Table of Contents

As filed with the Securities and Exchange Commission on April 26, 2013

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 OR |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 OR |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 OR |

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2012

Commission file number: 1-14846

AngloGold Ashanti Limited

(Exact Name of Registrant as Specified in its Charter)

Republic of South Africa

(Jurisdiction of Incorporation or Organization)

76 Jeppe Street, Newtown, Johannesburg, 2001

(P.O. Box 62117, Marshalltown, 2107)

South Africa

(Address of Principal Executive Offices)

ME Sanz Perez, Company Secretary, Telephone: +27 11 6376306, Facsimile: +27 86 6750137

E-mail: rsanz@anglogoldashanti.com, 76 Jeppe Street, Newtown, Johannesburg, 2001, South Africa

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

American Depositary Shares | New York Stock Exchange | |

Ordinary Shares | New York Stock Exchange* | |

6.00 Percent Mandatory Convertible Subordinated Bonds due 2013 | New York Stock Exchange |

| * | Not for trading, but only in connection with the registration of American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission |

Securities registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Ordinary Shares of 25 ZAR cents each | 383,320,962 | |||

E Ordinary Shares of 25 ZAR cents each | 1,617,752 | |||

A Redeemable Preference Shares of 50 ZAR cents each | 2,000,000 | |||

B Redeemable Preference Shares of 1 ZAR cent each | 778,896 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Yes x No ¨ |

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934. | Yes ¨ No x |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. | Yes x No ¨ |

Indicate by check mark whether the registrant (1) has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was

required to submit and post such files). | Yes x No ¨ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

(Check one): Large Accelerated Filer x | Accelerated Filer¨ | Non-Accelerated Filer ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP x |

International Financial Reporting Standards as issued by the International Accounting Standards Board¨Other¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes ¨ No x |

Table of Contents

| TABLE OF CONTENTS | Page | |||||

| 3 | ||||||

| 4 | ||||||

| 5 | ||||||

| 8 | ||||||

| 8 | ||||||

| 9 | ||||||

Item 1: | 10 | |||||

Item 2: | 10 | |||||

Item 3: | ||||||

| 3A. | 10 | |||||

| 3B. | 14 | |||||

| 3C. | 14 | |||||

| 3D. | 14 | |||||

Item 4: | 41 | |||||

| 4A. | 41 | |||||

| 4B. | 42 | |||||

| 4C. | 95 | |||||

| 4D. | 96 | |||||

Item 4A: | 121 | |||||

Item 5: | 122 | |||||

| 5A. | 123 | |||||

| 5B. | 149 | |||||

| 5C. | 158 | |||||

| 5D. | 158 | |||||

| 5E. | 158 | |||||

| 5F. | 158 | |||||

Item 6: | ||||||

| 6A. | 159 | |||||

| 6B. | 166 | |||||

| 6C. | 172 | |||||

| 6D. | 177 | |||||

| 6E. | 179 | |||||

Item 7: | 186 | |||||

| 7A. | 188 | |||||

| 7B. | 189 | |||||

| 7C. | 189 | |||||

Item 8: | ||||||

| 8A. | Consolidated financial statements and other financial information | 190 | ||||

| 190 | ||||||

| 196 | ||||||

| 8B. | 196 | |||||

1

Table of Contents

Item 9: | ||||||||

| 9A. | 197 | |||||||

| 9B. | 197 | |||||||

| 9C. | 198 | |||||||

| 9D. | 198 | |||||||

| 9E. | 198 | |||||||

| 9F. | 198 | |||||||

Item 10: | ||||||||

| 10A. | 199 | |||||||

| 10B. | 202 | |||||||

| 10C. | 213 | |||||||

| 10D. | 216 | |||||||

| 10E. | 217 | |||||||

| 10F. | 221 | |||||||

| 10G. | 221 | |||||||

| 10H. | 221 | |||||||

| 10I. | 221 | |||||||

Item 11: | 222 | |||||||

Item 12: | ||||||||

| 12A. | 229 | |||||||

| 12B. | 229 | |||||||

| 12C. | 229 | |||||||

| 12D. | ||||||||

| 229 | ||||||||

| 229 | ||||||||

Item 13: | 230 | |||||||

Item 14: | Material modifications to the rights of security holders and use of proceeds | 231 | ||||||

Item 15: | 232 | |||||||

Item 16A: | 234 | |||||||

Item 16B: | 235 | |||||||

Item 16C: | 236 | |||||||

Item 16D: | 236 | |||||||

Item 16E: | Purchases of equity securities by the issuer and affiliated purchasers | 236 | ||||||

Item 16F: | 237 | |||||||

Item 16G: | 237 | |||||||

Item 16H: | 237 | |||||||

Item 17: | 238 | |||||||

Item 18: | 239 and F pages | |||||||

Item 19 | Exhibits | E pages | ||||||

2

Table of Contents

AngloGold Ashanti Limited

In this annual report on Form 20-F, unless the context otherwise requires, references to AngloGold, AngloGold Ashanti, the company, the Company and the group are references to AngloGold Ashanti Limited including, as appropriate, subsidiaries and associate companies of AngloGold Ashanti.

US GAAP financial statements

The audited consolidated financial statements contained in this annual report on Form 20-F for the years ended December 31, 2012, 2011 and 2010 and as at December 31, 2012 and 2011 have been prepared in accordance with U.S. generally accepted accounting principles (US GAAP).

IFRS financial statements

As a company incorporated in the Republic of South Africa, AngloGold Ashanti also prepares annual audited consolidated financial statements and unaudited consolidated quarterly financial statements in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB). These financial statements (referred to as IFRS statements) are distributed to shareholders and are submitted to the JSE Limited (JSE), as well as the London, New York, Australian and Ghana stock exchanges and are furnished to the US Securities and Exchange Commission (SEC) on Form 6-K.

Currency

AngloGold Ashanti presents its consolidated financial statements in United States dollars.

In this annual report, references to rands, ZAR and R are to the lawful currency of the Republic of South Africa, references to US dollars, dollar or $ are to the lawful currency of the United States, references to€ are to the lawful currency of the European Union, references to C$ or CAD are to the lawful currency of Canada, references to ARS and peso are to the lawful currency of Argentina, references to AUD and A$ are to the lawful currency of Australia, references to BRL are to the lawful currency of Brazil, reference to NAD and N$ are to the lawful currency of Namibia, reference to Tsh is to the lawful currency of the United Republic of Tanzania and references to GHC, cedi or ¢ are to the lawful currency of Ghana.

See “Item 3A.: Selected financial data – Exchange rate information” for historical information regarding the US dollar/South African rand exchange rate. On April 19, 2013 the interbank US dollar/South African rand exchange rate as reported by OANDA Corporation was R9.17/$1.00.

Non-GAAP financial measures

In this annual report on Form 20-F, AngloGold Ashanti presents the financial items “total cash costs”, “total cash costs per ounce”, “total production costs” and “total production costs per ounce” which have been determined using industry guidelines and practices promulgated by the Gold Institute and are not US GAAP measures. An investor should not consider these items in isolation or as alternatives to production costs, net income/(loss) applicable to common shareholders, income/(loss) before income tax provision, net cash provided by operating activities or any other measure of financial performance presented in accordance with US GAAP. While the Gold Institute has provided definitions for the calculation of total cash costs and total production costs, the calculation of total cash costs, total cash costs per ounce, total production costs and total production costs per ounce may vary significantly among gold mining companies, and by themselves do not necessarily provide a basis for comparison with other gold mining companies. See “Glossary of selected terms – Financial terms – Total cash costs” and –“Total production costs” and “Item 5A.: Operating results – Total cash costs and total production costs”.

Shares and shareholders

In this annual report on Form 20-F, references to ordinary shares, ordinary shareholders and shareholders/members, should be read as common stock, common stockholders and stockholders, respectively, and vice versa.

