well as the qualifications, limitations or restrictions thereof, in the certificate of designation relating to that series. We will file as an exhibit to the registration statement of which this prospectus is a part, or will incorporate by reference herein from reports that we file with the SEC, the form of any certificate of designation that describes the terms of the series of preferred stock we are offering. We will describe in the applicable prospectus supplement the terms of the series of preferred stock being offered, including, to the extent applicable:

the title and stated value;

the number of shares we are offering;

• | |

• | the number of shares we are offering; |

• | the liquidation preference per share; |

• | the purchase price; |

• | the dividend rate, period and payment date and method of calculation for dividends; |

• | whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate; |

• | the procedures for any auction and remarketing; |

• | the provisions for a sinking fund; |

• | the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase rights; |

• | any listing of the preferred stock on any securities exchange or market; |

• | whether the preferred stock will be convertible into our Common Stock, and, if applicable, the conversion price, or how it will be calculated, and the conversion period; |

• | whether the preferred stock will be exchangeable into debt securities, and, if applicable, the exchange price, or how it will be calculated, and the exchange period; |

• | voting rights of the preferred stock; |

• | preemptive rights; |

• | restrictions on transfer, sale or other assignment; |

• | whether interests in the preferred stock will be represented by depositary shares; |

• | a discussion of material United States federal income tax considerations applicable to the preferred stock; |

• | the relative ranking and preferences of the preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; |

• | any limitations on the issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; and |

• | any other specific terms, preferences, rights or limitations of, or restrictions on, the preferred stock. |

the purchase price;

the dividend rate, period and payment date and method of calculation for dividends;

whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate;

the procedures for any auction and remarketing;

the provisions for a sinking fund;

the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase rights;

any listing of the preferred stock on any securities exchange or market;

whether the preferred stock will be convertible into our common stock, and, if applicable, the conversion price, or how it will be calculated, and the conversion period;

whether the preferred stock will be exchangeable into debt securities, and, if applicable, the exchange price, or how it will be calculated, and the exchange period;

voting rights of the preferred stock;

preemptive rights;

restrictions on transfer, sale or other assignment;

whether interests in the preferred stock will be represented by depositary shares;

a discussion of material United States federal income tax considerations applicable to the preferred stock;

the relative ranking and preferences of the preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs;

any limitations on the issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; and

any other specific terms, preferences, rights or limitations of, or restrictions on, the preferred stock.

If we issue shares of preferred stock under this prospectus, the shares will be fully paid and non-assessable.

The issuance of preferred stock could adversely affect the voting power of holders of common stockCommon Stock and reduce the likelihood that common stockholders will receive dividend payments and payments upon liquidation. The issuance could have the effect of decreasing the market price of the common stock.Common Stock. The issuance of preferred stock also could have the effect of delaying, deterring or preventing a change in control of us.

9

Outstanding Options, and Restricted Stock Units, and Warrants

As of November 8, 2017, (i) options to purchase an aggregate of 1,553,718 shares of common stock were outstanding under our 2016 Converted Equity Awards Incentive Plan, (ii) 442,993 restricted stock units were outstanding under our 2016 Converted Equity Awards Incentive Plan, (iii) options to purchase an aggregate of 1,421,864 shares of common stock were outstanding under our 2016 Stock Incentive Plan, (iv) 780,084 restricted stock units were outstanding under our 2016 Stock Incentive Plan and (v) an additional 1,332,990 shares were reserved for future issuance under our 2016 Stock Incentive Plan.

Stockholder Registration Rights

Certain holders of shares of our common stock are entitled to certain rights with respect to registration of such shares under the Securities Act of 1933, as amended, or the Securities Act. These shares are referred to as registrable securities. The holders of these registrable securities possess registration rights described in additional detail below pursuant to the terms of a registration rights agreement.

The registration of shares of our common stock pursuant to the exercise of registration rights described below would enable the holders to trade these shares without restriction under the Securities Act when the applicable registration statement is declared effective. We will pay the registration expenses, other than underwriting discounts, selling commissions and stock transfer taxes, of the shares registered pursuant to the demand and piggyback registration rights described below.