3

Table of Contents

CERTAIN FORWARD-LOOKING STATEMENTS

Certain statements contained in this document, other than statements of historical fact, including, without limitation, those concerning the economic outlook for the gold mining industry, expectations regarding gold prices, production, cash costs and other operating results, return on equity, productivity improvements, growth prospects and outlook of AngloGold Ashanti’s operations, individually or in the aggregate, including the achievement of project milestones, the completion and commencement of commercial operations of certain of AngloGold Ashanti’s exploration and production projects and the completion of acquisitions and dispositions, AngloGold Ashanti’s liquidity and capital resources and capital expenditures and the outcome and consequence of any potential or pending litigation or regulatory proceedings or environmental issues, are forward-looking statements regarding AngloGold Ashanti’s operations, economic performance and financial condition.

These forward-looking statements or forecasts involve known and unknown risks, uncertainties and other factors that may cause AngloGold Ashanti’s actual results, performance or achievements to differ materially from the anticipated results, performance or achievements expressed or implied in these forward-looking statements. Although AngloGold Ashanti believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results and forecasts could differ materially from those set out in the forward-looking statements as a result of among other factors, changes in economic, social and political and market conditions, success of business and operating initiative, changes in the regulatory environment and other government actions, including environmental approval, fluctuations in gold prices and exchange rates, the outcome of pending or future litigation proceedings and business and operational risk management and other factors as determined in “item 3D.: Risk factors” and elsewhere in this annual report. These factors are not necessarily all of the important factors that could cause AngloGold Ashanti’s actual results to differ materially from those expressed in any forward-looking statements. Other unknown or unpredictable factors could also have material adverse effects on future results. Consequently, readers are cautioned not to place undue reliance on forward-looking statements.

AngloGold Ashanti undertakes no obligation to update publicly or release any revisions to these forward-looking statements to events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events, except to the extent required by applicable law. All subsequent written or oral forward-looking statements attributable to AngloGold Ashanti or any person acting on its behalf are qualified by the cautionary statements herein.

4

Table of Contents

The following explanations are not intended as technical definitions but should assist the reader in understanding terminology used in this annual report. Unless expressly stated otherwise, all explanations are applicable to both underground and surface mining operations.

All injury frequency rate:The total number of injuries and fatalities that occurs per million hours worked.

BIF:Banded Ironstone Formation. A chemically formed iron-rich sedimentary rock.

By-products:Any products that emanate from the core process of producing gold, including silver, uranium and sulfuric acid.

Calc-silicate rock:A metamorphic rock consisting mainly of calcium-bearing silicates such as diopside and wollastonite, and formed by metamorphism of impure limestone or dolomite.

Carbon-in-leach (CIL):Gold is leached from a slurry of gold ore with cyanide in agitated tanks and adsorbed on to carbon granules in the same circuit. The carbon granules are separated from the slurry and treated in an elution circuit to remove the gold.

Carbon-in-pulp (CIP):Gold is leached conventionally from a slurry of gold ore with cyanide in agitated tanks. The leached slurry then passes into the CIP circuit where carbon granules are mixed with the slurry and gold is adsorbed on to the carbon. The granules are separated from the slurry and treated in an elution circuit to remove the gold.

Comminution:Comminution is the crushing and grinding of ore to make gold available for treatment. (See also “Milling”).

Contained gold:The total gold content (tons multiplied by grade) of the material being described.

Cut-off grade (surface mines):The minimum grade at which a unit of ore will be mined to achieve the desired economic outcome.

Depletion:The decrease in the quantity of ore in a deposit or property resulting from extraction or production.

Development:The process of accessing an orebody through shafts and/or tunneling in underground mining operations.

Diorite:An igneous rock formed by the solidification of molten material (magma).

Doré:Impure alloy of gold and silver produced at a mine to be refined to a higher purity, usually consisting of 85 percent gold on average.

Electro-winning:A process of recovering gold from solution by means of electrolytic chemical reaction into a form that can be smelted easily into gold bars.

Elution:Recovery of the gold from the activated carbon into solution before zinc precipitation or electro-winning.

Gold Produced:Refined gold in a saleable form derived from the mining process.

Grade:The quantity of gold contained within a unit weight of gold-bearing material generally expressed in ounces per short ton of ore (oz/t), or grams per metric tonne (g/t).

Greenschist:A schistose metamorphic rock whose green color is due to the presence of chlorite, epidote or actinolite.

5

Table of Contents

Leaching:Dissolution of gold from crushed or milled material, including reclaimed slime, prior to adsorption on to activated carbon.

Life of mine (LOM):Number of years for which an operation is planning to mine and treat ore, and is taken from the current mine plan.

Metallurgical plant:A processing plant constructed to treat ore and extract gold.

Metallurgical recovery factor (MetRF): A measure of the efficiency in extracting gold from the ore deposit.

Milling:A process of reducing broken ore to a size at which concentrating can be undertaken. (See also “Comminution”).

Mine call factor:The ratio, expressed as a percentage, of the total quantity of recovered and unrecovered mineral product after processing with the amount estimated in the ore based on sampling. The ratio of contained gold delivered to the metallurgical plant divided by the estimated contained gold of ore mined based on sampling.

Mineral deposit:A mineral deposit is a concentration (or occurrence) of material of possible economic interest in or on the earth’s crust.

Ore Reserve:That part of a mineral deposit which could be economically and legally extracted or produced at the time of the Ore Reserve determination.

Ounce (oz) (troy):Used in imperial statistics. A kilogram is equal to 32.1507 ounces. A troy ounce is equal to 31.1035 grams.

Pay limit:The grade of a unit of ore at which the revenue from the recovered mineral content of the ore is equal to the sum of total cash costs, closure costs, Ore Reserve development and stay-in-business capital. This grade is expressed as an in-situ value in grams per tonne or ounces per short ton (before dilution and mineral losses).

Precipitate:The solid product of chemical reaction by fluids such as the zinc precipitation referred to below.

Probable Ore Reserve:Ore Reserve for which quantity and grade are computed from information similar to that used for Proven Reserves, but the sites for inspection, sampling, and measurement are further apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for Proven Reserves, is high enough to assume continuity between points of observation.

Productivity:An expression of labor productivity based on the ratio of grams of gold produced per month to the total number of employees in mining operations.

Proven Ore Reserve:Ore Reserve for which the (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade is computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of the Ore Reserve are well established.

Project capital:Capital expenditure to either bring a new operation into production; to materially increase production capacity; or to materially extend the productive life of an asset.

Recovered grade:The recovered mineral content per unit of ore treated.

Reef:A gold-bearing sedimentary horizon, normally a conglomerate band that may contain economic levels of gold.

Refining:The final purification process of a metal or mineral.

6

Table of Contents

Rehabilitation:The process of reclaiming land disturbed by mining to allow an appropriate post-mining use. Rehabilitation standards are defined by country-specific laws, including but not limited to the South African Department of Mineral Resources, the US Bureau of Land Management, the US Forest Service, and the relevant Australian mining authorities, and address among other issues, ground and surface water, topsoil, final slope gradient, waste handling and re-vegetation issues.

Seismic event:A sudden inelastic deformation within a given volume of rock that radiates detectable seismic energy.

Shaft:A vertical or subvertical excavation used for accessing an underground mine; for transporting personnel, equipment and supplies; for hoisting ore and waste; for ventilation and utilities; and/or as an auxiliary exit.

Short ton:Used in imperial statistics. Equal to 2,000 pounds.

Skarn:A rock of complex mineralogical composition, formed by contact metamorphism and metasomatism of carbonate rocks.

Smelting:A pyro-metallurgical operation in which gold is further separated from impurities.