Generally, in an underwritten offering, the managing underwriter, if any, has the right, subject to specified conditions, to limitUnless otherwise indicated, the number of shares of Common Stock to be outstanding after this offering is based on 15,657,772 shares of Common Stock outstanding as of November 9, 2023. The number of shares of Common Stock outstanding after this offering excludes:

Warrants

Warrants 2019 – As of November 9, 2023, we have issued and outstanding common warrants to purchase 350,589 shares of our Common Stock at an exercise price of $18.20 per share issued as part of our March 2019 public offering. These warrants are immediately exercisable and expire on March 11, 2024. The exercise price and the number of shares of Common Stock purchasable upon the exercise of the warrants are subject to adjustment upon the occurrence of specific events, including sales of additional shares of Common Stock, stock dividends, stock splits, reclassifications and combinations of our Common Stock. If, at any time warrants are outstanding, any fundamental transaction occurs, as described in the warrants, the successor entity must assume the obligations to the warrant holders. Additionally, in the event of a fundamental transaction, other than one in which a successor entity that is a publicly traded corporation assumes the warrants, each holder will have the right to require us, or our successor, to repurchase the warrants for an amount of cash equal to the Black-Scholes value of the remaining unexercised portion of such warrants. Holders of the warrants do not have the rights or privileges of holders of the registrable securities are entitledour common shares, including any voting rights, until they exercise their warrants, with exceptions for participation in rights offerings or extraordinary distributions.

Existing Series A and Series B Common Warrants - As of November 9, 2023, we have issued and outstanding Series A common warrants to certain demand registration rights. Atpurchase 8,006,517 shares of our Common Stock and Series B common warrants to purchase 8,006,517 shares of our Common Stock at an exercise price of $0.233 per share as well as Series A common warrants to purchase 58,000 shares of our Common Stock and Series B common warrants to purchase 58,000 shares of our Common Stock at an exercise price of $0.62 per share. Each Series A Common Warrant may be exercised at any time following the holdersdate of at least 20%issuance and from time to time thereafter through and including the five year anniversary of the registrable securities, on not more than two occasions,initial exercise date. Each Series B Common Warrant may request that we register all or a portionbe exercised at any time following the date of theirissuance and from time to time thereafter through and including the eighteen month anniversary of the initial exercise date.

The exercise price and the number of shares of Common Stock purchasable upon the exercise of the warrants are subject to certain specified exceptions. Such request for registrationadjustment upon the occurrence of specific events, including sales of additional shares of Common Stock, stock dividends, stock splits, reclassifications and combinations of our Common Stock. If, at any time warrants are outstanding, any fundamental transaction occurs, as described in the warrants, the successor entity must cover securitiesassume the aggregate offering priceobligations to the warrant holders. Additionally, in the event of which, before payment of underwriting discounts and commissions, exceeds $10,000,000.

Piggyback Registration Rights

In connection with the filing of the registration statement of which this prospectus forms a part,fundamental transaction, the holders of the registrable securities were entitled to, and the necessary percentage of holders waived, their rights to notice of such filing and to include their shares of registrable securities in the registration statement of which this prospectus forms a part. If we propose to register for offer and sale any of our securities under the Securities Act in a future offering, either for our own account or for the account of other security holders, the holders of these shareswarrants will be entitled to certain “piggyback” registration rights allowing them to include their shares in such registration, subject to certain marketingreceive upon exercise of the warrants the kind and amount of securities, cash or other limitations. As a result, whenever we propose to file a registration statement under the Securities Act, including a registration statement on Form S-3 as discussed below, other than with respect to a demand registration or a registration statement on Forms S-4 or S-8 or related to stock issued upon conversion of debt securities,property that the holders of these shares are entitledwould have received had they exercised the warrants immediately prior to noticesuch fundamental transaction.

10

Holders of the registration andwarrants do not have the right, subject to limitations that the underwriters may impose on the numberrights or privileges of holders of our common shares, includedincluding any voting rights, until they exercise their warrants, with exceptions for participation in the registration, to include their shares in the registration.rights offerings or extraordinary distributions.

Certain Anti-Takeover EffectsProvisions of Our Charter DocumentsCertificate of Incorporation, Our Bylaws, the DGCL and Some Provisions of Delaware Lawour Rights Plan

Delaware Law

We are subject to Section 203 of the Delaware General Corporation Law,DGCL, which prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years after the date that such stockholder became an interested stockholder, with the following exceptions:

• | before such date, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder; | |

• | upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction began, excluding for purposes of determining the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned (1) by persons who are directors and also officers and (2) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or | |

• | on or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting of the stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder. |

before such date, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction began, excluding for purposes of determining the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned (1) by persons who are directors and also officers and (2) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

on or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting of the stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

In general, Section 203 defines a “business combination” to include the following:

• | any merger or consolidation involving the corporation and the interested stockholder; | |

• | any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder; | |

• | subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder; | |

• | any transaction involving the corporation that has the effect of increasing the proportionate share of the stock or any class or series of the corporation beneficially owned by the interested stockholder; or | |

• | the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits by or through the corporation. |

any merger or consolidation involving the corporation and the interested stockholder;

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock or any class or series of the corporation beneficially owned by the interested stockholder; or

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits by or through the corporation.