Stope:Underground excavation where the orebody is extracted.

Stripping ratio:The ratio of waste tonnes to ore tonnes mined calculated as total tonnes mined divided by ore tonnes mined.

Stoping:The process of excavating ore underground.

Syngenetic:Formed contemporaneously with the deposition of the sediment.

Tailings:Finely ground rock of low residual value from which valuable minerals have been extracted.

Tailings dam (slimes dam):Dam facilities designed to store discarded tailings.

Tonne:Used in metric statistics. Equal to 1,000 kilograms.

Tonnage:Quantity of material measured in tonnes or tons.

Waste:Material that contains insufficient mineralization for consideration for future treatment and, as such, is discarded.

Yield:The amount of valuable mineral or metal recovered from each unit mass of ore expressed as ounces per short ton or grams per metric tonne.

Zinc precipitation:Zinc precipitation is the chemical reaction using zinc dust that converts gold in solution to a solid form for smelting into unrefined gold bars.

7

Table of Contents

Average number of employees:The monthly average number of production and non-production employees and contractors employed during the year, where contractors are defined as individuals who have entered into a fixed-term contract of employment with a group company or subsidiary. Employee numbers of joint ventures represents the group’s attributable share.

Capital expenditure:Total capital expenditure on tangible assets.

Discontinued operation:A component of an entity that, pursuant to a single plan, has been disposed of or abandoned or is classified as held for sale until conditions precedent to the sale have been fulfilled.

Effective tax rate:Current and deferred taxation charge for the year as a percentage of profit before taxation.

OANDA Corporation:An internet-based provider of forex trading and currency information services.

Rated bonds:The $700 million 5.375 percent bonds due 2020, $300 million 6.5 percent bonds due 2040 and the $750 million 5.125 percent bonds due 2022.

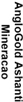

Region:Defines the operational management divisions within AngloGold Ashanti Limited, namely South Africa, Continental Africa (Ghana, Guinea, Mali, Namibia and Tanzania), Australasia, and the Americas (Argentina, Brazil and United States of America).

Related party:Parties are considered related if one party has the ability to control the other party or exercise significant influence over the other party in making financial and operating decisions.

Significant influence:The ability, directly or indirectly, to participate in, but not exercise control over, the financial and operating policy decision of an entity so as to obtain economic benefit from its activities.

STRATE:The licensed Central Securities Depository (CSD) for the electronic settlement of financial instruments in South Africa.

Total cash costs:Total cash costs include site costs for all mining, processing and administration, reduced by contributions from by-products and are inclusive of royalties and production taxes. Depreciation, depletion and amortization, rehabilitation, corporate administration, employee severance costs, capital and exploration costs are excluded. Total cash costs per ounce are the attributable total cash costs divided by the attributable ounces of gold produced.

Total production costs:Total cash costs plus depreciation, depletion and amortization, employee severance costs, rehabilitation and other non-cash costs. Corporate administration and exploration costs are excluded. Total production costs per ounce are the attributable total production costs divided by the attributable ounces of gold produced.

Weighted average number of ordinary shares:The number of ordinary shares in issue at the beginning of the year, increased by shares issued during the year, weighted on a time basis for the period during which they have participated in the income of the group, and increased by share options that are virtually certain to be exercised.

$, US$ or dollar | United States dollars | |||||

ARS | Argentinean peso | |||||

A$ or AUD | Australian dollars | |||||

BRL | Brazilian real | |||||

€ or Euro | European Euro | |||||

C$ or CAD | Canadian dollars | |||||

GHC, cedi or ¢ | Ghanaian cedi | |||||

N$ or NAD | Namibian dollars | |||||

Tsh | Tanzanian Shillings | |||||

ZAR, R or rand | South African rands |

8

Table of Contents

ADS | American Depositary Share | |

ADR | American Depositary Receipt | |

AIFR | All injury frequency rate | |

ASX | Australian Securities Exchange | |

Au | Contained gold | |

BBSY | Bank Bill Swap Bid Rate | |

bn | Billion | |

BEE | Black Economic Empowerment | |

capex | Capital expenditure | |

CDI | Chess Depositary Interests | |

CLR | Carbon Leader Reef | |

Companies Act | South African Companies Act 71, of 2008 | |

DMTNP | Domestic medium-term notes program | |

ERP | Enterprise resource planning | |

FIFR | Fatal injury frequency rate | |

G or g | Grams | |

g/t | Grams per tonne | |

GhDS | Ghanaian Depositary Share | |

GhSE | Ghana Stock Exchange | |

JORC | Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves | |

JIBAR | Johannesburg Interbank Agreed Rate | |

JSE | JSE Limited (Johannesburg Stock Exchange) | |

King III | South African King Code on Corporate Governance, 2009 | |

Kg or kg | Kilograms | |

Km or km | Kilometers | |

LSE | London Stock Exchange | |

LIBOR | London Interbank Offer Rate | |

LOM | Life of mine | |

M or m | Meter or million, depending on the context | |

Moz | Million ounces | |

Mt | Million tonnes or tons | |

Mtpa | Million tonnes/tons per annum | |

NYSE | New York Stock Exchange | |

Oz or oz | Ounces (troy) | |

oz/t | Ounces per ton | |

oz/TEC | Ounces per total employee costed | |

SAMREC | South African Code for the Reporting of Mineral Resources and Mineral Reserves 2007 Edition | |

SEC | United States Securities and Exchange Commission | |

SOX | Sarbanes-Oxley Act of 2002 | |

T or t | Tons (short) or tonnes (metric) | |

Tpa or tpa | Tonnes/tons per annum | |

US/USA/United States | United States of America | |

VCR | Ventersdorp Contact Reef |

Note:Rounding of figures in this report may result in computational discrepancies.

9

Table of Contents

ITEM 1: IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable.

ITEM 2: OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

| 3A. | SELECTED FINANCIAL DATA |

The selected financial information set forth below for the years ended December 31, 2010, 2011 and 2012 and as at December 31, 2011 and 2012 has been derived from, and should be read in conjunction with, the US GAAP financial statements included under Item 18 of this annual report. The selected financial information for the years ended December 31, 2008 and 2009 and as at December 31, 2008, 2009 and 2010 has been derived from the US GAAP financial statements not included in this annual report.

10

Table of Contents

Year ended December 31,

| ||||||||||||||||||||

| 2008 (1) | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

| (in millions, except share and per share amounts) | ||||||||||||||||||||

Consolidated statement of income | ||||||||||||||||||||

Sales and other income | 3,730 | 3,954 | 5,402 | 6,642 | 6,428 | |||||||||||||||

Product sales(2) | 3,655 | 3,784 | 5,334 | 6,570 | 6,353 | |||||||||||||||

Interest, dividends and other | 75 | 170 | 68 | 72 | 75 | |||||||||||||||

Costs and expenses | 4,103 | 4,852 | 5,021 | 4,521 | 5,217 | |||||||||||||||

Operating costs(3) | 2,452 | 2,543 | 3,112 | 3,555 | 3,876 | |||||||||||||||

Royalties | 78 | 84 | 142 | 193 | 164 | |||||||||||||||

Depreciation, depletion and amortization | 615 | 615 | 720 | 789 | 794 | |||||||||||||||

Impairment of assets | 670 | 8 | 91 | 17 | 367 | |||||||||||||||

Interest expense | 72 | 123 | 151 | 178 | 213 | |||||||||||||||

Accretion expense | 22 | 17 | 22 | 28 | 33 | |||||||||||||||

(Profit)/loss on sale of assets, realization of loans, indirect taxes and other | (64 | ) | 10 | (3 | ) | (43 | ) | 35 | ||||||||||||

Non-hedge derivative loss/(gain) and movement on bonds | 258 | 1,452 | 786 | (196 | ) | (265 | ) | |||||||||||||

(Loss)/income from continuing operations before income tax and equity income in associates | (373 | ) | (898 | ) | 381 | 2,121 | 1,211 | |||||||||||||

Taxation (expense)/benefit | (22 | ) | 33 | (255 | ) | (705 | ) | (340 | ) | |||||||||||

Equity (loss)/income in associates | (149 | ) | 88 | 40 | 59 | (23 | ) | |||||||||||||

Net (loss)/income from continuing operations | (544 | ) | (777 | ) | 166 | 1,475 | 848 | |||||||||||||

Discontinued operations | 23 | - | - | - | - | |||||||||||||||

Net (loss)/income | (521 | ) | (777 | ) | 166 | 1,475 | 848 | |||||||||||||

Less: Net income attributable to noncontrolling interests | (42 | ) | (48 | ) | (54 | ) | (50 | ) | (19 | ) | ||||||||||

Net (loss)/income - attributable to AngloGold Ashanti | (563 | ) | (825 | ) | 112 | 1,425 | 829 | |||||||||||||

Net (loss)/income - attributable to AngloGold Ashanti | ||||||||||||||||||||

(Loss)/income from continuing operations | (586 | ) | (825 | ) | 112 | 1,425 | 829 | |||||||||||||

Discontinued operations | 23 | - | - | - | - | |||||||||||||||

| (563 | ) | (825 | ) | 112 | 1,425 | 829 | ||||||||||||||

Basic (loss)/earnings per common share (in $)(4) | ||||||||||||||||||||

From continuing operations | (1.86 | ) | (2.30 | ) | 0.30 | 3.71 | 2.15 | |||||||||||||

Discontinued operations | 0.07 | - | - | - | - | |||||||||||||||

Net (loss)/income - attributable to AngloGold Ashanti common stockholders | (1.79 | ) | (2.30 | ) | 0.30 | 3.71 | 2.15 | |||||||||||||

Diluted (loss)/income per common share (in $)(4) | ||||||||||||||||||||

From continuing operations | (1.86 | ) | (2.30 | ) | 0.30 | 3.17 | 1.61 | |||||||||||||

Discontinued operations | 0.07 | - | - | - | - | |||||||||||||||

Net (loss)/income - attributable to common stockholders | (1.79 | ) | (2.30 | ) | 0.30 | 3.17 | 1.61 | |||||||||||||

Dividend per common share (cents) | 13 | 13 | 18 | 34 | 56 | |||||||||||||||

11

Table of Contents

| ||||||||||||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

| (in millions, except share and per share amounts) | ||||||||||||||||||||

| ||||||||||||||||||||

Consolidated balance sheet data (as at period end) | ||||||||||||||||||||

Cash and cash equivalents and restricted cash | 585 | 1,112 | 585 | 1,147 | 927 | |||||||||||||||

Other current assets | 2,328 | 1,646 | 1,412 | 1,484 | 1,863 | |||||||||||||||

Property, plant and equipment and acquired properties, net | 5,579 | 6,285 | 6,762 | 6,902 | 7,983 | |||||||||||||||

Goodwill and other intangibles, net | 152 | 180 | 197 | 213 | 305 | |||||||||||||||

Materials on the leach pad (long-term) | 261 | 324 | 331 | 393 | 445 | |||||||||||||||

| Other long-term assets, derivatives, deferred taxation assets and other long-term inventory | 546 | 1,115 | 1,101 | 1,046 | 1,579 | |||||||||||||||

|

| |||||||||||||||||||

Total assets | 9,451 | 10,662 | 10,388 | 11,185 | 13,102 | |||||||||||||||

|

| |||||||||||||||||||

Current liabilities | 3,458 | 4,475 | 1,004 | 919 | 1,959 | |||||||||||||||

Provision for environmental rehabilitation | 302 | 385 | 530 | 653 | 758 | |||||||||||||||

Deferred taxation liabilities | 1,008 | 1,171 | 1,200 | 1,242 | 1,157 | |||||||||||||||

Other long-term liabilities and derivatives | 1,277 | 1,186 | 3,065 | 2,849 | 3,380 | |||||||||||||||

Equity(5) | 3,406 | 3,445 | 4,589 | 5,522 | 5,848 | |||||||||||||||

|

| |||||||||||||||||||

Total liabilities and equity | 9,451 | 10,662 | 10,388 | 11,185 | 13,102 | |||||||||||||||

|

| |||||||||||||||||||

Capital stock (exclusive of long-term debt and redeemable preferred stock)

| 12 | 12 | 13 | 13 | 13 | |||||||||||||||

Number of common shares as adjusted to reflect changes in capital stock

| 353,483,410 | 362,240,669 | 381,204,080 | 382,242,343 | 383,320,962 | |||||||||||||||

Net assets | 3,406 | 3,445 | 4,589 | 5,522 | 5,848 | |||||||||||||||

| ||||||||||||||||||||

| (1) | 2008 results included the acquisition of the remaining 33 percent shareholding in the Cripple Creek and Victor Gold Mining Company with effect from July 1, 2008. In prior years, the investment was consolidated as a subsidiary. The 2008 accounting treatment is therefore consistent with that of prior years. |

| (2) | Product sales represent revenue from the sale of gold. |

| (3) | Operating costs include production costs, exploration costs, related party transactions, general and administrative, market development costs, employment severance costs and other. |

| (4) | The calculations of basic and diluted (loss)/earnings per common share are described in note 8 to the consolidated financial statements “Income/(loss) per common share”. Amounts reflected exclude E Ordinary shares. |

| (5) | Includes noncontrolling interests. |

12

Table of Contents

Annual dividends

The table below sets forth the amounts of interim, final and total dividends paid in respect of the past five years in cents per ordinary share. In respect of 2012, a fourth quarter dividend of 50 South African cents per ordinary share was declared on February 18, 2013, with a record date of March 15, 2013 and a payment date of March 28, 2013.

| Year ended December 31(1) | 2008 | 2009 | 2010 | 2011 | 2012 | |||||||||||||||

South African cents per ordinary share | ||||||||||||||||||||

First quarter | 100 | |||||||||||||||||||

Second quarter | 50 | 60 | 65 | 90 | 100 | |||||||||||||||

Third quarter | 90 | 50 | ||||||||||||||||||

Fourth quarter | 50 | 70 | 80 | 200 | 50 | |||||||||||||||

Total | 100 | 130 | 145 | 380 | 300 | |||||||||||||||

US cents per ordinary share(2) | ||||||||||||||||||||

First quarter | 11.81 | |||||||||||||||||||

Second quarter | 6.45 | 7.66 | 9.00 | 12.08 | 12.10 | |||||||||||||||

Third quarter | 10.87 | 5.76 | ||||||||||||||||||

Fourth quarter | 5.00 | 9.50 | 11.26 | 27.50 | 5.40 | |||||||||||||||

Total | 11.45 | 17.16 | 20.26 | 50.45 | 35.07 | |||||||||||||||

| (1) | During quarter three of 2011, the Company changed the frequency of dividend payments from half-yearly to quarterly. |

| (2) | Dividends for these periods were declared in South African cents. US dollar cents per share figures have been calculated based on exchange rates prevailing on each of the respective payment dates. |

For further information on the company’s policy on dividend distributions, see “Item 8A: Consolidated statements and other financial information – Annual dividend”.