In general, Section 203 defines an “interested stockholder” as an entity or person who, together with the person’s affiliates and associates, beneficially owns, or within three years prior to the time of determination of interested stockholder status did own, 15% or more of the outstanding voting stock of the corporation.

Certificate

Staggered Board; Removal of IncorporationDirectors. Our amended and Bylaws

Ourrestated certificate of incorporation provides for our board of directors to be divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Because our stockholders do not have cumulative voting rights, stockholders holding a majority of the shares of common stockCommon Stock outstanding are able to elect all of our directors. Our certificate of incorporation and our bylaws also provide that directors may be removed by the stockholders only for cause upon the vote of 75% of our outstanding common stock.

Common Stock. Furthermore, the authorized number of directors may be changed only by resolution of the board of directors, and vacancies and newly created directorships on the board of directors may, except as otherwise required by law or determined by the board, only be filled by a majority vote of the directors then serving on the board, even though less than a quorum.

Stockholder Action by Written Consent.Our amended and restated certificate of incorporation and amended and restated bylaws also provide that all stockholder actions must be effected at a duly called meeting of stockholders and eliminates the right of stockholders to act by written consent without a meeting. Our amended and restated bylaws also provide that only our chairman of the board, chief executive officer or the board of directors pursuant to a resolution adopted by a majority of the total number of authorized directors may call a special meeting of stockholders.

11

Requirements for Advance Notification of Stockholder Nominations, Proposals and Amendments. Our amended and restated bylaws also provide that stockholders seeking to present proposals before a meeting of stockholders to nominate candidates for election as directors at a meeting of stockholders must provide timely advance notice in writing, and specify requirements as to the form and content of a stockholder’s notice.

Our certificate of incorporation and bylaws provide that the stockholders cannot amend many of the provisions described above except by a vote of 75% or more of our outstanding common stock.Common Stock.

The combination of these provisions makes it more difficult for our existing stockholders to replace

Shareholder Rights Plan. On November 8, 2020, our board of directors as well as for another partyadopted a rights plan pursuant to obtain controlour rights agreement. The rights plan works by causing substantial dilution to any person or group that acquires beneficial ownership of us by replacingten percent (10%) or more of our Common Stock without the approval of our board of directors. SinceAs a result, the overall effect of the rights plan and the issuance of the rights pursuant to the rights plan may be to render more difficult or discourage a merger, tender or exchange offer or other business combination involving the Company that is not approved by our board of directors. The rights plan is not intended to interfere with any merger, tender or exchange offer or other business combination approved by our board of directors. The rights plan also does not prevent our board of directors hasfrom considering any offer that it considers to be in the powerbest interest of our stockholders. On November 2, 2023, we entered into Amendment No. 3 to retainthe Rights Agreement and discharge our officers, these provisions could also make it more difficult for existing stockholders or another partyextended the expiration of such agreement to effectNovember 4, 2024 and changed the exercise price to $2.02 per one one-thousandth of a change in management. In addition, the authorization of undesignated preferred stock makes it possible for our board of directorsSeries A Junior Participating Preferred Share, subject to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to change our control.adjustment.

Certain Anti-Takeover Effects.These provisions are intended to enhance the likelihood of continued stability in the composition of our board of directors and its policies and to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to reduce our vulnerability to hostile takeovers and to discourage certain tactics that may be used in proxy fights. However, such provisions could have the effect of discouraging others from making tender offers for our shares and may have the effect of delaying changes in our control or management. As a consequence, these provisions may also inhibit fluctuations in the market price of our stock that could result from actual or rumored takeover attempts. We believe that the benefits of these provisions, including increased protection of our potential ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure our company, outweigh the disadvantages of discouraging takeover proposals, because negotiation of takeover proposals could result in an improvement of their terms.

Transfer Agent and Registrar

The transfer agent and registrar for our common stockCommon Stock is Broadridge, Financial Solutions, Inc. The transfer agent’s address is P.O. Box 1342, Brentwood,which can be contacted at 51 Mercedes Way, Edgewood, NY 11717. The transfer agent for any series of preferred stock that we may offer under this prospectus will be named and described in the prospectus supplement for that series.11717, shareholder@broadridge.com, or +1 (720) 378-5591.

Listing on the NASDAQ GlobalNasdaq Capital Market

Our common stockCommon Stock is listed on the NASDAQ GlobalNasdaq Capital Market under the symbol “APVO.”

12

Risk Factors