Exchange rate information

The following table sets forth, for the periods and dates indicated, certain information concerning US dollar/South African rand exchange rates expressed in rands per $1.00. On April 19, 2013, the interbank rate between South African rands and US dollars as reported by OANDA Corporation was R9.17/$1.00.

| Year ended December 31 | High | Low | Year end | Average (1) | ||||||||||||

2008(2) | 11.27 | 6.74 | 9.30 | 8.26 | ||||||||||||

2009(3) | 10.70 | 7.21 | 7.41 | 8.44 | ||||||||||||

2010(3) | 8.08 | 6.57 | 6.64 | 7.34 | ||||||||||||

2011(3) | 8.60 | 6.49 | 8.14 | 7.27 | ||||||||||||

2012(3) | 8.95 | 7.46 | 8.47 | 8.20 | ||||||||||||

2013(3)(4) | 9.31 | 8.47 | 9.17 | 8.96 | ||||||||||||

| (1) | The average rate of exchange on the last business day of each month during the year. |

| (2) | Based on the noon buying rate in New York City for cable transfers as certified for customs purposes by the Federal Reserve Bank of New York. |

| (3) | Based on the interbank rate as reported by OANDA Corporation. |

| (4) | Through to April 19, 2013. |

| Exchange rate information for the months of (1) | High | Low | ||||||

October 2012 | 8.84 | 8.30 | ||||||

November 2012 | 8.95 | 8.63 | ||||||

December 2012 | 8.90 | 8.47 | ||||||

January 2013 | 9.07 | 8.47 | ||||||

February 2013 | 8.99 | 8.81 | ||||||

March 2013 | 9.31 | 8.89 | ||||||

April 2013(2) | 9.23 | 9.08 | ||||||

| (1) | Based on the interbank rate as reported by OANDA Corporation. |

| (2) | Through to April 19, 2013. |

13

Table of Contents

| 3B. | CAPITALIZATION AND INDEBTEDNESS |

Not applicable.

| 3C. | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable.

| 3D. | RISK FACTORS |

This section describes many of the risks that could affect AngloGold Ashanti. There may however be additional risks unknown to AngloGold Ashanti and other risks, currently believed to be immaterial, that could turn out to be material. Additional risks may arise or become material subsequent to the date of this document. These risks, either individually or simultaneously, could significantly affect the group’s business, financial results and the price of its securities.

Risks related to AngloGold Ashanti’s results of operations and financial condition as a result of factors that impact the gold mining industry generally.

Commodity market price fluctuations could adversely affect the profitability of operations.

AngloGold Ashanti’s revenues are primarily derived from the sale of gold and, to a lesser extent, uranium, silver and sulfuric acid. The company’s current policy is to sell its products at prevailing market prices and not to enter into price hedging arrangements. The market prices for these commodities fluctuate widely. These fluctuations are caused by numerous factors beyond the company’s control. For example, the market price of gold may change for a variety of reasons, including:

| • | speculative positions taken by investors or traders in gold; |

| • | monetary policies announced or implemented by central banks, including the US Federal Reserve; |

| • | changes in the demand for gold as an investment or as a result of leasing arrangements; |

| • | changes in the demand for gold used in jewellery and for other industrial uses, including as a result of prevailing economic conditions; |

| • | changes in the supply of gold from production, divestment, scrap and hedging; |

| • | financial market expectations regarding the rate of inflation; |

| • | the strength of the US dollar (the currency in which the gold price trades internationally) relative to other currencies; |

| • | changes in interest rates; |

| • | actual or anticipated sales or purchases of gold by central banks and the International Monetary Fund; |

| • | gold hedging and de-hedging by gold producers; |

| • | global or regional political or economic events; and |

| • | the cost of gold production in major gold producing countries. |

The market price of gold has been and continues to be significantly volatile. During 2012, the gold price traded from a low of $1,540 per ounce to a high of $1,790 per ounce. On April 19, 2013, the closing price of gold was $1,404 per ounce. The price of gold is often subject to sharp, short-term changes; for example, during the period from Friday, April 12, 2013 through Monday, April 15, 2013, the price of gold dropped $228 per ounce. While the overall supply of and demand for gold can affect its market price, the considerable size of historical mined (i.e., above ground) stocks of the metal means that these factors typically do not affect the gold price in the same manner or degree as for other commodities. In addition, the shift in demand from physical gold to investment and speculative demand may exacerbate the volatility of the gold price.

During 2012, there appeared to develop a relationship between the central banks and the price of gold with the price falling at the prospect of the end of quantitative easing in some of the main economies.

A sustained period of significant gold price volatility may adversely affect the company’s ability to evaluate the feasibility of undertaking new capital projects, or the continuity of existing operations, or to make other long-term strategic decisions. The use of lower gold prices in reserve calculations and life-of-mine plans could result in material write-downs of the company’s investment in mining properties and increased amortization, reclamation and closure charges.

14

Table of Contents

The spot price of uranium has been volatile in past years. During 2012, the price varied between a low of approximately $41 per pound and a high of $53 per pound. On April 19, 2013, the spot price of uranium was $41 per pound. Uranium prices can be affected by several factors, including demand for nuclear reactors, uranium production shortfalls and restocking by utilities. Events like those surrounding the earthquake and tsunami that occurred in Japan in 2011 can also have a material impact on the price of and demand for uranium.

The price of silver has experienced significant fluctuations. From a low of $26 per ounce in January 2012, the price rose steadily to reach a high of $37 per ounce in February 2012. By December 2012, the price had dropped to approximately $30 per ounce. Factors affecting the price of silver include investor demand, physical demand for silver bars, industrial and retail off-take, and silver coin minting. On April 19, 2013, the price of silver was $23 per ounce.

If revenue from sales of gold, uranium, silver or sulfuric acid falls below their respective cost of production for an extended period, AngloGold Ashanti may experience losses or be forced to change its dividend payment policies and curtail or suspend some or all of its exploration projects and existing operations. Declining commodities prices may also force a reassessment of the feasibility of a particular project or projects, which could cause substantial delays or interrupt operations until the reassessment can be completed.

Foreign exchange fluctuations could have a material adverse effect on AngloGold Ashanti’s results of operations and financial condition.

Gold is principally a US dollar-priced commodity and most of the company’s revenues are realized in, or linked to, US dollars while production costs are largely incurred in the local currency where the relevant operation is located. Given the company’s global operations and local foreign exchange regulations, some of its funds are held in local currencies, such as the South African rand, Ghanaian cedi, Brazilian real, Argentinean peso and the Australian dollar.

Exchange rate movements may have a material impact on AngloGold Ashanti’s operating results. For example, the company estimates that a 1 percent strengthening of all of the South African rand, Brazilian real, the Argentinean peso or the Australian dollar against the US dollar will, other factors remaining equal, result in an increase in total cash costs under IFRS of approximately $6 per ounce or approximately 1 percent of the company’s total cash costs. The impact on cash costs determined under US GAAP may be different.

The profitability of operations and the cash flows generated by these operations are significantly affected by fluctuations in input production prices, many of which are linked to the prices of oil and steel.

Fuel, energy and consumables, including diesel, heavy fuel oil, chemical reagents, explosives, tyres, steel and mining equipment consumed in mining operations form a relatively large part of the operating costs and capital expenditure of any mining company.

AngloGold Ashanti has no influence over the cost of these consumables, many of which are linked to some degree to the price of oil and steel.

The price of oil has recently been volatile, fluctuating between $88.40 and $130.57 per barrel of Brent crude in 2012. As of April 19, 2013, the price of oil was at $100.09 per barrel of Brent Crude. AngloGold Ashanti estimates that for each US dollar per barrel rise in the oil price, other factors remaining equal, the total cash costs under IFRS of all its operations increases by approximately $0.90 per ounce. The impact on cash costs determined under US GAAP may be different. The cash costs of certain of the company’s mines, particularly Yatela, Sadiola, Siguiri, Geita, Navachab, Morila, and Cripple Creek & Victor, are most sensitive to changes in the price of oil.

Furthermore, the price of steel has also been volatile. Steel is used in the manufacture of most forms of fixed and mobile mining equipment, which is a relatively large contributor to the operating costs and capital expenditure of a mine. For example, the price of flat hot rolled coil (North American Domestic FOB) steel traded between $590 per tonne and $733 per tonne in 2012. On April 19, 2013, the price of flat hot rolled coil (North American Domestic FOB) was $609 per tonne.

Fluctuations in oil and steel prices have a significant impact on operating costs and capital expenditure estimates and, in the absence of other economic fluctuations, could result in significant changes in the total expenditure estimates for new mining projects or render certain projects non-viable.

15

Table of Contents

Energy cost increases and power fluctuations and stoppages could adversely impact the company’s results of operations and financial condition.

Increasing global demand for energy, concerns about nuclear power, and the limited growth of new supply are impacting the price and supply of energy. The transition of emerging markets to higher energy consumption, carbon taxation as well as unrest and potential conflict in the Middle East, among other factors, could result in increased demand or constrained supply and sharply escalating oil and energy prices.

AngloGold Ashanti’s mining operations are substantially dependent upon electrical power generated by local utilities or by power plants situated at some of its operations. The unreliability of these local sources of power can have a material effect on the company’s operations, as large amounts of power are required for exploration, development, extraction, processing and other mining activities on the company’s properties.

In South Africa, the company’s operations are dependent on electricity supplied by one state-owned power generation company, Eskom. Electricity is used for most business and safety-critical operations that include cooling, hoisting and dewatering. Loss of power can therefore impact production, employee safety and prolonged outages could lead to flooding of workings and ore sterilization. In 2008, Eskom and the South African government declared a national emergency and warned that they could no longer guarantee the availability of electricity due to a national supply shortage blamed on coal supply shortages and unplanned generation-set outages as a result of maintenance backlog and asset age. The entire country went into a program of rolling blackouts and AngloGold Ashanti and other mining companies operating in South Africa were forced in late January until mid-March of 2008 to temporarily suspend mining operations at their mines. In addition, lightning damage to power stations can result in power interruptions at our operations. In this regard, AngloGold Ashanti’s two main operational sites in the West Wits region in South Africa had all main power interrupted between March 13, 2013 and March 15, 2013 after a fire caused by lightning damaged a transformer at a main regional substation. The power supply to AngloGold Ashanti’s South African operations may be curtailed or interrupted again in the future. A warning of the “very high” risk of blackouts was re-issued at the start of 2011 and again in 2012. While a national energy conservation program is in place, Eskom cannot guarantee that there will be no power interruptions and is again facing very tight supply reserve margins in 2013, which we expect to continue at least until the new coal fired Medupi Power Station starts to come on line in early 2014.

Eskom and the National Energy Regulator of South Africa (NERSA) recognize the need to increase electricity supply capacity and a series of tariff increases and proposals have been enacted to assist in the funding of this expansion. In 2010, NERSA approved an annual increase of 24.8 percent for 2010, 25.8 percent for 2011, 25.9 percent for 2012, and 16.0 percent for 2013. The actual increase implemented for 2012 was lowered to 16.09 percent after government intervention, but there can be no assurance as to the existence or nature of any government intervention in the future. In February 2013, NERSA announced that Eskom would be allowed to increase electricity tarriffs at an average yearly rate of 8 percent between 2013 and 2018. This increase is half the 16 percent sought by the utility in its application. As energy represents a large proportion of the company’s operating costs in South Africa, these increases have had, and any future increases will have, a materially adverse impact on the cash costs of its South African operations.

The company has also identified a risk of energy shortages in Argentina and the DRC. Furthermore, all of the company’s mining operations in Ghana depend on hydroelectric power supplied by the state-controlled Volta River Authority (VRA), which is supplemented by thermal power from the Takoradi plant and a smaller unit at Tema. During periods of below average inflows from the Volta reservoir, electricity supplies from the Akosombo Dam, the VRA’s primary generation source, may be curtailed as occurred in 1998, 2006 and the first half of 2007. During periods of limited electricity availability, the grid is subject to disturbances and voltage fluctuations which can damage equipment. Recent disruptions in natural gas supply from Nigeria, via the West Africa Gas Pipeline, has led to some reduction in thermal generation capacity and the use of more expensive light crude oil which is putting upward pressure on power tariffs. In the past, the VRA has obtained power from neighboring Côte d’Ivoire, which has intermittently experienced political instability and civil unrest. AngloGold Ashanti negotiates rates directly with the VRA and the VRA may not agree to a satisfactory rate during future rounds of negotiations.

The company’s mining operations in Guinea, Tanzania and Mali are dependent on power supplied by outside contractors and supplies of fuel are delivered by road. Power supplies have been disrupted in the past, resulting in production losses due to equipment failure.

Increased energy prices could negatively impact operating costs and cash flow of AngloGold Ashanti’s operations.

16

Table of Contents

Global economic conditions could adversely affect the profitability of operations.

AngloGold Ashanti’s operations and performance depend significantly on worldwide economic conditions. The global financial markets have experienced considerable volatility from uncertainty surrounding the level and sustainability of the sovereign debt of various countries. Concerns remain regarding the sustainability of the European Monetary Union and its common currency, the euro, in their current form, as well as the negative impacts of the recent downgrade of the sovereign credit rating of the Republic of South Africa. These conditions and other disruptions to international credit markets and financial systems have caused a loss of investor confidence and resulted in widening credit spreads, a lack of price transparency, increased credit losses and tighter credit conditions. Despite the aggressive measures taken by governments and central banks so far, economic recovery has been extremely slow. A significant risk remains that these measures may not prevent the global economy from falling back into an even deeper and longer lasting recession or even a depression.

A global economic downturn and recession may have follow-on effects on AngloGold Ashanti’s business that include inflationary cost pressures and commodity market fluctuations.

Other effects could, for example, include:

| • | the insolvency of key suppliers or contractors which could result in contractual breaches and in a supply chain breakdown; |

| • | the insolvency of one or more joint venture partners which could result in contractual breaches and disruptions at the operations of the company’s joint ventures; |

| • | changes in other income and expense which could vary materially from expectations, depending on gains or losses realized on the sale or exchange of financial instruments, and impairment charges that may be incurred with respect to investments; |

| • | AngloGold Ashanti’s defined benefit pension fund may not achieve expected returns on its investments, which could require the company to make substantial cash payments to fund any resulting deficits; |

| • | a reduction in the availability of credit which may make it more difficult for the company to obtain financing for its operations and capital expenditures or make that financing more costly; and |

| • | exposure to the liquidity and insolvency risks of the company’s lenders and customers; |

any of which could negatively affect AngloGold Ashanti’s financial results.

Inflation may have a material adverse effect on results of operations.

Many of AngloGold Ashanti’s operations are located in countries that have experienced high rates of inflation during certain periods. It is possible that significantly higher future inflation in the countries in which the company operates may result in an increase in operational costs in local currencies (without a concurrent devaluation of the local currency of operations against the dollar or an increase in the dollar price of gold). This could have a material adverse effect on the company’s results of operations and financial condition. Significantly higher and sustained inflation, with a consequent increase in operational costs, could result in the rationalization of higher cost mines or projects.

Mining companies face many risks related to the development of mining projects that may adversely affect the company’s results of operations and profitability.

The profitability of mining companies depends partly on the actual costs of developing and operating mines, which may differ significantly from estimates determined at the time the relevant project was approved following completion of its feasibility study. Development of mining projects may also be subject to unexpected problems and delays that could increase the development and operating costs of the relevant project.

AngloGold Ashanti’s decision to develop a mineral property is typically based on the results of a feasibility study. Feasibility studies estimate the expected or anticipated economic returns from the project. These estimates are based on assumptions regarding:

| • | future prices of gold, uranium, silver and other metals; |

| • | future currency exchange rates; |

| • | tonnage, grades and metallurgical characteristics of ore to be mined and processed; |

| • | anticipated recovery rates of gold, uranium, silver and other metals extracted from the ore; |

| • | anticipated capital expenditure and cash operating costs; and |

| • | required return on investment. |

17

Table of Contents

Actual cash operating costs, production and economic returns may differ significantly from those anticipated by such studies and estimates. Operating costs and capital expenditure are to a significant extent driven by the cost of commodity inputs consumed in mining, including fuel, chemical reagents, explosives, tyres and steel, and also by credits from by-products, such as silver and uranium. They could also fluctuate considerably as a result of changes in the prices of mining equipment used in the construction and operation of mining projects.

There are a number of uncertainties inherent in the development and construction of a new mine or the extension of an existing mine. In addition to those discussed above, these uncertainties include the:

| • | timing and cost of construction of mining and processing facilities, which can be considerable; |

| • | availability and cost of mining and processing equipment; |

| • | availability and cost of skilled labor, power, water and transportation; |

| • | availability and cost of appropriate smelting and refining arrangements; |

| • | applicable requirements and time needed to obtain the necessary environmental and other governmental permits; and |

| • | availability of funds to finance construction and development activities. |

The remote location of many mining properties, permitting requirements and/or delays, third-party legal challenges to individual mining projects and broader social or political opposition to mining may increase the cost, timing and complexity of mine development and construction. New mining operations could experience unexpected problems and delays during the development, construction, commissioning and commencement of production. AngloGold Ashanti may prove unable to successfully develop the La Colosa and Gramalote projects as well as other potential exploration sites in Colombia due to difficulties that could arise in relation to, for example, social and community opposition, litigation, ore body grades, definition of adequate reserves and resources, and the time taken to prove project feasibility that could result in the expiry of permits. For example, on March 11, 2013, Cortolima, a regional environmental authority in Colombia, issued an injunction against AngloGold Ashanti’s Colombian subsidiary, alleging that the subsidiary was operating without proper permits and was engaging in activity that was harmful to the environment. Furthermore, at around the same period in time, access to an AngloGold Ashanti drilling site was blockaded by residents of a nearby community.

Accordingly, AngloGold Ashanti’s future development activities may not result in the expansion or replacement of current production, or one or more new production sites or facilities may be less profitable than anticipated or may be loss-making. The company’s operating results and financial condition are directly related to the success of its project developments. A failure in the company’s ability to develop and operate mining projects in accordance with, or in excess of, expectations could negatively impact its results of operations, as well as its financial condition and prospects.

Mining companies face uncertainty and risks in exploration, feasibility studies and other project evaluation activities.

AngloGold Ashanti must continually replace Ore Reserve depleted by mining and production to maintain or increase production levels in the long term. This is undertaken by exploration activities that are speculative in nature. The ability of the company to sustain or increase its present levels of gold production depends in part on the success of its projects and it may be unable to sustain or increase such levels. For example, in South Africa, the company experienced declining production rates (1.213 million ounces of gold in 2012, compared with 1.624 million ounces of gold in 2011 and 1.784 million ounces in 2010), principally due to continued safety and associated stoppages, mining flexibility constraints and overall falls in grades. The significant decrease in 2012 was also mainly attributable to the industrial strike action at the company’s South African mines, which resulted in the loss of production of 235,000 ounces of gold.

Feasibility studies and other project evaluation activities necessary to determine the current or future viability of a mining operation are often unproductive. Such activities often require substantial expenditure on exploration drilling to establish the presence, extent and grade (metal content) of mineralized material. AngloGold Ashanti undertakes feasibility studies to estimate the technical and economic viability of mining projects and to determine appropriate mining methods and metallurgical recovery processes. These activities are undertaken to estimate the Ore Reserve.

Once mineralization is discovered, it may take several years to determine whether an adequate Ore Reserve exists, during which time the economic feasibility of the project may change due to fluctuations in factors that affect both revenue and costs, including:

| • | future prices of metals and other commodities; |

| • | future foreign currency exchange rates; |

| • | the required return on investment as based on the cost and availability of capital; and |

| • | applicable regulatory requirements, including environmental, health and safety matters. |

18

Table of Contents

Feasibility studies also include activities to estimate the anticipated:

| • | tonnages, grades and metallurgical characteristics of the ore to be mined and processed; |

| • | recovery rates of gold, uranium and other metals from the ore; and |

| • | capital expenditure and cash operating costs. |

These estimates depend on assumptions made on available data. Ore Reserve estimates are not precise calculations and depend on the interpretation of limited information on the location, shape and continuity of the mineral occurrence and on available sampling results. Further exploration and feasibility studies can result in new data becoming available that may change previous Ore Reserve estimates and impact the technical and economic viability of production from the project. Changes in the forecast prices of commodities, exchange rates, production costs or recovery rates may change the economic status of reserves resulting in revisions to previous Ore Reserve estimates. These revisions could impact depreciation and amortization rates, asset-carrying amounts, provisions for closedown, restoration and environmental rehabilitation costs.

AngloGold Ashanti undertakes annual revisions to its Ore Reserve estimates based upon actual exploration and production results, depletion, new information on geology, model revisions and fluctuations in production, economic assumptions and operating and other costs. These factors may result in reductions in Ore Reserve estimates, which could adversely affect life-of-mine plans and consequently the total value of the company’s mining asset base. Ore Reserve restatements could negatively affect the company’s results of operations, as well as its financial condition and prospects.

The increased overall demand for gold and other commodities, combined with a declining rate of discovery of new gold Ore Reserve in recent years, has resulted in the accelerated depletion of the existing Ore Reserve across the global gold sector. AngloGold Ashanti therefore faces intense competition for the acquisition of attractive mining properties. From time to time, the company evaluates the acquisition of an Ore Reserve, development properties or operating mines, either as stand-alone assets or as part of companies. AngloGold Ashanti’s decision to acquire these properties has been based on a variety of factors including historical operating results, estimates and assumptions regarding the extent of the Ore Reserve, cash and other operating costs, gold prices, projected economic returns and evaluations of existing or potential liabilities associated with the relevant property and its operations and how these factors may change in future. Other than historical operating results, these factors are uncertain and could have an impact on revenue, cash and other operating costs, as well as the process used to estimate the Ore Reserve.

As a result of these uncertainties, exploration and acquisitions by the company may not result in the expansion or replacement of current production or the maintenance of its existing Ore Reserve net of production or an increase in Ore Reserve. AngloGold Ashanti’s results of operations and financial condition are directly related to the success of its exploration and acquisition efforts and ability to replace or increase the existing Ore Reserve. If the company is not able to maintain or increase its Ore Reserve, its results of operations as well as its financial condition and prospects could be adversely affected.

Mining companies face many risks related to their operations that may adversely impact cash flows and overall profitability.

Gold mining is susceptible to events that may adversely impact a mining company’s ability to produce gold and meet production and cost targets. These events include, but are not limited to:

| • | environmental, as well as health and safety incidents during production or transportation resulting in injury, loss of life, or damage to equipment; |

| • | ground and surface water pollution; |

| • | social or community disputes or interventions; |

| • | security incidents; |

| • | surface or underground fires or explosions; |

| • | electrocution; |

| • | falls from heights and accidents relating to mobile machinery, including shaft conveyances and elevators, drilling blasting and mining operations; |

| • | labor force disputes and disruptions; |

| • | loss of information integrity or data; |

| • | activities of illegal or artisanal miners; |

| • | shortages in material and equipment; |

| • | mechanical failure or breakdowns and ageing infrastructure; |

| • | failure of unproven or evolving technologies; |

| • | energy and electrical power supply interruptions or rationing; |

19

Table of Contents

| • | unusual or unexpected geological formations, ground conditions, including lack of mineable face length, and ore-pass blockages; |

| • | water ingress and flooding; |

| • | process water shortages; |

| • | metallurgical conditions and gold recovery; |

| • | unexpected decline of ore grade; |

| • | unanticipated increases in gold lock-up and inventory levels at heap-leach operations; |

| • | fall-of-ground accidents in underground operations; |

| • | cave-ins, sinkholes, subsidence, rock falls, rock bursts, or landslides; |

| • | failure of mining pit slopes, heap-leach facilities, water or solution dams, waste stockpiles and tailings dam walls; |

| • | legal and regulatory restrictions and changes to such restrictions; |

| • | safety-related stoppages; |

| • | gold bullion theft; |

| • | corruption, fraud and theft; |

| • | allegations of human rights abuses; |

| • | seismic activity; and |

| • | other natural phenomena, such as floods, droughts or weather conditions, potentially exacerbated by climate change. |

Seismic activity is of particular concern in underground mining operations, particularly in South Africa due to the extent and extreme depth of mining, and also in Australia and Brazil due to the depth of mining and residual tectonic stresses. Despite modifications to mine layouts and support technology, as well as other technological improvements employed with a view to minimizing the incidence and impact of seismic activity, seismic events have caused death and injury to employees and contractors and may do so again in future, and have in the past and may again result in safety-related stoppages.

Seismic activity may also cause the loss of mining equipment, damage to or destruction of mineral properties or production facilities, monetary losses, environmental damage and potential legal liabilities. As a result, these events may have a material adverse effect on AngloGold Ashanti’s results of operations and financial condition. For example, in early 2011, mining of the Ventersdorp Contact Reef shaft pillar at Tau Tona was suspended following a significant seismic event. New equipment had to be purchased and the shutdown contributed to the decline in the operational output of the mine as compared to the previous year.

In the past, floods have also disrupted the operations of some of the company’s mines. For example, unprecedented heavy rains in February and March 2011 in Australia flooded the Sunrise Dam Gold Mine and forced a temporary shutdown of operations. The flood event impacted underground production for approximately four months and open pit production for approximately six months. Despite the shutdown, full costs were incurred as the mining contractors worked on remedial activities to repair damage and rehabilitate flooded areas. The considerable remedial work required adversely impacted cash costs per ounce and the impact of the flood event and the pit wall failure together significantly reduced planned production at the plant.

Mining companies’ operations are vulnerable to infrastructure constraints.

Mining, processing, development and exploration activities depend on adequate infrastructure. Reliable rail, ports, roads, bridges, power sources, power transmission facilities and water supply are critical to the company’s business operations and affect capital and operating costs. These infrastructure and services are often provided by third parties whose operational activities are outside the control of the company.

Interferences in the maintenance or provision of infrastructure, including unusual weather phenomena, sabotage and social unrest, could impede the company’s ability to deliver its products on time and adversely affect AngloGold Ashanti’s business, results of operations and financial condition.

Establishing infrastructure for the company’s development projects requires significant resources, identification of adequate sources of raw materials and supplies, and necessary co-operation from national and regional governments, none of which can be assured.

AngloGold Ashanti has operations or potential development projects in countries where government-provided infrastructure may be inadequate and regulatory regimes for access to infrastructure may be uncertain, which could adversely impact the efficient operation and expansion of its business. AngloGold Ashanti may not secure and maintain access to adequate infrastructure in the future, or it may not do so on reasonable terms.

20

Table of Contents

Mining companies face strong competition.

The mining industry is competitive in all of its phases. AngloGold Ashanti competes with other mining companies and individuals for specialized equipment, components and supplies necessary for exploration and development, for mining claims and leases on exploration properties and for the acquisition of mining assets. These competitors may have greater financial resources, operational experience and technical capabilities than AngloGold Ashanti. Competition may increase AngloGold Ashanti’s cost of acquiring suitable claims, properties and assets.

Mining companies are subject to extensive health and safety laws and regulations.

Gold mining operations are subject to extensive health and safety laws and regulations in every jurisdiction they operate in. These laws and regulations, along with international and industry standards, designed to protect and improve the safety and health of employees, require extensive compliance measures.

From time to time, new or updated health and safety laws, regulations and standards are introduced. Should compliance with these require a material increase in expenditure or material changes or interruptions to operations or production, including as a result of any failure to comply with applicable regulations, the company’s results of operations and financial condition could be adversely affected. Furthermore, AngloGold Ashanti is implementing an enhanced safety program, which could result in additional costs for the company.

In some of the jurisdictions in which AngloGold Ashanti operates, the government enforces compulsory shutdowns of operations to enable investigations into the cause of accidents. Certain of the company’s operations have been temporarily suspended for safety reasons in the past. In South Africa, in particular, so-called ‘Section 54 safety stoppages’ have become a significant issue. In 2011, the Inspector of Mines ordered the shutdown of entire mines in cases of relatively minor violations, which had a material impact on production at these mines. In particular, the Inspector issued Kopanang eleven Section 54 notices during 2011. Each notice resulted in Kopanang suspending operations either fully or partially in order to comply with the inspector’s recommendations on safety.

Safety-related stoppages resulted in the direct loss of 72,900 and 72,400 ounces of gold production during 2011 and 2012, respectively, in South Africa.

A working group comprised of the inspectorate, the mining industry and organized labor has been formed to address the trend of increasing safety stoppages in South Africa. However, the working group may not agree on how to address this issue and the number of safety stoppages may continue or even increase in the future.

AngloGold Ashanti’s reputation could be damaged by any significant governmental investigation or enforcement of health and safety laws, regulations or standards. Any of these factors could have a material adverse effect on the company’s results of operations and financial condition.

Mining companies are increasingly required to operate in a sustainable manner and to provide benefits to affected communities. Failure to comply with these requirements can result in legal suits, additional operational costs, investor divestment, loss of ‘social licence to operate’, and adversely impact mining companies’ financial condition.

As a result of public concern about the perceived ill effects of economic globalization, businesses in general and large multinational mining corporations such as AngloGold Ashanti in particular face increasing public scrutiny of their activities.

These businesses are under pressure to demonstrate that while they seek a satisfactory return on investment for shareholders, human rights are respected and other social partners, including employees, host communities and more broadly the countries in which they operate, also benefit from their commercial activities. Such pressures tend to be particularly focused on companies whose activities are perceived to have, or have, a high impact on their social and physical environment. The potential consequences of these pressures and the adverse publicity in cases where companies are believed not to be creating sufficient social and economic benefit may result in additional operating costs, reputational damage, active community opposition, allegations of human rights abuses, legal suits and investor withdrawal.

21

Table of Contents

Existing and proposed mining operations are often located at or near existing towns and villages, natural water courses and other infrastructure. As the impacts of dust generation, waste storage, water pollution or shortage, in particular, may be immediate and directly adverse to those communities, poor environmental management practices, or adverse changes in the supply or quality of water can result in community protest, regulatory sanctions or ultimately in the withdrawal of community and government support for company operations. For example, opposition to mining activity in the Tolima province of Colombia, which hosts the La Colosa deposit, has centered on the perception that large-scale mining activity will have a detrimental impact on the region’s river systems.

Mining operations must be designed to minimize their impact on such communities and the environment, either by changing mining plans to avoid such impact, by modifying operations, or by relocating the affected people to an agreed location. Responsive measures may also include the full restoration of livelihoods of those impacted.

In addition, as AngloGold Ashanti has a long history of mining operations in certain regions, issues may arise regarding historical as well as potential future environmental or health impacts in those areas. For example, certain parties, including non-governmental organizations, community groups and institutional investors, have raised concerns about surface and groundwater quality, among other issues, in the area surrounding the company’s Obuasi and Iduapriem mines in Ghana, including potential impacts to local rivers and wells used for water from heavy metals, arsenic and cyanide as well as sediment and mine rock waste.